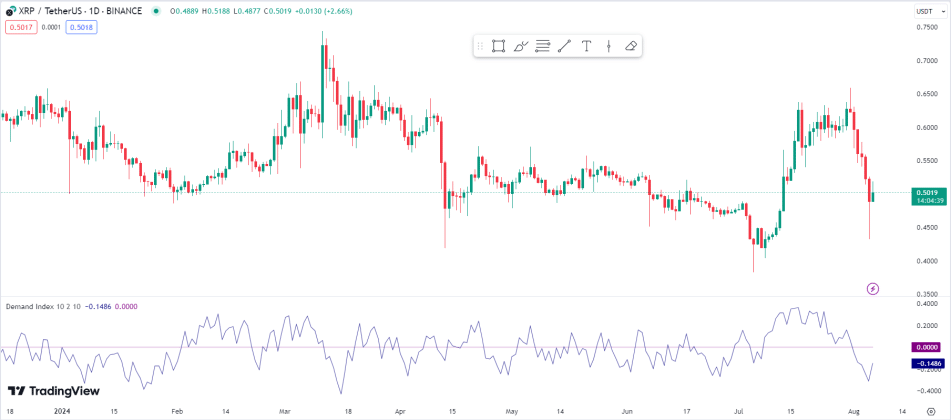

Will XRP ETFs Disappoint? Assessing Supply And Institutional Demand

Table of Contents

XRP Supply Dynamics and ETF Impact

The circulating supply of XRP and its distribution are critical factors determining the potential success of XRP ETFs. Understanding these dynamics is key to predicting price movements and the overall market impact of these new investment vehicles.

Current XRP Circulation and Distribution

The current circulating supply of XRP is approximately 50 billion tokens. However, a significant portion is held by Ripple Labs, the company behind XRP. This centralized holding presents both opportunities and challenges for XRP ETF investors.

- Implications of Ripple's Holdings on Market Liquidity: Ripple's holdings could act as a buffer against extreme price volatility, but also present a potential source of selling pressure if the company decides to liquidate a portion of its XRP.

- Potential for XRP Price Volatility Based on Supply Fluctuations: The release of XRP from escrow by Ripple, a process designed to manage the token's supply, has historically influenced price volatility. Understanding these unlocking schedules is crucial.

- Historical Price Behavior in Relation to Circulating Supply: Analyzing past XRP price movements in relation to changes in its circulating supply helps to forecast future price reactions to increased demand from ETFs.

Unlocking Schedules and Market Pressure

Ripple's scheduled XRP unlocks have been a source of both opportunity and concern for investors. These unlocks add to the circulating supply, potentially impacting the price.

- Potential Selling Pressure from Unlocks: Large unlocks can create selling pressure, leading to price drops if the market isn't prepared to absorb the increased supply.

- Strategies That Ripple Might Employ to Mitigate This Pressure: Ripple may implement strategies to manage the impact of unlocks, such as gradual releases or strategic partnerships.

- Historical Impact of Previous Unlocks: Studying the market's response to previous XRP unlocks offers valuable insights into how future unlocks might affect price.

ETF Demand and its Influence on Supply

The emergence of XRP ETFs will likely increase demand for XRP, potentially leading to interesting market dynamics.

- Potential for a Supply Squeeze: Increased ETF demand could outstrip the available supply, driving up the price of XRP.

- Impact on Trading Volume and Liquidity: XRP ETFs are likely to increase trading volume and liquidity in the XRP market.

- Potential for Premium Pricing in ETFs Compared to the Spot Market: Depending on demand and supply, XRP ETFs may trade at a premium compared to the spot price of XRP on exchanges.

Institutional Interest and Adoption of XRP

Institutional interest is another vital factor determining the success of XRP ETFs. The involvement of large investors and their investment strategies can significantly influence XRP's price and market stability.

Current Institutional Holdings of XRP

While precise figures are difficult to obtain, several institutions are known to hold or trade XRP.

- Examples of Institutions Currently Holding or Trading XRP: While not publicly disclosed by all, several large investment firms and hedge funds are speculated to have positions in XRP.

- Factors Driving Institutional Investment in Crypto Assets Generally and XRP Specifically: Institutional investors are increasingly drawn to crypto assets due to their potential for high returns and diversification benefits. XRP's focus on cross-border payments is another attractive feature.

- Potential for Increased Institutional Adoption: The launch of XRP ETFs may accelerate institutional adoption of XRP, increasing demand and price stability.

Regulatory Landscape and its Influence

Regulatory uncertainty surrounding XRP and cryptocurrencies in general significantly impacts institutional adoption.

- Impact of Ongoing Legal Battles Involving Ripple: The ongoing legal case against Ripple has created uncertainty, affecting institutional investor confidence.

- Potential Regulatory Changes and Their Effect on Institutional Investors: Favorable regulatory changes could significantly boost institutional investment in XRP.

- Attractiveness of XRP ETFs Within the Current Regulatory Framework: The regulatory landscape will be a determining factor in how attractive XRP ETFs become to institutional players.

ETF Accessibility and Institutional Participation

The accessibility of XRP ETFs to institutional investors will heavily influence their participation.

- Potential Barriers to Entry: High minimum investment requirements, complex regulatory compliance, and counterparty risks might limit participation.

- Potential Benefits for Institutions (Diversification, Exposure to the Crypto Market): ETFs offer institutions a more regulated and accessible way to gain exposure to the crypto market.

- Comparison of XRP ETFs to Other Crypto ETF Options: The comparative attractiveness of XRP ETFs against other crypto ETFs will influence investor choices.

Predicting Future XRP ETF Performance

Forecasting the future performance of XRP ETFs requires careful consideration of several interrelated factors.

Supply and Demand Equilibrium

The interplay between XRP supply and demand will ultimately dictate ETF pricing and performance.

- Formulate Predictions Based on Various Supply and Demand Scenarios: Various scenarios, ranging from high demand to moderate demand, need to be considered.

- Consider the Role of Market Sentiment and Speculation: Market sentiment and speculation will significantly influence XRP's price.

- Assess the Potential for Sustained Growth or Correction: The possibility of both sustained growth and price corrections should be considered.

Risk Assessment and Potential Downsides

Investing in XRP ETFs involves considerable risk. It's crucial to understand the potential downsides before investing.

- Identify Potential Price Volatility Risks: XRP's price can be volatile, posing significant risk to ETF investors.

- Analyze the Regulatory Risks: Regulatory uncertainty remains a major risk factor.

- Discuss the Risks Associated with Concentration in a Single Asset: Investing in a single asset, even within an ETF, carries concentration risk.

Conclusion

The success of XRP ETFs hinges on a delicate balance between XRP supply dynamics and the level of institutional demand. While the potential for increased liquidity and accessibility exists, significant uncertainties remain regarding regulatory hurdles and Ripple's future strategies. Careful consideration of the supply and demand factors discussed in this article is crucial for anyone contemplating investment in XRP ETFs. Before investing, thoroughly research the risks and rewards associated with XRP and the wider cryptocurrency market. Continue to monitor the impact of XRP ETFs on supply and institutional demand to make informed decisions regarding your investment in XRP ETFs.

Featured Posts

-

The Long Walk First Trailers Simple Scariness

May 08, 2025

The Long Walk First Trailers Simple Scariness

May 08, 2025 -

Is This Xrps Big Moment Etf Approvals Sec Developments And Ripples Future

May 08, 2025

Is This Xrps Big Moment Etf Approvals Sec Developments And Ripples Future

May 08, 2025 -

Ethereum Price Remains Firm Analyzing The Potential For Growth

May 08, 2025

Ethereum Price Remains Firm Analyzing The Potential For Growth

May 08, 2025 -

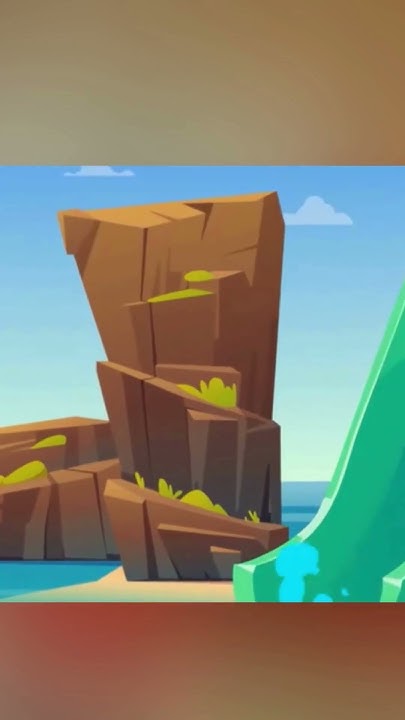

Sony Ps 5 Pro Teardown Liquid Metal Cooling System Revealed

May 08, 2025

Sony Ps 5 Pro Teardown Liquid Metal Cooling System Revealed

May 08, 2025 -

Psg Derrota Al Lyon En Su Propio Estadio

May 08, 2025

Psg Derrota Al Lyon En Su Propio Estadio

May 08, 2025