Wedbush's Apple Prediction: Bullish Despite Price Target Reduction

Table of Contents

Wedbush's Revised Price Target and Rationale

Wedbush's revised Apple price target reflects a nuanced view of the tech giant's future. Previously, they held a higher price target (the specific figure should be inserted here, referencing the original Wedbush report), but this has now been reduced to (insert new, reduced price target here). This reduction, while significant, doesn't signal a change in their fundamentally bullish stance on Apple.

-

Reasons for the Reduction: Wedbush cites several factors contributing to the price target reduction:

- Macroeconomic Headwinds: Concerns about a potential global recession and its impact on consumer spending are impacting Apple's projected sales, particularly for higher-priced products like iPhones. Inflation and rising interest rates are also playing a role in dampening investor sentiment across the tech sector.

- Supply Chain Challenges: While less severe than in previous years, lingering supply chain disruptions continue to pose a risk to Apple's production and delivery timelines, potentially affecting revenue projections.

- Slowing iPhone Sales Growth: Although iPhone sales remain strong, Wedbush anticipates a slight deceleration in growth compared to previous years, primarily due to macroeconomic factors and increased competition.

-

Impact on Investor Sentiment: The price target reduction naturally caused some short-term volatility in Apple's stock price. However, the overall market reaction has been relatively muted, suggesting that investors largely share Wedbush's long-term optimism. The percentage change in the price target (calculate and insert here) highlights the magnitude of the adjustment, providing context for investors' reactions.

Maintaining a Bullish Outlook: Why Wedbush Remains Positive on Apple

Despite the price target reduction, Wedbush maintains a bullish outlook on Apple's long-term prospects. Their positive sentiment is rooted in several key factors:

- Unwavering Brand Loyalty: Apple boasts an exceptionally loyal customer base, which translates into consistent demand for its products and services. This brand loyalty acts as a strong buffer against economic downturns.

- Robust Innovation Pipeline: Apple continues to invest heavily in research and development, consistently releasing innovative products and services that capture market share and drive growth. The anticipated launch of new products (mention specific products if known from Wedbush report) further solidifies their positive outlook.

- Strong Services Revenue Growth: Apple's services segment, encompassing offerings like Apple Music, iCloud, and the App Store, continues to show robust growth and is becoming an increasingly significant revenue driver, mitigating the reliance on hardware sales alone.

- Expansion into New Markets: Apple is actively expanding into new markets and demographics, further diversifying its revenue streams and fueling long-term growth. The ongoing penetration of emerging markets presents significant opportunities.

- Competitive Advantage: Despite competition, Apple maintains a significant competitive advantage built on its brand reputation, superior ecosystem, and innovative product design. Wedbush views this advantage as durable.

Implications for Apple Investors: How to Interpret the Prediction

Wedbush's revised Apple price target and continued bullish outlook offer a complex picture for investors. It’s crucial to adopt a balanced approach when interpreting this prediction.

- Interpreting the Prediction: The reduced price target shouldn't be interpreted as a bearish signal, but rather as a reflection of short-term market uncertainties. The firm's sustained bullish sentiment emphasizes the company's long-term potential.

- Risk Assessment: Investing in any stock involves risk. Currently, macroeconomic factors, geopolitical events, and potential supply chain disruptions present risks to Apple's stock price.

- Risk Management Strategies: Diversification and dollar-cost averaging are effective strategies to mitigate risk. Diversifying your portfolio across different asset classes reduces your exposure to any single stock's volatility. Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the stock price, reducing the impact of market fluctuations.

- Long-Term vs. Short-Term: Wedbush's analysis leans towards a long-term investment horizon. While short-term volatility is possible, the firm's bullish outlook suggests significant long-term growth potential for Apple investors.

Conclusion

Wedbush's revised Apple price target reflects a careful recalibration of expectations based on current market conditions, but their continued bullish outlook underscores the long-term potential of this tech giant. The reduction primarily reflects macroeconomic headwinds and a slight slowing of iPhone sales growth, not a fundamental shift in Apple’s strength. However, factors like brand loyalty, innovation, services revenue, and market expansion continue to fuel their optimistic assessment. While Wedbush's Apple prediction offers valuable insight, thorough research and consideration of your personal risk tolerance are paramount before making any investment decisions. Stay informed on the latest Apple stock predictions and analysis to make well-informed choices regarding your Apple investment strategy. Learn more about Wedbush's Apple analysis and other market predictions to further your understanding of the current investment climate and refine your own Apple stock prediction.

Featured Posts

-

2002 Submarine Scandal French Investigation Points To Malaysias Former Prime Minister Najib

May 25, 2025

2002 Submarine Scandal French Investigation Points To Malaysias Former Prime Minister Najib

May 25, 2025 -

Sean Penn Questions Dylan Farrows Account Of Woody Allen Abuse

May 25, 2025

Sean Penn Questions Dylan Farrows Account Of Woody Allen Abuse

May 25, 2025 -

Us Japan Trade Trumps Impact On The Nippon Steel Deal

May 25, 2025

Us Japan Trade Trumps Impact On The Nippon Steel Deal

May 25, 2025 -

Memorial Day Travel 2025 Optimal Flight Dates

May 25, 2025

Memorial Day Travel 2025 Optimal Flight Dates

May 25, 2025 -

Porsche Investuoja I Elektromobiliu Infrastruktura Europoje

May 25, 2025

Porsche Investuoja I Elektromobiliu Infrastruktura Europoje

May 25, 2025

Latest Posts

-

Cohere Asks Us Court To Dismiss Media Copyright Claim

May 25, 2025

Cohere Asks Us Court To Dismiss Media Copyright Claim

May 25, 2025 -

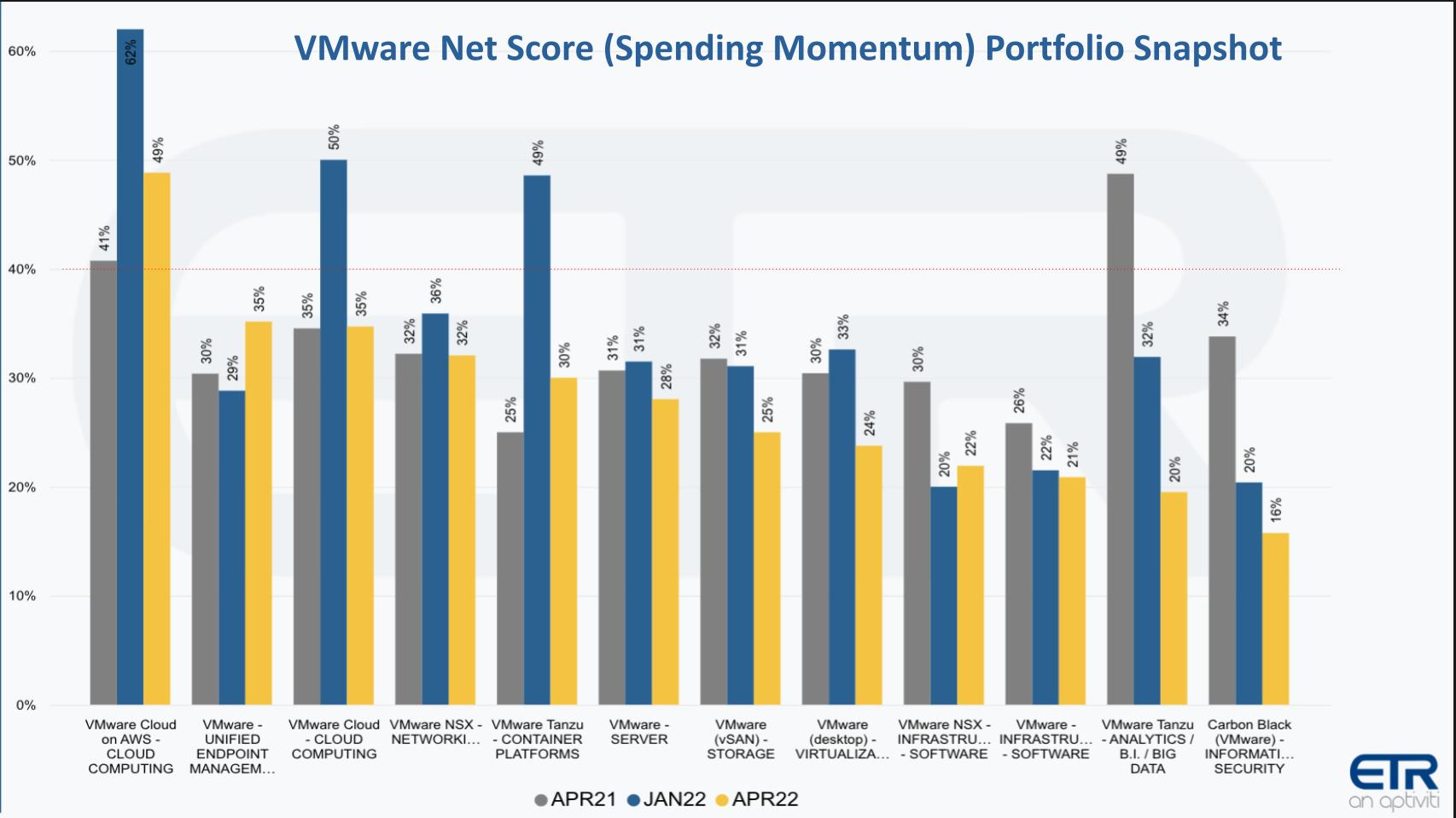

Broadcoms Proposed V Mware Price Hike An Unacceptable 1 050 Increase

May 25, 2025

Broadcoms Proposed V Mware Price Hike An Unacceptable 1 050 Increase

May 25, 2025 -

Cenovus Ceo Meg Acquisition Unlikely Amidst Focus On Organic Growth

May 25, 2025

Cenovus Ceo Meg Acquisition Unlikely Amidst Focus On Organic Growth

May 25, 2025 -

At And T Raises Alarm Over Broadcoms Extreme V Mware Price Hike

May 25, 2025

At And T Raises Alarm Over Broadcoms Extreme V Mware Price Hike

May 25, 2025 -

Extreme Price Increase For V Mware At And T Challenges Broadcoms Proposal

May 25, 2025

Extreme Price Increase For V Mware At And T Challenges Broadcoms Proposal

May 25, 2025