XRP Price Action: Analyzing The Impact Of The Derivatives Market

Table of Contents

The Mechanics of XRP Derivatives Trading

The XRP derivatives market offers a range of instruments for sophisticated trading strategies. Understanding these instruments is key to comprehending their influence on XRP price action. Let's explore the most prominent types:

-

Futures Contracts: These contracts obligate the buyer to purchase (or the seller to sell) a specific amount of XRP at a predetermined price on a future date. They are used extensively for hedging (protecting against price fluctuations) and speculation (betting on future price movements). XRP futures contracts allow traders to manage risk and potentially profit from anticipated price changes.

-

Options Contracts: Unlike futures, options contracts grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) XRP at a specific price (strike price) on or before a certain date (expiration date). Options provide flexibility for managing risk and generating potential profits, depending on the price movement of XRP. They offer leverage and the ability to define risk parameters.

-

Other Derivative Instruments: While futures and options are the most prevalent, other derivatives like swaps (agreements to exchange cash flows based on XRP price movements) also exist and contribute to the overall dynamics of the XRP derivatives market. These instruments, while less commonly traded by retail investors, can significantly impact XRP liquidity and volatility. Understanding their subtle influences is vital for a complete picture of XRP price action.

Keyword Optimization: XRP Futures, XRP Options, Ripple Derivatives Trading, XRP Volatility, XRP Swaps

How Derivatives Influence XRP Price Volatility

The volume of trading in XRP derivatives is directly correlated with the cryptocurrency's price volatility. Let's dissect this relationship:

-

Amplified Price Swings: Increased derivative trading volume, particularly speculative trading, can amplify XRP price swings. This is because derivative contracts leverage existing price movements, magnifying the impact of buying and selling pressure. A relatively small move in the spot market can create significantly larger price changes in the derivatives market.

-

Hedging and Dampened Volatility: Conversely, hedging activities, where market participants use derivatives to offset potential losses, can sometimes dampen volatility. If many traders are hedging against a potential XRP price drop, this can act as a stabilizing force. The net effect of hedging depends on the prevailing market sentiment and the overall volume of hedging transactions.

-

Speculative Trading and Volatility: Speculative trading in XRP derivatives can significantly boost volatility. Traders betting on price increases or decreases contribute to price swings, often exacerbating existing trends or creating new ones. This is especially pronounced during periods of uncertainty or major news events affecting XRP.

Keyword Optimization: XRP Volatility, XRP Price Swings, Derivatives and Volatility, Ripple Price Prediction, XRP Price Fluctuations

Liquidity and the XRP Derivatives Market

The XRP derivatives market plays a crucial role in shaping XRP's overall liquidity. However, this influence is double-edged:

-

Enhanced Liquidity: The availability of derivatives contracts can enhance XRP liquidity. By providing additional avenues for buying and selling XRP-related instruments, derivatives increase trading volume and facilitate faster price discovery.

-

Potential Downsides and Manipulation: While derivatives generally improve liquidity, they also present potential downsides. Flash crashes or manipulative activities can occur, particularly in less regulated markets. Large, coordinated trades in the derivatives market could exert undue influence on the spot price of XRP.

-

Regulatory Impact: Regulatory changes concerning XRP and its derivatives can profoundly impact liquidity. Stricter regulations might curb speculative trading and reduce overall volume, potentially decreasing liquidity. Conversely, clearer regulatory frameworks could attract more institutional investors, leading to increased liquidity.

Keyword Optimization: XRP Liquidity, Ripple Liquidity, Derivatives and Liquidity, XRP Market Depth, XRP Market Manipulation

Analyzing Price Action Through the Lens of Derivatives Data

Analyzing derivative market data offers valuable insights for formulating XRP trading strategies. Several key metrics are particularly relevant:

-

Open Interest and Volume: Tracking the open interest (the total number of outstanding derivative contracts) and trading volume provides clues about market sentiment and potential future price movements. High open interest with increasing volume suggests strong conviction in a particular direction.

-

Implied Volatility from Options: Options markets provide insights into implied volatility—the market's expectation of future price swings. High implied volatility suggests traders anticipate significant price fluctuations, while low implied volatility indicates a more stable outlook.

-

Market Sentiment: The pricing of derivative contracts reflects the overall market sentiment. For instance, if call options (bets on price increases) are significantly more expensive than put options (bets on price decreases), it suggests a bullish market sentiment for XRP.

Keyword Optimization: XRP Trading Strategy, Ripple Trading, Technical Analysis XRP, XRP Market Sentiment, XRP Open Interest

Conclusion

The XRP derivatives market exerts a multifaceted influence on XRP price action. Understanding the mechanics of derivative instruments, their impact on volatility and liquidity, and the art of analyzing related data is paramount for effective XRP trading and investment. By carefully monitoring derivative market activity, investors can glean valuable insights into market sentiment and potential price movements, allowing for more informed decision-making.

Call to Action: Stay informed about the ever-evolving XRP derivatives market to make more informed decisions regarding your XRP investments and trading strategies. Continue learning about XRP Price Action and the influence of the XRP Derivatives Market to optimize your portfolio. Understanding Ripple Derivatives and their impact on XRP Volatility is crucial for success in this dynamic market.

Featured Posts

-

Intense Thriller The Long Walk Trailer Released King Approves With Reservations

May 08, 2025

Intense Thriller The Long Walk Trailer Released King Approves With Reservations

May 08, 2025 -

Champions League Final Preview Hargreaves On Arsenal Vs Psg

May 08, 2025

Champions League Final Preview Hargreaves On Arsenal Vs Psg

May 08, 2025 -

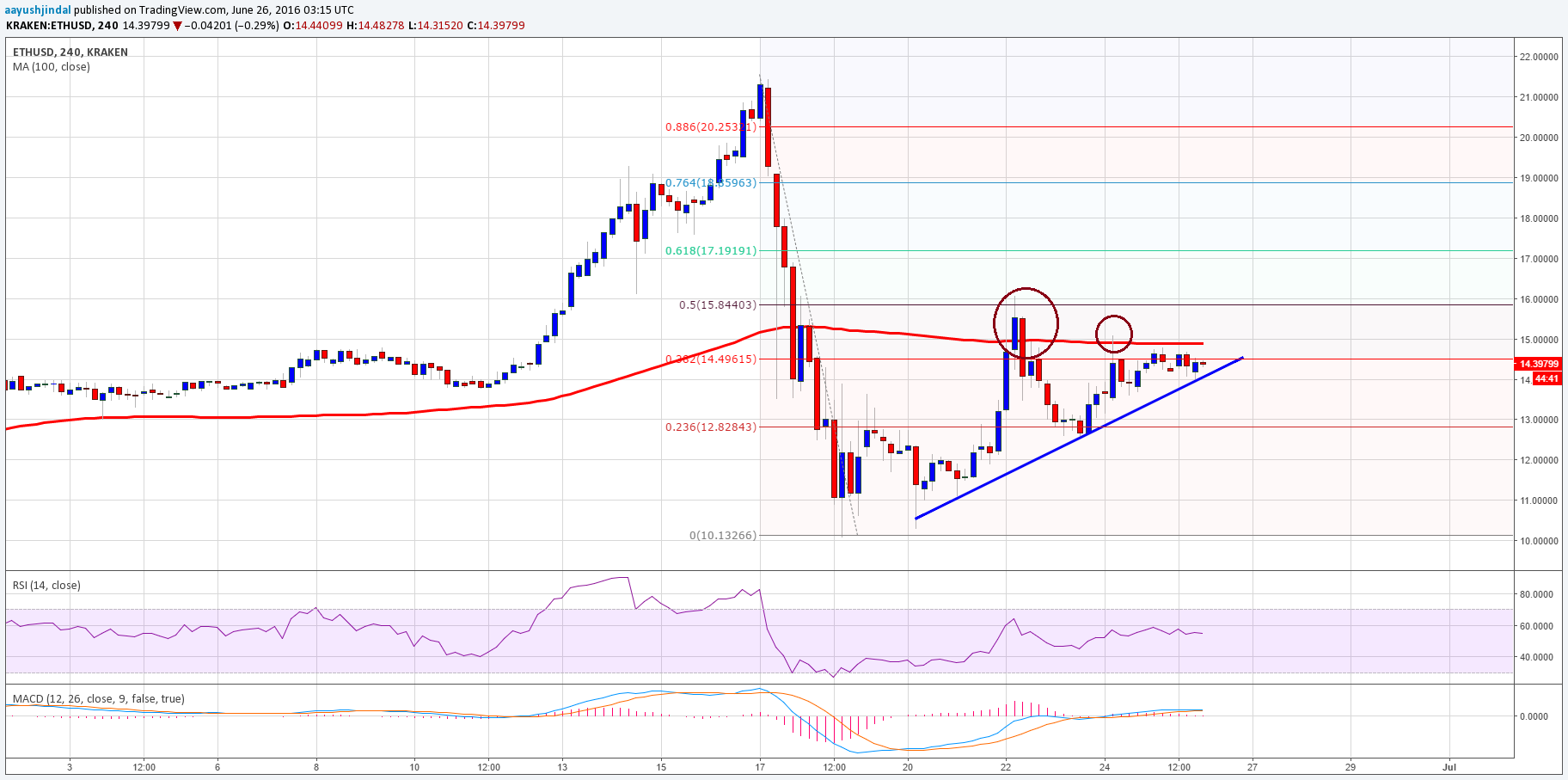

Ethereum Price Holds Above Key Support Could 1 500 Be Next

May 08, 2025

Ethereum Price Holds Above Key Support Could 1 500 Be Next

May 08, 2025 -

Okc Thunder Portland Trail Blazers Live Stream Tv Broadcast And Game Time March 7

May 08, 2025

Okc Thunder Portland Trail Blazers Live Stream Tv Broadcast And Game Time March 7

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Rise On The Horizon 3 Reasons Why

May 08, 2025

Xrp Price Prediction Is A Parabolic Rise On The Horizon 3 Reasons Why

May 08, 2025