Why The Fed Remains Cautious About Interest Rate Cuts

Table of Contents

Persistent Inflation as a Primary Concern

Inflation remains a primary concern for the Fed. The current inflation rate significantly deviates from the Fed's target of 2%. While recent figures show some cooling, inflation remains stubbornly elevated, fueled by several persistent factors. Supply chain disruptions, although easing, continue to contribute to higher prices for goods. Energy prices, volatile due to geopolitical events, add further inflationary pressure. Moreover, strong wage growth, a symptom of a tight labor market, contributes to demand-pull inflation, further complicating the situation.

- High inflation erodes purchasing power, impacting consumers' disposable income and economic growth.

- The Fed's mandate is to maintain price stability, aiming for a 2% inflation target. Falling short of this goal necessitates a cautious approach to interest rate cuts.

- Premature interest rate cuts risk reigniting inflation, potentially leading to a more challenging situation in the long run, requiring more aggressive measures later to control it.

The Risk of Premature Rate Cuts

Cutting interest rates prematurely carries considerable risk. The primary concern is the potential for reigniting inflation. Lower interest rates stimulate borrowing and spending, increasing aggregate demand. This increased demand, if not met by a corresponding increase in supply, can lead to higher prices, thus exacerbating the inflation problem.

- Increased consumer spending driven by lower borrowing costs leads to higher demand-pull inflation.

- Reduced interest rates can contribute to wage-price spirals, where rising wages lead to higher prices, which then lead to further wage increases, creating a vicious cycle of inflation.

- Cutting rates too soon could erode the Fed's credibility, undermining its ability to manage inflation effectively in the future. The public's trust in the Fed’s ability to maintain stable prices is crucial for economic stability.

Labor Market Strength and Wage Growth

The current labor market is characterized by low unemployment and robust job growth. While a strong labor market is generally positive, it also contributes to inflationary pressures. The tight labor market gives workers greater bargaining power, leading to upward pressure on wages. This wage growth, in turn, fuels demand-pull inflation as consumers have more disposable income to spend.

- Tight labor markets, with low unemployment, contribute to significant upward pressure on wages.

- Wage growth, while beneficial for workers, fuels demand-pull inflation, increasing aggregate demand and potentially driving up prices.

- The Fed faces the challenge of engineering a "soft landing"—cooling inflation without triggering a recession—a delicate balancing act requiring careful consideration of interest rate adjustments.

Global Economic Uncertainty and Geopolitical Risks

The global economic landscape is far from stable. The ongoing war in Ukraine, energy crises in Europe, and other geopolitical uncertainties significantly impact the US economy. These external factors add complexity to the Fed's decision-making process regarding interest rate cuts.

- Global supply chain disruptions, exacerbated by geopolitical events, continue to contribute to inflationary pressures, complicating efforts to control inflation domestically.

- Geopolitical instability introduces significant uncertainty, making it difficult to predict the future course of the economy and the effectiveness of monetary policy interventions.

- The Fed must consider these external factors alongside domestic economic indicators when making decisions about interest rate cuts or hikes.

Data Dependency and Future Outlook

The Fed's future decisions on interest rate cuts will be heavily data-dependent. Upcoming economic data releases, particularly inflation and employment reports, will be crucial in guiding their policy decisions.

- CPI (Consumer Price Index) reports provide key insights into the pace of inflation and its impact on the economy. These reports influence the probability of future interest rate cuts.

- Unemployment figures will help the Fed assess the health of the labor market and the potential for wage growth to fuel inflation.

- GDP growth data will provide insights into the overall momentum of the economy and its sensitivity to interest rate changes.

Conclusion

The Fed's cautious approach to interest rate cuts stems from several interconnected factors: persistent inflation, a strong labor market leading to wage growth, and significant global economic uncertainty. Premature interest rate cuts risk reigniting inflation and undermining the Fed's credibility. The risks associated with such a move are substantial, necessitating a data-driven, cautious approach. The Fed will continue to monitor key economic indicators closely, adjusting its monetary policy as needed. Stay updated on the latest developments concerning interest rate cuts and the Fed's monetary policy decisions to understand their impact on the economy.

Featured Posts

-

Prodolzhenie Snegopadov V Yaroslavskoy Oblasti Chto Nuzhno Znat

May 09, 2025

Prodolzhenie Snegopadov V Yaroslavskoy Oblasti Chto Nuzhno Znat

May 09, 2025 -

Dijon Et La Cite De La Gastronomie Intervention Municipale Face Aux Problemes D Epicure

May 09, 2025

Dijon Et La Cite De La Gastronomie Intervention Municipale Face Aux Problemes D Epicure

May 09, 2025 -

Bollywood Actress Lisa Rays Air India Complaint Airline Issues Official Response

May 09, 2025

Bollywood Actress Lisa Rays Air India Complaint Airline Issues Official Response

May 09, 2025 -

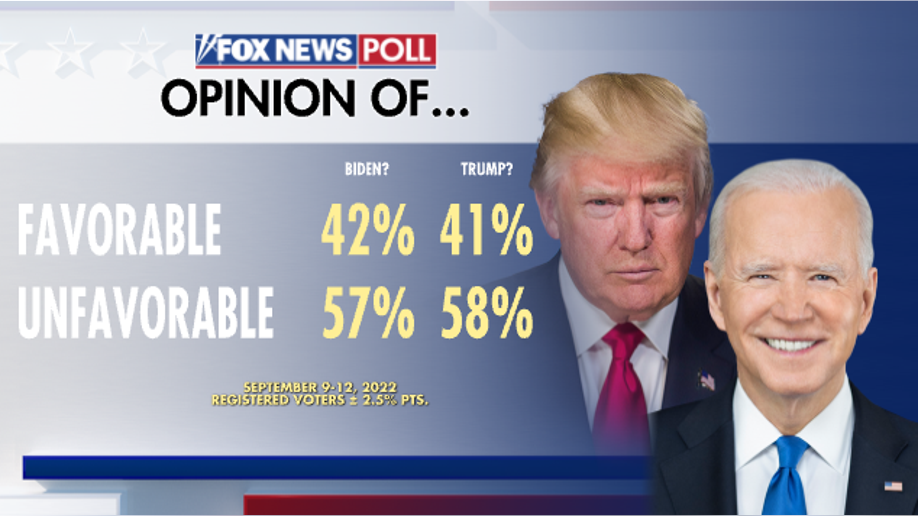

Us Attorney Generals Daily Fox News Appearances A Deeper Dive

May 09, 2025

Us Attorney Generals Daily Fox News Appearances A Deeper Dive

May 09, 2025 -

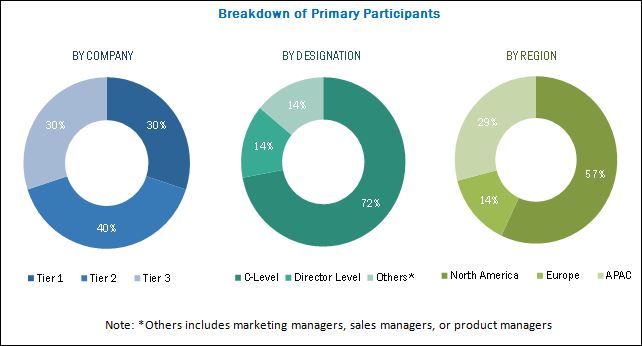

Wireless Mesh Network Market Size And Growth Forecast 9 8 Cagr

May 09, 2025

Wireless Mesh Network Market Size And Growth Forecast 9 8 Cagr

May 09, 2025