Why Buy AI Quantum Computing Stock On The Dip?

Table of Contents

The Undeniable Potential of AI Quantum Computing

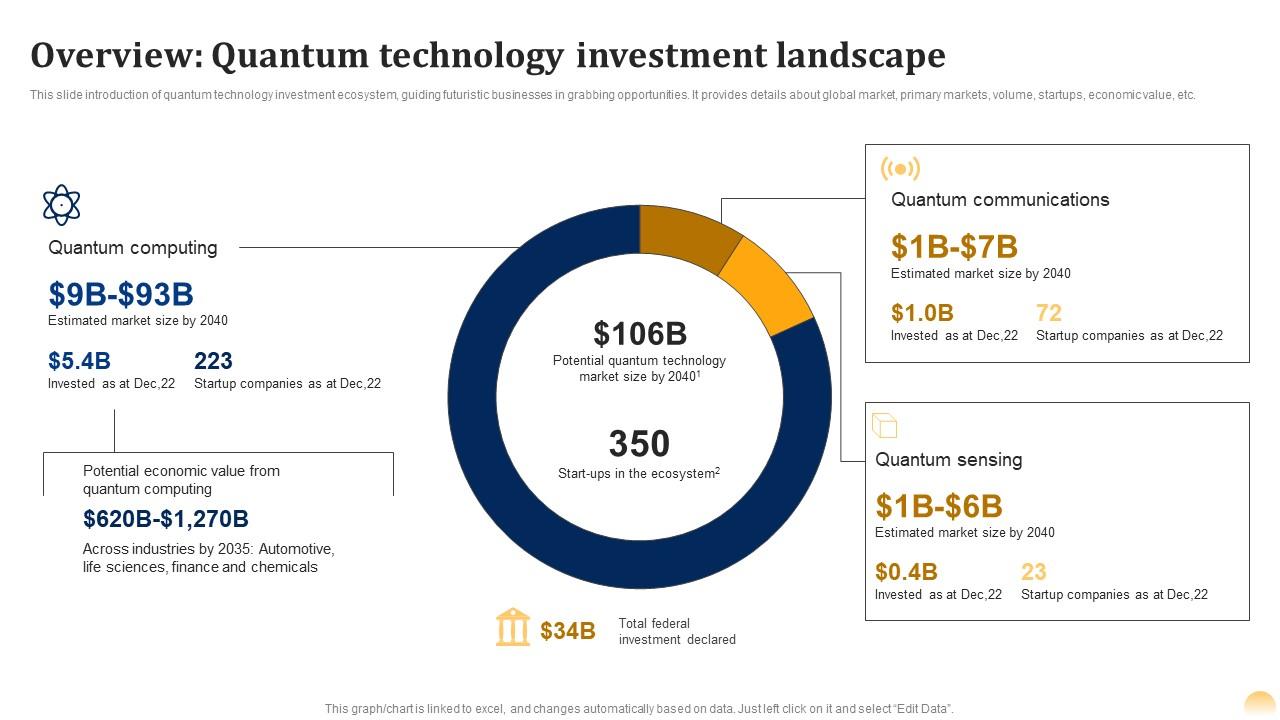

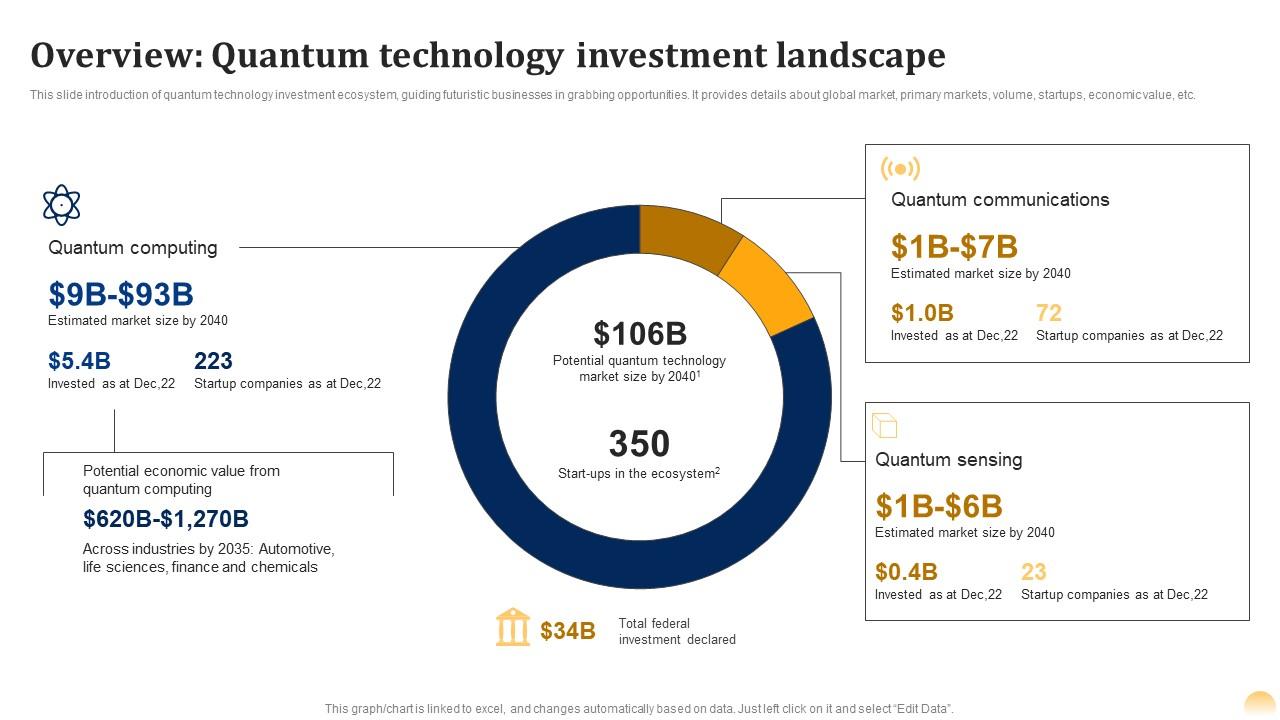

The convergence of artificial intelligence (AI) and quantum computing represents a technological revolution with the potential to reshape numerous industries. Quantum computing's ability to process vast amounts of data exponentially faster than classical computers, combined with AI's advanced analytical capabilities, unlocks unprecedented possibilities. This synergy promises breakthroughs across various sectors:

Keywords: Quantum computing applications, AI advancements, quantum supremacy, technological disruption

- Faster drug discovery and development: Quantum computers can simulate molecular interactions with unparalleled accuracy, accelerating the identification and development of new drugs and therapies. This could lead to quicker treatments for diseases like cancer and Alzheimer's.

- Improved financial modeling and risk assessment: The immense computational power of AI quantum computing can revolutionize financial modeling, allowing for more accurate predictions of market trends and risk assessment, leading to better investment strategies and more stable financial systems.

- Creation of novel materials with enhanced properties: Quantum simulations can help design materials with superior properties, leading to breakthroughs in various fields, from aerospace engineering to renewable energy. Imagine lighter, stronger materials for aircraft or more efficient solar panels.

- Breakthroughs in artificial intelligence algorithms: Quantum computing can significantly enhance the capabilities of AI algorithms, leading to more sophisticated machine learning models and improved problem-solving capabilities in areas like natural language processing and image recognition.

- Solving currently unsolvable computational problems: Many complex problems that are currently intractable for classical computers, such as protein folding and optimization problems, may become solvable using AI quantum computing, unlocking new scientific discoveries and technological innovations.

Why Buy on the Dip? Understanding Market Corrections

The current market correction presents a strategic opportunity for long-term investors. "Buying the dip" – purchasing assets when their prices have temporarily fallen – is a well-established investment strategy. While market volatility is inherent, the underlying potential of AI quantum computing remains strong. Temporary fluctuations shouldn't overshadow the technology's transformative potential.

Keywords: Stock market correction, dip buying strategy, risk mitigation, long-term investment, market volatility

- Market corrections offer discounted entry points for strong companies: During market downturns, even fundamentally sound companies experience price drops, creating opportunities to acquire shares at a reduced cost.

- Long-term investors benefit from buying during periods of market uncertainty: Market corrections are temporary. Long-term investors who buy during these periods are often rewarded handsomely when the market recovers.

- Diversification across multiple AI quantum computing stocks reduces risk: Don't put all your eggs in one basket. Diversifying your investments across several promising companies within the AI quantum computing sector can mitigate risk.

- Thorough due diligence is crucial before investing: Before investing in any AI quantum computing stock, conduct thorough research to understand the company's business model, financial health, and competitive landscape.

Identifying Promising AI Quantum Computing Stocks

Identifying promising companies in the AI quantum computing sector requires careful research and analysis. Remember, this is a rapidly evolving field, so staying informed is crucial. While we cannot recommend specific stocks due to legal and ethical considerations, here's how to approach your research:

Keywords: Quantum computing companies, stock screening, investment research, due diligence, financial analysis

- Analyze companies' research and development efforts: Look for companies with a strong track record of innovation and a clear roadmap for future development. Examine their publications and patents.

- Assess the strength of their intellectual property portfolio: A robust IP portfolio protects the company’s innovations and provides a competitive advantage.

- Examine their partnerships and collaborations with other industry players: Strategic alliances with established companies can accelerate growth and market penetration.

- Evaluate their financial performance and future projections: Analyze the company's financial statements, including revenue, profitability, and cash flow. Look at their projections for future growth.

- Consult with a financial advisor before making any investment decisions: Seek professional financial advice tailored to your individual circumstances and risk tolerance.

Managing Risk in AI Quantum Computing Investments

Investing in early-stage technologies like AI quantum computing carries inherent risks. Market fluctuations, technological hurdles, and competitive pressures can all impact investment returns. Therefore, responsible risk management is critical.

Keywords: Investment risk, portfolio diversification, risk tolerance, tech stock risk, responsible investing

- Diversify your investment portfolio across different sectors and asset classes: Don't concentrate your investments solely in AI quantum computing stocks. Diversification across various sectors helps mitigate overall portfolio risk.

- Only invest an amount you can afford to lose: Never invest more than you can afford to lose. Early-stage tech investments are inherently risky, and losses are possible.

- Stay informed about market trends and company developments: Keep up-to-date on industry news, company announcements, and market analysis to make informed investment decisions.

- Regularly review and adjust your investment strategy as needed: Your investment strategy shouldn't be static. Regularly review your portfolio and adjust your holdings based on market conditions and your own financial goals.

Conclusion

The convergence of AI and quantum computing presents a potentially transformative technological leap. The current market dip offers a unique opportunity to acquire promising AI quantum computing stocks at discounted prices. While risk is inherent in any investment, particularly in early-stage technologies, thorough due diligence and a well-diversified portfolio can mitigate these risks. Don't miss the boat on this potentially transformative technology. Start your research today and explore the opportunities presented by AI quantum computing stocks. Remember to conduct thorough due diligence and consult with a financial advisor before making any investment decisions. Take advantage of the current dip and secure your position in the future of AI quantum computing.

Featured Posts

-

Adressage Abidjan Comment Identifier Les Numeros De Batiment

May 20, 2025

Adressage Abidjan Comment Identifier Les Numeros De Batiment

May 20, 2025 -

Suki Waterhouses Twinks Tik Tok A Hilarious Moment Explained

May 20, 2025

Suki Waterhouses Twinks Tik Tok A Hilarious Moment Explained

May 20, 2025 -

Solo Travel Safety Budget And Itinerary Planning

May 20, 2025

Solo Travel Safety Budget And Itinerary Planning

May 20, 2025 -

March 16 2025 Nyt Mini Crossword Clues Answers And Solutions

May 20, 2025

March 16 2025 Nyt Mini Crossword Clues Answers And Solutions

May 20, 2025 -

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Ulos

May 20, 2025

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Ulos

May 20, 2025

Latest Posts

-

Champions League I Kroyz Azoyl Kai O Giakoymakis Diekdikoyn To Tropaio

May 20, 2025

Champions League I Kroyz Azoyl Kai O Giakoymakis Diekdikoyn To Tropaio

May 20, 2025 -

Protomagia Sto Oropedio Evdomos Idanikes Drastiriotites Kai Topia

May 20, 2025

Protomagia Sto Oropedio Evdomos Idanikes Drastiriotites Kai Topia

May 20, 2025 -

Protomagia Sto Oropedio Evdomos Odigos Gia Mia Aksexasti Empeiria

May 20, 2025

Protomagia Sto Oropedio Evdomos Odigos Gia Mia Aksexasti Empeiria

May 20, 2025 -

Kroyz Azoyl Telikos Champions League I Poreia Toy Giakoymaki

May 20, 2025

Kroyz Azoyl Telikos Champions League I Poreia Toy Giakoymaki

May 20, 2025 -

Prokrisi Kroyz Azoyl O Giakoymakis Ston Teliko Champions League

May 20, 2025

Prokrisi Kroyz Azoyl O Giakoymakis Ston Teliko Champions League

May 20, 2025