Will Canadian Tire's Acquisition Of Hudson's Bay Succeed? A Cautious Outlook

Table of Contents

Overlapping Customer Bases and Brand Synergy – Potential for Success?

Market Overlap and Competitive Advantages:

The success of this acquisition hinges significantly on the degree of overlap and synergy between Canadian Tire and Hudson's Bay's customer bases. While seemingly disparate at first glance – one focusing on automotive, home improvement, and sporting goods, the other on department store offerings – there's potential for cross-selling and expanded market reach. However, significant questions remain regarding the extent of actual overlap and the ability to leverage it effectively.

- Customer Profile Comparison: Canadian Tire's customer base tends to be more focused on practical, value-driven purchases, whereas Hudson's Bay attracts a more fashion-conscious and potentially higher-spending demographic. Identifying and targeting the overlapping segments will be crucial.

- Bundled Offerings and Loyalty Program Integration: Combining loyalty programs could offer significant benefits, creating a more comprehensive rewards system that incentivizes purchases across both brands. Bundled offers, such as discounts on home renovations paired with furniture purchases, could also drive sales.

- Increased Market Share: The combined reach of both retail giants could undoubtedly increase market share, especially in key urban centers where both brands have a strong presence.

- Cannibalization Concerns: A critical concern is potential cannibalization. Will the acquisition lead to decreased sales in one brand due to overlap with the other? This requires careful management and strategic product differentiation.

Integration Challenges and Operational Hurdles – Potential for Failure?

Merging Two Distinct Retail Cultures:

Integrating two such different retail companies presents substantial operational hurdles. Hudson's Bay operates within the higher-end department store segment, while Canadian Tire caters to a broader, more price-sensitive market. Bridging this cultural and operational gap will require careful planning and execution.

- Management Style and Corporate Philosophy Conflicts: Different management styles and corporate cultures can lead to friction and inefficiencies. Creating a unified vision and approach will be crucial.

- IT System and Supply Chain Integration: Merging IT systems and supply chains is a complex and time-consuming process, potentially leading to disruptions in operations and customer service.

- Employee Morale: Mergers often lead to uncertainty and anxiety among employees. Maintaining employee morale and minimizing job losses will be key to a smooth transition.

- Customer Service Disruptions: During the integration phase, customers may experience disruptions in service, potentially impacting brand loyalty. Minimizing these disruptions will be crucial.

Financial Implications and Investment Risk – A Calculated Risk?

The Financial Burden of Acquisition:

The financial viability of the acquisition is another critical factor. Canadian Tire will need to carefully manage the financial burden, considering debt levels, valuation, and projected return on investment (ROI).

- Canadian Tire's Financial Capacity: Canadian Tire's financial health and capacity to absorb the acquisition costs without impacting its core business are paramount.

- Projected ROI and Risks: A thorough assessment of projected ROI is essential, considering potential risks such as market downturns and integration challenges.

- Impact on Stock Price and Investor Sentiment: The acquisition's impact on Canadian Tire's stock price and investor sentiment needs close monitoring. Negative investor response could severely impact the success of the merger.

- Debt Financing and Long-Term Implications: The use of debt financing to fund the acquisition could significantly impact Canadian Tire's long-term financial stability.

The Evolving Canadian Retail Landscape – External Factors at Play

Impact of E-commerce and Shifting Consumer Preferences:

The success of the acquisition will also depend on external factors shaping the Canadian retail landscape. The rise of e-commerce, shifting consumer preferences, and economic conditions all play significant roles.

- Competitive Threats: Intense competition from other retailers, both online and brick-and-mortar, will necessitate a strong e-commerce strategy and a competitive pricing structure.

- Inflation and Consumer Spending: Inflation and changing consumer spending habits could significantly impact the success of the merger, potentially reducing consumer demand.

- E-commerce Integration and Expansion: A robust and integrated e-commerce platform will be crucial to compete effectively in the digital marketplace.

Conclusion: Canadian Tire and Hudson's Bay – A Verdict on the Acquisition's Future

The Canadian Tire and Hudson's Bay acquisition presents both significant opportunities and considerable challenges. While potential synergies exist, the integration process will be complex and costly. The evolving Canadian retail landscape, characterized by the rise of e-commerce and fluctuating consumer spending, adds another layer of uncertainty. Based on this analysis, a cautious outlook is warranted. The success of this merger will hinge on effective management of integration challenges, careful financial planning, and a robust strategy to navigate the competitive retail environment.

What are your thoughts on the Canadian Tire Hudson's Bay acquisition? Share your predictions in the comments below!

Featured Posts

-

Where To Watch Easy A Your Bbc Three Hd Guide

May 18, 2025

Where To Watch Easy A Your Bbc Three Hd Guide

May 18, 2025 -

Trump Says India Offered Tariff Cuts No Immediate Action

May 18, 2025

Trump Says India Offered Tariff Cuts No Immediate Action

May 18, 2025 -

Snl Controversy Audience Profanity During Ego Nwodim Sketch

May 18, 2025

Snl Controversy Audience Profanity During Ego Nwodim Sketch

May 18, 2025 -

Mits Statement On Students Controversial Ai Paper

May 18, 2025

Mits Statement On Students Controversial Ai Paper

May 18, 2025 -

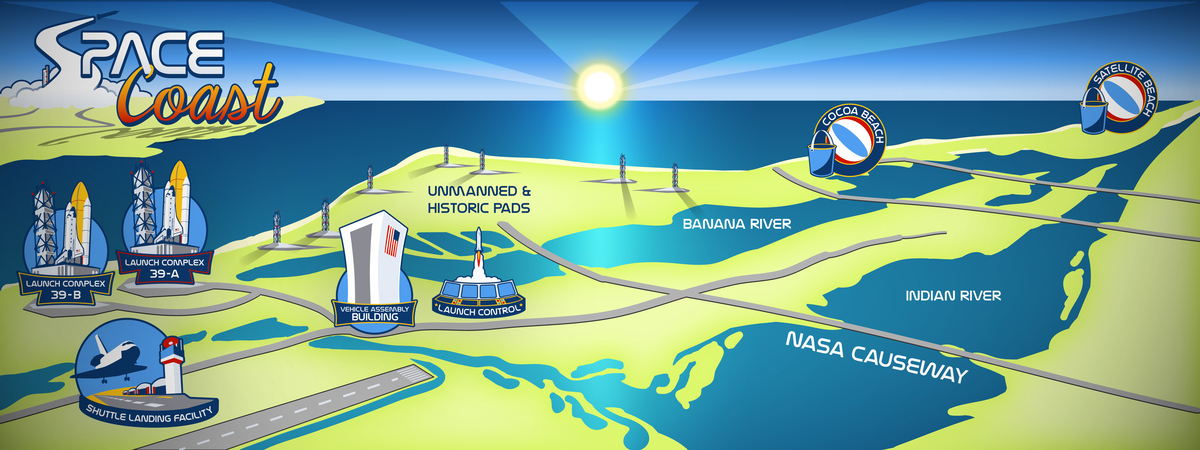

Florida Space Coast 800 000 Investment In Economic Growth

May 18, 2025

Florida Space Coast 800 000 Investment In Economic Growth

May 18, 2025

Latest Posts

-

A Former Colleagues Account Of Stephen Millers Abhorrent Actions

May 18, 2025

A Former Colleagues Account Of Stephen Millers Abhorrent Actions

May 18, 2025 -

Stephen Miller Former Colleague Exposes His Horrible Behavior

May 18, 2025

Stephen Miller Former Colleague Exposes His Horrible Behavior

May 18, 2025 -

Stephen Miller A Contender For National Security Advisor

May 18, 2025

Stephen Miller A Contender For National Security Advisor

May 18, 2025 -

Stephen Millers Horrible Behavior A Former Colleague Speaks Out

May 18, 2025

Stephen Millers Horrible Behavior A Former Colleague Speaks Out

May 18, 2025 -

Stiven Miller Noviy Sovetnik Trampa Po Natsionalnoy Bezopasnosti Axios

May 18, 2025

Stiven Miller Noviy Sovetnik Trampa Po Natsionalnoy Bezopasnosti Axios

May 18, 2025