XRP ETF Approval: Analyzing The Potential For $800 Million In Week 1

Table of Contents

H2: Factors Contributing to the Projected $800 Million Trading Volume

The projected $800 million in week one trading volume for an XRP ETF isn't just speculation; it's a confluence of several powerful factors.

H3: Institutional Investor Interest

Institutional investors, including hedge funds, asset management firms, and pension funds, are increasingly allocating capital to digital assets. An XRP ETF provides a crucial bridge, offering regulated and accessible entry into the XRP market. This regulated environment mitigates many of the risks associated with direct cryptocurrency investments, making it significantly more appealing to institutions bound by stringent compliance rules.

- Reduced Regulatory Uncertainty: The ETF structure provides a level of regulatory clarity that is currently lacking in many direct cryptocurrency investments.

- Portfolio Diversification: XRP, with its unique characteristics as a payment solution, offers diversification benefits within a broader digital asset portfolio.

- Potential for High Returns: The anticipated growth of the cryptocurrency market, coupled with XRP's established network, attracts institutional investors seeking significant returns.

- Ease of Trading: ETFs provide a familiar and easily accessible trading mechanism, integrated into existing brokerage accounts. This simplicity significantly lowers the barrier to entry for institutional investors. Keywords: Institutional investors, institutional adoption, regulated investment, asset management, XRP investment.

H3: Retail Investor Demand

Beyond institutional interest, retail investor demand plays a vital role. The simplicity of accessing XRP through an ETF is a major draw for individual investors who may be intimidated by the complexities of direct cryptocurrency exchanges.

- Accessibility: ETFs are readily available through standard brokerage platforms, eliminating the need for specialized cryptocurrency wallets or exchanges.

- Simplicity: Investing in an XRP ETF is as straightforward as investing in any other ETF, making it attractive to less experienced investors.

- FOMO (Fear of Missing Out): The anticipated growth and the potential for significant price appreciation can drive retail investor participation, fueling demand.

- Increased Market Awareness: The approval of an XRP ETF will significantly raise awareness of XRP amongst a wider audience, further stimulating retail demand. Keywords: Retail investors, individual investors, accessibility, ease of investment, XRP price, cryptocurrency investment.

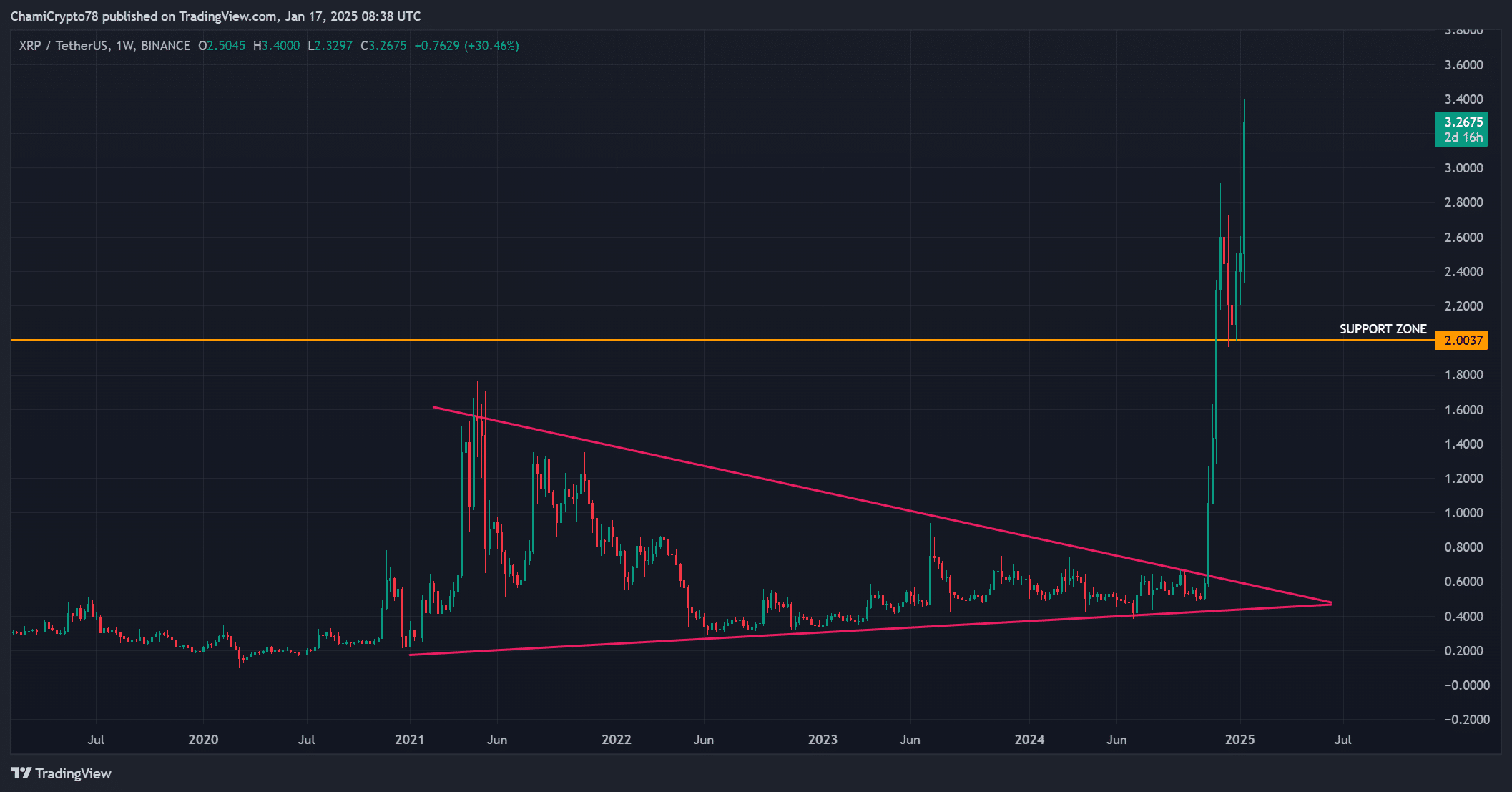

H3: Market Sentiment and Ripple's Legal Victory

Ripple’s partial legal victory against the SEC significantly shifted market sentiment. This positive development reduced uncertainty surrounding XRP's regulatory status and boosted investor confidence.

- Reduced Regulatory Risk: The court's ruling lessened the fear of future SEC actions against XRP, making it a more attractive investment.

- Increased Investor Confidence: The positive outcome injected confidence into the XRP market, prompting a surge in trading activity.

- Positive Media Coverage: The legal victory generated significant positive media attention, further contributing to the improved market sentiment.

- Price Appreciation: The positive news flow is anticipated to trigger a price increase for XRP, attracting further investment. Keywords: Ripple lawsuit, SEC lawsuit, market sentiment, investor confidence, price prediction, XRP price.

H2: Potential Implications of $800 Million Week 1 Trading Volume

Such a significant influx of capital into the XRP market would have profound implications.

H3: Price Volatility

A massive $800 million trading volume in the first week will almost certainly lead to significant price volatility. Speculation, market manipulation, and the inherent volatility of the cryptocurrency market will all play a role.

- Sharp Price Swings: Expect considerable price fluctuations, both upwards and downwards, in response to market forces.

- Increased Risk: Investors need to be aware of the elevated risk associated with this volatility and implement appropriate risk management strategies.

- Market Sentiment Shifts: Rapid price changes will be heavily influenced by news and overall market sentiment.

- Importance of Diversification: Investors should diversify their portfolios to mitigate the risks associated with XRP price fluctuations. Keywords: Price volatility, market fluctuation, risk management, price prediction, XRP price, cryptocurrency volatility.

H3: Increased Market Liquidity

The high trading volume will dramatically increase market liquidity for XRP. This means buyers and sellers will find it easier to execute trades quickly and efficiently, at fair prices.

- Improved Price Discovery: Greater liquidity leads to more accurate price discovery, reflecting the true market value of XRP.

- Reduced Slippage: Investors will experience less slippage (the difference between the expected price and the actual execution price) due to increased liquidity.

- Easier Trading: Trading will become smoother and more efficient for both institutional and retail investors.

- Attracting More Investors: Improved liquidity further enhances the attractiveness of XRP for both current and future investors. Keywords: Market liquidity, trading efficiency, price discovery, XRP liquidity.

H2: Challenges and Considerations

While the potential is exciting, several challenges and considerations remain.

H3: Regulatory Uncertainty

The cryptocurrency regulatory landscape is constantly evolving. Future regulatory changes could significantly impact the XRP ETF and its trading volume.

- SEC Regulations: The SEC's ongoing scrutiny of the cryptocurrency market poses a persistent risk.

- International Regulations: Regulations vary considerably across different jurisdictions, creating potential complexities for international investors.

- Ongoing Monitoring: Staying updated on regulatory developments is crucial for investors.

- Adaptability: Investors need to be prepared for potential regulatory shifts and their impact on XRP and ETFs. Keywords: Regulatory landscape, regulatory uncertainty, SEC regulations, cryptocurrency regulation, XRP regulation.

H3: Market Manipulation Risks

High volatility makes the market susceptible to manipulation. While regulatory bodies strive to prevent manipulation, vigilance is necessary.

- Price Manipulation: Artificial price increases or decreases can significantly impact investor returns.

- Wash Trading: Be aware of the potential for wash trading (creating artificial volume) to inflate price.

- Pump and Dump Schemes: These manipulative schemes can result in substantial losses for unsuspecting investors.

- Due Diligence: Thorough research and due diligence are paramount to mitigate the risks of market manipulation. Keywords: Market manipulation, price manipulation, investor protection, cryptocurrency scams.

3. Conclusion: Investing in the Future of XRP ETFs

The potential approval of an XRP ETF presents a unique opportunity, with the projected $800 million in week one trading volume driven by institutional interest, retail demand, and the positive market sentiment following Ripple's legal victory. However, significant price volatility and ongoing regulatory uncertainty pose considerable risks. Increased market liquidity offers a positive counterpoint. Before investing in XRP ETFs, thorough research and a careful assessment of your risk tolerance are essential. Learn more about XRP ETF investments and invest wisely in the XRP ETF market. Explore the potential of XRP ETFs, but always prioritize informed decision-making.

Featured Posts

-

Toronto Housing Market Update Significant Sales Drop And Price Correction

May 08, 2025

Toronto Housing Market Update Significant Sales Drop And Price Correction

May 08, 2025 -

Tnts Hilarious Take On Jayson Tatum For Lakers Vs Celtics Abc Game

May 08, 2025

Tnts Hilarious Take On Jayson Tatum For Lakers Vs Celtics Abc Game

May 08, 2025 -

Ethereum Network Sees Significant Increase In Address Activity

May 08, 2025

Ethereum Network Sees Significant Increase In Address Activity

May 08, 2025 -

Arsenal Vs Psg A Semi Final Showdown Tougher Than Real Madrid

May 08, 2025

Arsenal Vs Psg A Semi Final Showdown Tougher Than Real Madrid

May 08, 2025 -

Bitcoin Price Prediction Trumps 100 Day Speech And The 100 000 Target

May 08, 2025

Bitcoin Price Prediction Trumps 100 Day Speech And The 100 000 Target

May 08, 2025