XRP (Ripple) Price Prediction And Its Impact On Your Investment Strategy

Table of Contents

Analyzing Current Market Trends and Factors Influencing XRP Price

Several factors interplay to influence XRP's price. Understanding these is key to forming a realistic XRP price prediction.

Technical Analysis of XRP

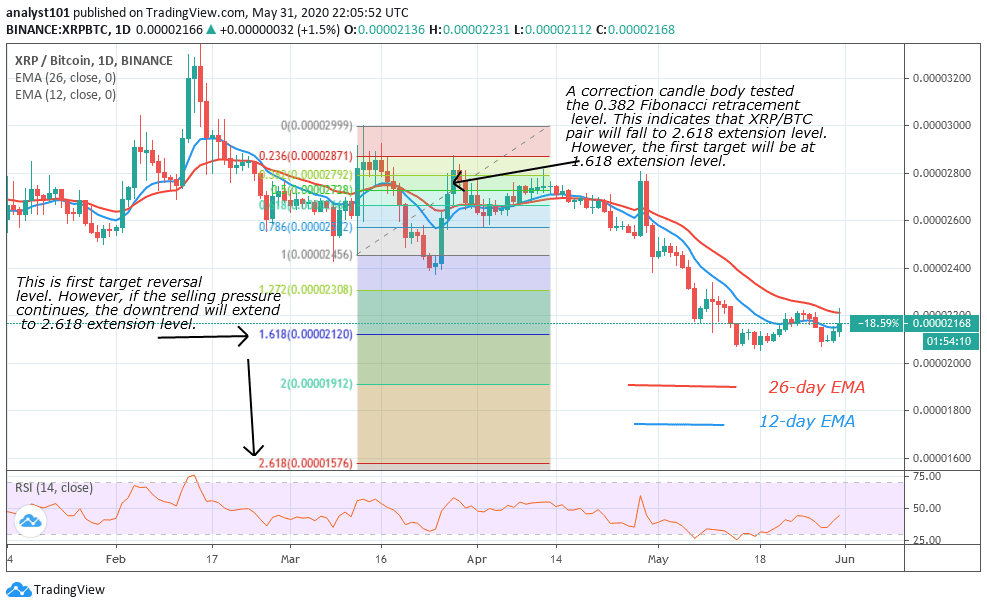

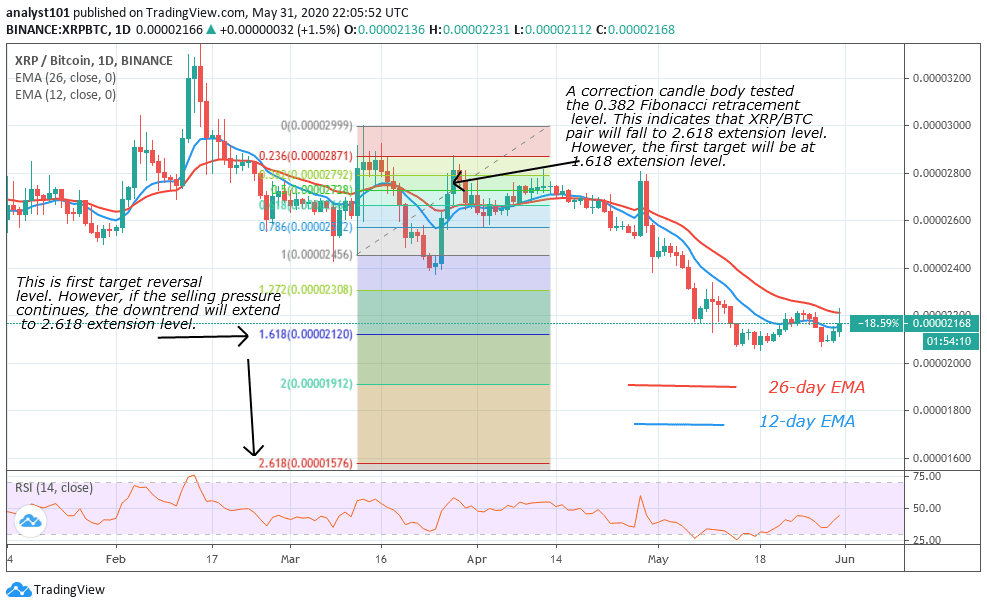

Technical analysis involves studying price charts and trading volume to identify patterns and predict future price movements. For XRP, this includes looking at:

- Moving Averages: Analyzing 50-day, 100-day, and 200-day moving averages can help identify potential support and resistance levels.

- RSI (Relative Strength Index): The RSI helps gauge the momentum of XRP's price, indicating whether it's overbought or oversold.

- MACD (Moving Average Convergence Divergence): The MACD identifies changes in the strength, direction, momentum, and duration of a trend in XRP's price.

Reputable resources like TradingView and CoinMarketCap provide tools and data for conducting technical analysis of XRP.

Fundamental Analysis of XRP

Fundamental analysis focuses on the underlying value of XRP. This involves examining:

- Ripple's Business Model: Ripple's On-Demand Liquidity (ODL) network facilitates faster and cheaper cross-border payments for financial institutions, a key driver of XRP's value.

- Partnerships: Ripple's partnerships with major banks and financial institutions significantly influence adoption and, consequently, price.

- Regulatory Landscape: The ongoing legal battle between Ripple and the SEC significantly impacts XRP's price, creating both uncertainty and potential for substantial price swings.

- Transaction Volume and Market Capitalization: Monitoring the volume of XRP transactions and its overall market capitalization provides insights into its current market standing.

Sentiment Analysis and Social Media Influence

News, social media trends, and overall market sentiment significantly impact XRP's price.

- Influencer Impact: Opinions from prominent cryptocurrency influencers can create FOMO (Fear Of Missing Out) or FUD (Fear, Uncertainty, and Doubt), leading to price volatility.

- Hype Cycles: Periods of intense hype or negative news can cause significant price fluctuations in short periods. Understanding these cycles is crucial for navigating the market.

Monitoring social media sentiment and news related to XRP is essential for understanding its short-term price movements.

XRP Price Predictions from Leading Analysts and Platforms

Predicting the price of any cryptocurrency, including XRP, is inherently speculative. However, analyzing predictions from various sources can offer a broader perspective.

Range of Predictions

Different analysts and platforms offer varying XRP price predictions. Some predict significant growth, while others forecast more moderate increases or even declines. It's vital to remember that:

- Timeframes Vary: Predictions are often categorized as short-term (months), mid-term (years), and long-term (several years).

- Uncertainty is Inherent: No prediction is guaranteed. Treat all forecasts with caution.

For example, some analysts predict XRP to reach $1 in the mid-term, while others suggest a potential price of $5 or more in the long term. Always cross-reference predictions from multiple sources.

Factors Driving Price Predictions

Analysts base their XRP price predictions on various factors, including:

- Adoption Rate: Wider adoption by financial institutions is a significant positive driver.

- Regulatory Clarity: A positive resolution of the SEC lawsuit could drastically impact XRP's price.

- Technological Advancements: Improvements to Ripple's technology and its integration with other systems could boost its value.

- Overall Market Conditions: The general state of the cryptocurrency market influences XRP's price.

Understanding these factors provides context for the different price projections.

Developing a Robust Investment Strategy for XRP

Investing in XRP requires a well-defined strategy that balances potential rewards with inherent risks.

Risk Assessment and Diversification

XRP is a highly volatile asset. Before investing, carefully assess your risk tolerance:

- Risk Tolerance: How much potential loss are you comfortable with?

- Diversification: Never put all your eggs in one basket. Diversify your portfolio across different cryptocurrencies and other asset classes.

This limits your exposure to the risk of significant losses if XRP's price declines.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) is a strategy to mitigate risk by investing a fixed amount of money at regular intervals, regardless of price fluctuations:

- Reduced Impact of Volatility: DCA smooths out price volatility, reducing the impact of buying at peak prices.

- Consistent Investment: Investing regularly builds your position steadily.

DCA can be a sound strategy for long-term XRP investment.

Setting Realistic Goals and Expectations

Avoid unrealistic expectations and develop a plan with attainable goals:

- Long-Term Perspective: Investing in cryptocurrencies requires patience. Focus on long-term growth potential rather than short-term price swings.

- Defined Exit Strategy: Having a clear plan for when and how to sell your XRP is crucial for managing risk and securing profits.

A well-defined plan is key to successful cryptocurrency investment.

Conclusion

Understanding XRP price predictions requires analyzing both technical and fundamental factors, alongside market sentiment and regulatory developments. While various analysts offer differing projections, the key takeaway is the importance of a well-informed investment strategy. This includes a thorough risk assessment, portfolio diversification, and the use of strategies like dollar-cost averaging. While XRP price predictions offer valuable insights, ultimately, your success hinges on a well-researched and carefully planned XRP investment strategy. Start planning yours today!

Featured Posts

-

Is Jayson Tatum Playing Tonight Celtics Vs Nets Injury Report And Game Status

May 08, 2025

Is Jayson Tatum Playing Tonight Celtics Vs Nets Injury Report And Game Status

May 08, 2025 -

Breaking Bread With Scholars Fostering Collaboration And Intellectual Growth

May 08, 2025

Breaking Bread With Scholars Fostering Collaboration And Intellectual Growth

May 08, 2025 -

Mraksh Ke Sahl Pr Kshty Hadthh Ansany Asmglng Ka Alzam 4 Grftar

May 08, 2025

Mraksh Ke Sahl Pr Kshty Hadthh Ansany Asmglng Ka Alzam 4 Grftar

May 08, 2025 -

Fifth Straight Loss For Angels Mike Trouts Knee Soreness A Major Factor

May 08, 2025

Fifth Straight Loss For Angels Mike Trouts Knee Soreness A Major Factor

May 08, 2025 -

Bitcoin Price Prediction Can Trumps Policies Push Btc To 100 000

May 08, 2025

Bitcoin Price Prediction Can Trumps Policies Push Btc To 100 000

May 08, 2025