What Makes An Investment A Real Safe Bet? A Practical Analysis

Table of Contents

Understanding Your Risk Tolerance

Before diving into specific investment options, assessing your personal risk tolerance is paramount. This crucial step determines the types of "safe investment options" suitable for your circumstances. A thorough understanding of your risk profile guides your investment strategy and prevents impulsive decisions driven by fear or greed.

- Consider your financial goals: Are you saving for a down payment on a house (short-term), or planning for retirement (long-term)? Short-term goals generally require lower-risk, more conservative investment strategies.

- Evaluate your emotional response to market fluctuations: How do you react to news of market downturns? A high tolerance for risk implies you can weather market volatility without panic selling.

- Determine your comfort level with potential losses: Every investment carries some degree of risk. Understanding your acceptable level of loss helps you avoid investments that could cause undue stress.

- Utilize risk tolerance assessment tools: Several online quizzes and consultations with financial advisors can help you objectively determine your risk tolerance.

Diversification: The Cornerstone of a Safe Bet Investment

Diversification is the bedrock of any successful "safe bet investment" strategy. It involves spreading your investments across various asset classes to reduce the impact of any single investment performing poorly. A diversified portfolio mitigates risk and improves the overall stability of your investments.

- Stocks: Consider both blue-chip stocks (established, large companies) known for stability and dividend-paying stocks that provide a regular income stream.

- Bonds: Government bonds are generally considered low-risk, while corporate bonds offer potentially higher returns but with increased risk.

- Real Estate: Rental properties can provide a steady income stream, while Real Estate Investment Trusts (REITs) offer a more liquid way to invest in real estate.

- Commodities: Precious metals like gold and silver are often seen as safe haven assets during times of economic uncertainty. However, their prices can fluctuate.

- Alternative investments: Hedge funds and private equity can offer diversification but are typically suitable only for high-net-worth individuals due to higher minimum investment requirements and complexities. These are generally not considered "safe bet investments" due to higher risk.

Building a "safe investment portfolio" requires careful asset allocation, balancing risk and potential returns.

Choosing the Right Asset Classes for a Safe Bet

Selecting the right asset classes is vital for creating a low-risk, stable investment portfolio. Certain asset classes are inherently less volatile than others, making them suitable for those seeking "safe investments."

- Government bonds: Issued by governments, these bonds are generally considered very low-risk, offering a predictable income stream with minimal risk of default. They are a cornerstone of many conservative investment strategies.

- High-quality dividend-paying stocks: These stocks offer a steady stream of income through dividends, providing a cushion against market fluctuations. However, the dividend payouts are not guaranteed and can be reduced or eliminated.

- Index funds: Index funds track a specific market index (like the S&P 500), offering broad market exposure at a low cost. While not entirely risk-free, they offer a diversified and relatively stable approach to investing. Understanding the difference between growth and value index funds is important for aligning with your risk tolerance. Growth index funds tend to be more volatile than value index funds.

These "low-risk assets" form the foundation of many "conservative investment strategies" aimed at capital preservation.

Professional Guidance: When to Seek Expert Help for Safe Bet Investments

While building a "safe bet investment" portfolio is possible through self-education, seeking professional guidance offers significant advantages. A financial advisor can provide personalized advice tailored to your specific needs and risk tolerance.

- Personalized financial planning: Advisors create customized plans aligned with your goals, timelines, and risk profile.

- Tailored investment strategies: They recommend specific investment options appropriate for your circumstances, helping you navigate the complexities of the market.

- Guidance through market volatility: Professional advisors can help you make rational decisions during periods of market uncertainty, preventing emotional responses that might harm your portfolio.

- Assistance with tax optimization: Advisors can help you structure your investments to minimize your tax liability, maximizing your returns.

Conclusion

Building a truly "safe bet investment" portfolio requires a multifaceted approach. Understanding your risk tolerance, employing diversification strategies, carefully selecting stable asset classes like government bonds and high-quality dividend-paying stocks, and seeking professional guidance when needed are all crucial steps. Remember, there's no such thing as a completely risk-free investment, but by following these guidelines, you can significantly reduce your risk and increase your chances of achieving your financial goals.

Start planning your "safe bet investment" strategy today! Assess your risk tolerance using online resources and consider the asset classes discussed. For personalized guidance, explore finding a qualified financial advisor. Further your knowledge by reading more about "low-risk investment options for beginners" or "building a secure retirement portfolio." Let's work together to build a secure financial future with smart and "secure investment strategies".

Featured Posts

-

Dakota Dzhonson Proval Goda Po Versii Zolotoy Maliny

May 09, 2025

Dakota Dzhonson Proval Goda Po Versii Zolotoy Maliny

May 09, 2025 -

Upcoming Trade Agreement Trumps Announcement With Uk

May 09, 2025

Upcoming Trade Agreement Trumps Announcement With Uk

May 09, 2025 -

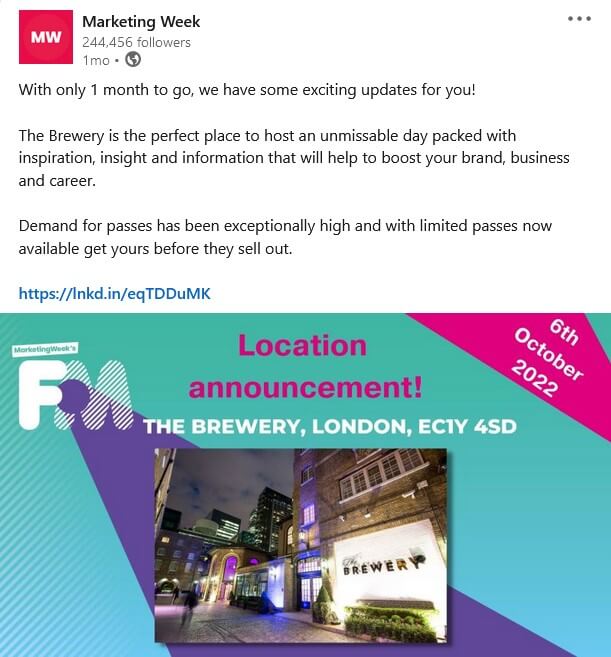

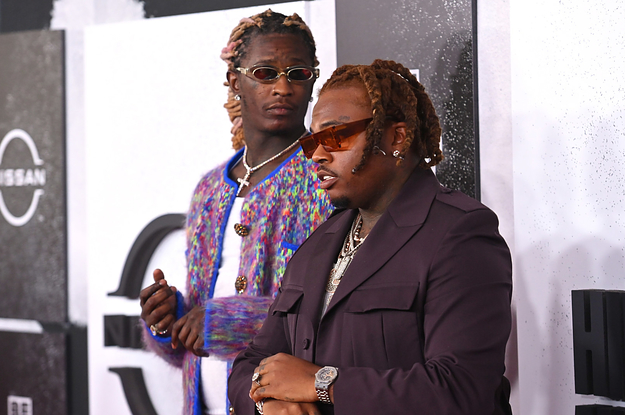

Young Thugs Reaction To Not Like U Name Drop After Prison Release

May 09, 2025

Young Thugs Reaction To Not Like U Name Drop After Prison Release

May 09, 2025 -

Imalaia Elaxista Xionia 23etis Istoriko Xamilo

May 09, 2025

Imalaia Elaxista Xionia 23etis Istoriko Xamilo

May 09, 2025 -

De Relatie Brekelmans India Uitdagingen En Kansen Voor Samenwerking

May 09, 2025

De Relatie Brekelmans India Uitdagingen En Kansen Voor Samenwerking

May 09, 2025