Your Guide To Success: 5 Dos And Don'ts For Private Credit Jobs

Table of Contents

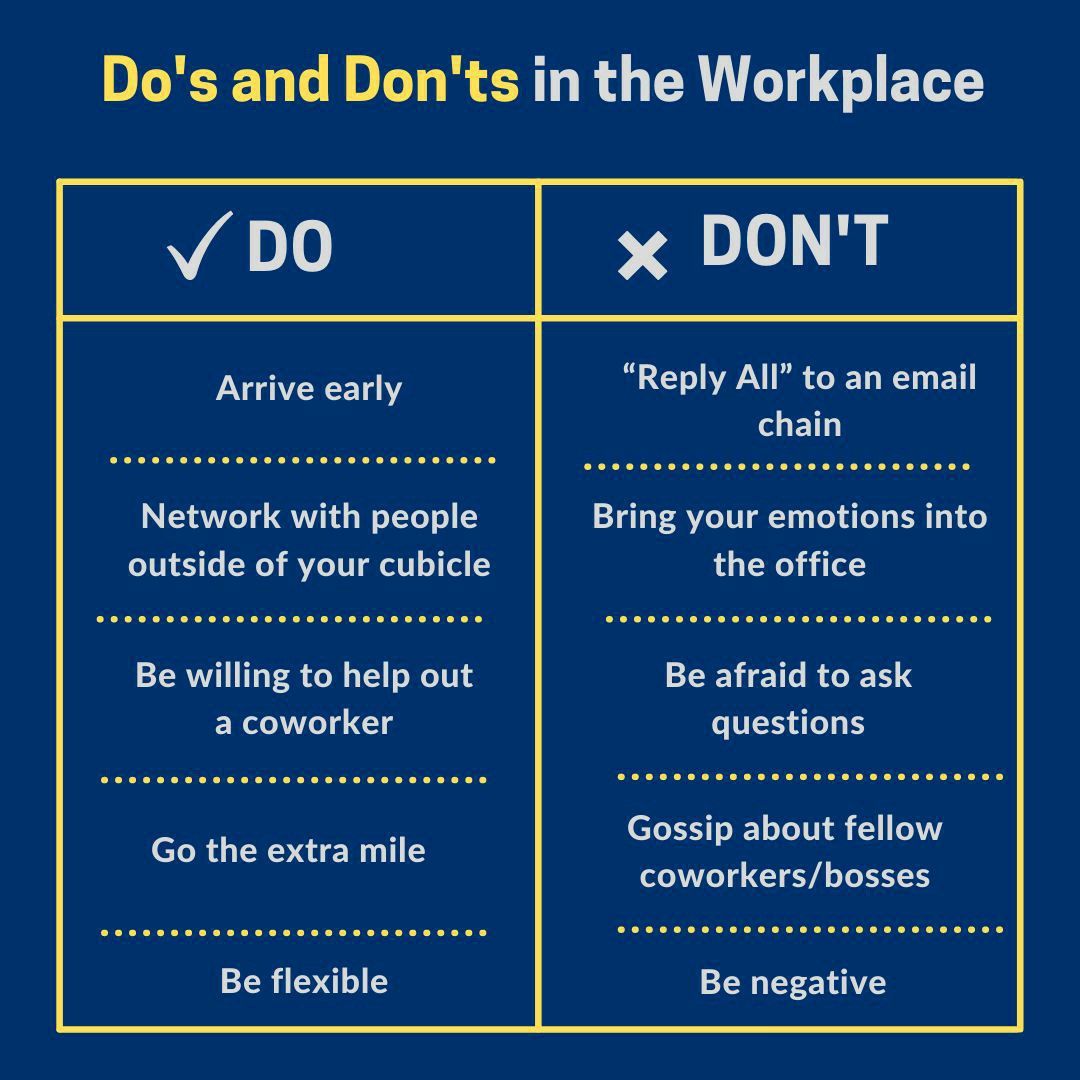

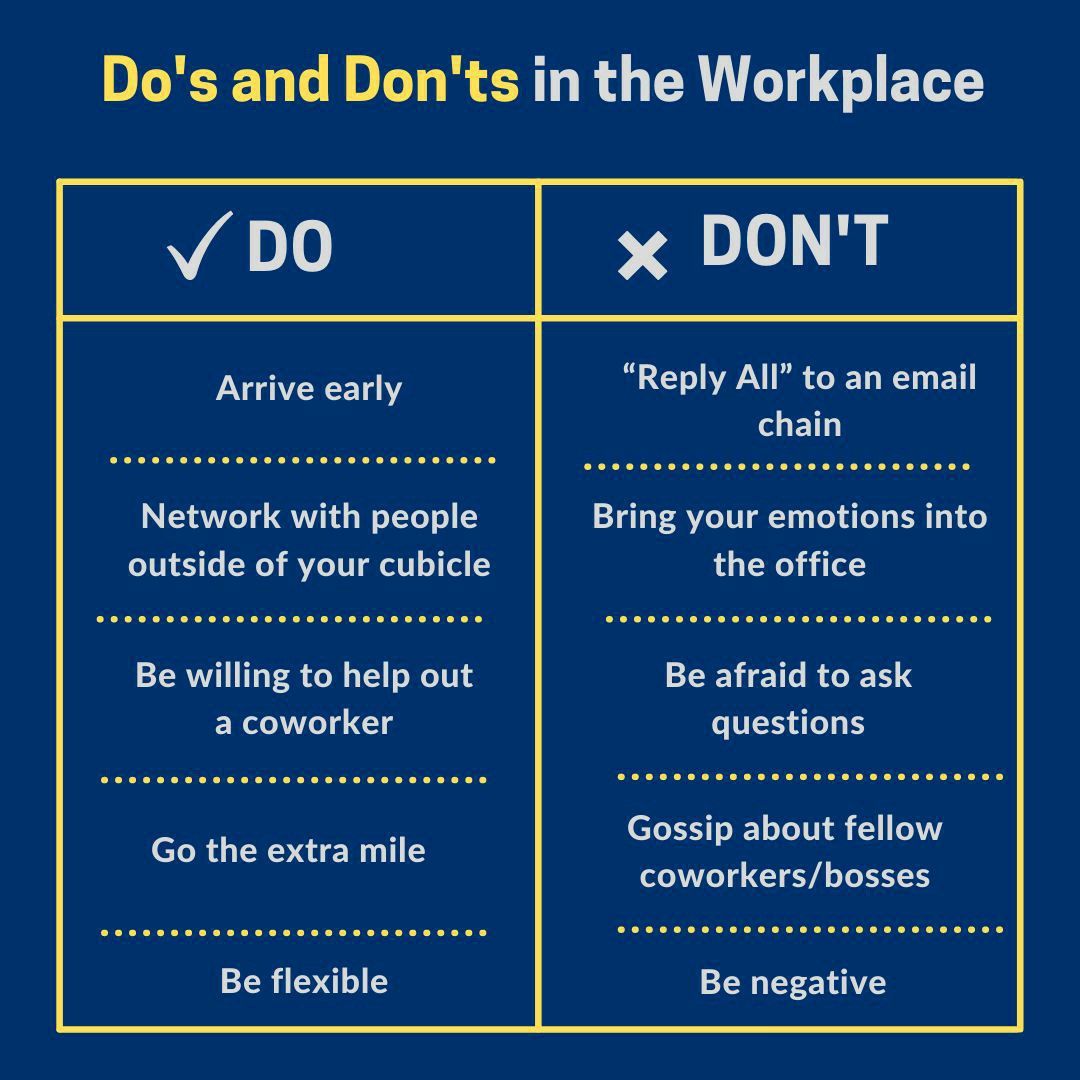

Do: Network Strategically to Secure Private Credit Jobs

Networking is crucial for breaking into the world of private credit jobs. Building relationships with professionals in the field can open doors to unadvertised positions and invaluable mentorship.

Attend Industry Events

- Target conferences and seminars focusing on private equity, credit funds, distressed debt, mezzanine finance, and alternative lending. These events are breeding grounds for networking opportunities.

- Engage actively in conversations, exchange business cards, and, importantly, follow up with new connections via email or LinkedIn within 24-48 hours. A simple, personalized message referencing your conversation significantly increases the chances of forming a lasting connection.

- Leverage LinkedIn to connect with attendees before the event to personalize your approach and after to solidify your network. Research attendees beforehand to identify individuals whose expertise aligns with your career goals.

Informational Interviews

- Reach out to professionals working in private credit roles for informational interviews. These informal conversations provide invaluable insights into the industry and specific companies.

- Prepare thoughtful questions demonstrating your genuine interest in their experience and career path. Focus on their journey, challenges overcome, and advice for someone entering the field.

- Express your career aspirations and clearly articulate your interest in private credit jobs. This can be a powerful way to make a lasting impression and potentially uncover hidden opportunities.

Cultivate Relationships

- Building strong relationships takes time and effort. Stay in touch regularly with your network, even if it's just a brief email or LinkedIn message.

- Offer assistance when possible – this could be as simple as sharing a relevant article or connecting them with someone in your network.

- Participate in industry discussions online (LinkedIn groups, relevant forums) and offline (conferences, workshops) to showcase your knowledge and build your reputation within the private credit jobs community.

Don't: Neglect Your Financial Modeling Skills for Private Credit Jobs

Proficiency in financial modeling is non-negotiable for most private credit jobs. Employers expect candidates to demonstrate a high level of competency and accuracy.

Mastering Excel and Financial Modeling Software

- Demonstrate advanced proficiency in Excel, including VBA macros for automation, advanced data analysis techniques (pivot tables, VLOOKUP), and building robust financial models.

- Familiarize yourself with industry-standard software such as Argus, Bloomberg Terminal, and other specialized platforms used for credit analysis and valuation.

- Practice building detailed financial models, including leveraged buyouts (LBOs), debt structuring scenarios, cash flow projections, and sensitivity analyses. The more experience you have, the more confident you’ll be in interviews.

Underestimating the Importance of Accuracy and Detail

- Private credit analysis demands meticulous attention to detail. Even small errors can have significant consequences.

- Develop strong analytical and problem-solving skills to ensure accuracy in your work. Practice regularly, and be prepared to explain your methodologies clearly and confidently.

- Mastering accuracy and precision will distinguish you from other candidates in the competitive landscape of private credit jobs.

Do: Tailor Your Resume and Cover Letter for Specific Private Credit Jobs

Generic applications rarely impress in a competitive market. Show recruiters you understand the nuances of each role and company.

Highlight Relevant Skills and Experience

- Customize your resume and cover letter for each job application, emphasizing the skills and experience most relevant to the specific role and company.

- Use keywords from the job description to demonstrate your understanding of the requirements. Quantify your achievements whenever possible using metrics to showcase your impact.

- Focus on skills directly applicable to private credit jobs, such as credit analysis, financial modeling, due diligence, and portfolio management.

Showcase Your Understanding of the Industry

- Demonstrate your knowledge of private credit markets, current trends (e.g., interest rate hikes, market cycles), and relevant regulatory frameworks. This shows initiative and deeper understanding.

- Research the specific company and its investment strategy. Mention specific deals or investments that resonate with your interests and skills. This personalized touch greatly increases your chances.

Don't: Underprepare for Private Credit Job Interviews

Interview preparation is critical. Thorough preparation demonstrates professionalism and competence.

Practice Behavioral Interview Questions

- Prepare for common behavioral interview questions (e.g., "Tell me about a time you failed," "Describe a challenging situation and how you overcame it") using the STAR method (Situation, Task, Action, Result).

- Practice your answers aloud to build confidence and refine your responses. Anticipate potential follow-up questions.

- Reflect on your past experiences and identify examples that showcase your skills and achievements relevant to private credit jobs.

Neglect Technical Questions

- Expect technical questions related to financial modeling, credit analysis, valuation techniques (DCF, comparable company analysis), and understanding of credit metrics (leverage ratios, interest coverage).

- Refresh your knowledge of key concepts and be prepared to demonstrate your problem-solving skills through detailed explanations and calculations.

- Practice case studies related to private credit transactions, such as evaluating a potential investment or analyzing a company’s financial statements.

Do: Follow Up After Private Credit Job Interviews

Following up demonstrates continued interest and professionalism.

Send a Thank-You Note

- Send a personalized thank-you note within 24 hours of each interview, reiterating your interest and highlighting key points from the conversation.

- Reference specific details from the interview to show you were actively listening and engaged.

- Reiterate your qualifications and enthusiasm for the specific private credit job.

Maintain Contact

- Follow up with the interviewer(s) a week or two after the interview to inquire about the hiring process. This shows you are persistent and genuinely interested.

- Avoid excessive follow-up, but a polite and professional check-in is appropriate.

Conclusion

Securing a successful career in private credit jobs requires a strategic approach. By following these dos and don'ts – networking effectively, mastering crucial skills, tailoring your application materials, preparing thoroughly for interviews, and maintaining consistent follow-up – you significantly improve your chances of landing your dream private credit job. Don't delay; start implementing these strategies today and embark on your journey to a fulfilling career in private credit!

Featured Posts

-

Flash Flood Warnings Issued April 4th 2025 April 2nd Tornado Update

May 26, 2025

Flash Flood Warnings Issued April 4th 2025 April 2nd Tornado Update

May 26, 2025 -

M And S Reveals 300 Million Cost Of Cyber Security Breach

May 26, 2025

M And S Reveals 300 Million Cost Of Cyber Security Breach

May 26, 2025 -

Restaurant Review Salon Yevani In Herzliya The Jerusalem Post

May 26, 2025

Restaurant Review Salon Yevani In Herzliya The Jerusalem Post

May 26, 2025 -

Meta Israel Launches Fifth Annual Holocaust Remembrance Day Instagram Campaign

May 26, 2025

Meta Israel Launches Fifth Annual Holocaust Remembrance Day Instagram Campaign

May 26, 2025 -

Russell And The Typhoons A Deep Dive Into The Bands History And Music

May 26, 2025

Russell And The Typhoons A Deep Dive Into The Bands History And Music

May 26, 2025

Latest Posts

-

6000

May 28, 2025

6000

May 28, 2025 -

18 000

May 28, 2025

18 000

May 28, 2025 -

Ou Acheter Le Samsung Galaxy S25 512 Go Au Meilleur Prix

May 28, 2025

Ou Acheter Le Samsung Galaxy S25 512 Go Au Meilleur Prix

May 28, 2025 -

Find The Best Personal Loan Interest Rate Today

May 28, 2025

Find The Best Personal Loan Interest Rate Today

May 28, 2025 -

Lowest Personal Loan Interest Rates A Simple Guide For 2024

May 28, 2025

Lowest Personal Loan Interest Rates A Simple Guide For 2024

May 28, 2025