XRP Recovery Uncertain Amidst Derivatives Market Stagnation

Table of Contents

The Ripple Lawsuit's Lingering Shadow

The ongoing SEC lawsuit against Ripple Labs casts a long shadow over XRP's price. The uncertainty surrounding the legal outcome significantly impacts investor sentiment and inhibits price movement. A definitive resolution, whether positive or negative, is crucial for unlocking XRP's potential. Until then, the lingering legal battle acts as a major deterrent.

- Uncertainty surrounding regulatory clarity: The lawsuit's outcome will set a precedent for how the SEC views other cryptocurrencies, impacting the entire market.

- Impact on institutional investment: Many institutional investors remain hesitant to allocate significant funds to XRP due to the legal risk.

- Effect on trading volume and liquidity: The uncertainty discourages trading activity, leading to lower volumes and reduced liquidity in the XRP market.

- Potential positive or negative outcomes of the lawsuit: A favorable ruling could trigger a substantial price surge, while an unfavorable outcome could lead to further price declines. The implications extend beyond XRP's immediate price, shaping the future of the broader crypto regulatory landscape.

Stagnation in the XRP Derivatives Market

The XRP derivatives market, encompassing futures and options contracts, currently displays signs of significant stagnation. Low trading volumes and open interest indicate a lack of investor confidence and limited speculative activity. This subdued activity hinders price discovery and contributes to increased volatility, making it challenging to accurately predict XRP's future price.

- Low trading volumes in futures and options contracts: The lack of substantial trading activity suggests limited interest in hedging or speculating on XRP's price movements.

- Limited participation from institutional investors: Institutional investors are generally risk-averse, and the ongoing lawsuit has further dampened their participation in the XRP derivatives market.

- Impact on price manipulation and market efficiency: Low liquidity can make the XRP market more susceptible to price manipulation, undermining its efficiency.

- Comparison with other crypto derivatives markets: Compared to more established cryptocurrencies like Bitcoin and Ethereum, the XRP derivatives market exhibits significantly lower activity, reflecting its current challenges.

Macroeconomic Factors and Crypto Market Sentiment

The broader macroeconomic environment and overall crypto market sentiment significantly influence XRP's price. Factors like inflation, interest rates, and regulatory announcements impact investor risk appetite, impacting all cryptocurrencies, including XRP. Currently, negative sentiment in the broader crypto market tends to exacerbate XRP's price struggles.

- Impact of general crypto market trends on XRP: XRP’s price often correlates with Bitcoin's price and the overall performance of the crypto market.

- Correlation between Bitcoin's price and XRP's price: When Bitcoin experiences a price surge, XRP often follows, and vice versa. This demonstrates the interconnectedness of cryptocurrencies.

- Influence of regulatory news on the entire crypto space: Negative regulatory news tends to negatively impact the entire sector, and XRP is not immune.

- Investor sentiment analysis - fear, uncertainty, and doubt (FUD) vs. optimism: Negative sentiment (FUD) frequently overshadows positive news regarding XRP's technology and potential, suppressing its price.

Technical Analysis of XRP Price Charts

Analyzing XRP price charts using technical indicators like moving averages, RSI, and support/resistance levels provides insights into potential price movements. While technical analysis is not foolproof, it offers valuable clues. Currently, certain indicators suggest a period of consolidation, highlighting the uncertainty surrounding XRP's short-term price direction. (Note: Including relevant charts here would enhance this section.)

- Key support and resistance levels: Identifying these levels can provide potential price targets and areas of potential reversal.

- Moving average convergence/divergence (MACD) analysis: MACD can signal potential trend changes and momentum shifts.

- Relative strength index (RSI) analysis: RSI can indicate whether XRP is overbought or oversold, potentially suggesting price reversals.

- Potential breakout scenarios: Identifying potential breakout points from established trading ranges can help predict future price movements.

Conclusion: Navigating the Uncertain Future of XRP

XRP's recovery remains uncertain, contingent on several interconnected factors: the resolution of the Ripple lawsuit, the revitalization of its derivatives market, prevailing macroeconomic conditions, and the overall sentiment within the cryptocurrency market. Technical analysis provides a short-term perspective, but long-term price prediction remains highly speculative. While potential for significant price growth exists if the lawsuit is resolved favorably and market sentiment improves, substantial downside risk also persists. To navigate this complexity, thorough research, consistent market monitoring, and careful risk management are essential. Stay updated on XRP, monitor the XRP market closely, and research XRP thoroughly before investing.

Featured Posts

-

Four More Human Smugglers Arrested By Fia Investigation Ongoing

May 08, 2025

Four More Human Smugglers Arrested By Fia Investigation Ongoing

May 08, 2025 -

Investigation Into Antisemitic Acts At Boeings Seattle Facility

May 08, 2025

Investigation Into Antisemitic Acts At Boeings Seattle Facility

May 08, 2025 -

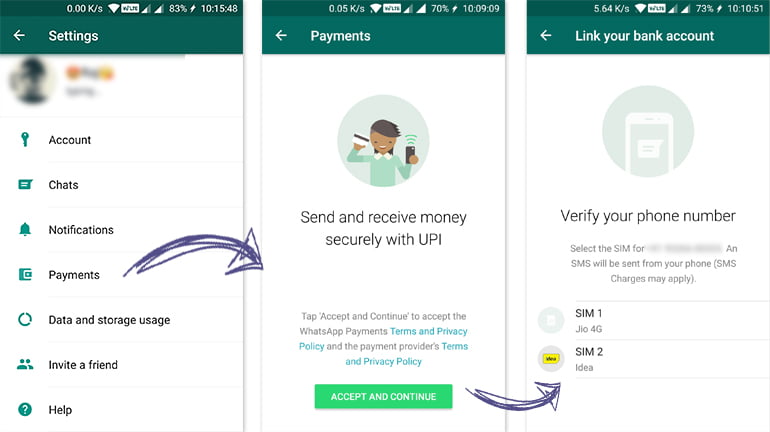

Uber Auto Payments Is Upi Still Available A Complete Guide

May 08, 2025

Uber Auto Payments Is Upi Still Available A Complete Guide

May 08, 2025 -

Is Increased Ethereum Address Activity A Bullish Signal

May 08, 2025

Is Increased Ethereum Address Activity A Bullish Signal

May 08, 2025 -

Market Volatility Alert Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025

Market Volatility Alert Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025