Why Did BCE Inc. Cut Its Dividend? Understanding The Impact On Investors

Table of Contents

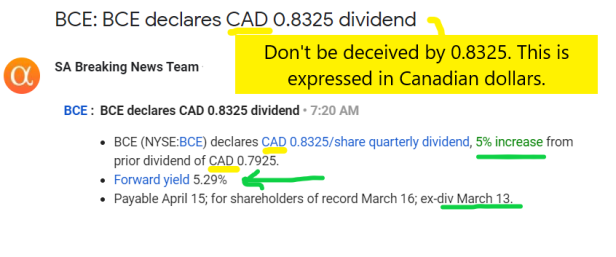

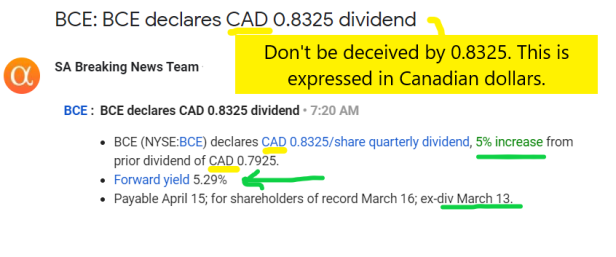

BCE Inc.'s Financial Performance Leading to the Dividend Cut

BCE Inc.'s recent financial performance provides crucial context for understanding the dividend reduction. Analyzing key metrics reveals a picture of pressures impacting the company's ability to maintain its previous dividend payout.

Analyzing Revenue Streams

BCE Inc.'s revenue streams, historically strong and diversified across wireless, wireline, and media, have experienced shifts in recent periods.

- Wireless: Increased competition and pricing pressures have impacted growth in this key sector.

- Wireline: The continued migration to wireless services has put pressure on wireline revenue, impacting profitability.

- Media: Changes in consumer viewing habits and the competitive landscape of the media industry have also contributed to revenue challenges.

These market pressures, combined with increased operational costs, have impacted overall revenue growth and profitability, necessitating a reevaluation of the dividend policy.

Debt Levels and Capital Expenditure

BCE Inc.'s debt-to-equity ratio has risen in recent years, largely due to significant capital expenditures in network infrastructure upgrades, including 5G expansion and fiber optic network development. These investments, while essential for long-term growth and competitiveness, have placed a strain on the company's financial resources, directly influencing the decision to reduce the dividend. The company's need to maintain a healthy financial position and manage its debt load played a significant role in the dividend cut. [Insert relevant chart/graph showing debt-to-equity ratio over time].

The Official Reasons Behind the BCE Inc. Dividend Reduction

BCE Inc.'s official statements regarding the dividend cut cite a need to prioritize strategic investments and strengthen its financial position.

Management's Perspective

In their official announcements, BCE Inc. management emphasized the importance of investing in future growth and network infrastructure upgrades. [Insert direct quote from BCE Inc. press release or investor call explaining the reasoning]. The company highlighted the long-term benefits of these investments, aiming to position BCE Inc. for continued success in a rapidly evolving telecommunications market.

Investor Reaction and Market Sentiment

The market reacted negatively to the announcement of the BCE Inc. dividend cut, with the stock price experiencing a short-term dip. [Mention specific stock price changes and percentage drop]. Analyst ratings were mixed, with some downgrading the stock while others maintained a more positive outlook, reflecting the varied perspectives on the long-term impact of the decision. Overall investor sentiment was cautious, with many seeking clarification on the company’s future financial projections and dividend policy.

Impact of the BCE Inc. Dividend Cut on Investors

The BCE Inc. dividend cut has varying consequences for different investor types.

Implications for Income Investors

Income investors relying on BCE Inc.'s dividend for regular income will experience a reduction in their cash flow. This necessitates a reassessment of their investment portfolios and the consideration of alternative income-generating strategies, such as shifting to higher-yielding dividend stocks or exploring bond investments.

Long-Term vs. Short-Term Investment Strategies

The dividend cut presents both challenges and opportunities. For long-term investors, the reduced dividend might be seen as a temporary setback, balanced by the potential for future growth driven by the company's strategic investments. Short-term traders might view the price volatility following the announcement as a chance for profit, albeit with increased risk.

Future Outlook for BCE Inc. and its Dividend Policy

BCE Inc.'s future plans and projections indicate a focus on strategic investments and debt reduction.

Potential for Dividend Restoration

The likelihood of a future dividend increase or restoration depends heavily on BCE Inc.'s financial performance in the coming years. Factors influencing the timing of a potential increase include revenue growth across its various segments, debt reduction progress, and overall market conditions. Any improvement in these areas would increase the probability of a future dividend increase.

Long-Term Investment Considerations

Investors considering a long-term investment in BCE Inc. need to carefully weigh the implications of the dividend cut against the company's long-term growth potential. A thorough assessment of BCE Inc.'s financial statements, future projections, and competitive landscape is crucial before making any investment decisions.

Conclusion

The BCE Inc. dividend cut was a strategic decision driven by a combination of factors, including increased competition, investment in network infrastructure, and the need to manage debt levels. The impact on investors varies, significantly affecting income investors while presenting both challenges and opportunities for long-term and short-term investors. Understanding the underlying financial factors and the company's future plans is vital for making informed investment decisions. Conduct further research into BCE Inc.’s financial performance and stay informed on future announcements regarding its dividend policy before making any investment decisions related to the BCE Inc. dividend cut.

Featured Posts

-

Ataque De Avestruz A Boris Johnson Durante Visita Familiar A Texas

May 12, 2025

Ataque De Avestruz A Boris Johnson Durante Visita Familiar A Texas

May 12, 2025 -

Bradley Wiggins From Cycling Champion To Drug Addiction And Bankruptcy

May 12, 2025

Bradley Wiggins From Cycling Champion To Drug Addiction And Bankruptcy

May 12, 2025 -

Jose Aldos Featherweight Return Challenges And Expectations

May 12, 2025

Jose Aldos Featherweight Return Challenges And Expectations

May 12, 2025 -

Ataque De Avestruz A Boris Johnson En Texas La Reaccion Del Exprimer Ministro

May 12, 2025

Ataque De Avestruz A Boris Johnson En Texas La Reaccion Del Exprimer Ministro

May 12, 2025 -

When Does Doom The Dark Ages Launch Global Release Times

May 12, 2025

When Does Doom The Dark Ages Launch Global Release Times

May 12, 2025