XRP: ETF Approvals, SEC Developments, And Ripple's Future

Table of Contents

The Potential Impact of XRP ETFs

What are XRP ETFs and Why Do They Matter?

Exchange-Traded Funds (ETFs) are investment vehicles that trade on stock exchanges, mirroring the performance of a specific asset or basket of assets. An XRP ETF would allow investors to gain exposure to XRP without directly buying and holding the cryptocurrency itself. This offers several advantages:

- Increased Accessibility: ETFs are generally easier to buy and sell than cryptocurrencies, making XRP more accessible to a wider range of investors, including those unfamiliar with cryptocurrency exchanges.

- Diversification: Investors can incorporate XRP into a diversified portfolio more easily through an ETF, mitigating risk.

- Regulatory Oversight: ETFs are subject to regulatory oversight, potentially providing a level of comfort to investors concerned about the volatility and regulatory uncertainty within the cryptocurrency market.

However, potential risks remain:

- Volatility: Even within an ETF structure, XRP's price remains subject to the volatility inherent in the cryptocurrency market.

- Expense Ratios: ETFs carry expense ratios, reducing returns.

Current Status of XRP ETF Applications and Predictions

Currently, there are no approved XRP ETFs in major markets. However, several firms are likely exploring the possibility. The likelihood of SEC approval hinges on several factors including: the SEC's overall stance on cryptocurrencies, the classification of XRP as a security or a commodity, and the ETF's proposed structure and risk management measures. Market analysts offer diverse predictions on the timeline, with some suggesting approvals could come within the next few years, while others remain more cautious, citing the ongoing regulatory uncertainty. Analyzing historical precedents for other cryptocurrency ETF applications provides some guidance, but the situation remains unique due to the ongoing Ripple lawsuit.

The Ongoing SEC vs. Ripple Lawsuit and its Implications

Understanding the Core Issues of the Lawsuit

The SEC's lawsuit against Ripple alleges that XRP is an unregistered security, violating federal securities laws. The core argument centers on the Howey Test, which defines an investment contract as an investment of money in a common enterprise with the expectation of profits solely from the efforts of others. Ripple counters that XRP is a decentralized digital asset and not a security. The outcome will significantly impact XRP's legal status and potentially set a precedent for future regulatory actions.

Ripple's Defense Strategies and Recent Developments

Ripple's defense rests on several key arguments, including the decentralization of XRP, its widespread use in payments, and the lack of direct control by Ripple over XRP's price or market. Recent court filings and developments reveal a back-and-forth between the parties, with ongoing discovery and legal arguments. The outcome of the lawsuit could influence Ripple's future operations and plans considerably, potentially leading to a settlement, a victory for Ripple, or a ruling in favor of the SEC.

The Broader Impact on the Crypto Market

The SEC vs. Ripple lawsuit has a significant ripple effect (pun intended) on the entire cryptocurrency market. The outcome will shape investor confidence, market sentiment, and future regulatory actions regarding other cryptocurrencies. A ruling against Ripple could trigger more aggressive regulatory scrutiny of other digital assets, while a victory for Ripple might foster a more favorable regulatory environment.

Ripple's Future and Long-Term Prospects for XRP

Ripple's Ongoing Development and Partnerships

Despite the legal challenges, Ripple continues to develop its technology and expand its partnerships through RippleNet, a global payments network utilizing blockchain technology. These ongoing advancements and collaborations demonstrate Ripple's commitment to innovation and growth, potentially contributing to the long-term adoption and value of XRP.

Predicting XRP's Price and Market Position

Predicting XRP's future price is inherently speculative. Several factors – including the outcome of the SEC lawsuit, potential ETF approvals, and broader market trends – will influence its price volatility. A positive resolution of the lawsuit and ETF approvals could lead to significant price increases. Conversely, an unfavorable outcome could depress the price. However, it's vital to remember that the cryptocurrency market is notoriously volatile and that investing in XRP carries significant risk.

Conclusion: The Future of XRP Remains Uncertain, But Informed Decisions Are Key

The future of XRP is intertwined with the outcome of the SEC lawsuit, the potential approval of XRP ETFs, and Ripple's continued development. Staying informed about regulatory developments and market trends is crucial for anyone considering investing in XRP. Thorough due diligence, including independent market research and risk assessment, is essential before making any investment decisions.

Continue researching XRP, stay updated on the latest news and developments regarding XRP, ETFs, and SEC actions. Engage with relevant communities and resources to make informed decisions about your investments. Remember, careful consideration and understanding of the inherent risks are key to navigating the dynamic world of XRP and other cryptocurrencies.

Featured Posts

-

Giants Defeat Angels Despite Mike Trouts Two Homeruns

May 08, 2025

Giants Defeat Angels Despite Mike Trouts Two Homeruns

May 08, 2025 -

Tuerkiye De Kripto Varliklar Icin Yeni Yasal Cerceve Spk Nin Adimlari

May 08, 2025

Tuerkiye De Kripto Varliklar Icin Yeni Yasal Cerceve Spk Nin Adimlari

May 08, 2025 -

Analyst Alert Ethereum Cross X Indicators Suggest Imminent Price Surge To 4 000

May 08, 2025

Analyst Alert Ethereum Cross X Indicators Suggest Imminent Price Surge To 4 000

May 08, 2025 -

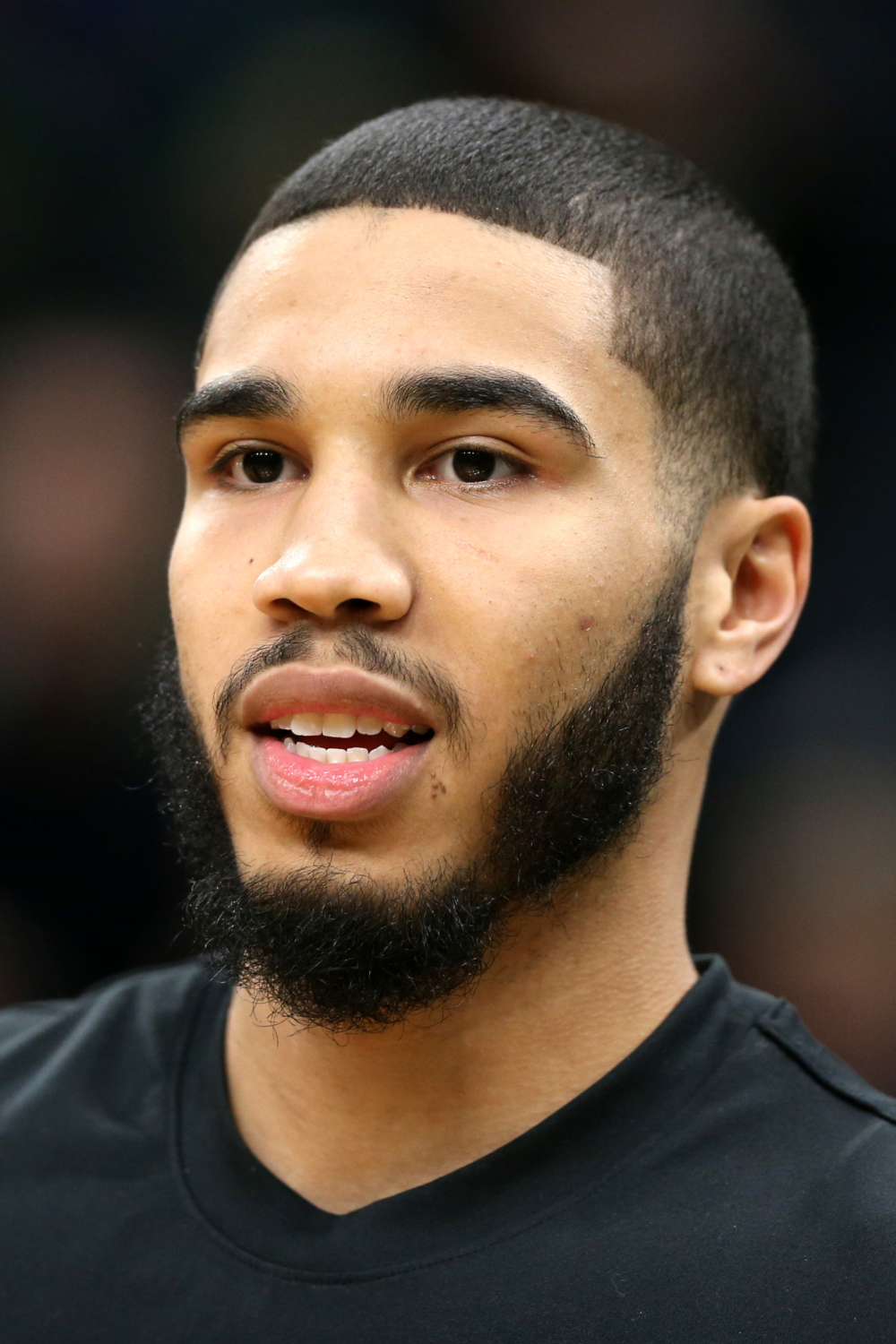

The Colin Cowherd Jayson Tatum Debate A Detailed Analysis

May 08, 2025

The Colin Cowherd Jayson Tatum Debate A Detailed Analysis

May 08, 2025 -

Revisiting Historic Double Performances In Okc Thunder History

May 08, 2025

Revisiting Historic Double Performances In Okc Thunder History

May 08, 2025