What Makes A Crypto Exchange Compliant In India? A Simple Guide For 2025

Table of Contents

Understanding the Indian Regulatory Framework for Crypto

The Indian regulatory landscape for cryptocurrencies is currently evolving, presenting both opportunities and challenges. While there's no specific overarching law defining cryptocurrencies, the government is actively working on creating a comprehensive legal framework. Several government bodies play a significant role, including the Reserve Bank of India (RBI), the Ministry of Finance, and the Securities and Exchange Board of India (SEBI).

- Overview of the current legal ambiguity surrounding cryptocurrencies: Currently, cryptocurrencies aren't explicitly banned but aren't fully recognized as legal tender either. This ambiguity creates uncertainty for businesses and investors.

- Discussion of potential future regulations and their implications: The government is reportedly considering a comprehensive crypto bill that could clarify the legal status of cryptocurrencies and potentially introduce a regulatory framework for crypto exchanges. This could involve licensing requirements, taxation policies, and consumer protection measures.

- Mention of the role of the Reserve Bank of India (RBI) and other relevant agencies: The RBI has expressed concerns about the risks associated with cryptocurrencies, particularly regarding money laundering and financial stability. Other agencies like SEBI are also involved in shaping the regulatory landscape, especially concerning the securities aspects of crypto assets.

- Key challenges and uncertainties in the regulatory environment: The lack of clear-cut legislation creates challenges for businesses operating in the crypto space. Uncertainty around taxation, licensing, and consumer protection remains a significant hurdle.

KYC/AML Compliance for Indian Crypto Exchanges

Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance are crucial for all Indian crypto exchanges. These regulations are designed to prevent the use of cryptocurrencies for illegal activities such as money laundering and terrorist financing.

- Comprehensive explanation of KYC procedures including identity verification, address verification, and source of funds: Indian crypto exchanges are required to verify the identity of their users through rigorous KYC processes. This typically involves verifying identity documents, proof of address, and potentially the source of funds used to purchase cryptocurrencies.

- Discussion of AML measures such as transaction monitoring, suspicious activity reporting, and sanctions screening: Exchanges must implement robust transaction monitoring systems to detect suspicious activity, such as large, unusual, or potentially illicit transactions. They are also obligated to report suspicious activity to the relevant authorities. Sanctions screening ensures that transactions are not linked to sanctioned individuals or entities.

- Importance of robust KYC/AML systems to prevent illegal activities: Strong KYC/AML systems are essential for preventing the use of crypto exchanges for money laundering, terrorist financing, and other illegal activities. These systems help maintain the integrity of the financial system.

- Penalties for non-compliance with KYC/AML regulations: Non-compliance with KYC/AML regulations can lead to significant penalties, including hefty fines, license revocation, and even legal action.

Tax Compliance for Crypto Transactions in India

Understanding the tax implications of cryptocurrency transactions is vital for both crypto exchanges and their users. The Indian tax authorities treat cryptocurrency transactions as assets, subjecting them to specific tax rules.

- Clarification on the taxability of cryptocurrency gains (capital gains tax): Profits from cryptocurrency trading are generally considered capital gains and are subject to capital gains tax. The tax rate depends on the holding period of the cryptocurrency.

- Discussion of GST implications on crypto exchange services: The Goods and Services Tax (GST) may apply to certain services provided by crypto exchanges, depending on the specific services offered.

- Overview of reporting requirements for crypto transactions: Users are required to report their cryptocurrency transactions to the tax authorities. The specific reporting requirements may vary depending on the type and amount of transactions.

- Potential tax audits and penalties for non-compliance: Non-compliance with tax regulations can lead to tax audits, penalties, and legal repercussions.

Data Security and Privacy for Compliant Crypto Exchanges in India

Protecting user data and maintaining privacy are paramount for any compliant crypto exchange in India. Robust security measures and adherence to data privacy regulations are essential.

- Importance of protecting user data from breaches and cyberattacks: Crypto exchanges handle sensitive user data, including personal information and financial details. Protecting this data from breaches and cyberattacks is crucial.

- Adherence to data privacy regulations like the Personal Data Protection Bill: Indian crypto exchanges must comply with the existing and upcoming data privacy regulations, such as the Personal Data Protection Bill, to ensure the protection of user data.

- Implementation of strong security protocols and encryption techniques: Implementing robust security protocols, including encryption, firewalls, and intrusion detection systems, is essential for protecting user data.

- Regular security audits and penetration testing: Regular security audits and penetration testing help identify vulnerabilities and ensure the ongoing security of the exchange's systems.

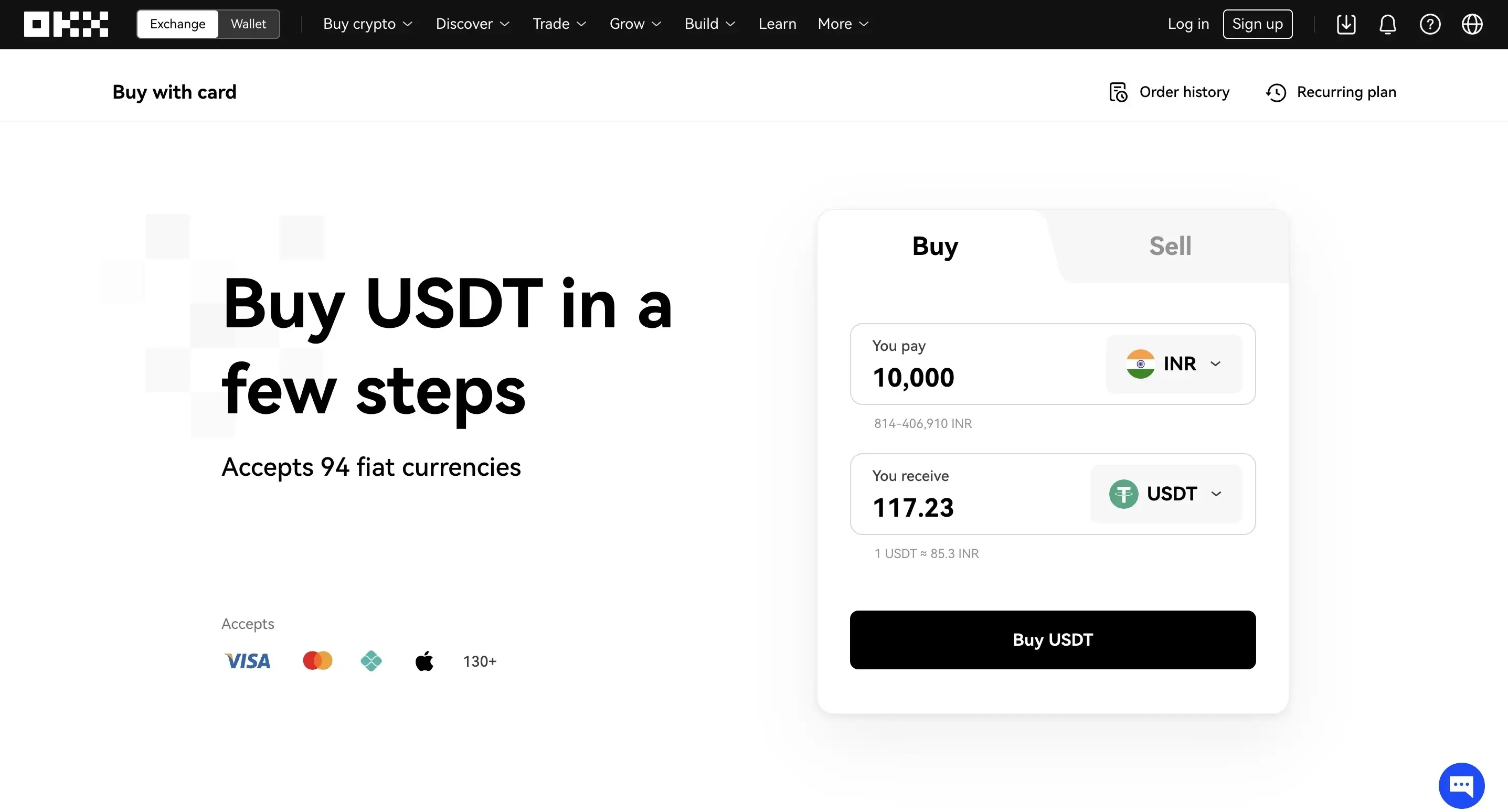

Choosing a Compliant Crypto Exchange in India

Selecting a compliant crypto exchange is crucial for protecting your investments and ensuring a safe trading experience.

- Verification of KYC/AML compliance certifications: Before using any exchange, verify that it holds the necessary KYC/AML compliance certifications.

- Checking for transparency in fee structures and operational processes: Choose an exchange with transparent fee structures and clearly defined operational processes.

- Reviewing the exchange's security measures and track record: Research the exchange's security measures and review its track record to assess its security posture.

- Considering user reviews and ratings from reputable sources: Read user reviews and ratings from reputable sources to get an understanding of the exchange's reputation and user experience.

Conclusion

Understanding Crypto Exchange Compliance in India is paramount for ensuring a secure and legal cryptocurrency experience. This guide has outlined the key aspects of regulatory compliance, including KYC/AML procedures, tax regulations, data security, and choosing a compliant platform. By adhering to these guidelines, both exchanges and users can contribute to a more responsible and sustainable crypto ecosystem in India. Choosing a compliant exchange is vital; prioritize your safety and always research thoroughly before engaging with any crypto exchange in India. Remember to stay updated on the evolving regulatory landscape regarding crypto exchange compliance in India.

Featured Posts

-

Burak Mavis Ve Akkor Davasinin Gelecegi Aihm Veya Karma Evlilik

May 15, 2025

Burak Mavis Ve Akkor Davasinin Gelecegi Aihm Veya Karma Evlilik

May 15, 2025 -

Kibris Baris Suereci Stefanos Stefanu Nun Oenemi

May 15, 2025

Kibris Baris Suereci Stefanos Stefanu Nun Oenemi

May 15, 2025 -

Npo Baas Onder Vuur Beschuldigingen Van Angstcultuur Door Medewerkers

May 15, 2025

Npo Baas Onder Vuur Beschuldigingen Van Angstcultuur Door Medewerkers

May 15, 2025 -

Discussie Leeflang Bruins En Npo Toezichthouder Moeten Overleggen

May 15, 2025

Discussie Leeflang Bruins En Npo Toezichthouder Moeten Overleggen

May 15, 2025 -

Npo Baas Beschuldigd Van Het Creeren Van Een Angstcultuur Door Tientallen Medewerkers

May 15, 2025

Npo Baas Beschuldigd Van Het Creeren Van Een Angstcultuur Door Tientallen Medewerkers

May 15, 2025

Latest Posts

-

Verbetering Van De Procedures Tegen Grensoverschrijdend Gedrag Binnen De Npo

May 15, 2025

Verbetering Van De Procedures Tegen Grensoverschrijdend Gedrag Binnen De Npo

May 15, 2025 -

Npo Baas Onder Vuur Beschuldigingen Van Angstcultuur Door Medewerkers

May 15, 2025

Npo Baas Onder Vuur Beschuldigingen Van Angstcultuur Door Medewerkers

May 15, 2025 -

Onvrede Leidt Tot Actie Tegen Npo Baas Frederieke Leeflang

May 15, 2025

Onvrede Leidt Tot Actie Tegen Npo Baas Frederieke Leeflang

May 15, 2025 -

Npos Aanpak Van Grensoverschrijdend Gedrag Wat Werkt Wel En Wat Niet

May 15, 2025

Npos Aanpak Van Grensoverschrijdend Gedrag Wat Werkt Wel En Wat Niet

May 15, 2025 -

Angstcultuur Bij De Npo Tientallen Medewerkers Spreken Zich Uit Tegen Baas

May 15, 2025

Angstcultuur Bij De Npo Tientallen Medewerkers Spreken Zich Uit Tegen Baas

May 15, 2025