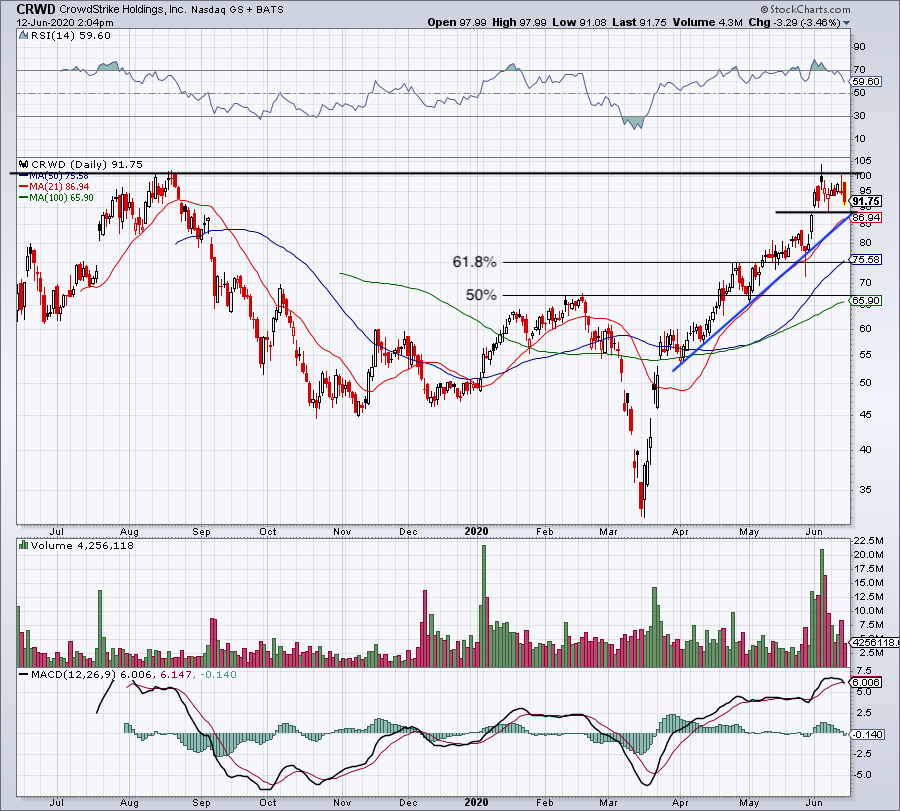

Wednesday's CoreWeave (CRWV) Stock Rally: Analysis And Potential Drivers

Table of Contents

The Impact of AI on CoreWeave's Growth

The explosive growth of artificial intelligence is undeniably a key driver behind CoreWeave's recent success. The demand for high-performance computing resources capable of handling complex AI workloads is soaring. This demand is fueled by advancements in machine learning, deep learning, and the increasing adoption of AI across various industries.

- High-Performance Computing Needs: The training of sophisticated AI models requires massive computational power, significantly more than traditional data processing tasks. This translates into a huge demand for powerful GPUs and optimized cloud infrastructure.

- CoreWeave's AI-Ready Infrastructure: CoreWeave has strategically positioned itself to capitalize on this demand. Its cloud infrastructure is specifically designed for AI workloads, offering GPU instances with optimized networking and storage solutions, enabling efficient and scalable AI model training and deployment.

- Market Position and Competitive Advantage: CoreWeave's focus on providing specialized AI infrastructure gives it a competitive advantage in the rapidly evolving cloud computing market. Its ability to cater to the unique needs of AI developers and researchers is attracting significant attention from investors.

- Competitive Landscape: While competitors exist in the cloud computing space, CoreWeave’s specialization in AI and its strong partnerships differentiate it, contributing to the positive market sentiment and subsequent stock price appreciation.

Nvidia's Partnership and its Significance

CoreWeave's strategic partnership with Nvidia, a leading provider of GPU technology, plays a crucial role in its success. This collaboration significantly strengthens CoreWeave's offerings and bolsters investor confidence.

- Access to Cutting-Edge Technology: The partnership provides CoreWeave with access to Nvidia's latest GPU technology, enabling it to offer its customers the most advanced and powerful computing resources for AI and other demanding workloads. This access to leading-edge GPUs is a critical differentiator.

- Strengthened Offerings: Integration with Nvidia's software and hardware solutions enhances CoreWeave's cloud platform, making it more efficient and attractive to clients. This translates into higher demand and potential for increased revenue.

- Future Collaboration Potential: The ongoing collaboration between CoreWeave and Nvidia suggests a promising future, with potential for further technological advancements and expansion of their joint offerings. This creates a positive outlook for long-term growth.

- Market Impact: The Nvidia partnership creates a positive market narrative around CRWV, signaling a commitment to innovation and technological leadership. This positive sentiment contributes significantly to the increased investor confidence and the recent stock rally.

Market Sentiment and Investor Confidence

The surge in CoreWeave's stock price reflects a positive market sentiment towards the company and the broader cloud computing and AI sectors.

- Favorable Tech Stock Market: Recent trends in the stock market have favored growth stocks, particularly those in the technology sector, which has been positively impacted by the continued rise of AI.

- Investor Expectations: Investors are increasingly optimistic about CoreWeave's potential for growth, given its strategic position within the rapidly expanding AI market. Meeting or exceeding these expectations is crucial for maintaining the positive momentum.

- Financial Performance: Positive financial performance and strong revenue projections further reinforce investor confidence and contribute to the upward trajectory of the stock price.

- Risk Assessment: While the potential for growth is significant, investors should always conduct a thorough risk assessment, considering factors such as market volatility and competition before making investment decisions.

CoreWeave's Competitive Advantage and Future Outlook

CoreWeave's success stems from its unique value proposition and strategic market positioning.

- Unique Selling Points: CoreWeave’s specialization in AI-optimized cloud infrastructure, combined with its strategic partnerships, creates a powerful competitive advantage. Its focus on providing high-performance computing resources tailored for AI workloads sets it apart from more generalized cloud providers.

- Market Penetration: CoreWeave's expansion plans and continued focus on innovation are expected to further enhance its market penetration, attracting new clients and driving revenue growth.

- Revenue Projections and Growth Forecasts: Positive revenue projections and optimistic growth forecasts underpin investor confidence and contribute to the stock price increase.

- Long-Term Investment Potential: The long-term investment potential of CRWV stock hinges on the company's ability to maintain its innovative edge, expand its market share, and effectively manage the risks associated with operating in a highly competitive and rapidly evolving industry.

Conclusion

This analysis of Wednesday's CoreWeave (CRWV) stock rally highlights the significant influence of several key factors: the accelerating adoption of AI, the strategic partnership with Nvidia, and the generally positive market sentiment towards the cloud computing sector. The company's strong market positioning within the rapidly expanding AI infrastructure market suggests considerable potential for future growth.

Call to Action: Understanding the factors driving CoreWeave's (CRWV) performance is crucial for investors interested in the high-growth cloud computing and AI sectors. However, thorough due diligence and further research into CoreWeave and the broader market are strongly recommended before making any investment decisions. Stay informed about CoreWeave (CRWV) stock and its continued evolution in the dynamic world of cloud computing and AI.

Featured Posts

-

The Most Refreshing Hot Weather Drink You Ve Never Heard Of

May 22, 2025

The Most Refreshing Hot Weather Drink You Ve Never Heard Of

May 22, 2025 -

The Klopp Factor Hout Bay Fcs Unexpected Ascent

May 22, 2025

The Klopp Factor Hout Bay Fcs Unexpected Ascent

May 22, 2025 -

Official Partnership Aims Group Joins Forces With World Trading Tournament Wtt

May 22, 2025

Official Partnership Aims Group Joins Forces With World Trading Tournament Wtt

May 22, 2025 -

Why Did Core Weave Crwv Stock Experience A Sharp Increase Last Week

May 22, 2025

Why Did Core Weave Crwv Stock Experience A Sharp Increase Last Week

May 22, 2025 -

Understanding The Name Of Peppa Pigs New Baby Sister

May 22, 2025

Understanding The Name Of Peppa Pigs New Baby Sister

May 22, 2025

Latest Posts

-

Remembering Adam Ramey A Tribute To The Dropout Kings Vocalist

May 22, 2025

Remembering Adam Ramey A Tribute To The Dropout Kings Vocalist

May 22, 2025 -

Remembering Adam Ramey Dropout Kings Vocalist 32

May 22, 2025

Remembering Adam Ramey Dropout Kings Vocalist 32

May 22, 2025 -

Death Of Adam Ramey Dropout Kings Vocalist Passes Away At 32

May 22, 2025

Death Of Adam Ramey Dropout Kings Vocalist Passes Away At 32

May 22, 2025 -

Dropout Kings Vocalist Adam Ramey Dies Unexpectedly

May 22, 2025

Dropout Kings Vocalist Adam Ramey Dies Unexpectedly

May 22, 2025 -

Adam Ramey Dropout Kings Vocalist Dead At 32

May 22, 2025

Adam Ramey Dropout Kings Vocalist Dead At 32

May 22, 2025