XAUUSD Gold Price Recovery: US Economic Data And Rate Cut Speculation

Table of Contents

Weakening US Economic Data and its Impact on XAUUSD

The US dollar and gold prices share an inverse relationship. A stronger dollar typically puts downward pressure on gold prices, as it becomes more expensive for holders of other currencies to purchase gold. Conversely, a weakening dollar tends to boost the XAUUSD. Several key economic indicators are closely watched for their impact on the dollar's strength and, consequently, the gold price.

Recent trends reveal a mixed economic picture in the US. Let's look at some key indicators:

-

Inflation: Lower-than-expected inflation figures, as measured by the Consumer Price Index (CPI) and Producer Price Index (PPI), can signal a less aggressive approach by the Fed regarding interest rate hikes, potentially weakening the dollar and supporting the XAUUSD.

-

GDP Growth: Slower-than-anticipated GDP growth indicates a weakening economy, reducing investor confidence and potentially leading to a flight to safety, boosting gold demand and the XAUUSD.

-

Unemployment Figures: High unemployment figures are often a sign of economic weakness. This can lead to a decrease in the dollar's value and a rise in the XAUUSD.

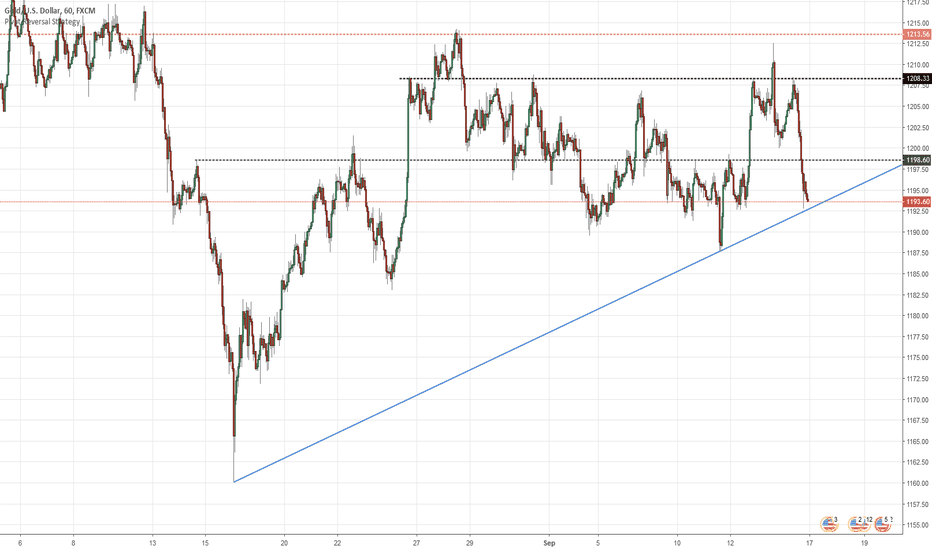

[Insert relevant chart/graph here showing the correlation between economic data (e.g., CPI, GDP growth, unemployment rate) and XAUUSD performance over a specific period.]

Rate Cut Speculation and its Influence on XAUUSD Gold Prices

Interest rate cuts by the Federal Reserve significantly impact gold prices. Lower interest rates generally reduce the attractiveness of dollar-denominated assets, including bonds, making gold a relatively more appealing investment. This increased demand pushes the XAUUSD higher.

Market expectations regarding future Fed rate cuts are keenly observed by gold investors. Different scenarios could play out:

-

Aggressive Rate Cuts: A series of significant rate cuts could lead to a substantial increase in gold prices, reflecting a weakening dollar and increased investor demand for safe-haven assets.

-

Gradual Rate Cuts: More moderate and gradual rate cuts would likely result in a more tempered rise in the XAUUSD.

-

No Rate Cuts: If the Fed decides against cutting rates, the XAUUSD might stagnate or even decline, depending on other market factors.

[Include expert opinions or forecasts here, citing reputable sources, regarding the likelihood of future Fed rate cuts.]

Safe-Haven Demand and Geopolitical Factors Driving XAUUSD

Gold is a well-established safe-haven asset. During times of economic or geopolitical uncertainty, investors often flock to gold as a store of value, driving up its price. Current geopolitical events play a significant role:

-

Increased Global Uncertainty: Escalating geopolitical tensions, such as wars or trade disputes, often heighten investor anxiety, leading to increased demand for gold as a hedge against risk.

-

Escalating Geopolitical Tensions: Major geopolitical events can trigger a significant surge in XAUUSD, as investors seek safety in gold.

-

Safe-Haven Demand Offset: Strong safe-haven demand can sometimes offset the negative effects of weak economic data on the XAUUSD.

Conclusion: Navigating the XAUUSD Gold Price Recovery

The potential for XAUUSD gold price recovery hinges on several interconnected factors: weakening US economic data, speculation regarding Fed rate cuts, and persistent safe-haven demand. The inverse relationship between the US dollar and gold prices remains a crucial element in understanding XAUUSD price movements.

Based on our analysis, a combination of weak economic data and expectations of rate cuts could significantly bolster the XAUUSD. However, it's crucial to remember that gold prices are influenced by numerous other factors, making precise predictions challenging.

Call to action: Stay informed about the latest US economic data releases and Federal Reserve announcements to effectively track XAUUSD gold price movements and potentially capitalize on recovery opportunities. Learn more about effective XAUUSD gold price trading strategies and robust risk management techniques to navigate this dynamic market successfully.

Featured Posts

-

Reddit Experiencing Widespread Outage Psa And Service Status

May 17, 2025

Reddit Experiencing Widespread Outage Psa And Service Status

May 17, 2025 -

New Uber Pet Service Launches In Delhi And Mumbai

May 17, 2025

New Uber Pet Service Launches In Delhi And Mumbai

May 17, 2025 -

Fortnite Item Shop Gets Easier A Helpful New Feature Explained

May 17, 2025

Fortnite Item Shop Gets Easier A Helpful New Feature Explained

May 17, 2025 -

Bridges Urges Thibodeau To Manage Knicks Starters Playing Time

May 17, 2025

Bridges Urges Thibodeau To Manage Knicks Starters Playing Time

May 17, 2025 -

Seattle Mariners Quiet Winter Draws Criticism From Former Player

May 17, 2025

Seattle Mariners Quiet Winter Draws Criticism From Former Player

May 17, 2025