Wildfire Speculation: Is Betting On The Los Angeles Fires A Sign Of The Times?

Table of Contents

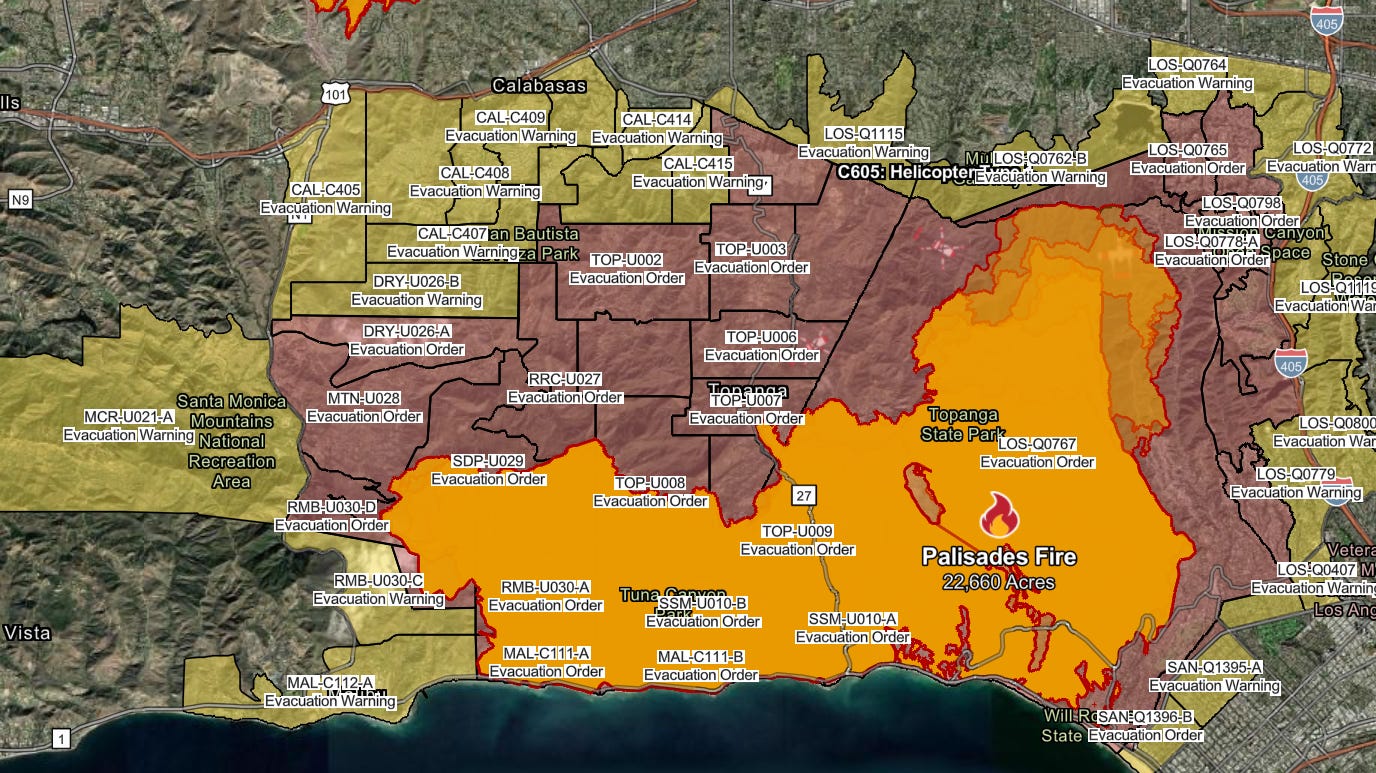

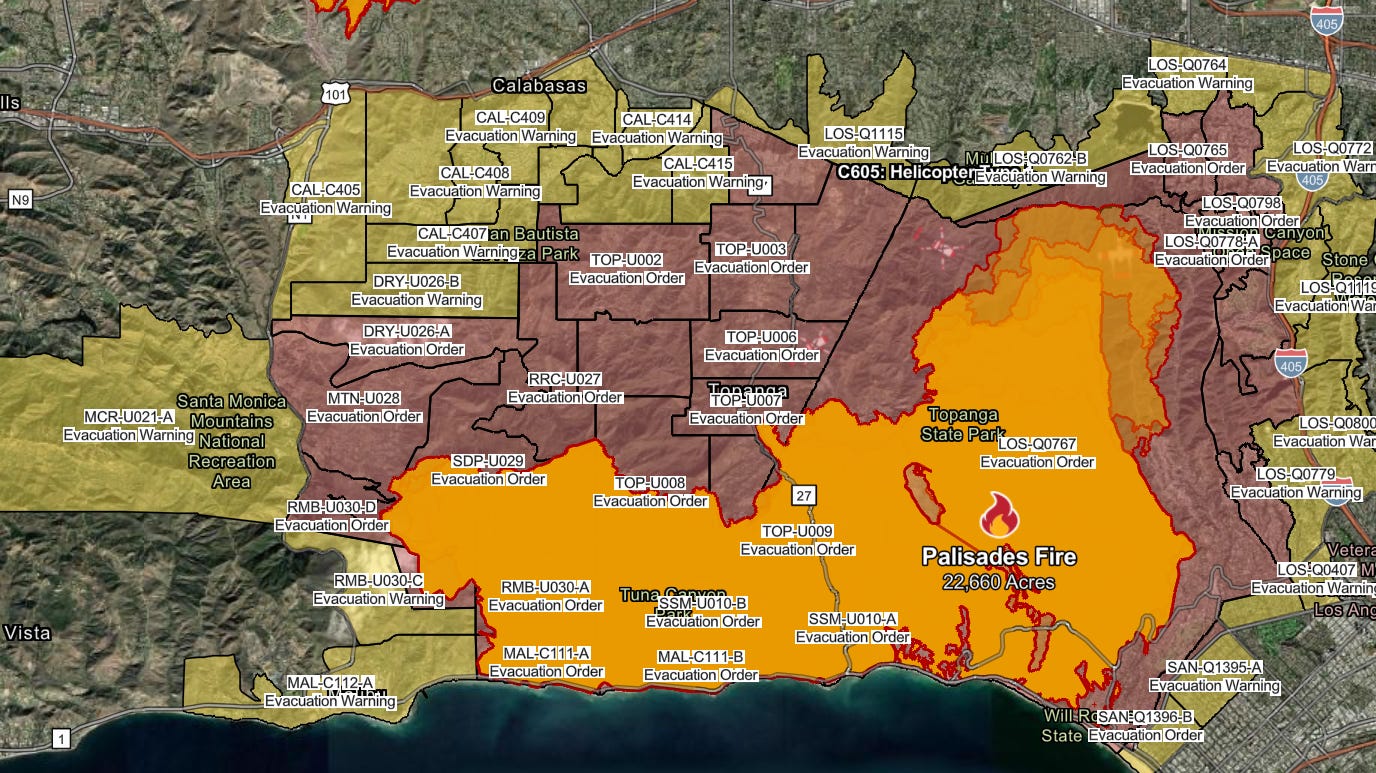

The Growing Risk of Wildfires in Los Angeles

The risk of devastating wildfires in Los Angeles is escalating at an alarming rate. This increase isn't just a matter of chance; it's directly linked to a complex interplay of factors, primarily driven by climate change.

Climate Change and Increased Fire Risk

Climate change is significantly exacerbating the wildfire threat in Los Angeles. Scientific consensus points to a clear correlation between rising global temperatures and the increased frequency and intensity of wildfires.

- Increased Temperatures: Higher average temperatures dry out vegetation, creating readily available fuel for wildfires.

- Drought Conditions: Prolonged periods of drought further desiccate the landscape, making it incredibly susceptible to ignition.

- Santa Ana Winds: These powerful, dry winds, common in Southern California, rapidly spread wildfires, making them incredibly difficult to contain.

- Fuel Buildup: Years of fire suppression have led to an accumulation of dry brush and undergrowth, providing ample fuel for larger, more intense fires.

The sheer scale of recent wildfires underscores this growing danger. The Woolsey Fire (2018) and the Getty Fire (2019), for example, caused widespread destruction and cost billions in damages, highlighting the devastating economic impact of these events.

The Economic Impact of Wildfires in Los Angeles

The financial consequences of wildfires in Los Angeles are staggering and far-reaching. The costs extend far beyond immediate property damage.

- Cost of Firefighting: Suppressing large wildfires requires massive resources, including personnel, equipment, and aerial support, leading to immense expenditure.

- Rebuilding Infrastructure: The destruction of homes, businesses, and critical infrastructure necessitates costly rebuilding efforts, impacting the local economy.

- Displacement of Residents: Thousands of people are often displaced from their homes, leading to considerable human suffering and financial strain.

- Impact on Tourism: Wildfires can significantly disrupt tourism, a vital component of the Los Angeles economy.

The economic repercussions of major wildfires like the Station Fire (2009) and the Thomas Fire (2017) demonstrate the immense financial burden these events place on the city and the state.

The Rise of Wildfire-Related Betting and Investment

The increasing awareness of wildfire risk has created a parallel market: wildfire speculation. Individuals and institutions are finding ways to profit from the increasing likelihood of these catastrophic events.

Types of Wildfire Speculation

Several avenues exist for speculating on wildfires, ranging from formal financial instruments to informal bets.

- Insurance Derivatives: These complex financial instruments allow investors to bet on the payouts of insurance companies in the event of widespread wildfire damage.

- Catastrophe Bonds: These bonds are designed to provide payouts to investors if a specified catastrophic event, such as a major wildfire, occurs. They offer a high-risk, high-reward investment strategy.

- Informal Bets: While less structured, informal bets on the likelihood or severity of wildfires also exist among individuals.

While these methods offer potential profits, they also carry substantial risks. The unpredictable nature of wildfires means that losses can be significant.

The Ethics of Profiting from Disaster

The ethical implications of profiting from natural disasters are complex and multifaceted.

- Vulnerable Populations: Wildfires disproportionately affect vulnerable populations, and profiting from their suffering raises serious ethical concerns.

- Exploiting Human Suffering: The act of speculating on wildfire damage can be seen as exploiting human suffering for financial gain.

- Potential for Market Manipulation: The wildfire speculation market is vulnerable to manipulation, which could exacerbate the financial consequences for affected communities.

However, it's also important to consider the counterargument that the insurance industry, through its involvement in catastrophe bonds and derivatives, plays a crucial role in risk mitigation and providing financial support in the aftermath of disasters.

The Future of Wildfire Risk and Speculation

Predicting and mitigating wildfire risk is crucial to minimizing both the human and financial cost of these events. Technological advancements are playing an increasingly important role.

Predictive Modeling and Wildfire Forecasting

Technology is improving our ability to anticipate and predict wildfires.

- Satellite Imagery: Sophisticated satellite imagery provides real-time monitoring of vegetation conditions, identifying potential fire hazards.

- Weather Patterns: Advanced weather forecasting models help predict the likelihood and spread of wildfires based on wind patterns, temperature, and humidity.

- Fuel Models: Data-driven fuel models assess the amount and type of flammable material in a given area, aiding in risk assessment.

- Early Warning Systems: Improved early warning systems provide timely alerts to communities at risk, enabling quicker evacuations and responses.

These tools enhance our ability to prepare for and respond to wildfires.

Mitigation Strategies and Their Impact on Speculation

Effective mitigation strategies can reduce the likelihood and severity of wildfires, potentially impacting the wildfire speculation market.

- Forest Management: Implementing proactive forest management practices, such as controlled burns and thinning of overgrown vegetation, reduces fuel loads.

- Building Codes: Stricter building codes that incorporate fire-resistant materials and defensible space requirements can minimize property damage.

- Community Preparedness: Educating and empowering communities with wildfire preparedness plans and evacuation procedures is vital.

By implementing robust mitigation strategies, we can decrease the frequency and intensity of wildfires, ultimately reducing the appeal and profitability of wildfire speculation.

Wildfire Speculation: A Reflection of Our Times

The increasing frequency and intensity of wildfires in Los Angeles, coupled with the rise of wildfire speculation, highlight a critical juncture. Climate change is undeniably driving the increased risk of these catastrophic events, and the financialization of this risk raises profound ethical questions. The development of sophisticated predictive models and the implementation of effective mitigation strategies are crucial to minimizing both the human and financial costs of wildfires.

Understand the risks and responsibilities involved before engaging in any form of wildfire speculation. Learn more about Los Angeles wildfire prevention efforts and contribute to safer communities. Together, we can build more resilient communities and reduce our reliance on profiting from disaster.

Featured Posts

-

Inter Rent Reit Accepts Takeover Bid From Executive Chair And Sovereign Wealth Fund

May 29, 2025

Inter Rent Reit Accepts Takeover Bid From Executive Chair And Sovereign Wealth Fund

May 29, 2025 -

New Horror Movie Sinners Terrorizes Louisiana Theaters Soon

May 29, 2025

New Horror Movie Sinners Terrorizes Louisiana Theaters Soon

May 29, 2025 -

Lana Del Reys Bombshell A Kiss With Morgan Wallen At Stagecoach

May 29, 2025

Lana Del Reys Bombshell A Kiss With Morgan Wallen At Stagecoach

May 29, 2025 -

The Bond Market Crisis What You Need To Know Now

May 29, 2025

The Bond Market Crisis What You Need To Know Now

May 29, 2025 -

Freestyler Angelina Komashko Stays In State Uc Davis Commitment

May 29, 2025

Freestyler Angelina Komashko Stays In State Uc Davis Commitment

May 29, 2025

Latest Posts

-

Setlist Fm Y Ticketmaster Nueva Integracion Para Una Mejor Gestion De Conciertos

May 30, 2025

Setlist Fm Y Ticketmaster Nueva Integracion Para Una Mejor Gestion De Conciertos

May 30, 2025 -

Integracion De Setlist Fm Y Ticketmaster Beneficios Para Los Amantes De La Musica

May 30, 2025

Integracion De Setlist Fm Y Ticketmaster Beneficios Para Los Amantes De La Musica

May 30, 2025 -

Experiencia Mejorada Para Fans Setlist Fm Se Integra Con Ticketmaster

May 30, 2025

Experiencia Mejorada Para Fans Setlist Fm Se Integra Con Ticketmaster

May 30, 2025 -

Ticketmaster Y Setlist Fm Se Unen Una Experiencia De Fan Mejorada

May 30, 2025

Ticketmaster Y Setlist Fm Se Unen Una Experiencia De Fan Mejorada

May 30, 2025 -

Setlist Fm Mejora La Experiencia Del Usuario Con Ticketmaster

May 30, 2025

Setlist Fm Mejora La Experiencia Del Usuario Con Ticketmaster

May 30, 2025