What's Driving CoreWeave's Stock Price?

Table of Contents

CoreWeave's Business Model and Growth Potential

CoreWeave's success hinges on its ability to provide robust, scalable, and cost-effective cloud infrastructure, perfectly positioned to capitalize on the explosive growth of the AI sector.

High Demand for AI Infrastructure

The AI revolution is here, and it's driving unprecedented demand for powerful computing resources. CoreWeave's specialized GPU-powered cloud computing services are at the heart of this revolution.

- AI's Growing Needs: The development and deployment of sophisticated AI models, from large language models to complex image recognition systems, require immense computational power. This demand fuels the growth of companies like CoreWeave.

- Key Partnerships and Customers: CoreWeave boasts impressive partnerships with leading AI companies and research institutions, securing a strong foothold in the market. These collaborations further solidify their position as a critical infrastructure provider.

- Market Projections: The market for AI infrastructure is projected to experience exponential growth in the coming years. Analysts predict significant expansion, offering CoreWeave a substantial runway for continued growth and revenue generation. This positive outlook directly impacts CoreWeave stock.

Competitive Advantages

CoreWeave distinguishes itself through several key competitive advantages:

- Sustainable Practices: CoreWeave's commitment to sustainability sets it apart, appealing to environmentally conscious clients and investors. This contributes positively to their brand image and investor confidence.

- Specialized Hardware: CoreWeave utilizes cutting-edge hardware optimized for AI workloads, providing superior performance and efficiency compared to general-purpose cloud solutions.

- Efficient Infrastructure: Their infrastructure is designed for optimal performance and resource utilization, translating to cost savings for clients and enhanced profitability for CoreWeave. This efficiency is a significant driver of CoreWeave stock valuation.

Market Sentiment and Investor Confidence

Market sentiment and investor confidence play a vital role in shaping CoreWeave's stock price.

Recent News and Events

Recent announcements significantly influence investor perception of CoreWeave.

- Earnings Reports: Strong earnings reports demonstrating robust revenue growth and profitability naturally boost investor confidence and drive up the CoreWeave stock price.

- Strategic Partnerships: New partnerships with major technology companies strengthen CoreWeave's market position and signal future growth potential, impacting the CoreWeave stock positively.

- Product Launches: The introduction of innovative products and services expands CoreWeave's offerings and attracts new customers, increasing the overall value proposition and influencing investor sentiment. (Links to relevant news articles would be inserted here).

Analyst Ratings and Predictions

Analyst opinions significantly contribute to shaping the overall market sentiment surrounding CoreWeave stock.

- Key Ratings Agencies: Major investment banks and research firms regularly publish ratings and price targets for CoreWeave stock, influencing investor decisions.

- Consensus Forecasts: A consensus of positive analyst predictions generally translates to increased investor confidence and upward pressure on the CoreWeave stock price.

- Discrepancies in Opinions: Divergences in analyst opinions can create volatility in the CoreWeave stock price, highlighting the importance of conducting thorough due diligence.

Macroeconomic Factors and Industry Trends

Broader economic conditions and industry trends influence CoreWeave's stock valuation.

Interest Rates and Inflation

Macroeconomic factors like interest rates and inflation impact the entire tech sector, including CoreWeave.

- Interest Rates and Tech Valuations: Rising interest rates generally lead to lower valuations for growth stocks like CoreWeave, as investors seek safer, higher-yield investments.

- Inflation and Cloud Spending: High inflation can impact businesses' spending on cloud computing services, potentially affecting CoreWeave's revenue growth.

Overall Tech Sector Performance

The performance of the broader tech sector heavily influences CoreWeave's stock price.

- Sector-Wide Trends: Positive performance in the tech sector generally translates to increased investor confidence in individual tech companies like CoreWeave.

- Comparative Performance: CoreWeave's performance relative to its competitors within the cloud computing and AI infrastructure market influences investor sentiment and stock price.

Conclusion

In conclusion, the CoreWeave stock price is influenced by a complex interplay of factors. Strong growth potential within the booming AI infrastructure market, positive market sentiment fueled by strong earnings and strategic partnerships, and the overall performance of the tech sector all contribute significantly. Macroeconomic conditions, including interest rates and inflation, also play a role. Understanding these key drivers is crucial for making informed investment decisions related to CoreWeave stock. Conduct thorough research and consult with a financial advisor before making any investment choices. Remember to carefully analyze CoreWeave's financial performance, competitive landscape, and future growth prospects before considering a CoreWeave investment.

Featured Posts

-

Du An Duong 4 Lan Xe Xuyen Rung Ma Da Dong Nai Kien Nghi Ket Noi Binh Phuoc

May 22, 2025

Du An Duong 4 Lan Xe Xuyen Rung Ma Da Dong Nai Kien Nghi Ket Noi Binh Phuoc

May 22, 2025 -

Nyt Wordle Help Hints And Answer For April 12 1393

May 22, 2025

Nyt Wordle Help Hints And Answer For April 12 1393

May 22, 2025 -

21 Year Old Peppa Pig Mystery Finally Explained Fans React

May 22, 2025

21 Year Old Peppa Pig Mystery Finally Explained Fans React

May 22, 2025 -

Core Weave Crwv Stock Performance On Thursday Factors Contributing To The Decline

May 22, 2025

Core Weave Crwv Stock Performance On Thursday Factors Contributing To The Decline

May 22, 2025 -

New Yorks Downtown The New Hotspot For The Wealthy

May 22, 2025

New Yorks Downtown The New Hotspot For The Wealthy

May 22, 2025

Latest Posts

-

Frontmans Name Dead At 32 A Tribute To A Rock Music Icon

May 22, 2025

Frontmans Name Dead At 32 A Tribute To A Rock Music Icon

May 22, 2025 -

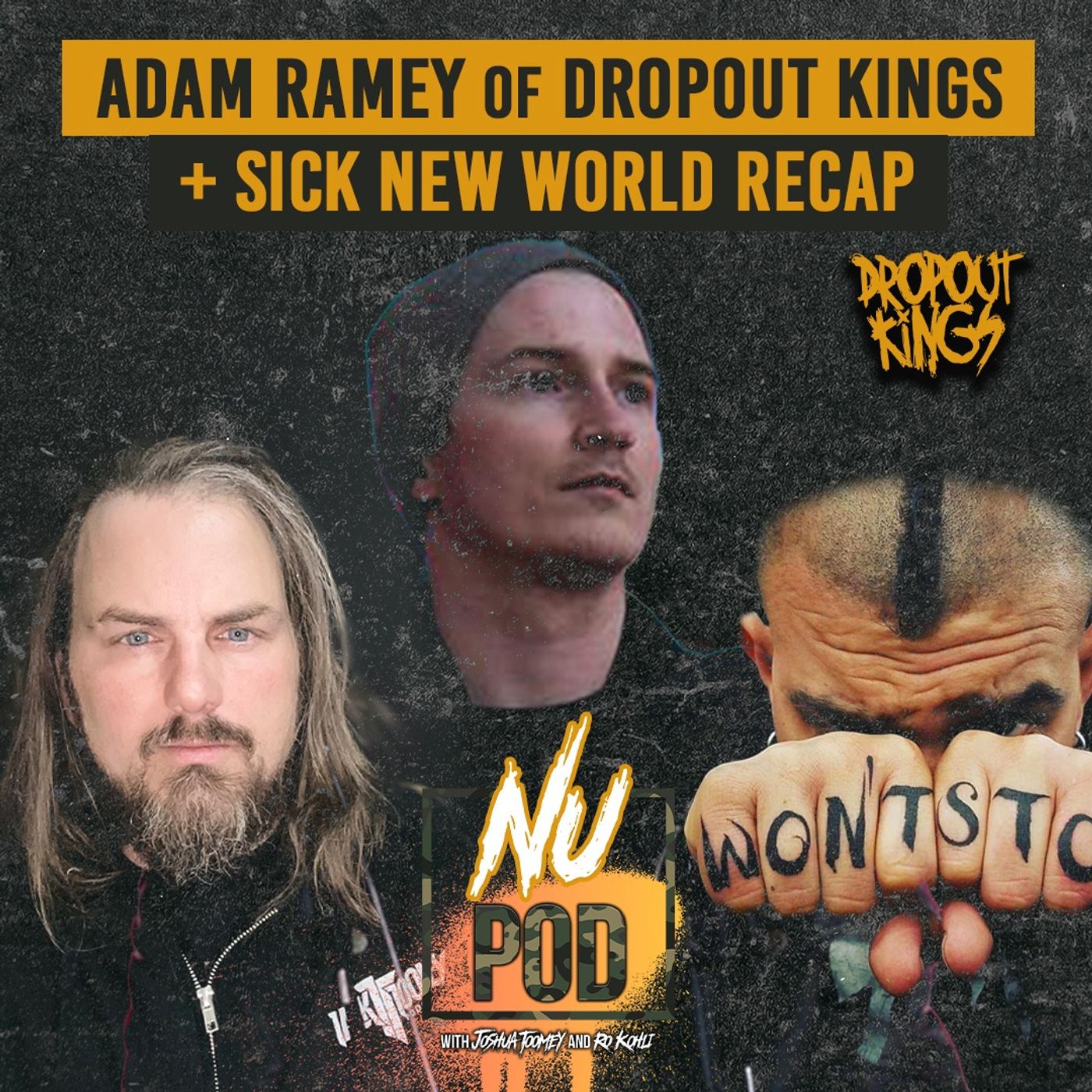

Dropout Kings Vocalist Adam Ramey Dies At 32

May 22, 2025

Dropout Kings Vocalist Adam Ramey Dies At 32

May 22, 2025 -

The Untimely Death Of A Rock Star Frontmans Name Passes Away At 32

May 22, 2025

The Untimely Death Of A Rock Star Frontmans Name Passes Away At 32

May 22, 2025 -

A Rock Legend Lost The Death Of Band Name S Frontman At 32

May 22, 2025

A Rock Legend Lost The Death Of Band Name S Frontman At 32

May 22, 2025 -

Adam Ramey Dropout Kings Vocalist Dies At 31 A Music Industry Loss

May 22, 2025

Adam Ramey Dropout Kings Vocalist Dies At 31 A Music Industry Loss

May 22, 2025