Yuan Support From PBOC Lower Than Predicted For The First Time In 2024

Table of Contents

Reasons for Reduced PBOC Yuan Support

The reduced PBOC intervention to support the Yuan stems from a confluence of factors, impacting both global and domestic economic landscapes.

Weakening Global Demand

Global recessionary fears are significantly impacting Chinese exports, putting considerable pressure on the Yuan. A weakening global economy translates directly into reduced demand for Chinese goods.

- Decreased export orders: Many multinational companies are cutting back on orders, leading to lower production levels and impacting Chinese factories.

- Falling commodity prices: Reduced global demand also leads to lower prices for raw materials, further squeezing profit margins for Chinese exporters.

- Impact on manufacturing sector: The manufacturing sector, a crucial component of the Chinese economy, is experiencing a slowdown, directly influencing the Yuan's value. This weakening Yuan, coupled with decreased export-oriented growth, points to the effects of a global economic slowdown on China.

Increased Capital Outflows

Capital is flowing out of China at an accelerated rate, exerting downward pressure on the Yuan. Several factors contribute to this capital flight.

- Concerns about China's property market: The ongoing challenges in China's real estate sector are deterring both domestic and foreign investors.

- Geopolitical uncertainties: Global geopolitical instability and rising tensions are prompting investors to seek safer havens for their capital.

- Investment diversification: Investors are diversifying their portfolios, reducing their exposure to the Chinese market and contributing to capital outflows. The resulting RMB depreciation highlights the vulnerability of the Chinese economy to shifts in global investor sentiment and geopolitical risks.

Shift in PBOC Monetary Policy

The PBOC might be subtly shifting its approach to managing the Yuan, moving towards a more market-driven exchange rate.

- Focus on domestic stability: The PBOC may be prioritizing domestic economic stability over maintaining a specific Yuan exchange rate.

- Managing inflation: Allowing some Yuan depreciation might help control inflation by lowering import prices.

- Allowing for greater market determination of exchange rate: This shift suggests a move away from direct intervention and towards a more flexible exchange rate mechanism. This change in PBOC intervention strategy highlights a potential recalibration of its monetary policy priorities.

Impact on Yuan Exchange Rate and Volatility

The reduced PBOC support has already resulted in notable changes in the Yuan's exchange rate and increased market volatility.

Yuan Depreciation

The Yuan has depreciated against major currencies like the US dollar and the Euro.

- Historical data comparison: Analyzing historical data reveals a clear downward trend in the Yuan's value since the reduced PBOC support.

- Predictions for future movements: Many analysts predict further depreciation in the short to medium term.

- Potential for further depreciation: The ongoing economic headwinds suggest a potential for continued Yuan devaluation. This RMB exchange rate fluctuation increases the currency risk for both domestic and international investors.

Increased Market Volatility

The uncertainty surrounding the Yuan's future value has increased volatility in the foreign exchange market.

- Increased trading volume: Increased speculation and hedging activities have led to higher trading volumes in the Yuan market.

- Speculation: Market participants are actively speculating on the Yuan's future movements, further exacerbating volatility.

- Impact on investor confidence: The increased volatility is impacting investor confidence, leading to caution and potentially hindering investment inflows into China. This market uncertainty underscores the need for careful monitoring of the situation and informed decision-making.

Economic Consequences for China

The decreased PBOC Yuan support and the subsequent changes in the exchange rate will have significant consequences for the Chinese economy.

Impact on Inflation

A weaker Yuan will likely increase the cost of imported goods, potentially fueling inflationary pressures.

- Increased cost of imported goods: As the Yuan depreciates, imports become more expensive, pushing up prices for consumers.

- Potential impact on consumer spending: Higher prices could dampen consumer spending and slow down economic growth.

- PBOC response: The PBOC may need to intervene with other monetary policy tools to manage inflation. This inflationary pressure could lead to further adjustments in PBOC monetary policy.

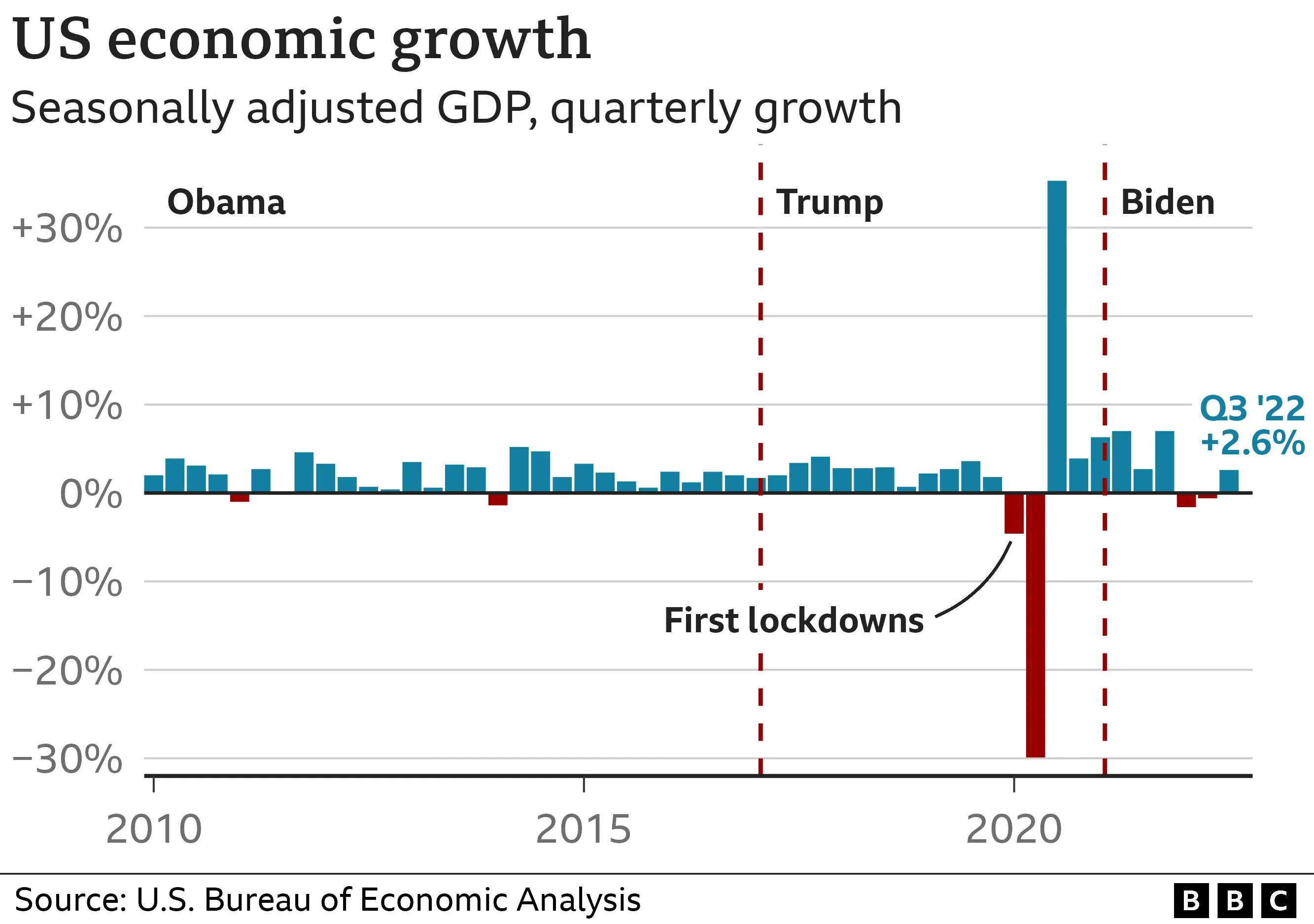

Effect on Economic Growth

The combined effects of weakening global demand, capital outflows, and increased uncertainty could negatively impact China's economic growth and GDP.

- Impact on exports and imports: The weaker Yuan could boost exports in the short term, but the negative impact on overall global demand may outweigh this benefit. Import costs will rise.

- Investor sentiment: The uncertainty surrounding the Yuan's value is likely to dampen investor sentiment and discourage investment.

- Government response measures: The Chinese government may need to implement further stimulus measures to counter the negative effects on economic growth. The impact on China's GDP will require close monitoring of economic indicators and government policy response.

Conclusion

The reduced PBOC support for the Yuan, a surprising development in 2024, is driven by weakening global demand, increased capital outflows, and a potential shift in PBOC monetary policy. This has led to Yuan depreciation, increased market volatility, and potential negative consequences for China's inflation and economic growth. The unexpected nature of the decreased support underscores the complexities of managing the Chinese economy in a rapidly changing global environment. Staying informed about future developments concerning Yuan support mechanisms from the PBOC and its implications for the Chinese economy in 2024 and beyond is crucial. Further research into the ongoing situation and its long-term impact is essential for understanding the future trajectory of both the Chinese economy and the Yuan.

Featured Posts

-

The Impact Of Ha Seong Kim And Blake Snells Bond On Korean Baseball

May 16, 2025

The Impact Of Ha Seong Kim And Blake Snells Bond On Korean Baseball

May 16, 2025 -

Trumps Second Term An Examination Of Presidential Pardons

May 16, 2025

Trumps Second Term An Examination Of Presidential Pardons

May 16, 2025 -

Knicks Upset Celtics In Game 1 A Historic Loss For Boston

May 16, 2025

Knicks Upset Celtics In Game 1 A Historic Loss For Boston

May 16, 2025 -

Californias Economy Under Pressure The 16 Billion Impact Of Trumps Tariffs

May 16, 2025

Californias Economy Under Pressure The 16 Billion Impact Of Trumps Tariffs

May 16, 2025 -

Vercels Response To La Ligas Controversial Anti Piracy Tactics

May 16, 2025

Vercels Response To La Ligas Controversial Anti Piracy Tactics

May 16, 2025