Will Trump's Economic Policies Send Bitcoin To $100,000? A Price Prediction Analysis

Table of Contents

Trump's Economic Policies and their Impact on the Global Economy

During his presidency, Donald Trump implemented several significant economic policies. Key among these were substantial tax cuts aimed at stimulating economic growth and a focus on deregulation across various sectors. These policies, while intended to boost the US economy, had complex and far-reaching ripple effects that could impact Bitcoin's price.

H3: Impact on Inflation:

Trump's economic policies, particularly the tax cuts, led to an increase in government spending and a potentially larger money supply. This can fuel inflation, eroding the purchasing power of fiat currencies like the US dollar. Bitcoin, often touted as a hedge against inflation, could see increased demand as investors seek to protect their wealth from devaluation.

- Increased money supply: A larger money supply dilutes the value of each unit of currency, leading to inflation.

- Potential devaluation of the dollar: Inflation weakens the dollar, making alternative assets like Bitcoin more attractive.

- Bitcoin's role as a store of value: Many investors view Bitcoin as a store of value, similar to gold, providing a hedge against inflationary pressures.

H3: Impact on the US Dollar:

The strength of the US dollar is inversely correlated with Bitcoin's price. A weaker dollar generally boosts Bitcoin's price, as investors seek alternative assets. Trump's policies, depending on their impact on the US economy and global trade, could influence the dollar's strength and thus affect Bitcoin indirectly.

- Inverse relationship between USD and Bitcoin: A weakening dollar often leads to increased Bitcoin demand.

- Potential for Bitcoin adoption as a global currency: A decline in the USD's dominance could accelerate Bitcoin's adoption as an alternative global currency.

- Flight to safety during economic uncertainty: Economic uncertainty caused by policy changes can drive investors to seek safer havens, including Bitcoin.

H3: Impact on Global Trade and Uncertainty:

Trump's trade policies, including tariffs and trade disputes, created significant uncertainty in the global economy. This uncertainty can drive investors towards safer assets like Bitcoin, increasing its demand.

- Risk-off sentiment driving investors to safe havens like Bitcoin: In times of economic instability, investors often move to assets perceived as less risky.

- Increased volatility in the market: Trade wars and policy uncertainty contribute to overall market volatility, potentially impacting Bitcoin's price significantly.

- Potential for capital flight into cryptocurrencies: Uncertainty can lead to capital flight from traditional markets into cryptocurrencies like Bitcoin.

Bitcoin's Intrinsic Value and Market Sentiment

While Trump's policies are a factor, Bitcoin's price is also driven by intrinsic factors and market sentiment independent of any single political figure.

H3: Adoption and Technological Advancements:

The growing adoption of Bitcoin by businesses and institutions, along with continuous technological advancements, significantly influences its price.

- Lightning Network: Faster and cheaper transactions improve Bitcoin's usability and appeal.

- Institutional investment: Large-scale investments from institutional players validate Bitcoin's value proposition.

- DeFi growth: The growth of decentralized finance (DeFi) applications built on blockchain technology increases Bitcoin's utility.

- Growing acceptance by businesses: Wider merchant acceptance fuels adoption and demand.

H3: Market Sentiment and Speculation:

News cycles, social media trends, and investor sentiment heavily influence Bitcoin's price. Speculation and the "fear of missing out" (FOMO) can drive dramatic price swings.

- FOMO (fear of missing out): Rapid price increases can fuel speculative buying, pushing prices further up.

- Media hype: Positive media coverage can inflate demand and price.

- Influencer impact: Opinions from prominent figures in the crypto space can significantly sway market sentiment.

- Regulatory uncertainty: Unclear regulatory frameworks can create uncertainty and volatility.

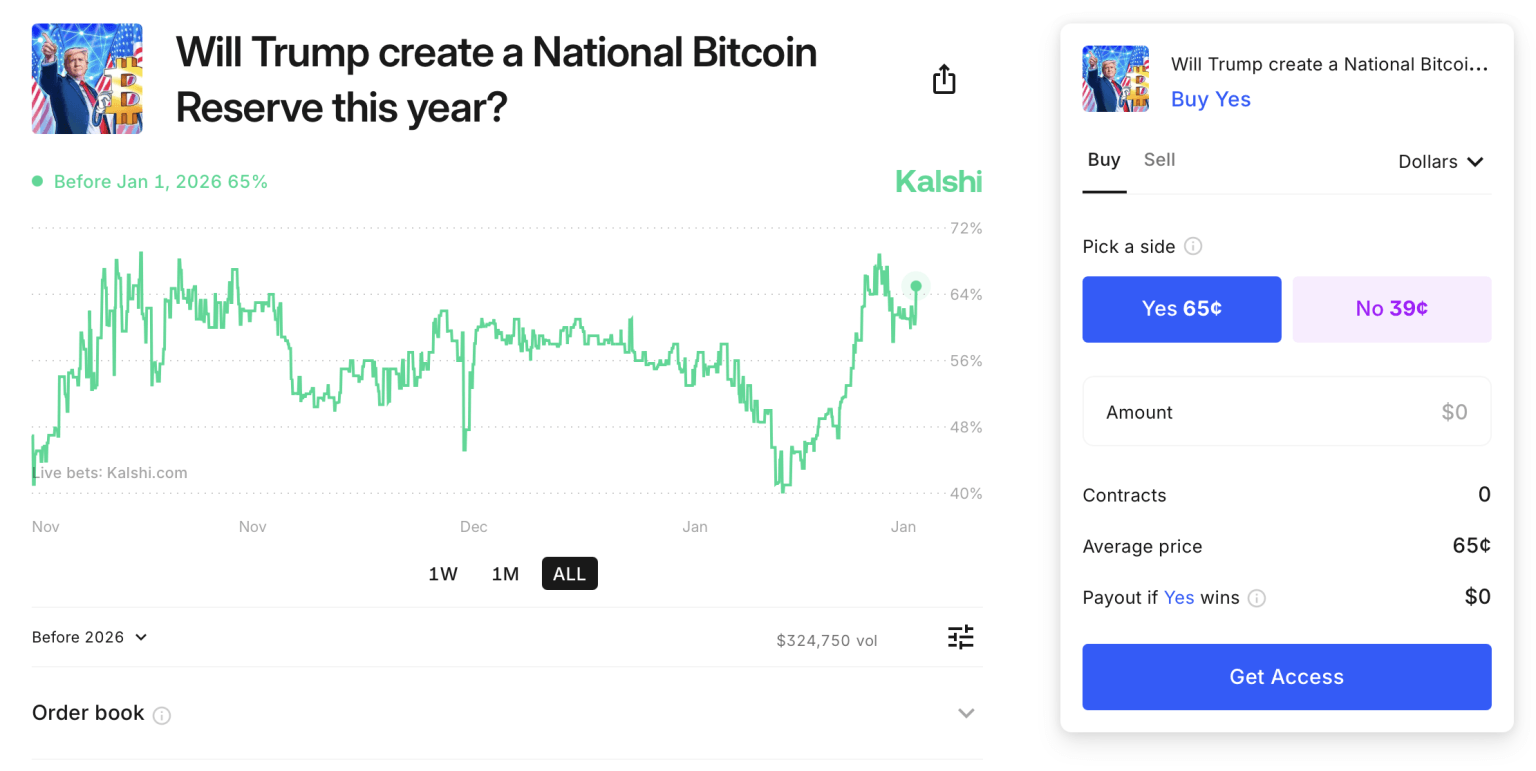

Analyzing the Correlation Between Trump's Policies and Bitcoin Price

Establishing a direct correlation between specific Trump policies and Bitcoin's price movements is challenging due to the multitude of factors influencing the cryptocurrency market. While some periods might show a loose correlation, a definitive causal relationship is difficult to prove without sophisticated econometric modeling. (Note: Ideally, this section would include charts and graphs illustrating any potential correlation observed during Trump's presidency. A statistical analysis would further strengthen this section.) Expert opinions from financial analysts and cryptocurrency experts could also be included here to provide diverse perspectives.

Price Prediction and Conclusion

Predicting Bitcoin's price to reach $100,000 solely based on Trump's economic policies is highly speculative. While his policies could contribute to factors like inflation and US dollar weakness, potentially boosting Bitcoin's price, other market forces are equally important.

- Best-case scenario: A combination of factors – increased inflation, a weaker dollar, wider Bitcoin adoption, and positive market sentiment – could drive Bitcoin's price towards $100,000. The probability of this scenario depends on numerous unpredictable factors.

- Worst-case scenario: Negative market sentiment, tighter regulations, or economic downturns could significantly hinder Bitcoin's price growth.

- Most likely scenario: A gradual increase in Bitcoin's price, influenced by a complex interplay of Trump’s legacy policies and other market forces, is a more realistic expectation. Reaching $100,000 may take longer than anticipated, or may not happen at all.

Conclusion

This analysis explores the potential, albeit indirect and complex, influence of Trump's economic policies on Bitcoin's price. The interplay between inflation, the US dollar's strength, global trade uncertainty, and Bitcoin's intrinsic value creates a complex dynamic. While Trump's policies may contribute to certain market conditions that could favor Bitcoin price appreciation, it's crucial to understand that many other factors are at play. Predicting whether Bitcoin will reach $100,000 remains highly speculative.

While Trump's policies may play a role, thorough research is crucial before making any Bitcoin price predictions. Stay informed about the latest developments in the cryptocurrency market to make your own informed decisions about Bitcoin investment. This analysis is not financial advice.

Featured Posts

-

Jayson Tatum Colin Cowherds Persistent Criticism And The Ongoing Debate

May 08, 2025

Jayson Tatum Colin Cowherds Persistent Criticism And The Ongoing Debate

May 08, 2025 -

Unforgettable Oscars Snubs When Talent Went Unrecognized

May 08, 2025

Unforgettable Oscars Snubs When Talent Went Unrecognized

May 08, 2025 -

Darkseids Legion Attacks Dc Comics Superman July 2025 Solicits Revealed

May 08, 2025

Darkseids Legion Attacks Dc Comics Superman July 2025 Solicits Revealed

May 08, 2025 -

Xrp Price On The Rise Grayscales Etf Application Under Sec Scrutiny

May 08, 2025

Xrp Price On The Rise Grayscales Etf Application Under Sec Scrutiny

May 08, 2025 -

The Galaxy Feels Small Revisiting Yavin 4 In Star Wars

May 08, 2025

The Galaxy Feels Small Revisiting Yavin 4 In Star Wars

May 08, 2025