10% Jump In Ethereum Address Activity: A Sign Of Growing Adoption?

Table of Contents

Analyzing the 10% Increase in Ethereum Address Activity

Tracking Ethereum address activity provides valuable insights into the network's growth and user engagement. We employ on-chain data analysis, focusing on the number of unique addresses interacting with the Ethereum blockchain within a specific timeframe. Comparing this recent surge to historical data reveals its significance.

- Timeframe: The 10% increase in Ethereum address activity was observed over the past [Insert specific timeframe, e.g., quarter, month].

- Total Active Addresses: This increase represents a jump from approximately [Insert previous number] to [Insert current number] unique active Ethereum addresses.

- Significant Outliers: While the overall trend shows consistent growth, [mention any significant spikes or dips during the period and their possible causes]. [Include a chart or graph visually representing the data here].

Potential Drivers Behind Increased Ethereum Address Activity

Several factors likely contributed to this significant rise in Ethereum address activity. Let's explore the key drivers:

Growing DeFi Adoption

Decentralized Finance (DeFi) has exploded in popularity, attracting a large influx of new users to the Ethereum network. The accessibility of DeFi protocols and the potential for high yields have been major drawcards.

- Key DeFi Protocols: Platforms like Aave, Uniswap, and Compound have witnessed substantial growth, driving a significant portion of the increase in Ethereum address activity.

- Appeal of DeFi: The promise of high returns, transparency, and permissionless access has attracted both retail and institutional investors, fueling the creation of new Ethereum addresses.

- Growth Statistics: [Insert statistics on DeFi growth, e.g., Total Value Locked (TVL) increase, number of unique users across major DeFi platforms].

NFT Market Expansion

The Non-Fungible Token (NFT) market has experienced phenomenal growth, further contributing to the increase in Ethereum address activity. The allure of digital ownership and the potential for high returns has attracted millions of new users.

- Popular NFT Marketplaces: OpenSea, Rarible, and other prominent marketplaces have seen explosive growth in trading volume and user base.

- Prominent NFT Projects: High-profile NFT projects have generated significant buzz and attracted a large number of new users to the Ethereum network.

- NFT Sales Volume: [Insert data on NFT sales volume and user growth during the relevant period].

Ethereum Improvement Proposals (EIPs)

Recent Ethereum upgrades and improvements, implemented through Ethereum Improvement Proposals (EIPs), have enhanced the network's scalability, security, and usability, potentially encouraging greater adoption.

- Relevant EIPs: EIPs such as [mention specific EIPs and their impact, e.g., EIP-1559, which introduced transaction fee burning].

- Impact of EIPs: These improvements have addressed scalability concerns and enhanced the overall user experience, leading to increased network participation.

- Resources: [Link to relevant documentation or resources about the mentioned EIPs].

Institutional Investment

The growing interest from institutional investors is another significant factor. Larger players are increasingly recognizing Ethereum's potential and are allocating resources to the network.

- Significant Investments: [Mention any notable institutional investments in Ethereum during the period].

- Impact of Institutional Adoption: This influx of institutional capital provides significant legitimacy and stability, further driving adoption.

- News and Reports: [Link to relevant news articles or reports on institutional investment in Ethereum].

Is this a Sustainable Trend? Analyzing Long-Term Implications

While the 10% jump in Ethereum address activity is encouraging, its sustainability depends on several factors.

- Competition: The emergence of competing blockchains could pose a challenge to Ethereum's continued growth.

- Regulatory Changes: Regulatory uncertainty and potential changes in the regulatory landscape could impact adoption rates.

- Future Developments: Future upgrades and developments in the Ethereum ecosystem, such as the transition to Ethereum 2.0, will play a crucial role in shaping its long-term success.

Conclusion: The Significance of the 10% Jump in Ethereum Address Activity

The 10% increase in Ethereum address activity is a significant development, suggesting a surge in adoption driven by the growth of DeFi, the NFT market boom, successful EIPs, and increasing institutional investment. While the sustainability of this trend hinges on overcoming challenges like competition and regulatory uncertainty, the positive momentum suggests a bright future for Ethereum. To gain a deeper understanding of Ethereum's adoption rate, stay informed about developments in the ecosystem and track future changes in Ethereum address activity. You can find reliable resources for tracking Ethereum address activity here: [link to a relevant resource].

Featured Posts

-

Lyon Psg Macini Canli Izlemek Icin Tam Rehber

May 08, 2025

Lyon Psg Macini Canli Izlemek Icin Tam Rehber

May 08, 2025 -

Oelueme Hazirlik Kripto Varlik Mirasinizi Korumanin Yollari

May 08, 2025

Oelueme Hazirlik Kripto Varlik Mirasinizi Korumanin Yollari

May 08, 2025 -

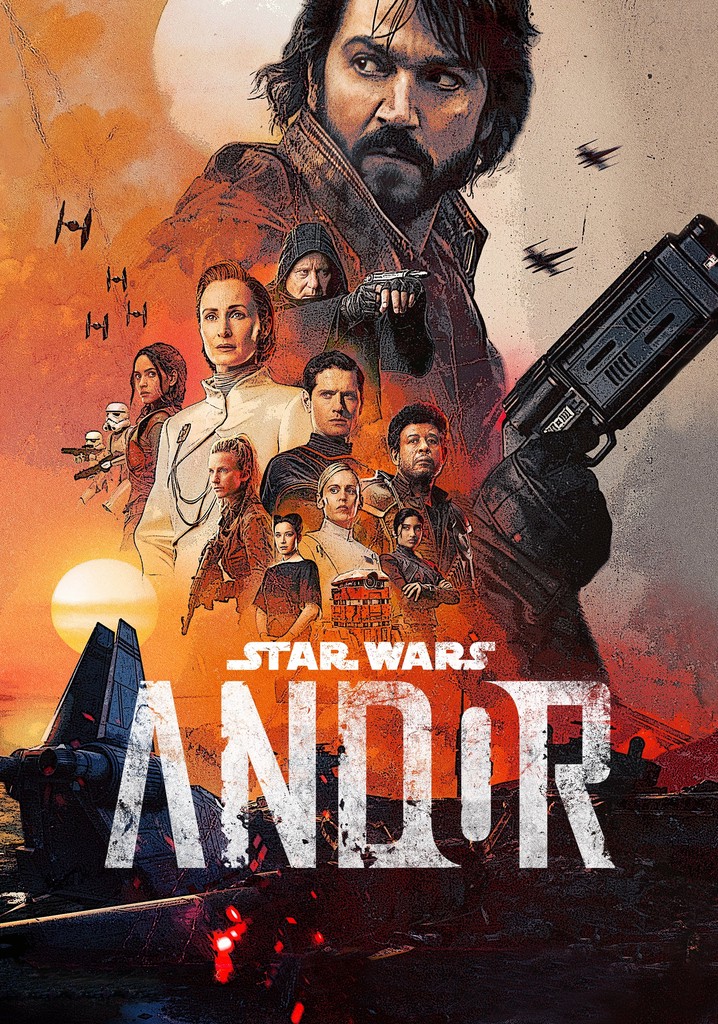

Stream Andor Season 1 Episodes 1 3 Hulu And You Tube Availability

May 08, 2025

Stream Andor Season 1 Episodes 1 3 Hulu And You Tube Availability

May 08, 2025 -

Ethereum Liquidations Surge To 67 M Is A Further Market Sell Off Imminent

May 08, 2025

Ethereum Liquidations Surge To 67 M Is A Further Market Sell Off Imminent

May 08, 2025 -

Kripto Para Yatirimi Kripto Lider Hakkinda Bilmeniz Gerekenler

May 08, 2025

Kripto Para Yatirimi Kripto Lider Hakkinda Bilmeniz Gerekenler

May 08, 2025