XRP ETF: High Supply And Low Institutional Interest Raise Concerns

Table of Contents

The XRP Supply Dilemma: A Barrier to ETF Approval

The massive circulating supply of XRP presents a significant challenge to the approval and success of an XRP ETF. This contrasts sharply with the demand needed to support a stable and thriving exchange-traded product. Let's explore the implications of this high supply.

High Circulating Supply vs. Limited Demand

-

Comparison to other cryptocurrencies: Compare XRP's circulating supply (currently over 50 billion) to Bitcoin (around 21 million maximum supply) and Ethereum (with a significantly smaller supply compared to XRP). This stark difference highlights a key concern; a massive supply can make price stability difficult to maintain. Successful ETFs, like those for Bitcoin, have benefitted from a comparatively more constrained supply.

-

Implications for price volatility: A large circulating supply makes XRP vulnerable to price manipulation and volatility. Even relatively small changes in buying or selling pressure can cause disproportionately large price swings, impacting investor confidence and creating risk for ETF investors. This volatility is a key concern for regulators.

-

Potential for market manipulation: The sheer volume of XRP in circulation creates a greater opportunity for market manipulation. Large holders could potentially influence the price through coordinated buying or selling, harming smaller investors and undermining the integrity of the market. This possibility is a major hurdle for regulators considering ETF approval.

SEC Scrutiny and Regulatory Concerns

The Securities and Exchange Commission (SEC) has expressed concerns about the high supply of XRP and its potential impact on investor protection within an ETF framework. These concerns are central to the approval process.

-

Past SEC statements and actions: The SEC's previous actions regarding XRP, particularly in the context of the Ripple Labs lawsuit, have highlighted its scrutiny of the cryptocurrency's regulatory status. These past actions cast a long shadow on the potential for a successful XRP ETF.

-

Regulatory hurdles related to XRP's supply: The SEC's concerns focus on the potential for market manipulation and price instability associated with XRP's vast circulating supply. Regulators need assurances that an ETF based on XRP can protect investors from these risks.

-

Importance of regulatory clarity: Regulatory clarity surrounding XRP is paramount for ETF approval. Until the SEC provides clear guidance on XRP's regulatory status, the uncertainty will deter institutional investors and hinder the prospects of an XRP ETF.

Lackluster Institutional Interest: A Sign of Market Sentiment

Another significant hurdle for an XRP ETF is the relatively low level of institutional interest in XRP compared to other crypto assets like Bitcoin and Ethereum. This lack of institutional adoption reflects broader market sentiment.

Limited Adoption by Major Players

-

Institutional holdings comparison: Data on institutional holdings reveals a significantly smaller allocation of assets towards XRP compared to Bitcoin or Ethereum. This lack of investment from major players indicates a hesitancy to embrace XRP as a viable asset.

-

Reasons for limited institutional interest: The reasons for this limited interest are multi-faceted, including ongoing regulatory uncertainty, the aftermath of the Ripple Labs lawsuit, and concerns about the high circulating supply.

-

Impact on ETF demand: Low institutional interest translates to lower demand for an XRP ETF. Without significant institutional buy-in, the potential success of an XRP ETF is diminished, making it less attractive to potential investors.

Impact of Ripple Lawsuit Aftermath

The Ripple Labs lawsuit and its aftermath have significantly impacted institutional confidence in XRP and its potential for future growth. The lingering effects pose a challenge for ETF approval.

-

Impact on XRP's regulatory compliance: The lawsuit's outcome, while partially favorable to Ripple, continues to raise questions about XRP's regulatory compliance in various jurisdictions. This uncertainty discourages institutional investment.

-

Effect on investor sentiment: The lawsuit created negative investor sentiment towards XRP, leading many institutional investors to remain on the sidelines. Rebuilding trust and confidence will require time and clear regulatory signals.

-

Impact of ongoing legal uncertainty: Even with a partial resolution, the lingering legal uncertainty surrounding XRP adds further complexities to ETF applications. This uncertainty creates risks for ETF issuers and investors.

Conclusion

The high circulating supply of XRP and the relatively low level of institutional interest present substantial challenges to the successful launch of an XRP ETF. The SEC's scrutiny and the lingering impact of the Ripple lawsuit further complicate the matter. While the potential benefits of an XRP ETF are undeniable, investors should carefully consider these concerns before investing. Further regulatory clarity and increased institutional adoption are crucial for the viability of an XRP ETF in the long term. Stay informed about developments regarding XRP ETF approvals and consider your investment strategy carefully. Conduct thorough research before making any investment decisions related to XRP ETFs and other crypto assets.

Featured Posts

-

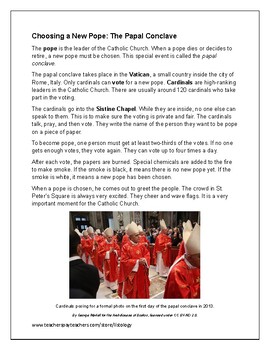

Understanding The Papal Conclave Choosing The Next Leader Of The Catholic Church

May 08, 2025

Understanding The Papal Conclave Choosing The Next Leader Of The Catholic Church

May 08, 2025 -

Antqal Jysws Lflamnghw Rd Fel Alshmrany Almuthyr Lljdl Fydyw

May 08, 2025

Antqal Jysws Lflamnghw Rd Fel Alshmrany Almuthyr Lljdl Fydyw

May 08, 2025 -

Ripple Xrp Price Prediction Will Xrp Hit 3 40

May 08, 2025

Ripple Xrp Price Prediction Will Xrp Hit 3 40

May 08, 2025 -

Dwp Warning Urgent Call Regarding Your Bank Account And 12 Benefits

May 08, 2025

Dwp Warning Urgent Call Regarding Your Bank Account And 12 Benefits

May 08, 2025 -

April 2nd 2025 Lotto And Lotto Plus Winning Numbers

May 08, 2025

April 2nd 2025 Lotto And Lotto Plus Winning Numbers

May 08, 2025