Why Did CoreWeave Inc. (CRWV) Stock Fall On Tuesday?

Table of Contents

Broader Market Downturn and Tech Sector Weakness

Overall Market Sentiment

Tuesday's market showed a general negative trend, impacting the tech sector significantly. This broader market downturn played a role in CRWV's stock price decline. The Nasdaq Composite, a key index for technology stocks, experienced a notable decrease, reflecting a general sell-off in the tech sector. This negative sentiment likely contributed to the decline in CoreWeave's share price.

- Negative Tech News: Reports of slowing growth in certain segments of the tech industry and rising interest rates created a negative ripple effect impacting investor confidence across the board. This uncertainty led to a general risk-off sentiment, where investors moved away from riskier assets like technology stocks.

- Investor Risk Aversion: With uncertainty in the global economy, many investors opted for safer investments, leading to a sell-off in growth stocks, including CRWV. This risk aversion is a common factor in market downturns.

- Index Performance: The Nasdaq Composite fell by X%, and other tech-heavy indices also showed significant losses on Tuesday. This broader market weakness created a headwind for CRWV, pushing its stock price down along with the sector.

Lack of Positive Catalysts or News

Absence of Significant Announcements

The absence of any positive news or announcements from CoreWeave itself might have contributed to the stock price drop. Without positive catalysts, the stock became vulnerable to the broader market pressures.

- No Earnings Reports or Partnerships: The period leading up to Tuesday lacked any significant positive announcements, such as strong earnings reports, new partnerships, or product launches that could have boosted investor confidence and supported the stock price.

- Quiet Period Considerations: It's possible that CoreWeave was in a quiet period before an earnings announcement, preventing them from releasing positive news that might have offset the broader market downturn. This lack of communication could have fueled negative speculation.

- Potential Overvaluation Correction: Prior to Tuesday's drop, the CRWV stock price might have been considered overvalued by some analysts, setting the stage for a correction. The broader market sell-off provided the catalyst for this correction to occur.

Specific Concerns Regarding CoreWeave's Business

Competition and Market Saturation

The cloud computing and AI infrastructure market is highly competitive. Concerns regarding market saturation and intense competition from established players could have weighed on investor sentiment.

- Key Competitors: CoreWeave faces competition from industry giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. Any significant announcements or successes from these competitors could negatively impact investor perception of CRWV's growth potential.

- Market Saturation Concerns: The increasing number of players in the cloud computing market raises concerns about market saturation. This intensifies competition for market share and could put pressure on profitability and growth.

- Market Share Analysis: Analysis of CoreWeave's current market share and future growth potential, particularly in light of intensifying competition, might have raised concerns amongst some investors.

Financial Performance and Investor Expectations

CoreWeave's recent financial performance and whether it met or exceeded investor expectations also played a crucial role in Tuesday's decline.

- Analyst Expectations: If CoreWeave's recent financial reports fell short of analyst expectations, this could have led to a sell-off by investors who were disappointed with the results.

- Profitability and Cash Flow: Concerns regarding CoreWeave's profitability or cash flow, especially in a rapidly expanding market requiring significant capital investments, might have contributed to investor uncertainty.

- Financial Risks: Any concerns regarding high debt levels or other financial risks, such as dependence on specific customers, could also have contributed to the negative investor sentiment and Tuesday's stock price drop.

Conclusion

This analysis explored several potential reasons for CoreWeave Inc. (CRWV)'s stock decline on Tuesday. Factors including broader market weakness, the absence of positive news, and potential concerns about the company's competitive landscape and financial performance could all have played a role. Determining the exact cause requires further investigation and analysis of investor sentiment.

Call to Action: To stay informed about future developments impacting CoreWeave (CRWV) stock and the broader cloud computing sector, continue following our analysis and regularly check back for updates on the CRWV stock price and other relevant news. Understanding the dynamics of the CRWV stock price requires ongoing monitoring and analysis of this volatile sector.

Featured Posts

-

G 7 Mulls Lowering De Minimis Tariffs On Chinese Imports

May 22, 2025

G 7 Mulls Lowering De Minimis Tariffs On Chinese Imports

May 22, 2025 -

De Betaalbaarheid Van Huizen In Nederland Een Debat Tussen Abn Amro En Geen Stijl

May 22, 2025

De Betaalbaarheid Van Huizen In Nederland Een Debat Tussen Abn Amro En Geen Stijl

May 22, 2025 -

Wyoming Guided Fishing Volunteer Advisors Needed

May 22, 2025

Wyoming Guided Fishing Volunteer Advisors Needed

May 22, 2025 -

Liverpools Fortune Favors The Brave Analyzing Their Win Against Psg With Arne Slots Insights And Alissons Impact

May 22, 2025

Liverpools Fortune Favors The Brave Analyzing Their Win Against Psg With Arne Slots Insights And Alissons Impact

May 22, 2025 -

Gray Wolf Population Setback Death Of Second Translocated Animal In Wyoming

May 22, 2025

Gray Wolf Population Setback Death Of Second Translocated Animal In Wyoming

May 22, 2025

Latest Posts

-

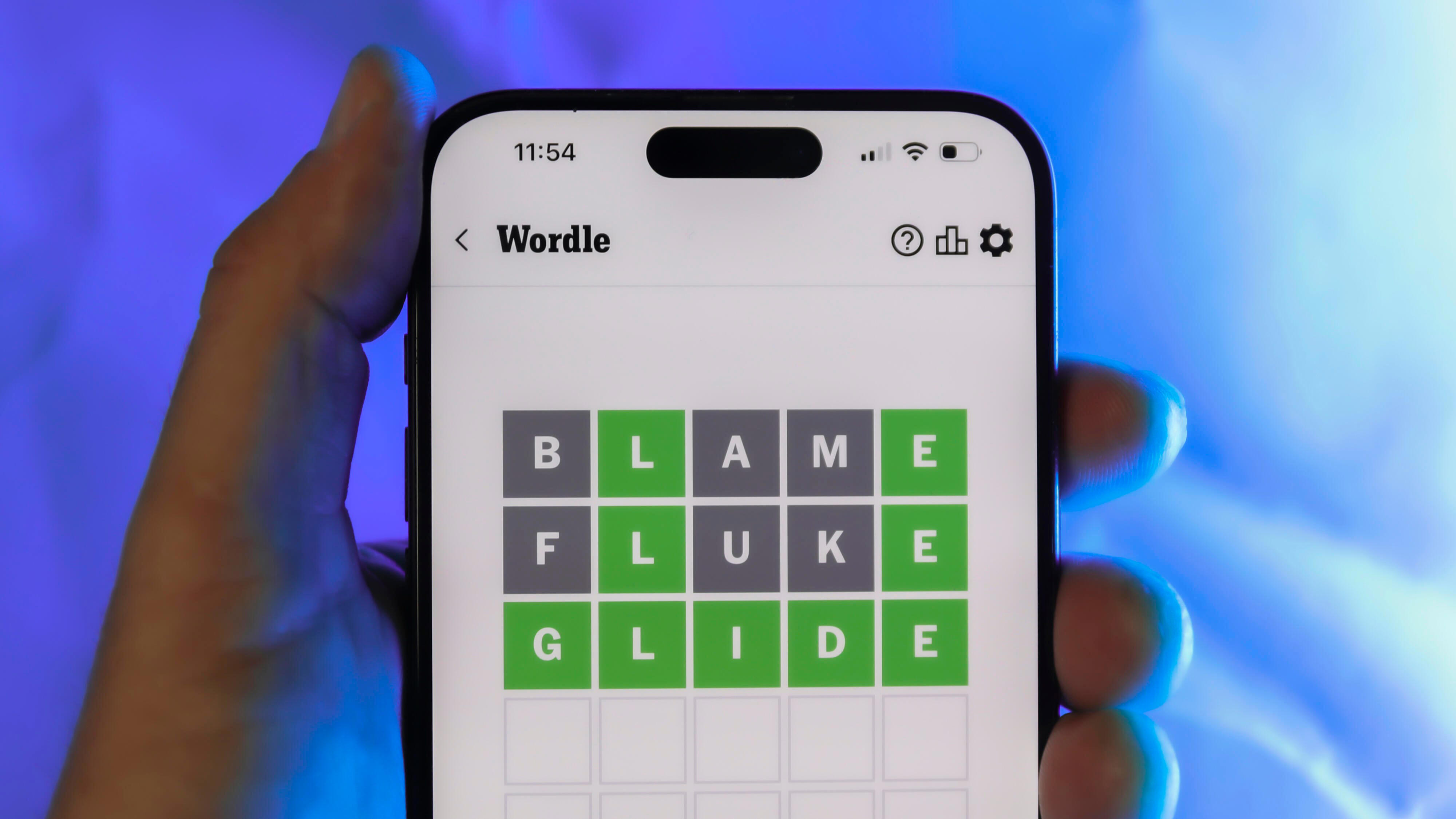

Wordle Puzzle 1356 March 6th Clues And Solution

May 22, 2025

Wordle Puzzle 1356 March 6th Clues And Solution

May 22, 2025 -

Solve Wordle 1356 Hints Clues And The Answer For Thursday March 6th

May 22, 2025

Solve Wordle 1356 Hints Clues And The Answer For Thursday March 6th

May 22, 2025 -

Wordle 1356 March 6th Solve Todays Puzzle With Our Hints And Answer

May 22, 2025

Wordle 1356 March 6th Solve Todays Puzzle With Our Hints And Answer

May 22, 2025 -

Wordle Game 370 March 20 Clues And Solution

May 22, 2025

Wordle Game 370 March 20 Clues And Solution

May 22, 2025 -

Wordle 370 March 20th Hints Clues And Solution

May 22, 2025

Wordle 370 March 20th Hints Clues And Solution

May 22, 2025