Will A Canadian Tire-Hudson's Bay Partnership Succeed? A Detailed Analysis

Table of Contents

Synergies and Potential Benefits of a Canadian Tire-Hudson's Bay Partnership

A partnership between Canadian Tire and HBC could unlock significant synergies, leading to substantial benefits for both companies and the Canadian retail market.

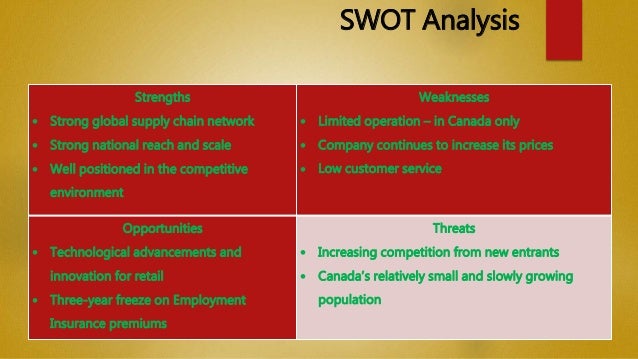

Expanding Market Reach and Customer Base

The combined entity would leverage the existing customer bases of both Canadian Tire and Hudson's Bay, dramatically expanding their market reach.

- Increased brand awareness: A combined entity would enjoy amplified brand visibility and recognition across a wider demographic.

- Access to new demographics: Canadian Tire's strong presence in suburban and rural areas complements HBC's more urban focus, providing access to diverse customer segments.

- Potential for cross-promotion and loyalty programs: A unified loyalty program could incentivize cross-shopping, boosting sales across both brands.

A detailed look at customer profiles reveals limited overlap, suggesting that a combined entity could effectively cater to a significantly broader consumer base. Canadian Tire's focus on automotive, home improvement, and sporting goods could be complemented by HBC's offerings in apparel, home furnishings, and luxury goods. This complementary nature minimizes direct competition between the brands, maximizing the potential for growth.

Supply Chain Optimization and Cost Savings

Consolidating their supply chains could yield considerable cost savings and operational efficiencies.

- Reduced operational costs: Shared logistics, distribution networks, and procurement could significantly lower expenses.

- Improved inventory management: Better coordination could lead to optimized inventory levels, reducing waste and storage costs.

- Streamlined supply chain: A unified system could enhance efficiency and responsiveness to market demands.

- Potential for bulk purchasing discounts: Combined purchasing power would allow for substantial discounts from suppliers.

This enhanced efficiency would directly impact pricing and profitability, making both companies more competitive and potentially increasing their profit margins.

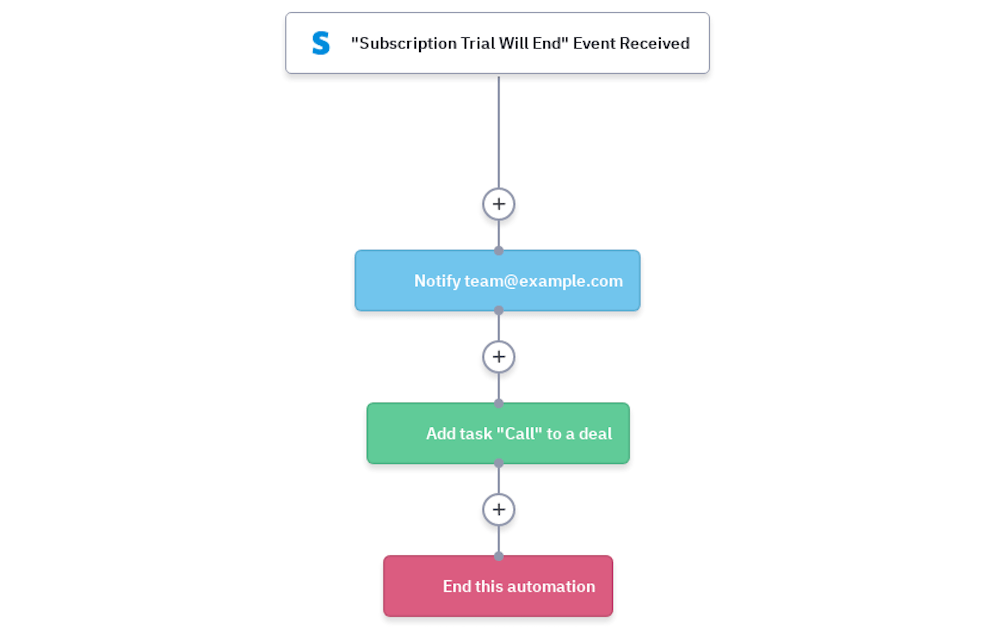

Enhanced Omnichannel Presence

Integrating online and offline retail channels could create a superior customer experience.

- Improved online shopping experience: A unified e-commerce platform could provide a seamless and user-friendly shopping experience.

- Better integration of online and offline retail channels: Customers could easily browse online and pick up in-store, or return online purchases at physical locations.

- Expanded delivery options: Leveraging both companies' existing delivery networks could expand delivery reach and options for customers.

- Enhanced customer service: Integrated customer service channels would provide more convenient and efficient support.

This enhanced omnichannel strategy would improve customer satisfaction, fostering loyalty and attracting new customers.

Challenges and Potential Risks of a Canadian Tire-Hudson's Bay Partnership

While a partnership presents numerous opportunities, several challenges and potential risks must be considered.

Integration Challenges and Cultural Differences

Merging two distinct corporate cultures and operating systems can be complex and time-consuming.

- Potential conflicts in management styles: Differences in leadership approaches and decision-making processes could create friction.

- Difficulties in integrating IT systems: Consolidating IT infrastructure and data systems could be technically challenging and costly.

- Challenges in harmonizing employee benefits and compensation: Balancing employee expectations and ensuring fairness across both companies is crucial.

Past merger failures highlight the critical need for a well-defined integration plan that addresses potential cultural clashes and operational complexities.

Competition in the Canadian Retail Market

The Canadian retail market is highly competitive, with major players like Walmart and Amazon posing significant challenges.

- Increased competition with Walmart, Amazon, and other major retailers: A combined Canadian Tire-HBC entity would face intensified competition.

- Potential for antitrust scrutiny: Regulatory bodies may scrutinize the merger to ensure it doesn't create a monopoly or stifle competition.

Careful analysis of market share and competitive dynamics is crucial to assess the potential impact of the partnership on market dominance.

Brand Dilution and Customer Confusion

Combining two strong brands requires a delicate balance to avoid diluting brand identity and confusing customers.

- Potential negative impact on brand image and customer perception: Poorly managed integration could damage the reputation of both brands.

- The importance of a clear branding strategy: Maintaining distinct brand identities while leveraging synergies is crucial.

A clear and effective branding strategy is vital to avoid alienating existing customers and maintaining the positive associations each brand currently enjoys.

Financial Considerations and Viability of the Partnership

The financial implications of a Canadian Tire-Hudson's Bay partnership are critical to its success.

Financial Projections and Return on Investment

A thorough financial analysis is needed to assess the potential return on investment.

- Projected revenue growth: Synergies should lead to increased revenue, but accurate projections require careful market analysis.

- Cost-reduction targets: Specific cost-saving goals should be established and tracked to measure the efficiency of the integration.

- Return on investment (ROI) analysis: A comprehensive ROI analysis will determine the financial viability of the partnership.

- Potential impact on shareholder value: The impact on shareholder value must be carefully assessed to secure necessary investment and support.

Detailed financial modeling, including best-case and worst-case scenarios, is necessary to evaluate the potential financial outcomes.

Funding and Financing Strategies

Securing appropriate funding is essential for the success of the partnership.

- Debt financing: Borrowing money could provide necessary capital, but increases financial risk.

- Equity financing: Issuing new shares could dilute existing ownership but reduce debt burden.

- Mergers and acquisitions: The specific structure of the partnership will influence financing requirements.

- Potential impact on credit ratings: The chosen financing strategy will affect the creditworthiness of both companies.

A careful assessment of available financing options is crucial to determine the optimal strategy that balances risk and reward.

Conclusion: Will a Canadian Tire-Hudson's Bay Partnership Succeed? A Final Verdict

A Canadian Tire-Hudson's Bay partnership presents a compelling opportunity for growth and synergy, potentially enhancing their market position and creating a more robust omnichannel experience. However, significant challenges exist, particularly regarding integration complexities, fierce competition, and the delicate balancing act of maintaining distinct brand identities. The financial viability hinges on successful integration, cost-cutting, and revenue growth, all while navigating potential antitrust concerns and market volatility. While the potential rewards are significant, the risks are equally substantial. Ultimately, the success of such a venture depends heavily on meticulous planning, effective execution, and a clear understanding of the competitive landscape.

We encourage you to share your thoughts on the potential Canadian Tire Hudson's Bay merger and its implications for the future of Canadian retail. What are your predictions for the success of this potential strategic alliance? Join the conversation using #CanadianTireHBCmerger #CanadianRetailFuture #StrategicPartnershipsInRetail.

Featured Posts

-

Santos Ufc 313 Strategy Knockout For 50 000 And Babys Diapers

May 19, 2025

Santos Ufc 313 Strategy Knockout For 50 000 And Babys Diapers

May 19, 2025 -

The Trial Ending Explained Teas Crime And Her Parents Fate Unveiled

May 19, 2025

The Trial Ending Explained Teas Crime And Her Parents Fate Unveiled

May 19, 2025 -

Robert Pattinson And Kristen Stewart At Cannes 2025 A Possibility

May 19, 2025

Robert Pattinson And Kristen Stewart At Cannes 2025 A Possibility

May 19, 2025 -

Vstrecha V Zheneve Gensek Oon Obsudit Kiprskiy Vopros

May 19, 2025

Vstrecha V Zheneve Gensek Oon Obsudit Kiprskiy Vopros

May 19, 2025 -

El Polemico Comentario De Alfonso Arus Sobre Melody Y Eurovision 2025 En Arusero

May 19, 2025

El Polemico Comentario De Alfonso Arus Sobre Melody Y Eurovision 2025 En Arusero

May 19, 2025