Will QBTS Stock Rise Or Fall After The Next Earnings Report?

Table of Contents

The upcoming earnings report for QBTS is a pivotal moment for investors. Will the results send the stock soaring, or will it plummet? This article delves into the key factors that will determine whether QBTS stock rises or falls after the release, helping you navigate this crucial period in the market. We will examine recent performance, upcoming projects, and market sentiment to offer a comprehensive outlook on QBTS stock's future.

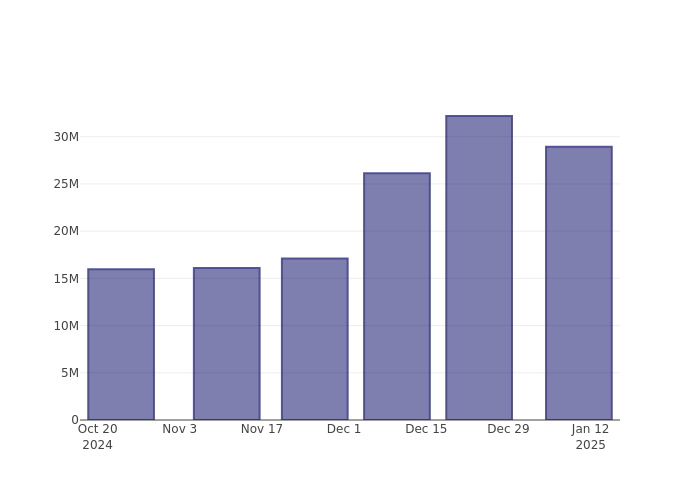

Analyzing QBTS's Recent Performance and Financial Health

Understanding QBTS's current financial standing is crucial for predicting its post-earnings report performance. We need to look at both the top and bottom lines, and assess its overall financial health.

Revenue Growth and Profitability

Examining QBTS's revenue growth and profitability is paramount. We need to analyze both short-term and long-term trends to assess the company's financial strength.

- Compare current performance to previous quarters and years: Look for consistent growth or concerning declines in revenue. A sustained upward trend suggests positive momentum, while a significant drop could signal underlying issues.

- Highlight any significant changes in revenue streams: Are there new products driving growth, or is the company relying heavily on existing offerings? Diversification of revenue streams is generally viewed positively by investors.

- Analyze the impact of any cost-cutting measures or new product launches: Cost-cutting measures can boost profitability, but might also signal underlying weakness. Successful new product launches, conversely, could significantly impact revenue and future growth.

- Discuss profit margins and their implications for future growth: Healthy profit margins are crucial for a company's long-term sustainability and indicate efficient operations. A shrinking margin might warrant closer scrutiny.

Debt Levels and Cash Flow

QBTS's debt levels and cash flow are equally important indicators of its financial health. High debt can restrict future growth and increase financial vulnerability.

- Discuss the impact of debt on the company's financial health: High debt-to-equity ratios can be a warning sign. Investors often prefer companies with lower debt loads.

- Assess the potential for future debt issuance: Will QBTS need to take on more debt to fund future projects? This could impact its financial flexibility.

- Analyze the company's free cash flow and its ability to return value to shareholders: Positive free cash flow indicates the company is generating cash beyond its operational needs, which could lead to dividends, share buybacks, or investment in future growth.

Impact of Upcoming Projects and Announcements on QBTS Stock Price

Future projects and announcements play a significant role in shaping investor expectations and QBTS stock price. Positive news can boost investor confidence, while setbacks can lead to a decline.

New Product Launches and Market Expansion

New product launches and market expansion efforts are key drivers of future growth for QBTS. Success in these areas can significantly impact the company's valuation.

- Detail the potential market size and competition for new products: A large addressable market and limited competition are positive indicators. Conversely, a crowded market with strong competitors could pose a challenge.

- Assess the success rate of previous product launches: Past performance is often a good indicator of future success. If QBTS has a track record of successfully launching new products, investors are more likely to have confidence in future ventures.

- Discuss the financial projections associated with new projects: Realistic and achievable financial projections increase investor confidence. Unrealistic projections may raise concerns.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions can significantly impact QBTS's financial performance and future trajectory. These moves can create synergies, expand market reach, or accelerate innovation.

- Assess the potential synergies and benefits of new partnerships: Successful partnerships can lead to increased efficiency, access to new markets, or technological advancements.

- Discuss the integration risks associated with acquisitions: Integrating acquired companies can be challenging and costly. A smooth integration is critical for realizing the benefits of an acquisition.

- Evaluate the financial implications of these partnerships and acquisitions: Thoroughly assess the financial aspects of these deals to understand their impact on QBTS's bottom line.

Market Sentiment and Investor Expectations for QBTS

Market sentiment and investor expectations are powerful forces shaping QBTS stock price. Understanding these dynamics is crucial for predicting the stock's future trajectory.

Analyst Ratings and Price Targets

Analyst ratings and price targets provide valuable insights into market sentiment. Positive ratings and high price targets often signal bullish investor sentiment.

- Summarize the range of analyst price targets: The range of price targets gives a sense of the uncertainty surrounding future stock price. A wide range indicates greater uncertainty.

- Identify any significant changes in analyst ratings: Sudden changes in ratings can indicate shifts in analyst sentiment and may influence investor behavior.

- Discuss the potential impact of differing analyst opinions on investor sentiment: Differing opinions can lead to market volatility and uncertainty, making it harder to predict the stock's future movement.

Overall Market Conditions and Industry Trends

Broader macroeconomic factors and industry trends can significantly influence QBTS stock price, regardless of the company's earnings report.

- Analyze the impact of interest rates, inflation, and economic growth on the stock market: These macroeconomic factors can affect investor risk appetite and overall market performance.

- Discuss the competitive landscape and any disruptive technologies impacting the industry: Strong competition and disruptive technologies can significantly affect the future of the industry and QBTS's prospects.

Conclusion: Navigating the Future of QBTS Stock

The future trajectory of QBTS stock following its next earnings report hinges on a complex interplay of factors, including financial performance, new project success, and prevailing market sentiment. Analyzing these elements is crucial for making informed investment decisions. While predicting market movement with certainty is impossible, a careful assessment of these aspects can help you prepare for potential stock price fluctuations.

Call to Action: Stay informed about the upcoming QBTS earnings report and continue to monitor key performance indicators to make informed decisions regarding your investment in QBTS stock. Understanding the factors influencing QBTS stock price is essential for successful investing. Keep researching and make wise investment choices based on your risk tolerance and understanding of QBTS’s future.

Featured Posts

-

Experience Superior Sound The Best Wireless Headphones Available

May 21, 2025

Experience Superior Sound The Best Wireless Headphones Available

May 21, 2025 -

Sejarah Kesuksesan Liverpool Para Pelatih Di Balik Gelar Liga Inggris

May 21, 2025

Sejarah Kesuksesan Liverpool Para Pelatih Di Balik Gelar Liga Inggris

May 21, 2025 -

Symposio Megalis Tessarakostis Patriarxiki Ekklisiastiki Akadimia Kritis

May 21, 2025

Symposio Megalis Tessarakostis Patriarxiki Ekklisiastiki Akadimia Kritis

May 21, 2025 -

The Goldbergs Exploring The Shows Enduring Appeal

May 21, 2025

The Goldbergs Exploring The Shows Enduring Appeal

May 21, 2025 -

Analyzing The D Wave Quantum Qbts Stock Drop Mondays Events

May 21, 2025

Analyzing The D Wave Quantum Qbts Stock Drop Mondays Events

May 21, 2025

Latest Posts

-

Little Britain Revival Matt Lucas Responds To Fan Inquiries About The Future

May 21, 2025

Little Britain Revival Matt Lucas Responds To Fan Inquiries About The Future

May 21, 2025 -

Is This The End Walliams And Cowells Britains Got Talent Feud Explodes

May 21, 2025

Is This The End Walliams And Cowells Britains Got Talent Feud Explodes

May 21, 2025 -

Little Britain Cancelled Why Gen Z Loves It

May 21, 2025

Little Britain Cancelled Why Gen Z Loves It

May 21, 2025 -

Matt Lucas Gives Little Britain Revival Update Following Fan Questions

May 21, 2025

Matt Lucas Gives Little Britain Revival Update Following Fan Questions

May 21, 2025 -

The David Walliams Simon Cowell Rift A Britains Got Talent Breakdown

May 21, 2025

The David Walliams Simon Cowell Rift A Britains Got Talent Breakdown

May 21, 2025