Weak Q1 Results Send Kering Shares Down 6%

Table of Contents

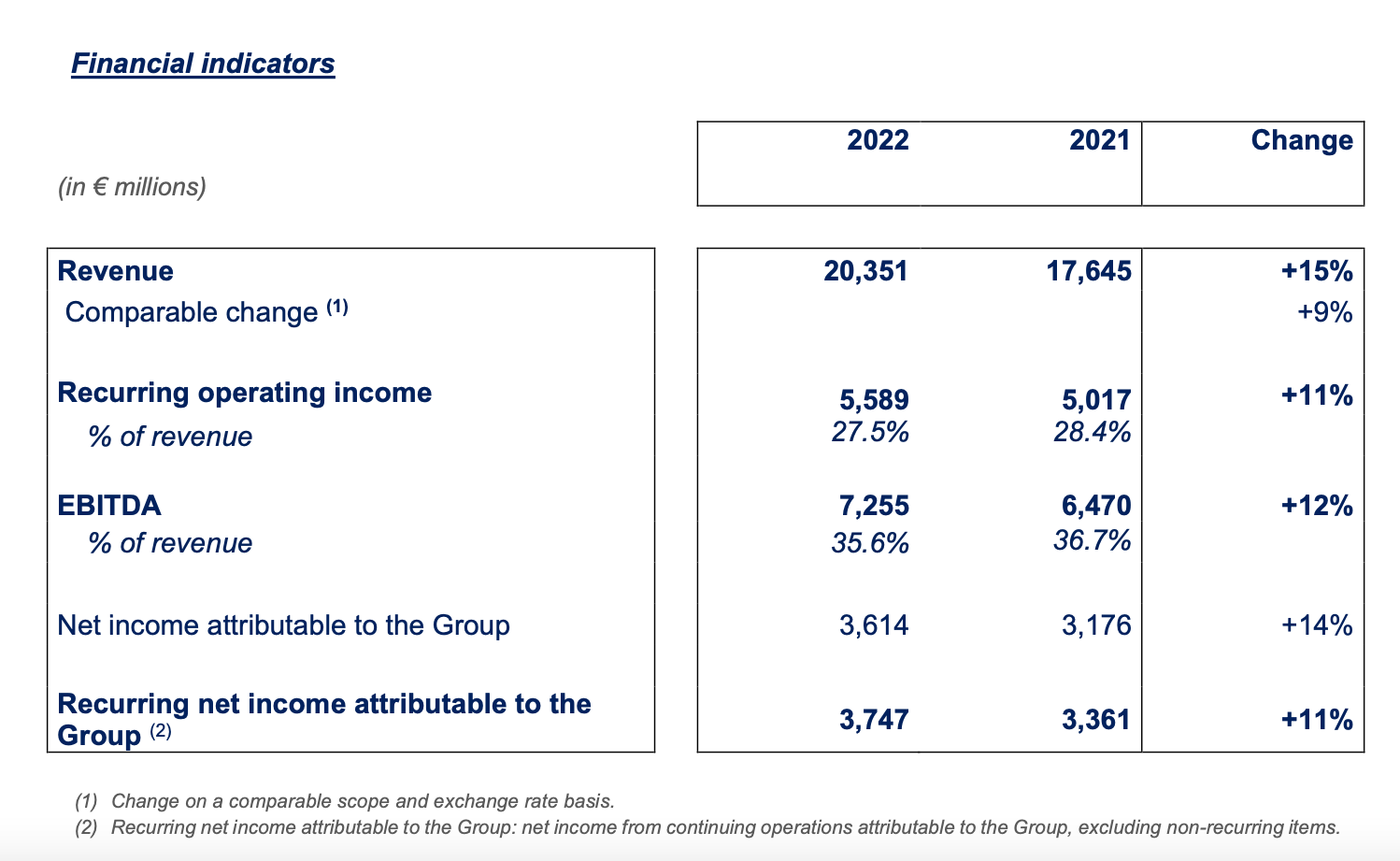

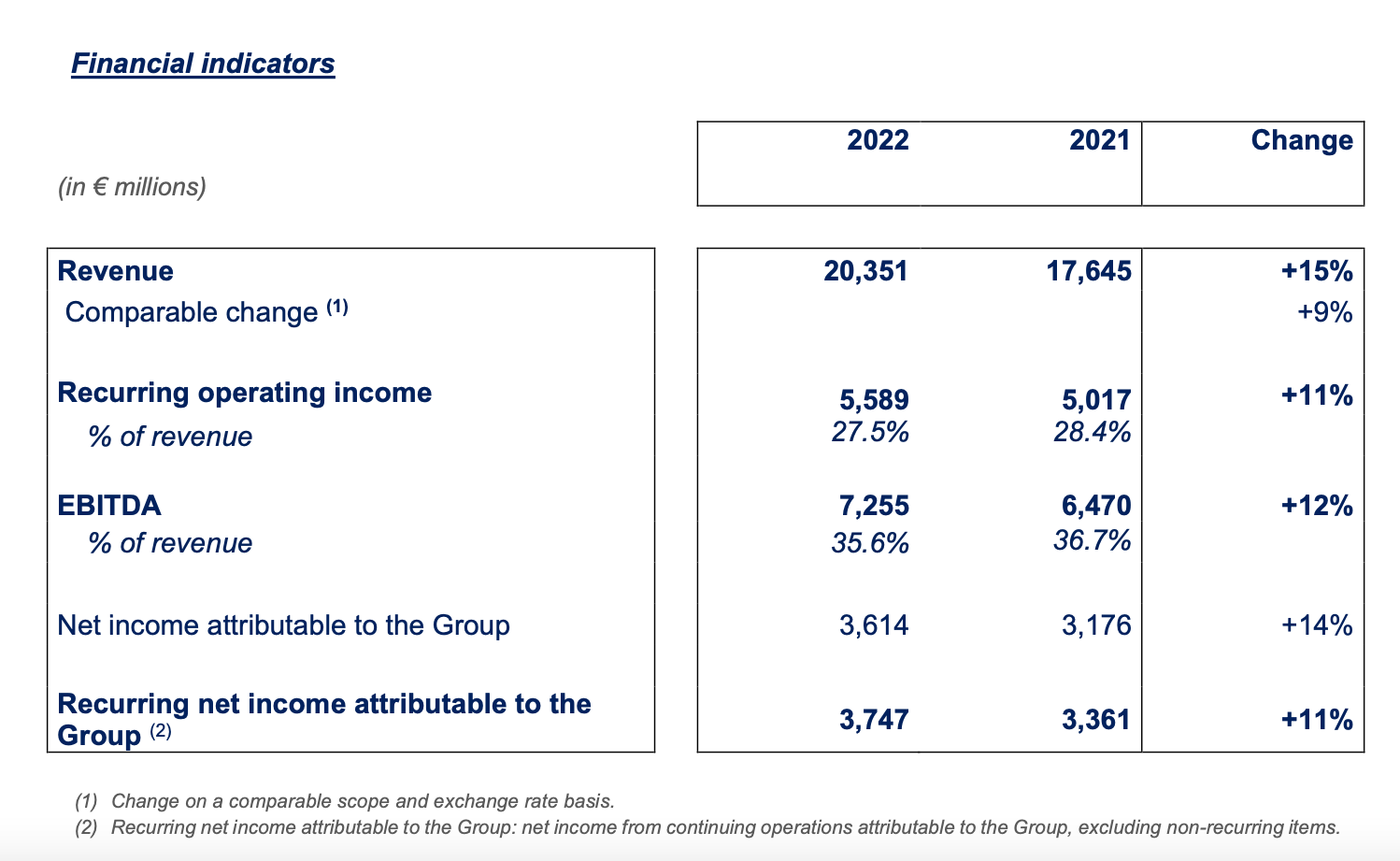

Disappointing Q1 Performance: A Detailed Look at the Numbers

Kering's Q1 revenue figures revealed a concerning picture. The company reported a significant decrease in comparable sales, falling short of both analyst expectations and the previous year's performance. Let's break down the key financial indicators:

-

Q1 Revenue: Kering reported a [Insert actual Q1 revenue figure] in revenue, representing a [Insert percentage] decrease compared to Q1 2022 and a [Insert percentage] shortfall against analyst consensus. This marks a substantial drop for a company accustomed to robust growth.

-

Brand-Specific Performance: While some brands demonstrated resilience, others underperformed significantly. Gucci, traditionally Kering's flagship brand, saw a [Insert percentage change] in sales, indicating a slowdown in its growth trajectory. Saint Laurent fared comparatively better, with a [Insert percentage change], while Balenciaga's performance was [Insert percentage change]. A detailed breakdown of performance across all brands is crucial to understanding the overall picture. Further investigation is needed to understand the specific reasons behind the discrepancies across the portfolio.

-

External Factors: Currency fluctuations played a role, negatively impacting reported revenue figures. The strengthening Euro against other major currencies, particularly the US dollar, reduced the value of international sales when converted back to Euros. Additional external factors, such as supply chain disruptions impacting production and logistics, also contributed to the lower-than-expected results.

-

Profitability: The impact on earnings per share (EPS) was significant. Kering reported an EPS of [Insert EPS figure], reflecting the pressure on profitability margins. This lower-than-expected profitability further fueled investor concerns.

Underlying Factors Contributing to Kering's Weak Q1

The disappointing Q1 results weren't solely attributable to internal factors. Several macroeconomic trends and industry-specific challenges played a significant role:

-

Luxury Market Slowdown: A potential slowdown in the global luxury market is a major concern. High inflation and economic uncertainty are causing consumers to reconsider discretionary spending, impacting demand for luxury goods across the board. The luxury goods market, highly susceptible to economic fluctuations, shows signs of weakening demand, impacting brands like Kering.

-

Supply Chain Issues: Ongoing supply chain disruptions, including increased transportation costs and raw material shortages, continue to hamper production and delivery, putting further pressure on margins and sales. These challenges haven't completely disappeared and continue to affect the overall luxury goods industry.

-

Changing Consumer Spending: Consumer spending patterns are shifting. Younger generations are prioritizing experiences over material possessions, creating a more nuanced and competitive luxury market that requires brands to adapt to changing demographics and preferences.

-

Geopolitical Uncertainty and Inflation: The ongoing war in Ukraine, coupled with persistent inflation, has created a climate of geopolitical uncertainty that negatively impacts consumer confidence and investment decisions. This instability can be linked to a decrease in luxury purchases, as these are often seen as non-essential.

-

China Market Impact: China, a key market for luxury goods, experienced slower-than-expected growth in Q1, further dampening Kering’s overall performance. The recent economic slowdown in China significantly affected Kering's sales.

Investor Reactions and Market Outlook for Kering

The market reacted swiftly and negatively to Kering's Q1 results. The 6% drop in share price reflects investor sentiment and uncertainty about the company's future prospects.

-

Stock Market Reaction: The immediate market reaction was a significant sell-off, indicating a loss of confidence among investors. This volatility highlights the impact of unexpected financial news on the stock market.

-

Analyst Ratings: Following the release of the Q1 results, several analysts revised their ratings and price targets for Kering stock. Some downgraded their outlook, citing concerns about the company's ability to navigate the current economic headwinds.

-

Long-Term Implications: The weak Q1 performance raises questions about Kering's long-term business strategy and brand positioning. The company will need to adapt to the changing market dynamics and consumer preferences to regain its growth momentum.

-

Future Growth Opportunities: Despite the challenges, Kering still possesses significant growth potential. Its diverse brand portfolio offers opportunities for expansion in emerging markets and through strategic partnerships. The long-term vision of the company will need to incorporate adaptations to the economic and market changes.

Conclusion

Kering's disappointing Q1 results, marked by a 6% drop in share price, highlight the challenges facing the luxury goods sector. A combination of factors, including a potential slowdown in the luxury market, persistent supply chain issues, and changing consumer spending habits, contributed to the weak performance. The uncertainty surrounding Kering's future prospects underscores the need for a strategic reassessment and adaptation to the evolving market landscape. To stay informed about Kering's performance and the evolving dynamics of the luxury goods market, monitor Kering's future announcements and financial reports for further updates on their Q1 results and overall strategy. Regularly check reputable financial news sources for analysis and insights regarding Kering's stock price and future performance. Understanding the implications of these weak Q1 results is crucial for investors and those interested in the luxury goods sector.

Featured Posts

-

England Airpark And Alexandria International Airports Ae Xplore Your Gateway To Local And Global Adventures

May 25, 2025

England Airpark And Alexandria International Airports Ae Xplore Your Gateway To Local And Global Adventures

May 25, 2025 -

New York Times Connections Hints And Answers March 18 2025 646

May 25, 2025

New York Times Connections Hints And Answers March 18 2025 646

May 25, 2025 -

Amundi Djia Ucits Etf Nav Calculation And Implications

May 25, 2025

Amundi Djia Ucits Etf Nav Calculation And Implications

May 25, 2025 -

Kyle And Teddis Heated Confrontation A Dog Walker Showdown

May 25, 2025

Kyle And Teddis Heated Confrontation A Dog Walker Showdown

May 25, 2025 -

Positieve Aex Prestaties Tegenover Onrustige Amerikaanse Beurs

May 25, 2025

Positieve Aex Prestaties Tegenover Onrustige Amerikaanse Beurs

May 25, 2025

Latest Posts

-

Amsterdam Accueille Le Ces Unveiled Europe Innovation Et Technologie

May 25, 2025

Amsterdam Accueille Le Ces Unveiled Europe Innovation Et Technologie

May 25, 2025 -

Retour Du Ces Unveiled A Amsterdam Les Technologies De Demain

May 25, 2025

Retour Du Ces Unveiled A Amsterdam Les Technologies De Demain

May 25, 2025 -

Ces Unveiled Europe Nouveautes Technologiques A Amsterdam

May 25, 2025

Ces Unveiled Europe Nouveautes Technologiques A Amsterdam

May 25, 2025 -

1 500 Expected At Best Of Bangladesh Netherlands Event European Investors Attend

May 25, 2025

1 500 Expected At Best Of Bangladesh Netherlands Event European Investors Attend

May 25, 2025 -

Netherlands Hosts Major Bangladesh Business And Cultural Event

May 25, 2025

Netherlands Hosts Major Bangladesh Business And Cultural Event

May 25, 2025