Why Did CoreWeave Inc. (CRWV) Stock Fall On Thursday?

Table of Contents

Broad Market Downturn and Sector-Specific Weakness

Thursday's downturn in the CRWV stock price wasn't an isolated incident. The overall market sentiment was negative, impacting many tech stocks, including those in the cloud computing and AI infrastructure sectors where CoreWeave operates. This broader market weakness played a significant role in the decline.

- Market Indices Performance: The Nasdaq Composite and the S&P 500 both experienced considerable losses on Thursday, indicating a widespread sell-off across the technology sector. This general market negativity likely exacerbated the CRWV stock price drop.

- Technology Sector Headwinds: Negative news affecting the broader technology sector, such as concerns about rising interest rates, potential regulatory changes, or slowing economic growth, could have contributed to investor apprehension and selling pressure across the board, including CRWV.

- Investor Sentiment Shift: A shift in investor sentiment away from growth stocks towards more defensive investments is a common occurrence in periods of market uncertainty. CoreWeave, as a relatively young growth company, is particularly susceptible to such shifts.

Lack of Positive Catalysts and Investor Sentiment

The absence of positive news or catalysts for CoreWeave on Thursday might have also contributed to the stock's decline. Investors often react negatively when anticipated positive events fail to materialize.

- Missed Expectations: Were there any anticipated earnings reports, partnerships, or product launches that investors were hoping for? The lack of such positive announcements could have led to disappointment and selling.

- Analyst Ratings and Reports: Any negative analyst reports or downgrades released before or on Thursday could have influenced investor confidence and triggered selling pressure.

- Growth Concerns: Concerns about CoreWeave's future growth prospects, perhaps fueled by macroeconomic uncertainties or competitive pressures, could have weighed on investor sentiment.

Specific News or Events Affecting CRWV

It's crucial to investigate whether any company-specific news or events directly influenced the CRWV stock price drop. Even seemingly minor announcements can have a significant market impact.

- Official Communications: A thorough review of CoreWeave's press releases, SEC filings, and other official communications from Thursday is necessary to rule out any negative news or announcements directly impacting investor confidence.

- Competitive Landscape: Actions by competitors in the cloud computing and AI infrastructure space could have negatively affected investor perception of CoreWeave's market position and future prospects.

- Negative Media or Social Media Sentiment: Negative media coverage or a surge in negative social media sentiment surrounding CoreWeave could have contributed to the sell-off. Any significant negative news, even if unfounded, can impact market sentiment.

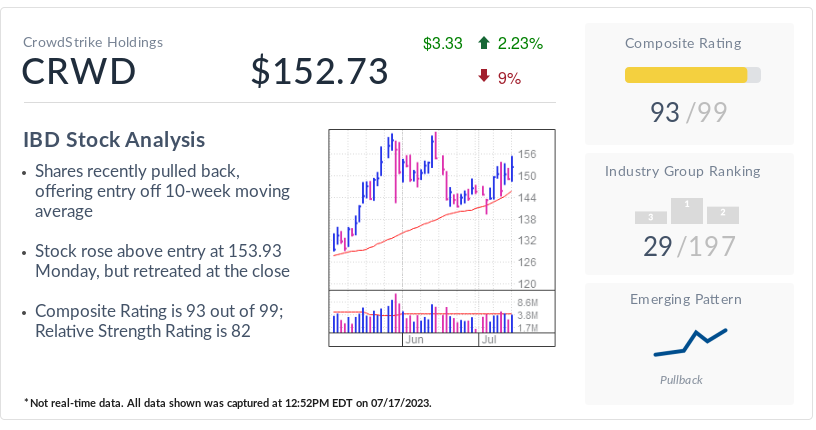

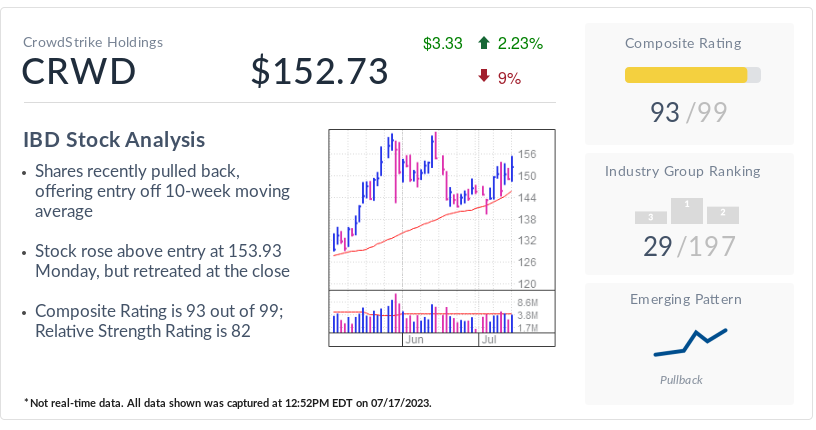

Technical Analysis and Trading Activity

Analyzing the technical aspects of CRWV's stock performance on Thursday provides further insight into the decline. Technical indicators can reveal underlying trading patterns.

- Trading Volume: An unusually high trading volume on Thursday could indicate a significant shift in investor sentiment, with a large number of investors simultaneously selling their shares.

- Chart Patterns: Analyzing the CRWV stock chart for patterns like support/resistance level breakdowns or other significant technical indicators could provide further clues to the reasons behind the price drop.

- Short Selling: A surge in short selling activity targeting CRWV could have amplified the downward pressure on the stock price.

Conclusion: Understanding and Reacting to CRWV Stock Volatility

The decline in CoreWeave (CRWV) stock price on Thursday resulted from a confluence of factors. Broad market weakness affecting the technology sector, a lack of positive catalysts for the company, potentially negative company-specific news, and technical trading patterns all contributed to the drop. Understanding these intricate interactions is crucial for navigating the volatility inherent in the stock market. Remember that the stock market is inherently unpredictable. While analyzing these factors can offer valuable insights, it's essential to conduct thorough research and consult with financial advisors before making any investment decisions regarding CoreWeave stock. Understanding the intricacies behind CoreWeave (CRWV) stock fluctuations is crucial. Continue to monitor the CRWV stock price and stay informed to make well-informed investment decisions.

Featured Posts

-

31 Pay Cut For Bps Chief Executive Officer

May 22, 2025

31 Pay Cut For Bps Chief Executive Officer

May 22, 2025 -

Australian Trans Influencers Record Fact Or Fiction A Critical Analysis

May 22, 2025

Australian Trans Influencers Record Fact Or Fiction A Critical Analysis

May 22, 2025 -

Klyuchovi Momenti Peregovoriv Pro Vstup Ukrayini Do Nato Komentar Yevrokomisara

May 22, 2025

Klyuchovi Momenti Peregovoriv Pro Vstup Ukrayini Do Nato Komentar Yevrokomisara

May 22, 2025 -

Kham Pha Cac Tuyen Giao Thong Tp Hcm Va Ba Ria Vung Tau

May 22, 2025

Kham Pha Cac Tuyen Giao Thong Tp Hcm Va Ba Ria Vung Tau

May 22, 2025 -

Vanja I Sime Fotografije Koje Su Osvojile Fanove Gospodina Savrsenog

May 22, 2025

Vanja I Sime Fotografije Koje Su Osvojile Fanove Gospodina Savrsenog

May 22, 2025

Latest Posts

-

Wordle Today 1 363 Hints Clues And Answer For Thursday March 13th

May 22, 2025

Wordle Today 1 363 Hints Clues And Answer For Thursday March 13th

May 22, 2025 -

Wordle Solution And Clues For April 26 2025 Puzzle 1407

May 22, 2025

Wordle Solution And Clues For April 26 2025 Puzzle 1407

May 22, 2025 -

Wordle Answer And Hints Today April 26 2025 Puzzle 1407

May 22, 2025

Wordle Answer And Hints Today April 26 2025 Puzzle 1407

May 22, 2025 -

Wordle Puzzle 1356 March 6th Clues And Solution

May 22, 2025

Wordle Puzzle 1356 March 6th Clues And Solution

May 22, 2025 -

Solve Wordle 1356 Hints Clues And The Answer For Thursday March 6th

May 22, 2025

Solve Wordle 1356 Hints Clues And The Answer For Thursday March 6th

May 22, 2025