Walleye Cuts Credit: A Restructuring Of Commodities Team Focus

Table of Contents

Defining the "Walleye Cuts Credit" Initiative

The name "Walleye Cuts Credit" might seem unusual, but it reflects an internal metaphor: just as a skilled angler carefully selects and utilizes the best parts of a walleye, this initiative focuses on precision in resource allocation. We are strategically "cutting" away inefficiencies and redundancies to maximize the "credit"—or value—generated by the commodities team. The primary goals of this restructuring are threefold:

-

Improved Efficiency: Streamlining processes and workflows to minimize wasted time and effort.

-

Cost Reduction: Identifying and eliminating unnecessary expenses to improve profitability.

-

Enhanced Market Responsiveness: Improving our ability to quickly adapt to changing market conditions and capitalize on opportunities.

-

Bullet Points:

- Reduce operational redundancies by identifying and eliminating overlapping tasks and responsibilities.

- Improve data analysis and forecasting capabilities through the implementation of advanced analytical tools and techniques. This strengthens our ability to predict market trends and make informed trading decisions.

- Strengthen risk management procedures by implementing stricter controls and oversight. This reduces exposure to potential losses and ensures financial stability.

- Enhance communication and collaboration within the team through improved internal communication channels and collaborative workspaces. This fosters a more cohesive and productive work environment.

Key Structural Changes Implemented in the Restructuring

"Walleye Cuts Credit" involved significant changes to the team's structure, directly impacting workflow and efficiency. These changes include:

- Consolidation of Overlapping Roles: Several positions with similar responsibilities were merged to eliminate redundancy and streamline workflows. This reduces personnel costs and improves overall efficiency.

- Creation of Specialized Units: The team was reorganized into three specialized units: Trading, Risk Management, and Market Analysis. This specialization allows team members to focus on their core competencies, resulting in increased expertise and productivity.

- Implementation of New Technologies: We invested in new data management and analytical software to improve data processing, reporting, and forecasting accuracy. This allows for faster decision-making and more effective market analysis.

- Clarification of Responsibilities and Accountability: Clear roles and responsibilities were defined for each team member, promoting individual accountability and reducing confusion. This improved transparency and increased overall team effectiveness.

Impact on Resource Allocation and Cost Reduction

"Walleye Cuts Credit" has directly impacted resource allocation and led to significant cost reductions. This includes:

- Optimized Budget Allocation: Resources are now allocated to high-priority projects that yield the greatest return on investment (ROI). This ensures that our resources are used efficiently and effectively.

- Reduction in Operational Expenses: The restructuring has reduced operational expenses through eliminating redundancies, optimizing workflows, and improving resource utilization.

- Improved ROI on Technology Investments: The implementation of new technologies has already shown a positive impact on team productivity and the accuracy of market forecasts.

- Increased Team Productivity per Capita: Through improved efficiency and clearer roles, we are seeing a marked increase in the productivity of each team member. This directly contributes to improved profitability.

Measuring the Success of Walleye Cuts Credit

The success of "Walleye Cuts Credit" is being measured using several key performance indicators (KPIs):

- Increased Trading Profits: A primary metric for success is an increase in trading profits, reflecting the improved efficiency and decision-making within the team.

- Reduced Risk Exposure: We are monitoring risk exposure levels to ensure that the restructuring has not inadvertently increased vulnerability to market fluctuations.

- Improved Forecast Accuracy: The accuracy of market forecasts is a crucial indicator of the effectiveness of our new analytical tools and techniques.

- Enhanced Employee Satisfaction: Employee satisfaction is tracked through regular surveys to ensure that the restructuring has not negatively impacted morale or productivity. A happy and engaged team is more productive.

Conclusion

The "Walleye Cuts Credit" initiative represents a significant step towards improving the efficiency and performance of the commodities team. By streamlining operations, optimizing resource allocation, and implementing targeted structural changes, the restructuring aims to enhance profitability and risk management within a dynamic market environment. We are committed to maximizing the value of our resources and improving our operational efficiency and financial optimization through initiatives like Walleye Cuts Credit.

Call to Action: To learn more about the strategic initiatives driving efficiency improvements within our commodities division, stay tuned for future updates on the success of the "Walleye Cuts Credit" program and how these changes contribute to our overall financial optimization. We are committed to transparently communicating the impact of Walleye Cuts Credit on our operational efficiency and performance.

Featured Posts

-

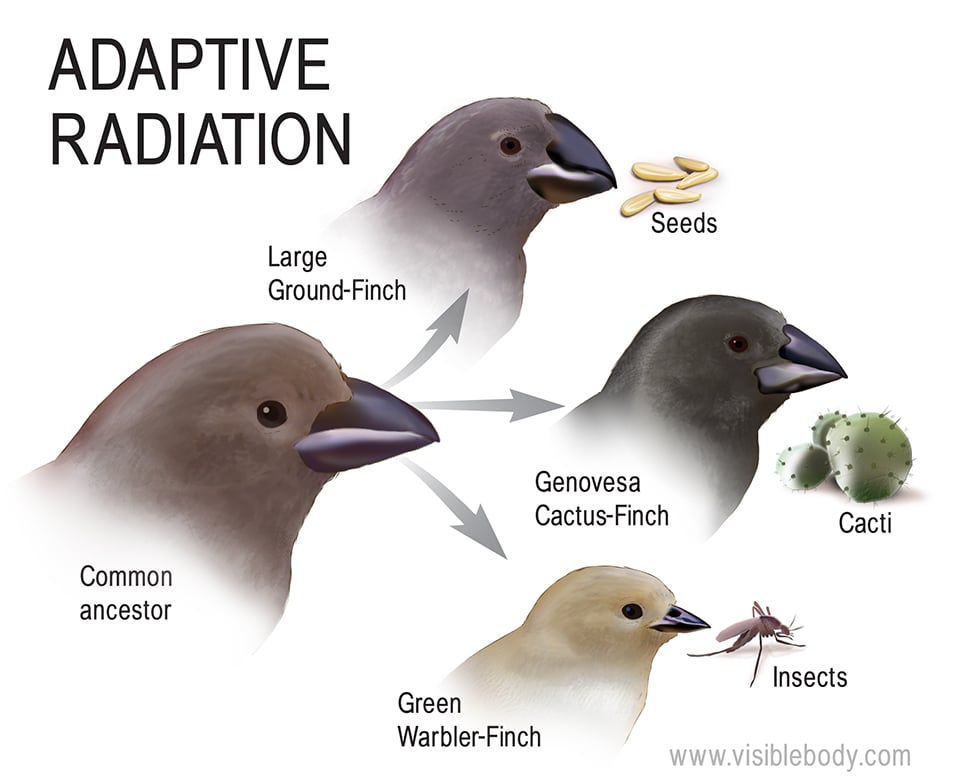

The Wonder Of Animals A Journey Through Evolution And Adaptation

May 13, 2025

The Wonder Of Animals A Journey Through Evolution And Adaptation

May 13, 2025 -

Gaza Hostage Situation The Nightmare Continues For Families

May 13, 2025

Gaza Hostage Situation The Nightmare Continues For Families

May 13, 2025 -

2024 Byd Seal Buyers Guide Everything You Need To Know

May 13, 2025

2024 Byd Seal Buyers Guide Everything You Need To Know

May 13, 2025 -

Live Stream Duke Vs Oregon Ncaa Tournament Game Where To Watch

May 13, 2025

Live Stream Duke Vs Oregon Ncaa Tournament Game Where To Watch

May 13, 2025 -

Why Angus Should Become A Recurring Character In Elsbeths Stories

May 13, 2025

Why Angus Should Become A Recurring Character In Elsbeths Stories

May 13, 2025

Latest Posts

-

Dodgers Vs Angels Ohtanis Epic 6 Run 9th Inning

May 14, 2025

Dodgers Vs Angels Ohtanis Epic 6 Run 9th Inning

May 14, 2025 -

6 Run 9th Ohtanis Power Drives Dodgers Comeback Win

May 14, 2025

6 Run 9th Ohtanis Power Drives Dodgers Comeback Win

May 14, 2025 -

14 11 Thriller Ohtanis Late Homer Secures Dodgers Victory Over Diamondbacks

May 14, 2025

14 11 Thriller Ohtanis Late Homer Secures Dodgers Victory Over Diamondbacks

May 14, 2025 -

Late Game Heroics Ohtanis 6 Run 9th Secures Dodgers Comeback

May 14, 2025

Late Game Heroics Ohtanis 6 Run 9th Secures Dodgers Comeback

May 14, 2025 -

Oh Ohtani Dodgers Late Rally 3 Run Homer Power 14 11 Win Over Diamondbacks

May 14, 2025

Oh Ohtani Dodgers Late Rally 3 Run Homer Power 14 11 Win Over Diamondbacks

May 14, 2025