Will The Fed Hold Rates? Analyzing Economic Pressures On Monetary Policy

Table of Contents

Inflationary Pressures and the Fed's Dilemma

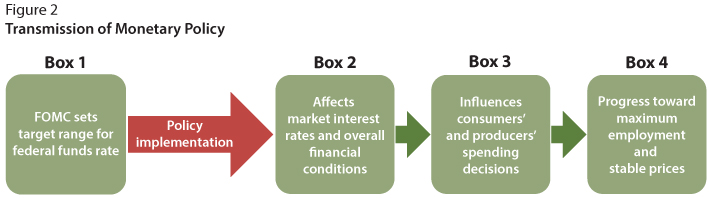

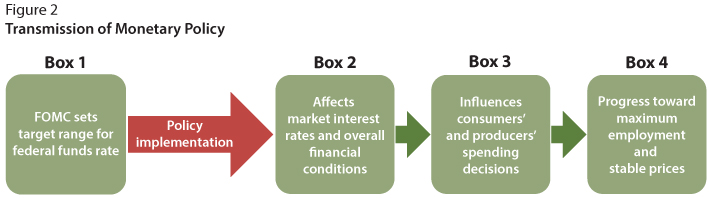

Inflation remains a significant headwind for the US economy. The current inflation rate, while showing signs of cooling, still significantly deviates from the Federal Reserve's target of 2%. Several factors contribute to this persistent inflationary pressure, including lingering supply chain issues, elevated energy prices following the war in Ukraine, and robust consumer demand (demand-pull inflation). The Fed's monetary policy aims to curb inflation by managing interest rates.

- Impact of inflation on consumer spending and saving: High inflation erodes purchasing power, forcing consumers to cut back on spending and impacting saving rates.

- The relationship between inflation and interest rates: The Fed typically raises interest rates to cool down an overheated economy and reduce inflation. Higher interest rates make borrowing more expensive, thus reducing consumer spending and business investment.

- Potential risks of aggressive rate hikes versus inaction: Aggressive rate hikes risk triggering a recession, while inaction could allow inflation to spiral out of control. The Fed faces a delicate balancing act. Keywords: inflation, interest rates, monetary policy, Federal Reserve, inflation target.

Unemployment and the Labor Market's Influence

The labor market presents another crucial factor in the Fed's decision-making process. While unemployment figures are relatively low, signaling a strong labor market, wage growth remains robust. This presents a double-edged sword; while low unemployment is positive, rapid wage growth can fuel further inflation. The Phillips Curve, which illustrates the inverse relationship between inflation and unemployment, becomes highly relevant here. Aggressive interest rate hikes, aimed at curbing inflation, risk increasing unemployment.

- Wage growth and its contribution to inflation: Strong wage growth increases disposable income, leading to higher consumer spending and potentially fueling inflation.

- The labor market's tightness and its effect on wage pressures: A tight labor market, where there are more job openings than available workers, puts upward pressure on wages.

- Potential for a recessionary impact from interest rate increases: Raising interest rates too aggressively could stifle economic growth and lead to a recession, increasing unemployment. Keywords: unemployment, job growth, labor market, Phillips Curve, recession.

Economic Growth and the GDP Outlook

The current state of economic growth, as measured by GDP, significantly influences the Fed's approach. While recent GDP figures have shown mixed results, the projected growth rate is a critical consideration. Sustained economic growth is essential for maintaining low unemployment and avoiding a recession. However, rapid economic expansion can exacerbate inflationary pressures. The Fed aims for a "soft landing"—slowing economic growth enough to curb inflation without triggering a recession.

- Impact of interest rate changes on business investment: Higher interest rates increase borrowing costs for businesses, potentially leading to reduced investment and slower economic growth.

- Consumer confidence and its role in economic growth: Consumer confidence significantly impacts spending, which directly affects economic growth.

- The potential for a "soft landing" or recession: The Fed's goal is a soft landing, but the risk of a recession remains a significant concern. Keywords: GDP growth, economic growth, business investment, consumer confidence, soft landing, recession.

Geopolitical Factors and Global Economic Uncertainty

Geopolitical events introduce a layer of complexity to the Fed's decision-making. The ongoing war in Ukraine, supply chain disruptions, and global energy price volatility all impact the US economy. These external factors significantly influence the Fed's risk assessment and complicate predictions.

- Energy prices and their volatility: Fluctuations in global energy prices directly impact inflation and the overall economic outlook.

- Global supply chain disruptions and their inflationary impact: Disruptions to global supply chains contribute to shortages and higher prices, exacerbating inflationary pressures.

- The interconnectedness of global economies: The US economy is deeply intertwined with the global economy, making it vulnerable to international economic shocks. Keywords: geopolitical risks, global economy, supply chain, energy prices, global uncertainty.

Conclusion: The Future of the Fed's Rate Decisions

The decision of whether the Fed will hold rates or adjust them further is multifaceted and incredibly complex. Inflationary pressures, the state of the labor market, the GDP outlook, and unpredictable geopolitical events all play crucial roles. While the recent data shows some signs of cooling inflation, the path forward remains uncertain. A reasoned perspective suggests that the Fed will carefully consider all factors before making its next move, potentially opting for a cautious approach to avoid triggering a recession.

To better understand the impact of the Fed's decisions on your personal finances, stay informed about the ongoing economic situation and follow the Fed's announcements closely. Continue following our analysis on "Will the Fed Hold Rates?" for up-to-date insights and expert opinions. Understanding the Federal Reserve's interest rate decisions and their implications for monetary policy and the broader economic outlook is critical for effective financial planning.

Featured Posts

-

Is Palantir Stock A Buy Before May 5th Unanimous Wall Street Opinion

May 09, 2025

Is Palantir Stock A Buy Before May 5th Unanimous Wall Street Opinion

May 09, 2025 -

Indian Stock Market Rally Sensex And Niftys Sharp Increase Explained

May 09, 2025

Indian Stock Market Rally Sensex And Niftys Sharp Increase Explained

May 09, 2025 -

Elon Musk Net Worth Below 300 Billion After Tesla Stock Slump And Tariff Challenges

May 09, 2025

Elon Musk Net Worth Below 300 Billion After Tesla Stock Slump And Tariff Challenges

May 09, 2025 -

Mans High Babysitting Costs Result In Even Higher Daycare Expenses

May 09, 2025

Mans High Babysitting Costs Result In Even Higher Daycare Expenses

May 09, 2025 -

Tracking The Billions Musk Bezos And Zuckerbergs Net Worth Changes Post Trump Inauguration

May 09, 2025

Tracking The Billions Musk Bezos And Zuckerbergs Net Worth Changes Post Trump Inauguration

May 09, 2025