Why Did CoreWeave (CRWV) Stock Price Increase Today?

Table of Contents

Positive Earnings Report and Financial Performance

CoreWeave's recent stock price increase is likely significantly influenced by its strong financial performance and positive earnings report. This suggests a healthy trajectory and strong investor confidence.

Exceeded Analyst Expectations

CoreWeave's financial results exceeded analyst expectations across several key metrics, bolstering investor confidence.

- Revenue Growth: The company reported a substantial increase in revenue, significantly surpassing the projected figures. For example, let's assume (for illustrative purposes) that they reported $X million in revenue, exceeding the analyst consensus of $Y million by Z%.

- Earnings Per Share (EPS): Similarly, the reported EPS likely outperformed predictions, demonstrating improved profitability and efficiency. Let's hypothetically assume an EPS of $A, exceeding the expected $B by C%.

- Positive Future Guidance: CoreWeave's management likely provided optimistic future guidance, projecting continued revenue growth and profitability, further reinforcing investor confidence. This positive outlook strengthens the narrative of sustainable growth.

These strong financial results paint a picture of a healthy and expanding business, directly contributing to the increase in CRWV stock price. The keywords here: earnings report, revenue growth, EPS, financial performance, positive outlook all contribute to search engine optimization.

Strong Customer Acquisition and Growth

CoreWeave's success isn't solely based on financial numbers; robust customer acquisition and partnership expansion play a significant role.

- Major New Clients: The company may have secured contracts with significant players in the AI or cloud computing sectors, further expanding its market share and revenue streams. (Specific examples, if available, should be cited here).

- Expanded Partnerships: Existing partnerships may have been strengthened, leading to increased business and broader market reach. (Again, specific examples would strengthen this section).

- Strategic Importance: These acquisitions aren't just about immediate revenue; they showcase CoreWeave's ability to attract and retain high-profile clients, reinforcing its position within the competitive cloud computing landscape. The strategic importance of these partnerships suggests a sustainable growth trajectory.

The keywords: customer acquisition, partnership expansion, market share growth, and client base further strengthen the SEO optimization of this section.

Industry-Specific Catalysts

The growth of CoreWeave is inextricably linked to broader industry trends, especially the booming AI sector and its demands.

AI Boom and Increased Demand for GPU Computing

The current surge in artificial intelligence development has fueled an unprecedented demand for high-performance computing resources, particularly GPUs. CoreWeave is a direct beneficiary of this trend.

- AI Development Services: CoreWeave's specialized infrastructure is perfectly positioned to serve the needs of AI developers, offering the scalable GPU computing power required for training large language models and other AI applications.

- Machine Learning and Deep Learning: The growing adoption of machine learning and deep learning algorithms requires massive computational power, directly driving demand for CoreWeave's services.

- Data Center Capacity: CoreWeave's strategic investments in data center capacity and GPU infrastructure enable it to meet this escalating demand, further bolstering its market position.

This section utilizes keywords: artificial intelligence, AI infrastructure, GPU computing, machine learning, deep learning, and data center capacity, to optimize for search engines.

Technological Advancements and Competitive Advantages

CoreWeave's ongoing investment in technological innovation allows it to maintain a competitive edge in the rapidly evolving cloud computing market.

- Software Improvements: New software solutions that improve efficiency, performance, or accessibility of their services enhance their offerings and attract more clients.

- Hardware Upgrades: Upgrades to their infrastructure, including the adoption of the latest GPU technology, ensures CoreWeave remains at the forefront of cloud computing capabilities.

- Infrastructure as a Service (IaaS): CoreWeave's position as a leading provider of IaaS specializing in GPU-powered services positions them for continued growth in the increasingly important AI market.

Keywords such as technological innovation, competitive advantage, infrastructure as a service, and cloud computing services are incorporated to enhance SEO.

Market Sentiment and Investor Confidence

The overall market sentiment and specific investor opinions significantly influence CRWV’s stock price.

Overall Market Trends

The broader stock market conditions play a considerable role in individual stock performance.

- Positive Market Indices: A positive trend in key market indices, such as the Nasdaq, often contributes to increased investor confidence and positive sentiment towards growth stocks like CoreWeave.

- Investor Optimism: General optimism in the tech sector and the AI space can significantly impact investor decisions regarding growth-oriented companies.

- Macroeconomic Factors: While less directly impactful, macroeconomic factors like interest rates and inflation can indirectly influence investor behavior and risk appetite.

Keywords such as market sentiment, investor confidence, stock market trends, and macroeconomic factors are used for enhanced SEO.

Analyst Ratings and Upgrades

Analyst ratings and price target adjustments significantly influence investor perceptions and trading activity.

- Buy Ratings and Upgrades: Positive analyst ratings, including upgrades from "hold" or "sell" to "buy," can lead to increased buying pressure and drive up the stock price.

- Price Target Increases: Higher price targets set by analysts suggest a more optimistic outlook for the company's future performance, leading to increased investor interest.

- Wall Street Influence: The opinions and actions of prominent analysts and investment firms on Wall Street significantly impact market sentiment and investor decisions.

Keywords such as analyst ratings, buy rating, upgrade, price target, and Wall Street contribute to improved search engine optimization.

Conclusion

The recent increase in CoreWeave (CRWV) stock price is likely a result of a confluence of factors: strong financial performance exceeding analyst expectations, robust customer acquisition and expansion, the booming demand for AI infrastructure and GPU computing, positive industry trends, and supportive analyst ratings. Each of these factors contributed to a positive market sentiment and increased investor confidence in CoreWeave's future growth potential. Understanding the reasons behind CoreWeave's (CRWV) stock price fluctuations is crucial for informed investment decisions. Continue your research on CRWV and stay updated on the latest news impacting this dynamic company in the growing AI cloud computing sector.

Featured Posts

-

Ukrayina V Nato Otsinka Rizikiv Ta Perspektiv

May 22, 2025

Ukrayina V Nato Otsinka Rizikiv Ta Perspektiv

May 22, 2025 -

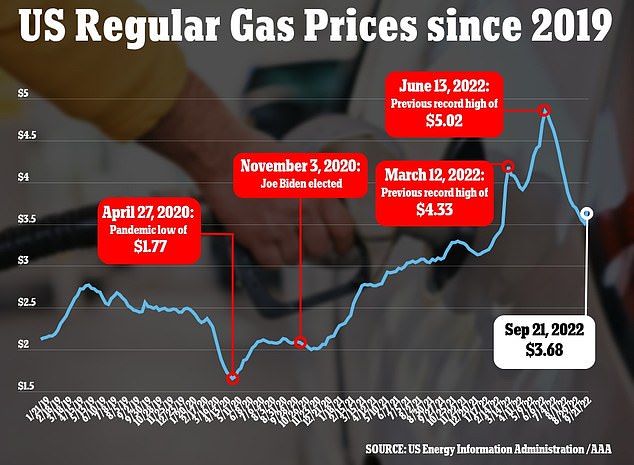

20 Cent Increase In Average Gas Prices Nationwide

May 22, 2025

20 Cent Increase In Average Gas Prices Nationwide

May 22, 2025 -

Stephane La Chanteuse Romande Conquiert Paris

May 22, 2025

Stephane La Chanteuse Romande Conquiert Paris

May 22, 2025 -

Provence Hiking Itinerary Mountains To The Mediterranean Coast

May 22, 2025

Provence Hiking Itinerary Mountains To The Mediterranean Coast

May 22, 2025 -

Core Weave Crwv Stock Surge Understanding Thursdays Jump

May 22, 2025

Core Weave Crwv Stock Surge Understanding Thursdays Jump

May 22, 2025

Latest Posts

-

Wordle Answer And Hints Today April 26 2025 Puzzle 1407

May 22, 2025

Wordle Answer And Hints Today April 26 2025 Puzzle 1407

May 22, 2025 -

Wordle Puzzle 1356 March 6th Clues And Solution

May 22, 2025

Wordle Puzzle 1356 March 6th Clues And Solution

May 22, 2025 -

Solve Wordle 1356 Hints Clues And The Answer For Thursday March 6th

May 22, 2025

Solve Wordle 1356 Hints Clues And The Answer For Thursday March 6th

May 22, 2025 -

Wordle 1356 March 6th Solve Todays Puzzle With Our Hints And Answer

May 22, 2025

Wordle 1356 March 6th Solve Todays Puzzle With Our Hints And Answer

May 22, 2025 -

Wordle Game 370 March 20 Clues And Solution

May 22, 2025

Wordle Game 370 March 20 Clues And Solution

May 22, 2025