Why Did CoreWeave, Inc. (CRWV) Stock Price Soar On Thursday?

Table of Contents

Positive Earnings Report and Revenue Growth

CoreWeave's impressive performance stems largely from its robust financial results. The company delivered a strong earnings report, significantly exceeding analyst expectations and demonstrating substantial revenue growth. This positive financial performance is a key driver of the increase in CoreWeave, Inc. (CRWV) stock price.

Exceeding Analyst Expectations

- Revenue: CoreWeave reported Q[Quarter] revenue of [Insert Actual Revenue Figure], surpassing the consensus analyst estimate of [Insert Analyst Estimate]. This represents a [Percentage]% increase compared to the same quarter last year.

- Earnings Per Share (EPS): The company's EPS came in at [Insert Actual EPS Figure], significantly higher than the anticipated [Insert Analyst Estimate]. This substantial EPS growth reflects CoreWeave's efficient operations and strong profitability.

- Key Metrics: Other key metrics, such as gross margin and operating income, also exceeded expectations, further solidifying the positive narrative surrounding CoreWeave earnings and its overall financial performance. This strong showing clearly boosted investor confidence in the CRWV revenue stream and future prospects.

Strong Customer Acquisition and Retention

CoreWeave's success isn't solely attributed to strong financial numbers; the company also demonstrated significant progress in customer acquisition and retention.

- New Clients: CoreWeave secured several notable new clients across various sectors, including [mention specific sectors, e.g., finance, healthcare, technology]. This expansion into diverse markets indicates the broad applicability of CoreWeave's solutions and its increasing market share.

- Strategic Partnerships: The company has forged key partnerships with [mention specific partners] which has further broadened its reach and enhanced its service offerings, solidifying CRWV client acquisition strategies and leading to improved customer retention.

- Expanding Services: CoreWeave's expansion into new service offerings, like [mention specific new services], has attracted a wider range of clients and contributed to the company's robust growth. This expansion signals CoreWeave's commitment to innovation and its capacity to meet the evolving needs of the market.

Industry Trends Favorable to CoreWeave's Business Model

The surge in CoreWeave, Inc. (CRWV) stock price isn't solely due to internal factors; favorable industry trends also play a significant role.

Growing Demand for AI and Cloud Computing

The rapid growth of artificial intelligence (AI) and cloud computing is a major tailwind for CoreWeave's business model. The increasing demand for high-performance computing resources, particularly GPUs, perfectly aligns with CoreWeave's specialized infrastructure.

- Market Reports: Industry reports from [mention reputable sources, e.g., Gartner, IDC] predict substantial growth in the AI and cloud computing markets over the next few years. This robust forecast further validates CoreWeave’s strategic position within this expanding landscape.

- GPU Computing: CoreWeave's focus on GPU computing positions it ideally to capitalize on the burgeoning demand for AI infrastructure and large language models. This focus ensures they are well-positioned to benefit from the explosive growth in the data center demand, critical for processing immense datasets for AI applications.

Strategic Partnerships and Technological Advancements

CoreWeave's strategic partnerships and continuous technological advancements further enhance its market position and contribute to the positive outlook for the CoreWeave, Inc. (CRWV) stock price.

- Collaborations: The company's collaborations with leading technology providers in the AI and cloud computing space have expanded its capabilities and strengthened its ecosystem. These partnerships provide access to cutting-edge technologies and resources.

- Technological Innovation: CoreWeave's ongoing commitment to innovation and technological leadership ensures that its infrastructure remains at the forefront of the industry. This commitment to innovation translates into a competitive advantage and enhanced offerings for its clients.

Market Sentiment and Investor Confidence

Positive market sentiment and growing investor confidence significantly influence the CoreWeave, Inc. (CRWV) stock price.

Positive Analyst Upgrades and Ratings

Several analysts have recently upgraded their ratings and price targets for CRWV stock, reflecting a positive outlook on the company's future performance.

- Analyst Upgrades: [Mention specific analysts and their upgraded ratings, including their rationale]. These positive assessments contribute to increased investor confidence and drive demand for CRWV stock.

- Price Target Increases: Increased price targets by analysts indicate a belief in CoreWeave's potential for further growth, further driving investor optimism and fueling the upward trend in the CRWV stock price.

Overall Market Conditions

While company-specific factors play a crucial role, the overall market environment also influences the CoreWeave, Inc. (CRWV) stock price.

- Sector Performance: The strong performance of the technology sector, particularly within cloud computing and AI, has created a positive backdrop for CoreWeave's stock performance.

- Economic Conditions: While broader economic conditions can influence market sentiment, the strong fundamentals of CoreWeave have allowed its stock to largely withstand broader market volatility.

Conclusion: Understanding the CoreWeave, Inc. (CRWV) Stock Price Rally

The recent surge in CoreWeave, Inc. (CRWV) stock price is a result of several converging factors. Strong earnings, exceeding analyst expectations, and demonstrable revenue growth coupled with robust customer acquisition and retention are key internal drivers. Favorable industry trends, particularly the growing demand for AI and cloud computing, along with strategic partnerships and technological advancements, provide significant external tailwinds. Finally, positive analyst upgrades and a generally positive market sentiment have contributed to increased investor confidence. Understanding these interconnected factors is essential for comprehending the upward trajectory of the CoreWeave, Inc. (CRWV) stock price.

Stay updated on future developments of CoreWeave, Inc. (CRWV) stock price by following our blog and subscribing to our newsletter!

Featured Posts

-

Understanding Kartels Influence On Guyanese Rum Culture

May 22, 2025

Understanding Kartels Influence On Guyanese Rum Culture

May 22, 2025 -

Danh Gia Tac Dong Du An Xay Dung Cau Ma Da Dong Nai

May 22, 2025

Danh Gia Tac Dong Du An Xay Dung Cau Ma Da Dong Nai

May 22, 2025 -

Abn Amro Analyse Van De Stijgende Vraag Naar Occasions

May 22, 2025

Abn Amro Analyse Van De Stijgende Vraag Naar Occasions

May 22, 2025 -

From Scatological Documents To Engaging Podcast The Power Of Ai

May 22, 2025

From Scatological Documents To Engaging Podcast The Power Of Ai

May 22, 2025 -

Remont Pivdennogo Mostu Pidryadniki Protses Ta Zatrati

May 22, 2025

Remont Pivdennogo Mostu Pidryadniki Protses Ta Zatrati

May 22, 2025

Latest Posts

-

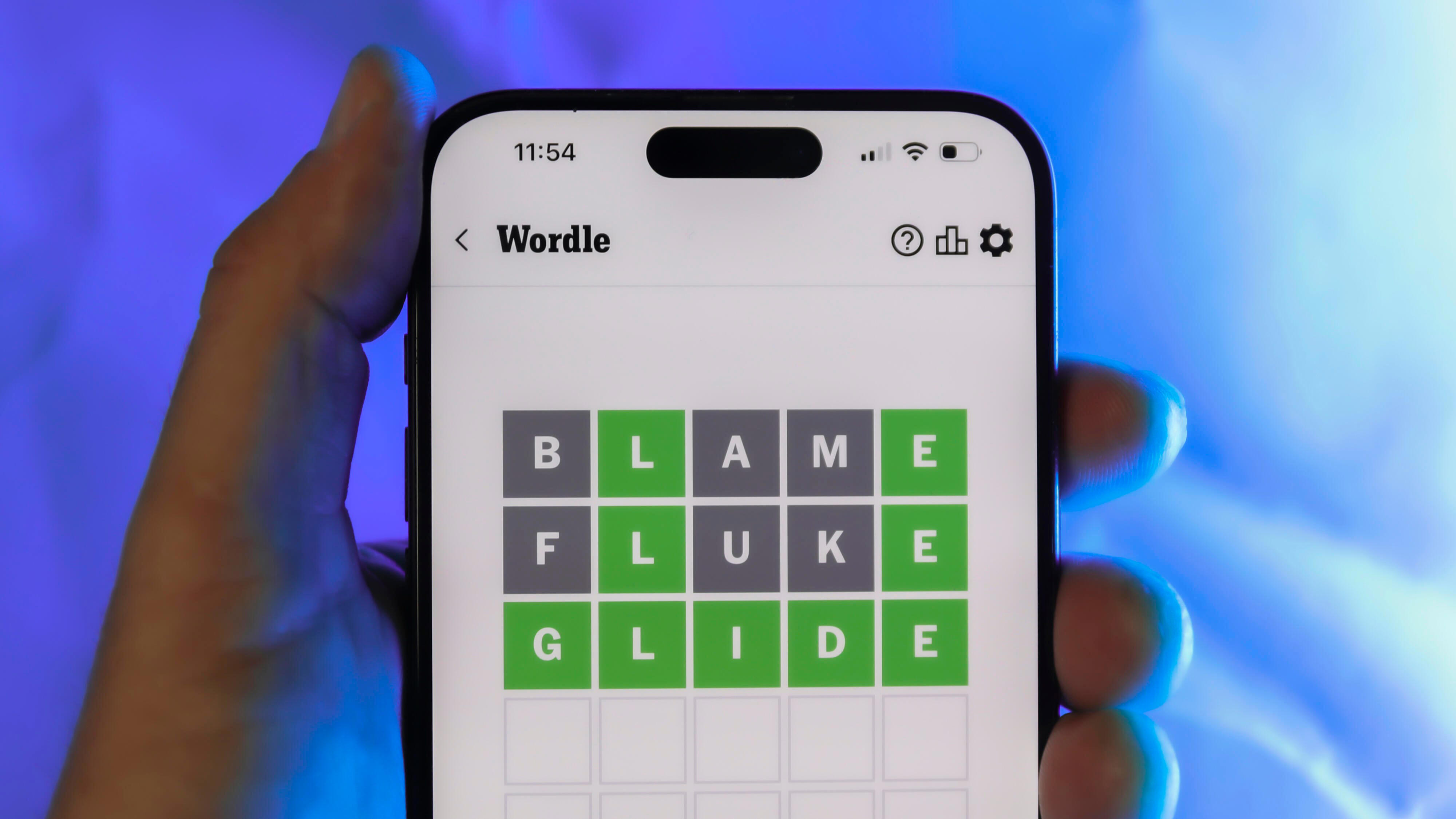

Wordle Solution And Clues For April 26 2025 Puzzle 1407

May 22, 2025

Wordle Solution And Clues For April 26 2025 Puzzle 1407

May 22, 2025 -

Wordle Answer And Hints Today April 26 2025 Puzzle 1407

May 22, 2025

Wordle Answer And Hints Today April 26 2025 Puzzle 1407

May 22, 2025 -

Wordle Puzzle 1356 March 6th Clues And Solution

May 22, 2025

Wordle Puzzle 1356 March 6th Clues And Solution

May 22, 2025 -

Solve Wordle 1356 Hints Clues And The Answer For Thursday March 6th

May 22, 2025

Solve Wordle 1356 Hints Clues And The Answer For Thursday March 6th

May 22, 2025 -

Wordle 1356 March 6th Solve Todays Puzzle With Our Hints And Answer

May 22, 2025

Wordle 1356 March 6th Solve Todays Puzzle With Our Hints And Answer

May 22, 2025