2% LVMH Share Drop Follows Disappointing Q1 Sales Results

Table of Contents

LVMH Moët Hennessy Louis Vuitton, the world's largest luxury goods company, experienced a significant 2% share price drop following the release of its disappointing Q1 2024 sales results. This unexpected downturn raises concerns about the overall health of the luxury goods market and the potential for a broader economic slowdown. This article delves into the reasons behind this drop and analyzes its implications for investors and the luxury industry as a whole. The performance of LVMH, a bellwether for the luxury sector, is sending ripples through the financial world and prompting questions about the future of high-end consumer spending.

Disappointing Q1 Sales Figures: A Detailed Analysis

Keywords: LVMH Q1 sales, revenue decline, sales growth slowdown, financial performance, earnings report

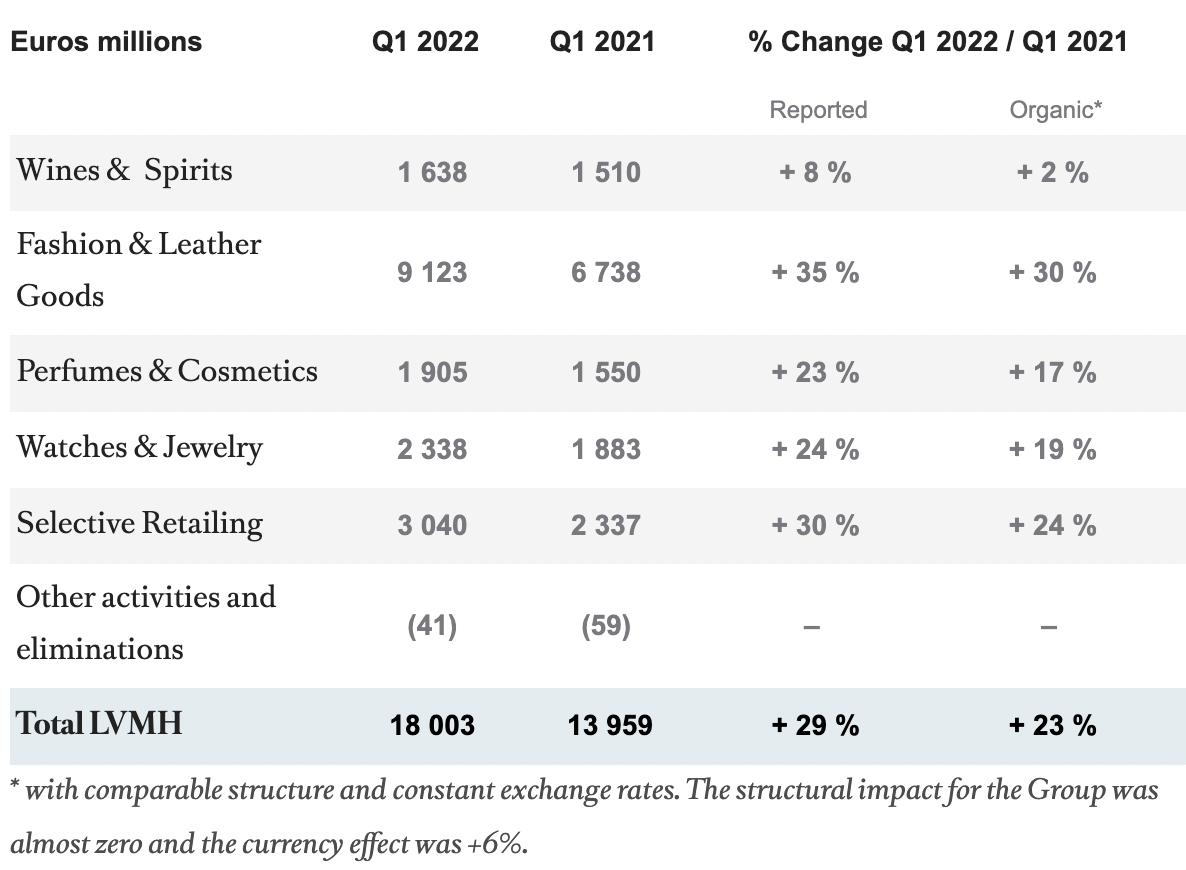

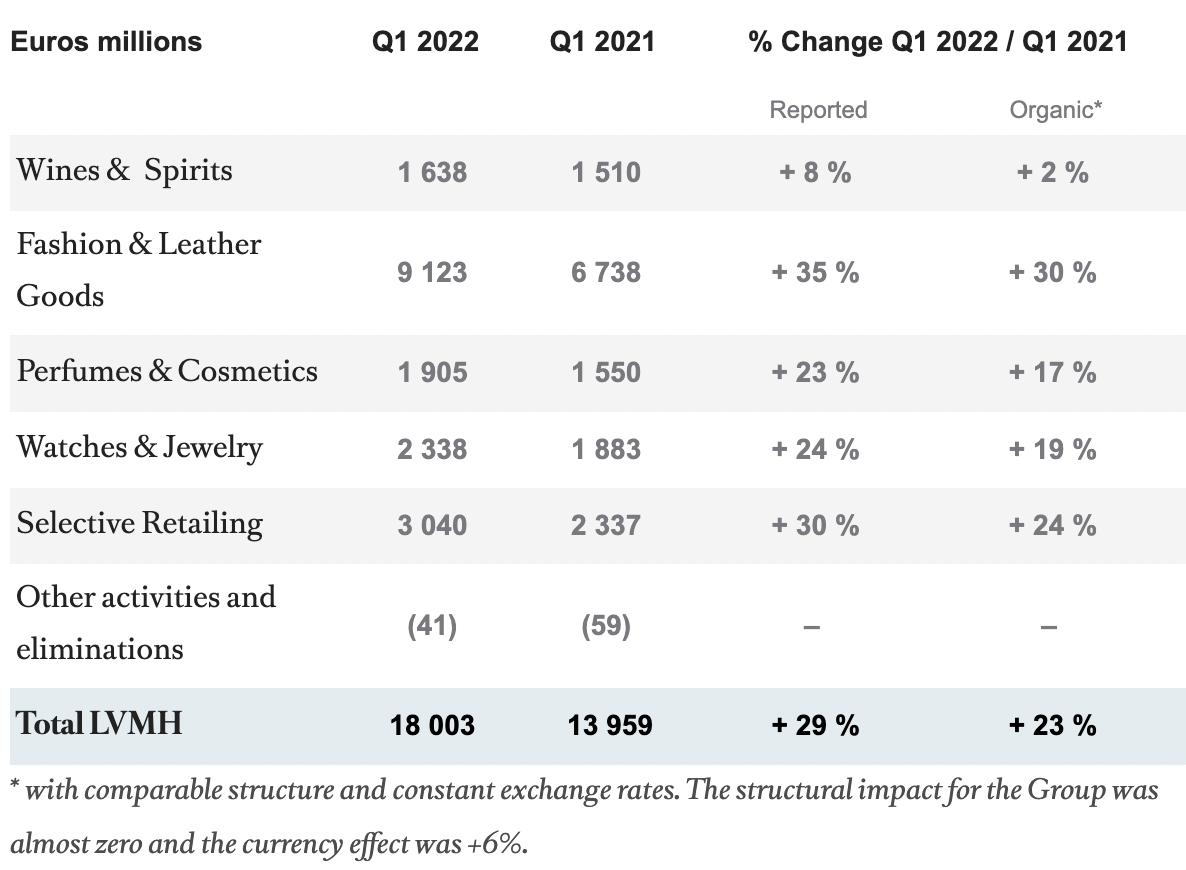

LVMH's Q1 2024 sales figures fell short of both internal projections and analyst expectations. While the exact percentage drop compared to Q1 2023 remains to be fully analyzed by financial experts, early indications suggest a significant deceleration in sales growth. This slowdown wasn't uniform across all brands or geographic regions.

-

Breakdown of Sales Performance: While some brands like Louis Vuitton continued to show strong performance in certain key markets, others experienced more pronounced slowdowns. Dior, for example, might have seen softer sales in specific product categories. Sephora's performance likely also played a role in the overall revenue picture. A detailed brand-by-brand breakdown will be crucial in understanding the nuances of the report.

-

Geographical Performance: The impact wasn't geographically uniform either. While some regions like Europe might have performed relatively strongly, others, possibly including Asia, may have experienced more significant declines in revenue. These regional discrepancies are important to understand and will probably be analyzed further in upcoming reports.

-

Macroeconomic Factors: The disappointing sales figures can be partly attributed to macroeconomic headwinds. Inflation, rising interest rates, and a general decrease in consumer confidence, especially amongst high-net-worth individuals, have all contributed to a more cautious spending environment.

-

Underperforming Product Categories: Specific product categories within the LVMH portfolio might have underperformed, creating a drag on overall revenue. This could be due to changes in consumer preferences, increased competition, or simply a correction after exceptionally strong growth in prior periods. Further analysis is needed to determine this.

-

Competitor Performance: Comparing LVMH's performance to its main competitors in the luxury goods sector will provide valuable context. A relative analysis of the Q1 performance across other luxury brands will better illustrate whether this slowdown is unique to LVMH or indicative of a broader trend in the luxury market.

Impact on LVMH Stock Price and Investor Sentiment

Keywords: LVMH stock price, investor confidence, market reaction, stock market volatility, share price fluctuation

The 2% drop in LVMH's share price immediately following the release of the Q1 sales results reflects a significant negative reaction from investors. This swift market reaction underscores the importance of LVMH within the luxury sector and the sensitivity of investor sentiment to any indication of a slowdown.

-

Market Reaction and Trading Volume: The volume of LVMH stock traded after the news suggests considerable investor activity, with many likely reacting to the unexpected dip in sales. This increased trading activity reflects the uncertainty surrounding the luxury market’s future performance.

-

Long-Term Implications: The long-term implications for LVMH's stock price will depend on several factors. These include the company's ability to adapt to changing market conditions, consumer responses to new product lines or strategies and the general health of the global economy.

-

Analyst Reactions: Analyst ratings and future projections will also influence the stock price trajectory. The initial market response might prompt analysts to revise their ratings and earnings projections which may lead to further fluctuations in the LVMH stock price.

-

Impact on Bernard Arnault: Given Bernard Arnault's significant stake in LVMH, the share price drop will have inevitably impacted his net worth. This is a common occurrence whenever the stock price of a company experiences changes.

The Broader Implications for the Luxury Goods Market

Keywords: luxury market outlook, luxury consumer, economic slowdown, consumer confidence, luxury retail

The disappointing LVMH Q1 results raise concerns about the broader luxury goods market. This decline could signify a potential overall slowdown in the sector, rather than an issue specific to LVMH alone.

-

Market Slowdown Indication: The performance of LVMH often serves as a strong indicator of the health of the luxury market. A significant downturn in its sales figures could signal a similar trend among its competitors.

-

Contributing Factors: Several factors beyond macroeconomic trends could contribute to a potential luxury market slowdown. These could include shifts in consumer behavior towards sustainable luxury, increasing competition from new entrants, or growing geopolitical uncertainties.

-

Other Luxury Brands: Examining the performance of other leading luxury brands will be crucial in determining whether this is an industry-wide trend or a unique challenge for LVMH. A comparison with the results of other major players will provide the necessary perspective.

-

Future Strategies: Navigating these challenges will require innovative strategies from LVMH and other players in the luxury sector. These might include focusing on sustainable practices, leveraging digital technologies, and creating highly personalized customer experiences.

LVMH's Response and Future Outlook

Keywords: LVMH strategy, future plans, corporate response, business strategy, brand management

LVMH's response to the Q1 results, along with its future plans, will be critical in determining its recovery and future growth.

-

Official Statements: The company's official statements regarding the Q1 performance and future outlook will provide crucial insight into their strategic thinking and planned actions. These statements will outline any changes they anticipate undertaking to address recent setbacks and achieve their future goals.

-

Strategic Adjustments: LVMH is likely to implement strategies to address the challenges and boost performance. These might involve targeted marketing campaigns, pricing adjustments, product innovation, or cost-cutting measures.

-

Areas for Growth: Identifying and focusing on areas of future growth and innovation will be key. This may include leveraging e-commerce, expanding into new markets, or developing new product categories to appeal to evolving consumer preferences.

-

Acquisitions and Expansion: Potential acquisitions or expansion plans could play a role in LVMH's long-term growth strategy. These could be targeted acquisitions that strengthen the brand’s portfolio or expansion into new segments or markets.

Conclusion

The 2% LVMH share drop following disappointing Q1 sales results underscores the challenges facing the luxury goods market. While factors like macroeconomic conditions play a role, the performance of individual brands within the LVMH portfolio highlights the need for strategic adaptation. The future performance of LVMH and the luxury sector as a whole will depend on successfully navigating these headwinds.

Call to Action: Stay informed about the evolving situation with LVMH and the luxury goods market. Follow our updates for further analysis of LVMH’s performance and the impact of the Q1 results on the broader luxury sector. Continue to monitor the LVMH stock price and its correlation with wider market trends and LVMH's strategic responses to fluctuating demand.

Featured Posts

-

M56 Road Closure Live Traffic And Travel Updates Due To Accident

May 24, 2025

M56 Road Closure Live Traffic And Travel Updates Due To Accident

May 24, 2025 -

Evrovidenie Pobediteli Poslednikh 10 Let Chto S Nimi Seychas

May 24, 2025

Evrovidenie Pobediteli Poslednikh 10 Let Chto S Nimi Seychas

May 24, 2025 -

Kak Zhenyatsya Na Kharkovschine Svadebniy Bum Bolee 600 Brakov Za Mesyats

May 24, 2025

Kak Zhenyatsya Na Kharkovschine Svadebniy Bum Bolee 600 Brakov Za Mesyats

May 24, 2025 -

Lewis Hamiltons Comments Criticized Ferraris Strong Response

May 24, 2025

Lewis Hamiltons Comments Criticized Ferraris Strong Response

May 24, 2025 -

Us Bands Glastonbury Appearance Unofficial Announcement Ignites Speculation

May 24, 2025

Us Bands Glastonbury Appearance Unofficial Announcement Ignites Speculation

May 24, 2025

Latest Posts

-

Sharp Decline On Amsterdam Stock Exchange 11 Down In Three Days

May 24, 2025

Sharp Decline On Amsterdam Stock Exchange 11 Down In Three Days

May 24, 2025 -

Amsterdam Exchange Suffers 11 Drop Since Wednesday Three Days Of Losses

May 24, 2025

Amsterdam Exchange Suffers 11 Drop Since Wednesday Three Days Of Losses

May 24, 2025 -

Amsterdam Stock Exchange Plunges Third Consecutive Day Of Heavy Losses

May 24, 2025

Amsterdam Stock Exchange Plunges Third Consecutive Day Of Heavy Losses

May 24, 2025 -

Legal Battle Amsterdam Residents Sue City Council For Tik Tok Driven Overcrowding At Snack Bar

May 24, 2025

Legal Battle Amsterdam Residents Sue City Council For Tik Tok Driven Overcrowding At Snack Bar

May 24, 2025 -

Dazi E Mercati L Impatto Sulle Borse E Le Reazioni Della Ue

May 24, 2025

Dazi E Mercati L Impatto Sulle Borse E Le Reazioni Della Ue

May 24, 2025