XRP's Price Outlook: Analyzing The Grayscale ETF's Impact

Table of Contents

Grayscale's ETF Approval and its Ripple Effect on the Crypto Market

The landmark court victory for Grayscale against the SEC, paving the way for the approval of its Bitcoin ETF, holds profound implications for the broader cryptocurrency market. This legal precedent could significantly influence the SEC's future decisions regarding other crypto assets, including XRP. A potential approval of a Grayscale XRP ETF would be a game-changer.

The ramifications are substantial:

- Increased Institutional Investment in XRP: The approval of an ETF would open the doors for institutional investors, who often prefer the regulated and structured environment of exchange-traded products, to invest directly in XRP. This influx of capital could significantly boost XRP's market capitalization.

- Higher Liquidity and Trading Volume for XRP: ETFs typically enhance liquidity and trading volume in the underlying asset. Increased trading activity would make XRP more accessible and attractive to a wider range of investors, potentially stabilizing its price and reducing volatility.

- Potential Price Surge Due to Increased Demand: Increased institutional and retail investment fueled by the ETF's availability would likely lead to a surge in demand, potentially driving XRP's price significantly higher.

- Impact on XRP's Regulatory Uncertainty: The approval of an XRP ETF would indirectly signal a degree of regulatory acceptance, reducing the uncertainty surrounding XRP's legal status and bolstering investor confidence.

Factors Influencing XRP's Price Beyond the Grayscale ETF

While the Grayscale ETF approval would be a major catalyst, several other factors can independently affect XRP's price. The ongoing legal battle between Ripple and the SEC remains a crucial consideration. The outcome of this case significantly influences investor sentiment and market confidence in XRP. Furthermore, macroeconomic factors and the overall cryptocurrency market sentiment, particularly Bitcoin's price movements, will undoubtedly play a significant role.

Here are some key factors to consider:

- Ripple's Legal Progress and its Effect on Investor Confidence: A favorable ruling in Ripple's case would dramatically improve investor confidence, potentially leading to a significant price increase. Conversely, an unfavorable outcome could depress XRP's price.

- Adoption of XRP by Financial Institutions and Payment Providers: Increased adoption of XRP by financial institutions and payment providers for cross-border transactions would enhance its utility and boost its value.

- Technological Advancements and Improvements in the XRP Ledger: Upgrades and improvements to the XRP Ledger's technology, such as enhanced scalability and security, would increase its attractiveness and potentially drive up its price.

- Overall Cryptocurrency Market Sentiment and Bitcoin's Price Movements: The overall sentiment in the cryptocurrency market and the performance of Bitcoin, the dominant cryptocurrency, significantly influence XRP's price movements.

Potential XRP Price Scenarios: Bullish and Bearish Cases

Predicting XRP's price with certainty is impossible, but analyzing various scenarios based on different outcomes can provide a more informed outlook.

Bullish Scenario: If the Grayscale ETF is approved and Ripple wins its case against the SEC, a significant price surge is highly probable. Increased institutional investment, improved regulatory clarity, and enhanced market confidence would create a perfect storm for XRP. Price targets could reach the $2-$5 range within a 1-2 year timeframe.

Bearish Scenario: If the ETF is rejected or Ripple loses its case, XRP's price could experience a significant downturn. Reduced investor confidence, increased regulatory uncertainty, and negative market sentiment could lead to a substantial price drop. In a worst-case scenario, the price might stagnate or even decline to levels below its current trading price.

Neutral Scenario: A neutral scenario would involve a sideways market, with XRP's price fluctuating within a relatively narrow range. This could occur if the ETF application is delayed or the Ripple case remains unresolved for an extended period.

Bullet points summarizing the scenarios:

- Bullish scenario: Price targets: $2-$5; Catalysts: Grayscale ETF approval + Ripple win; Timeframe: 1-2 years.

- Bearish scenario: Price targets: below current price; Potential risks: ETF rejection + Ripple loss; Timeframe: 6-12 months.

- Neutral scenario: Price movement: sideways; Contributing factors: ETF application delay + ongoing Ripple case.

Conclusion:

The potential approval of a Grayscale XRP ETF could significantly impact XRP's price, but it's not the only factor to consider. Ripple's legal battle, broader market trends, and technological advancements all play crucial roles. While a bullish scenario offers exciting potential, a bearish outcome remains a possibility. It's crucial to conduct thorough research and consider various scenarios before making any investment decisions. Stay informed about the latest developments concerning the Grayscale ETF and XRP's price outlook. Continue your research on XRP and other cryptocurrencies to make well-informed investment decisions.

Featured Posts

-

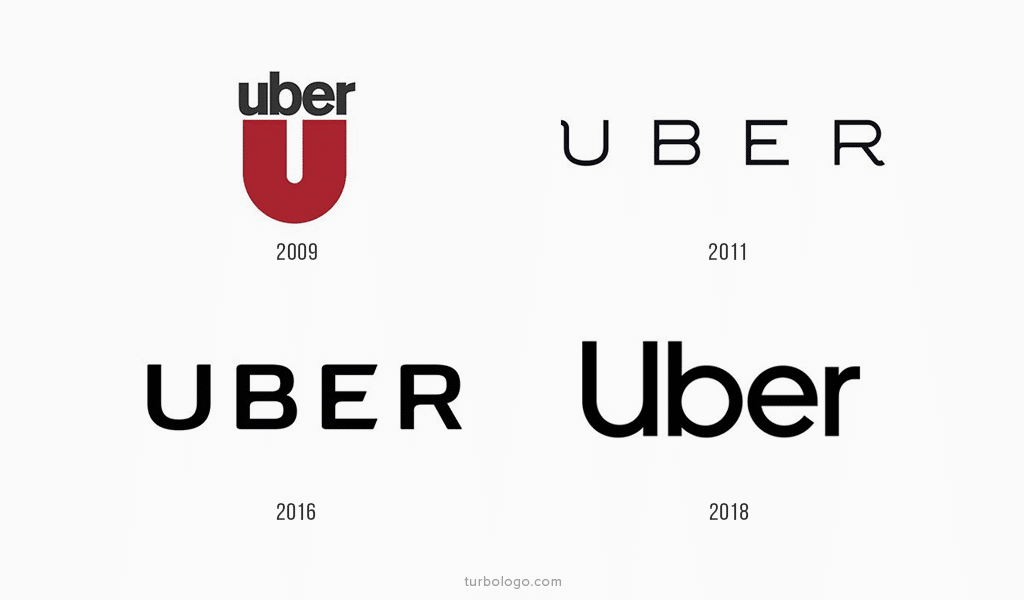

Uber Big Change Auto Service Now Cash Only

May 08, 2025

Uber Big Change Auto Service Now Cash Only

May 08, 2025 -

Supermans Loyal Companion Krypto Featured In New Movie Clip

May 08, 2025

Supermans Loyal Companion Krypto Featured In New Movie Clip

May 08, 2025 -

Sifrenizi Unuttunuz Mu Kripto Varlik Mirasiniz Tehlikede

May 08, 2025

Sifrenizi Unuttunuz Mu Kripto Varlik Mirasiniz Tehlikede

May 08, 2025 -

Urgent Dwp Halts Benefits For 355 000 3 Month Notice

May 08, 2025

Urgent Dwp Halts Benefits For 355 000 3 Month Notice

May 08, 2025 -

Arsenal Psg Maci Hangi Kanalda Saat Kacta Basliyor Canli Izleme

May 08, 2025

Arsenal Psg Maci Hangi Kanalda Saat Kacta Basliyor Canli Izleme

May 08, 2025