Will Low Mortgage Rates (3% Or Less) Boost Canada's Housing Sales?

Table of Contents

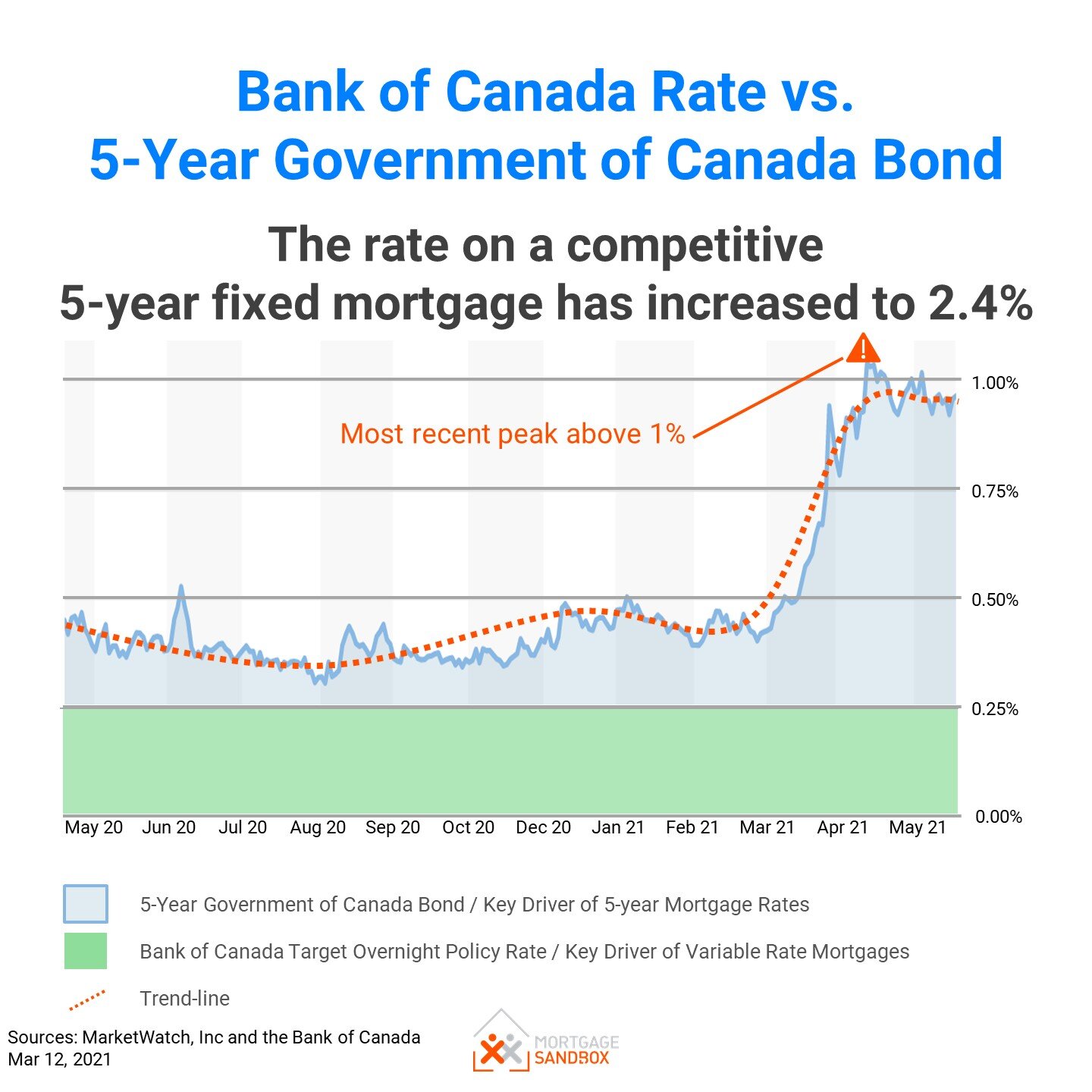

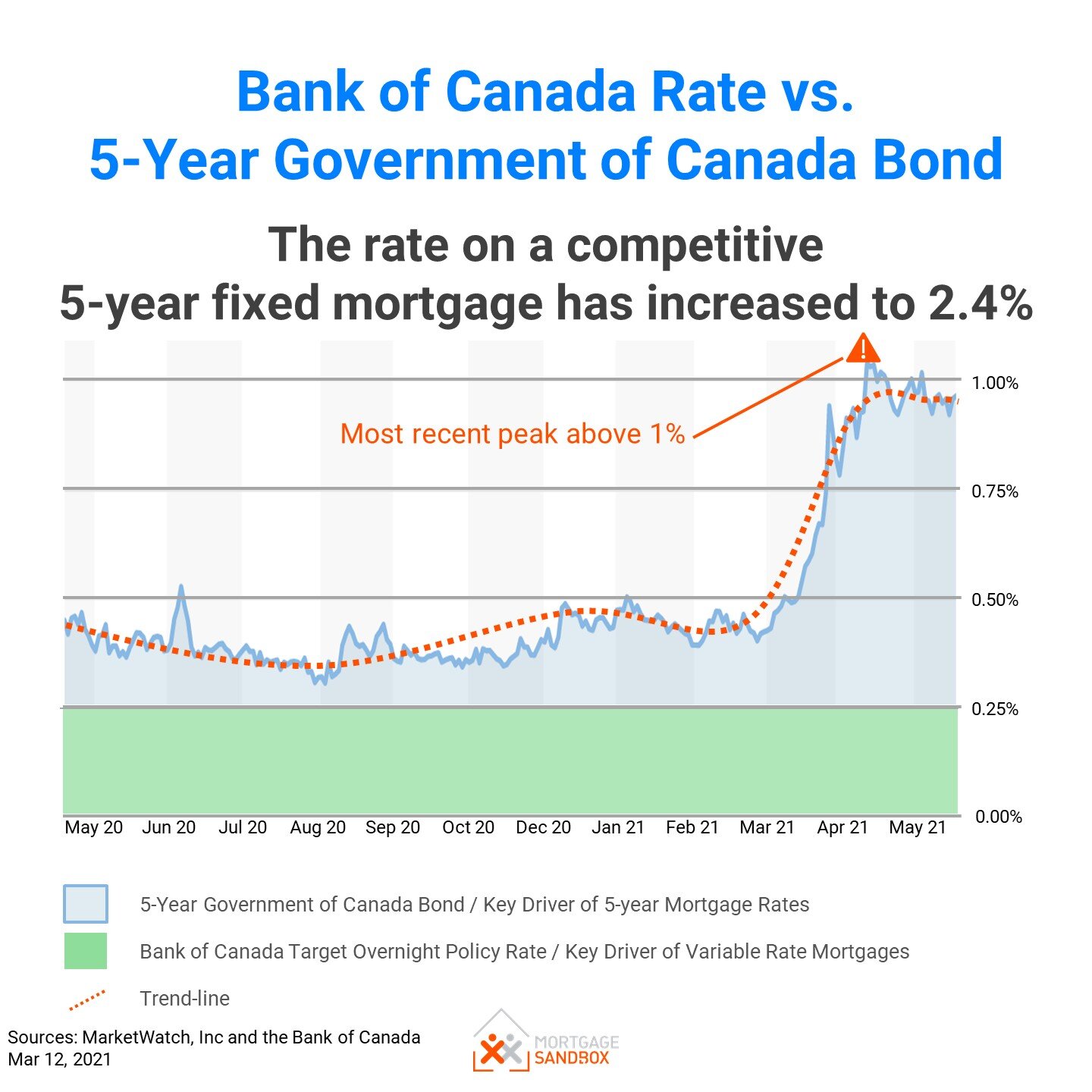

The Allure of Low Mortgage Rates

Low mortgage rates act as a powerful magnet for potential homebuyers. The psychological impact of seeing a significantly lower monthly payment is substantial. A 3% mortgage rate translates to dramatically reduced monthly costs compared to rates seen in recent years. This translates to:

- Increased Affordability: Lower monthly payments make homeownership accessible to a broader range of buyers, including first-time homebuyers who may have previously been priced out of the market.

- Higher Mortgage Qualification: More buyers can qualify for larger mortgages with the same income, expanding their purchasing power and potentially driving them toward higher-priced properties.

- Boosted Purchasing Power: This increased affordability translates into higher demand, potentially leading to a surge in sales activity across various price points.

Historically, periods of low interest rates in Canada have frequently correlated with increased housing market activity. However, it’s important to note that these past periods also had different economic circumstances, making direct comparisons complex. The current market should be evaluated independently with consideration for the present economic situation.

Increased Buyer Demand and Competition

Low mortgage rates are expected to fuel a surge in buyer demand. This increased competition could lead to multiple offers, bidding wars, and ultimately, higher prices, even with more buyers entering the market. We can expect:

- First-Time Homebuyers: Attracted by lower monthly payments, a significant number of first-time homebuyers will likely enter the market, increasing overall demand.

- Upgrading Homeowners: Existing homeowners will also be incentivized to upgrade to larger homes or more desirable locations, taking advantage of lower borrowing costs.

- Investor Activity: Real estate investors will likely see low rates as an opportune time to invest, further contributing to the increased demand and potentially driving up prices in specific markets.

Regional variations will undoubtedly exist. Markets with already limited inventory will likely experience more intense competition than those with a larger supply of homes.

Economic Factors Influencing Housing Sales

The broader economic climate plays a crucial role in shaping the housing market's response to low mortgage rates. Factors such as inflation, unemployment, and government policies significantly impact buyer confidence and affordability.

- Inflation's Impact: High inflation erodes purchasing power, potentially offsetting some of the benefits of low mortgage rates. Rising prices for building materials and other goods can also influence home construction and therefore affect housing supply.

- Unemployment Concerns: High unemployment rates decrease buyer confidence, reducing demand despite the attractive mortgage rates.

- Government Policies: Government policies, such as mortgage stress tests, influence buyer eligibility and limit borrowing capacity. Changes to these policies can have a noticeable effect on market activity.

These factors can either amplify or dampen the effects of low mortgage rates on housing sales. A strong economy with low unemployment and controlled inflation would likely enhance the positive impacts of low rates. Conversely, a weak economy could mitigate the effects, leading to a less significant surge in sales.

The Role of Housing Inventory

Currently, Canada's housing inventory is [Insert current data on housing inventory, e.g., tight/ample]. Low inventory in many areas could counteract the positive effects of low mortgage rates. Instead of a significant increase in sales volume, this could translate to increased price escalation in a seller's market.

- Regional Inventory Variations: Inventory levels vary significantly across different Canadian regions. Areas with limited supply will see the most intense competition and price growth.

- Price Escalation: Low inventory combined with high demand could lead to significant price increases, making homes less affordable despite the low mortgage rates.

- Seller's Market Dominance: A seller's market conditions would be characterized by multiple offers, short selling times, and high prices.

Will Low Mortgage Rates (3% or Less) Really Boost Canada's Housing Market?

In conclusion, while low mortgage rates (3% or less) have the potential to stimulate buyer demand and increase housing sales in Canada, the overall impact is complex and depends on several interacting factors. Increased affordability and purchasing power could drive significant demand, but this could be offset by economic headwinds like inflation and limited housing inventory. A balanced perspective recognizes both the positive and negative implications. It is crucial to stay informed about current and future mortgage rate adjustments and overall market conditions to make informed decisions. Further research into Canadian mortgage rates and their historical impact on the housing market can offer a more comprehensive understanding. The relationship between low mortgage rates (3% or less) and Canada's housing sales remains dynamic and multifaceted, requiring ongoing analysis and consideration of all contributing elements.

Featured Posts

-

Marvels Cancelled Show A Silver Lining For Henry Cavill

May 12, 2025

Marvels Cancelled Show A Silver Lining For Henry Cavill

May 12, 2025 -

3 10 S

May 12, 2025

3 10 S

May 12, 2025 -

T Mobiles 16 Million Data Breach Fine Three Years Of Violations

May 12, 2025

T Mobiles 16 Million Data Breach Fine Three Years Of Violations

May 12, 2025 -

10 Images Benny Blancos Actions Amid Selena Gomez Relationship Speculation

May 12, 2025

10 Images Benny Blancos Actions Amid Selena Gomez Relationship Speculation

May 12, 2025 -

Rencontre Inattendue Sylvester Stallone Decouvre Le Travail D Une Artiste

May 12, 2025

Rencontre Inattendue Sylvester Stallone Decouvre Le Travail D Une Artiste

May 12, 2025