Will Wall Street's Recovery Undermine The DAX's Recent Success?

Table of Contents

The DAX's Recent Performance and Contributing Factors

The DAX, Germany's leading stock market index, has shown significant strength recently. Several key factors have contributed to this positive performance.

Strong German Economic Fundamentals

Germany's robust economic fundamentals have played a crucial role in the DAX's success.

- GDP Growth: Consistent GDP growth, exceeding expectations in recent quarters, has boosted investor confidence.

- Industrial Production: Strong industrial production, particularly in key sectors like automotive manufacturing and engineering, has underpinned the DAX's rise.

- Low Unemployment: Low unemployment rates indicate a healthy labor market, further supporting economic growth and consumer spending.

- Government Policies: Supportive government policies focused on infrastructure investment and technological advancement have also created a positive environment for businesses.

Global Factors Supporting DAX Growth

Beyond Germany's domestic strength, several global factors have contributed to the DAX's upward trajectory.

- Easing Inflation: A global easing of inflationary pressures has reduced concerns about interest rate hikes, benefiting riskier assets like stocks.

- Supply Chain Recovery: The gradual recovery of global supply chains has lessened production bottlenecks and boosted corporate profits.

- Geopolitical Events: While geopolitical uncertainties remain, their impact on the DAX has been relatively muted compared to other markets, suggesting resilience within the German economy.

- Positive Investor Sentiment: Overall positive investor sentiment towards European markets has fueled investment in the DAX.

Wall Street's Recovery and its Potential Impact

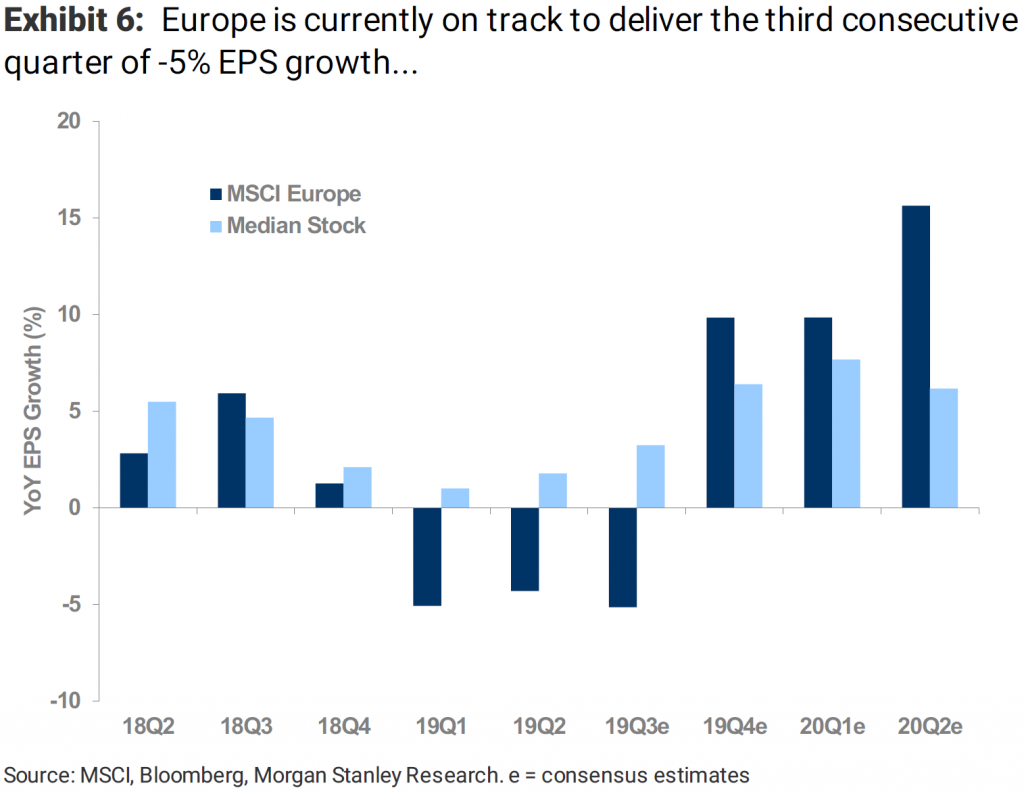

The recovery of Wall Street, fueled by strong corporate earnings and adjusted interest rates, presents a potential challenge to the DAX's continued success.

Analyzing Wall Street's Resurgence

Several factors have driven the impressive rebound on Wall Street:

- Strong Corporate Earnings: Many US companies have reported better-than-expected earnings, boosting investor confidence.

- Interest Rate Adjustments: The Federal Reserve's (Fed) adjustments to interest rates, while still impacting the economy, have created a more predictable environment for investors.

- Increased Investor Confidence: Growing investor confidence in the US economy has led to increased capital flows into US markets.

- Index Performance: The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite have all shown significant gains, reflecting the broader US market recovery.

The Transatlantic Connection and its Influence on the DAX

The performance of the DAX is not isolated from developments on Wall Street.

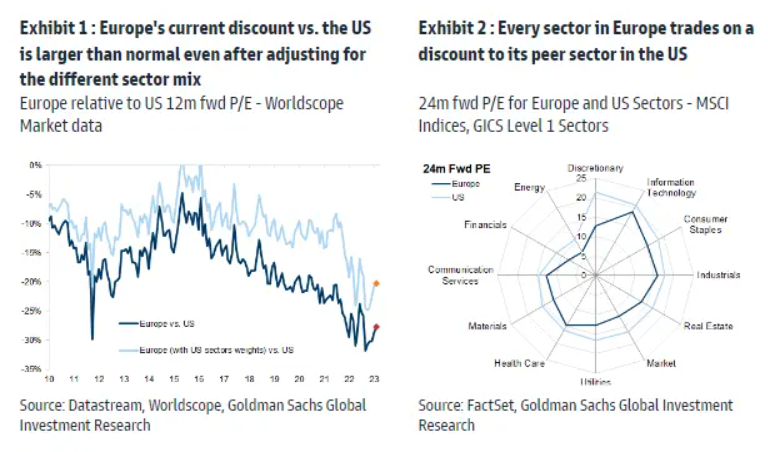

- Correlation: A strong correlation exists between the DAX and US markets, indicating that movements in one often influence the other.

- Capital Flight: A significant Wall Street recovery could potentially lead to capital flight from European markets, including Germany, as investors seek higher returns in the US.

- Currency Fluctuations: Fluctuations in the Euro/Dollar exchange rate can significantly impact the DAX's performance, as a stronger dollar could make German exports less competitive.

Sector-Specific Analysis

Comparing similar sectors in both markets reveals potential areas of both competition and cooperation.

- Automotive: The automotive sector, a key component of both the DAX and US markets, faces similar global challenges and opportunities.

- Technology: The tech sector in both regions is highly competitive, with both German and US companies vying for market share.

Alternative Scenarios and Future Outlook

Several potential scenarios could unfold regarding the interplay between Wall Street's recovery and the DAX's performance.

Scenario 1: Wall Street's recovery overshadows DAX gains.

In this scenario, a strong Wall Street recovery could draw significant investment away from the DAX, potentially leading to a slowdown or even decline in the German index.

Scenario 2: DAX maintains its strength despite Wall Street's recovery.

The DAX could retain its strength due to continued robust German economic fundamentals and factors independent of US market performance.

Scenario 3: A synergistic relationship emerges between the two markets.

Both markets could experience growth, with positive developments in one supporting the other through global trade and investment flows.

Experts predict continued volatility in both markets, with the outcome dependent on several factors including geopolitical stability, inflation rates, and investor sentiment.

Conclusion: Will Wall Street's Recovery Undermine the DAX's Success? A Look Ahead

The impact of Wall Street's recovery on the DAX remains uncertain. While a strong US market could potentially draw investment away from Germany, the DAX's underlying strength and resilience suggest it may weather the storm. Understanding the interplay between Wall Street and the DAX is crucial for investors. Stay tuned for further analysis and continue to monitor the situation closely to make informed decisions about your investments in the DAX and related markets. The relationship between these two major global indices warrants continuous observation and careful consideration for long-term investment strategies.

Featured Posts

-

L Impatto Dei Dazi Di Trump Del 20 Sull Unione Europea Il Caso Del Settore Moda

May 25, 2025

L Impatto Dei Dazi Di Trump Del 20 Sull Unione Europea Il Caso Del Settore Moda

May 25, 2025 -

Porsche Macan Rafbill Skodum Nanar Eiginleika Og Taekni

May 25, 2025

Porsche Macan Rafbill Skodum Nanar Eiginleika Og Taekni

May 25, 2025 -

Konchita Vurst Yiyi Peredbachennya Peremozhtsiv Yevrobachennya 2025

May 25, 2025

Konchita Vurst Yiyi Peredbachennya Peremozhtsiv Yevrobachennya 2025

May 25, 2025 -

Matt Maltese On Intimacy And Growth In His Forthcoming Album Her In Deep

May 25, 2025

Matt Maltese On Intimacy And Growth In His Forthcoming Album Her In Deep

May 25, 2025 -

Kapitaalmarkt Rentestijging En De Sterke Euro

May 25, 2025

Kapitaalmarkt Rentestijging En De Sterke Euro

May 25, 2025

Latest Posts

-

Bangladesh In Europe Renewed Focus On Collaboration And Growth

May 25, 2025

Bangladesh In Europe Renewed Focus On Collaboration And Growth

May 25, 2025 -

Inzicht In De Recente Marktdraai Europese Aandelen

May 25, 2025

Inzicht In De Recente Marktdraai Europese Aandelen

May 25, 2025 -

Wat Betekent De Snelle Marktdraai Voor Europese Aandelen

May 25, 2025

Wat Betekent De Snelle Marktdraai Voor Europese Aandelen

May 25, 2025 -

De Snelle Marktdraai Europese Aandelen In Focus

May 25, 2025

De Snelle Marktdraai Europese Aandelen In Focus

May 25, 2025 -

Boosting Local Economies And Global Connections The Ae Xplore Campaign Launches

May 25, 2025

Boosting Local Economies And Global Connections The Ae Xplore Campaign Launches

May 25, 2025