Will Canadian Tire's Acquisition Of Hudson's Bay Pay Off? A Realistic Assessment

Table of Contents

Synergies and Strategic Rationale

The Canadian Tire acquisition of Hudson's Bay rests on several key strategic pillars promising significant synergies and expansion opportunities. Let's delve into the core reasons behind this ambitious move.

Expanding Retail Reach and Customer Base

This merger dramatically expands Canadian Tire's retail footprint and customer base. HBC's prime real estate locations in major city centers provide access to a wealthier demographic, significantly different from Canadian Tire's traditional customer profile.

- Increased store footprint in major city centers: HBC's strategically located department stores provide Canadian Tire with immediate access to high-traffic areas previously unavailable to them. This expands reach into densely populated urban markets, offering significant growth potential.

- Access to a wealthier demographic: Hudson's Bay's customer base skews towards a higher income bracket, a demographic that Canadian Tire can now target with new product offerings and marketing strategies. This diversification could lead to increased average transaction values.

- Potential for cross-promotion and bundled offers: The merger creates numerous opportunities for synergistic marketing campaigns. Imagine bundled offers combining Canadian Tire's automotive services with HBC's home goods, or joint loyalty programs rewarding customers across both brands.

Keywords: market expansion, customer acquisition, diversification, retail synergy, real estate strategy

Operational Efficiencies and Cost Savings

Beyond market expansion, the merger promises considerable cost savings through operational efficiencies. Combining two large retail operations allows for significant streamlining across numerous areas.

- Consolidation of distribution networks: Merging supply chains can reduce transportation costs, warehouse expenses, and inventory management complexities. This streamlined approach could significantly boost profit margins.

- Shared resources (IT, marketing, etc.): Combining IT infrastructure, marketing departments, and other shared services can generate substantial economies of scale, reducing overhead costs.

- Potential workforce optimization: While potentially sensitive, merging operations can lead to greater efficiency in staffing and resource allocation, although careful management is crucial to mitigate potential job losses and maintain employee morale.

Keywords: cost reduction, supply chain optimization, operational efficiency, economies of scale, synergy benefits

Challenges and Potential Pitfalls

While the potential benefits are significant, the Canadian Tire acquisition of Hudson's Bay also presents considerable challenges that could hinder its success.

Integration Difficulties and Brand Conflicts

Integrating two distinct brands with different target audiences, product offerings, and brand identities presents a major hurdle. Maintaining brand loyalty while capitalizing on synergies requires careful planning and execution.

- Maintaining brand loyalty for both Canadian Tire and Hudson's Bay: Both brands have strong loyal customer bases. Preserving the unique identity and appeal of each brand is paramount to avoid alienating existing customers.

- Avoiding brand dilution: Integrating the brands requires a delicate balance. Overly aggressive integration could dilute the distinct identities of each brand, potentially harming their individual appeal.

- Potential for customer confusion: Customers may be confused by the merger, especially if the integration process isn't clearly communicated and executed effectively.

Keywords: brand integration, brand management, brand conflict, cultural integration, merger challenges

Competition and Market Saturation

The Canadian retail market is fiercely competitive, with established giants like Walmart and Amazon, alongside numerous other players. The combined entity will face significant pressure to maintain market share.

- Competition from Walmart, Amazon, and other major retailers: The merged company will need to differentiate itself from competitors to maintain a competitive edge in a crowded market. This will require innovative strategies and a strong focus on customer experience.

- Need to adapt to evolving consumer behavior: Consumers increasingly shop online, demanding seamless omnichannel experiences. The merged entity will need to adapt its strategies to meet these changing expectations.

- Importance of online presence: A robust and competitive e-commerce presence is crucial for survival in today’s market, requiring substantial investment in digital infrastructure and online marketing.

Keywords: market competition, e-commerce competition, retail landscape, competitive advantage, market saturation

Economic Uncertainty and Consumer Spending

Economic downturns and fluctuations in consumer spending can significantly impact the success of any large retail merger. The Canadian economy's vulnerability to external shocks makes this a serious risk.

- Vulnerability to economic recession: Economic instability can significantly reduce consumer spending, impacting sales across both Canadian Tire and Hudson's Bay stores.

- Impact on consumer confidence: Periods of economic uncertainty often lead to decreased consumer confidence, leading to reduced discretionary spending on non-essential items.

- Need for flexible pricing and promotional strategies: The ability to adapt pricing and promotional strategies to changing economic conditions will be crucial for maintaining profitability.

Keywords: economic impact, consumer spending, recession risk, financial performance, market volatility

Conclusion

Canadian Tire's acquisition of Hudson's Bay presents both enormous potential and significant challenges. The opportunity for synergy and market expansion is undeniable, but successful integration will hinge on several factors: meticulous brand management, effective cost control, and the ability to adapt to the ever-evolving retail landscape. The long-term success of this ambitious undertaking remains uncertain, necessitating close observation and strategic flexibility. The future success will depend on successfully navigating the complexities of brand integration, fierce competition, and economic uncertainty.

Call to Action: Stay tuned for further updates on the Canadian Tire and Hudson's Bay merger, and share your thoughts on whether this Canadian Tire acquisition will ultimately pay off in the comments below! Keywords: Canadian Tire acquisition, Hudson's Bay merger, retail future, Canadian retail market, future outlook

Featured Posts

-

Solve The Nyt Mini Crossword Answers For March 27

May 20, 2025

Solve The Nyt Mini Crossword Answers For March 27

May 20, 2025 -

Talisca Tadic Transferi Fenerbahce De Gerilim Ve Yeni Bir Doenem

May 20, 2025

Talisca Tadic Transferi Fenerbahce De Gerilim Ve Yeni Bir Doenem

May 20, 2025 -

Gaza Food Supplies Israel Announces Resumption Of Aid

May 20, 2025

Gaza Food Supplies Israel Announces Resumption Of Aid

May 20, 2025 -

Druga Vagitnist Dzhennifer Lourens Zavershilas Radisna Novina

May 20, 2025

Druga Vagitnist Dzhennifer Lourens Zavershilas Radisna Novina

May 20, 2025 -

Fieldview Care Home Allegations De Maltraitance Et D Abus Sexuels Developpement De La Situation

May 20, 2025

Fieldview Care Home Allegations De Maltraitance Et D Abus Sexuels Developpement De La Situation

May 20, 2025

Latest Posts

-

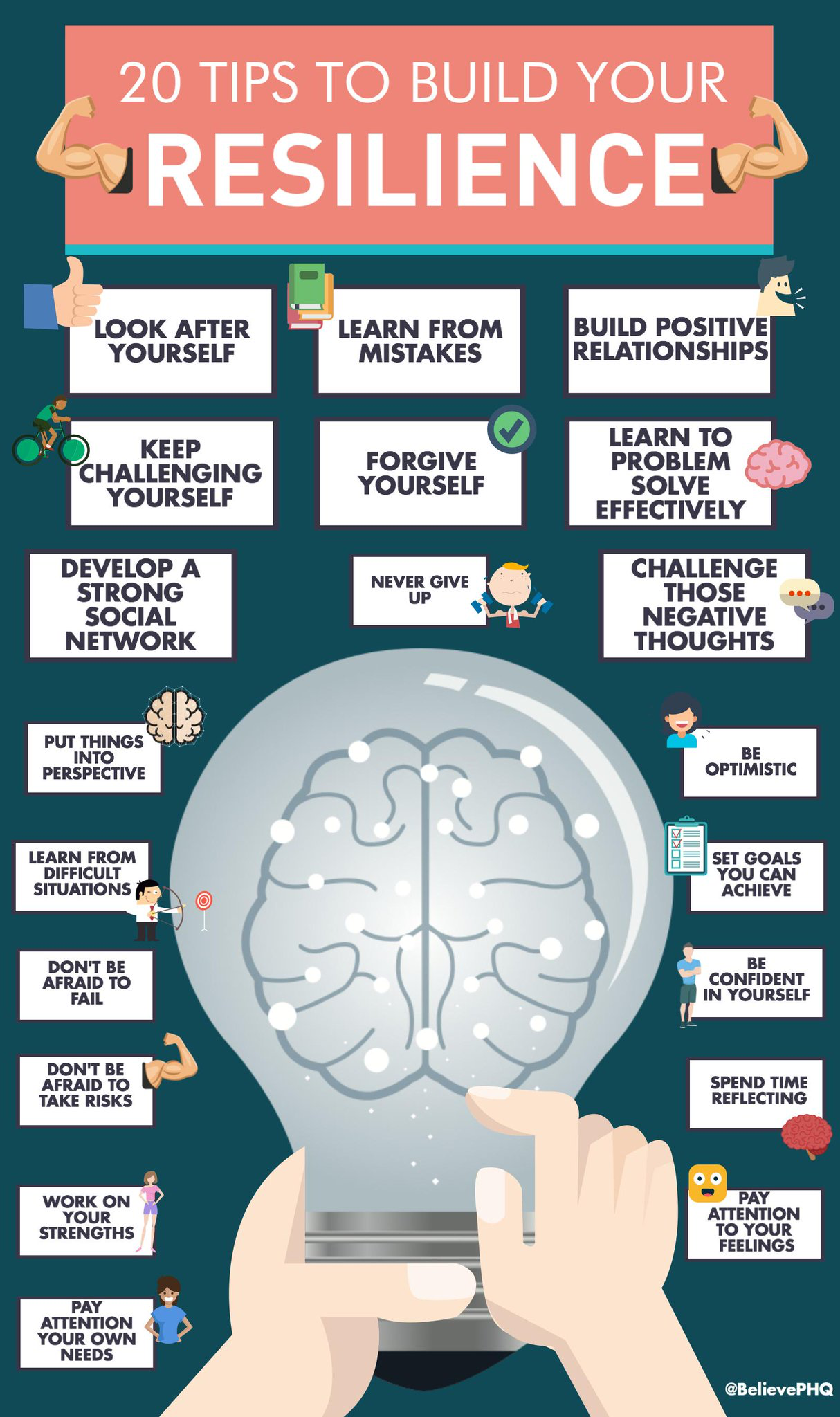

Boosting Resilience Strategies For Improved Mental Health

May 20, 2025

Boosting Resilience Strategies For Improved Mental Health

May 20, 2025 -

Cultivating Resilience A Guide To Mental Well Being

May 20, 2025

Cultivating Resilience A Guide To Mental Well Being

May 20, 2025 -

Resilience And Mental Health From Setback To Success

May 20, 2025

Resilience And Mental Health From Setback To Success

May 20, 2025 -

Resilience And Mental Health Building Strength Not Bitterness

May 20, 2025

Resilience And Mental Health Building Strength Not Bitterness

May 20, 2025 -

Scott Savilles Passion For Cycling Ragbrai And Everyday Adventures

May 20, 2025

Scott Savilles Passion For Cycling Ragbrai And Everyday Adventures

May 20, 2025