Will Climate Risk Hurt My Credit When I Buy A Home?

Table of Contents

How Climate Change Impacts Property Values

Climate change significantly impacts property values. The direct correlation between increased climate risk and property devaluation is undeniable. As extreme weather events become more frequent and intense, properties in high-risk areas face a greater chance of damage and decreased desirability.

- Increased insurance premiums: Properties in flood plains or wildfire-prone areas face significantly higher insurance premiums, making them less attractive to potential buyers and reducing their market value.

- Property damage from extreme weather events: Flooding, wildfires, hurricanes, and other extreme weather can cause extensive and costly damage, reducing a property's value dramatically. The cost of repairs can far exceed insurance coverage.

- Reduced demand for properties in high-risk zones: As awareness of climate risk grows, buyers are increasingly hesitant to purchase properties in areas vulnerable to climate-related disasters, leading to lower demand and reduced prices.

- Government regulations and restrictions on development: Governments are increasingly implementing stricter building codes and regulations in high-risk areas, limiting development and potentially impacting property values.

For instance, coastal erosion is steadily reducing the value of beachfront properties, while increased wildfire risk in certain regions is making homes less desirable, even leading to significant devaluation after a fire event, regardless of whether the specific property was damaged. These factors directly contribute to property devaluation, potentially impacting your ability to secure a mortgage or maintain equity.

The Link Between Property Value and Mortgage Lending

Lenders assess risk meticulously before approving a mortgage. A crucial part of this assessment is the property's appraised value.

- Lenders conduct appraisals to determine property worth: A professional appraiser evaluates the property's condition, location, and market value.

- Appraisals consider climate risk factors: Appraisers are increasingly factoring in climate risks, such as flood risk, wildfire risk, and proximity to vulnerable areas, when determining a property's value.

- Lower property value can lead to higher loan-to-value ratios (LTV): A lower appraised value increases the loan-to-value ratio (LTV), making you a higher risk to the lender.

- Higher LTV ratios may require higher down payments or stricter lending terms: To mitigate risk, lenders may require larger down payments or impose stricter lending terms for properties with higher LTV ratios.

- Difficulty securing a mortgage in high-risk areas: Securing a mortgage on a property in a high-risk area can become significantly more challenging, or even impossible, due to lender concerns.

The appraisal process is key. If climate risk factors lead to a lower appraisal, it can directly affect your ability to secure a mortgage or obtain favorable loan terms. Understanding this link is crucial for navigating the home-buying process in a climate-conscious world.

Climate Risk and Your Credit Score – The Indirect Impact

While climate risk doesn't directly impact your credit score, its indirect effects can be devastating.

- Foreclosure due to property damage or devaluation: Severe property damage from a climate-related event could lead to financial hardship, potentially resulting in foreclosure.

- Difficulty refinancing due to lower property value: If your property value decreases significantly due to climate risk, refinancing your mortgage may become difficult or impossible.

- Increased debt due to repair costs after climate-related damage: Repairing damage from climate-related events can be incredibly expensive, increasing your debt and potentially impacting your credit score.

- Late payments due to financial hardship caused by climate events: Financial strain from climate-related damage can lead to missed mortgage payments, negatively affecting your credit report.

These scenarios highlight how climate-related events can trigger a cascade of financial challenges that ultimately impact your credit score.

Protecting Your Credit During Climate-Related Events

Taking proactive steps can significantly mitigate the financial risks associated with climate change and protect your credit score.

- Purchase flood or wildfire insurance: Protecting your property with appropriate insurance coverage is crucial to minimizing financial losses.

- Research climate risk before purchasing a home: Thoroughly research the climate risks associated with your desired location before making an offer.

- Consider a smaller mortgage or higher down payment: A smaller mortgage or a larger down payment can lower your LTV ratio and make you a less risky borrower.

- Create an emergency fund for unexpected repairs: Having a financial buffer can help you handle unexpected repairs without resorting to high-interest debt.

By taking these steps, you can significantly improve your ability to weather climate-related events financially and protect your credit score.

Conclusion

Climate risk doesn't directly affect your credit score, but its impact on property values and your overall financial well-being can have severe consequences. Understanding the potential indirect effects – from difficulty securing a mortgage to potential foreclosure – is critical for informed home buying. To protect your credit and financial future, prioritize thorough research into climate risks in your desired location. Make informed decisions about your mortgage and insurance, and build a financial safety net to handle unexpected events. Consider using a climate risk assessment tool before making a significant investment in a property. Protect your credit and secure your financial future by making climate risk a key consideration in your home buying journey. Learn more about climate-resilient homes and make informed decisions to avoid future financial hardship.

Featured Posts

-

Wtt Chennai Unexpected Loss For Aruna

May 21, 2025

Wtt Chennai Unexpected Loss For Aruna

May 21, 2025 -

Damaging Winds And Fast Moving Storms What To Watch For

May 21, 2025

Damaging Winds And Fast Moving Storms What To Watch For

May 21, 2025 -

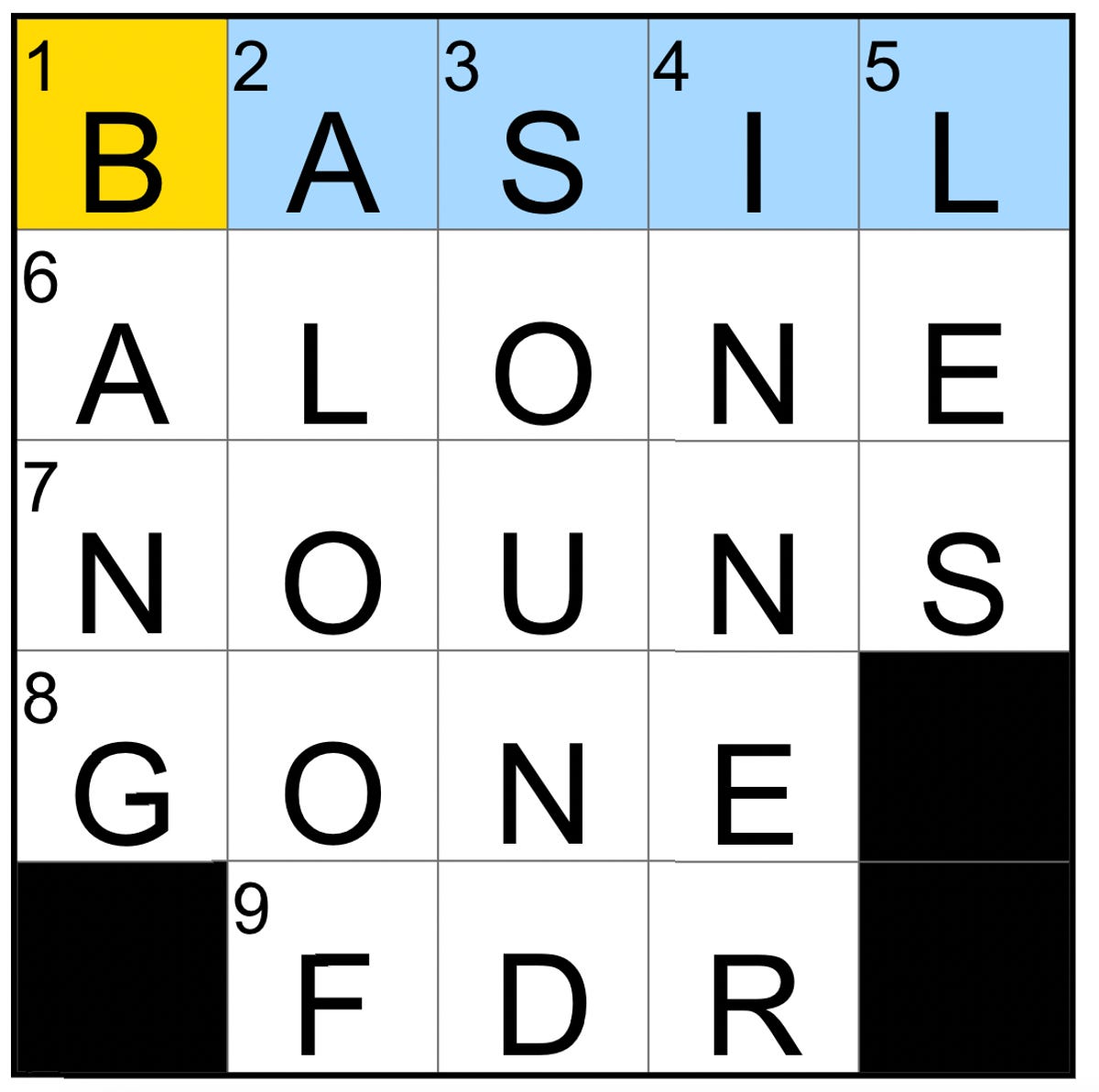

Nyt Mini Crossword Clues And Solutions April 18 2025

May 21, 2025

Nyt Mini Crossword Clues And Solutions April 18 2025

May 21, 2025 -

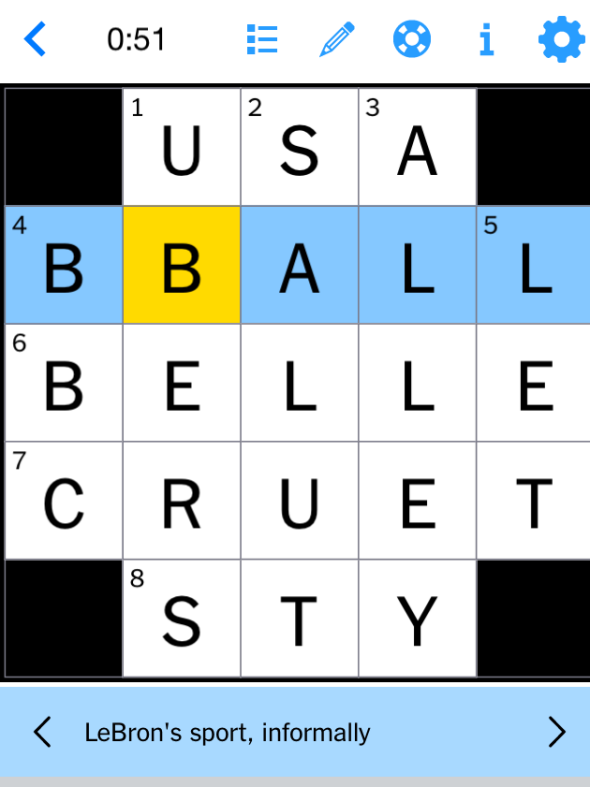

April 20 2025 Nyt Mini Crossword Complete Answers And Hints

May 21, 2025

April 20 2025 Nyt Mini Crossword Complete Answers And Hints

May 21, 2025 -

Huizenmarktprognose Abn Amro Rentedaling En Prijsstijgingen

May 21, 2025

Huizenmarktprognose Abn Amro Rentedaling En Prijsstijgingen

May 21, 2025

Latest Posts

-

Bangladeshinfo Com Exploring Bangladesh Through Detailed Information

May 21, 2025

Bangladeshinfo Com Exploring Bangladesh Through Detailed Information

May 21, 2025 -

How To Watch Live Bundesliga Football A Comprehensive Guide

May 21, 2025

How To Watch Live Bundesliga Football A Comprehensive Guide

May 21, 2025 -

Finding Information On Bangladesh Your Resource At Bangladeshinfo Com

May 21, 2025

Finding Information On Bangladesh Your Resource At Bangladeshinfo Com

May 21, 2025 -

Fsv Mainz 05 Vs Bayer 04 Leverkusen Matchday 34 Highlights And Post Match Report

May 21, 2025

Fsv Mainz 05 Vs Bayer 04 Leverkusen Matchday 34 Highlights And Post Match Report

May 21, 2025 -

Live Bundesliga Schedule Fixtures And Where To Watch

May 21, 2025

Live Bundesliga Schedule Fixtures And Where To Watch

May 21, 2025