30% Drop In Palantir Stock: Time To Invest?

Table of Contents

Understanding the 30% Palantir Stock Price Drop

Potential Factors Contributing to the Decline

Several factors likely contributed to Palantir's recent stock price plummet. Understanding these is crucial for any Palantir investment strategy.

-

Market Sentiment: The broader tech sector downturn significantly impacted Palantir. Negative investor sentiment towards growth stocks, fueled by rising interest rates and economic uncertainty, likely exacerbated the drop in Palantir's price. This broader market trend affected many tech companies, not just Palantir.

-

Profitability Concerns: Palantir's path to profitability remains a key concern for many investors. While revenue growth has been impressive, achieving consistent profitability is crucial for long-term stock appreciation. Analyzing Palantir's recent financial reports and comparing them to projections is vital for assessing its future profitability.

-

Competition: The data analytics market is fiercely competitive. Established players and emerging startups constantly challenge Palantir's market share. Understanding the competitive landscape and Palantir's competitive advantages is essential for evaluating its future performance.

-

Geopolitical Factors: Global events and geopolitical instability can impact investor confidence and affect Palantir's business, particularly its government contracts. Changes in government policies or international relations can create uncertainty, affecting the Palantir stock price.

-

Specific News Events: The 30% drop might have been triggered or amplified by specific news events. These could include disappointing earnings reports, missed revenue projections, or negative analyst ratings. Careful review of Palantir news announcements around the time of the drop is necessary for a complete understanding.

Analyzing Palantir's Fundamentals

Despite the stock price decline, a thorough analysis of Palantir's fundamentals is essential. Key aspects to consider include:

-

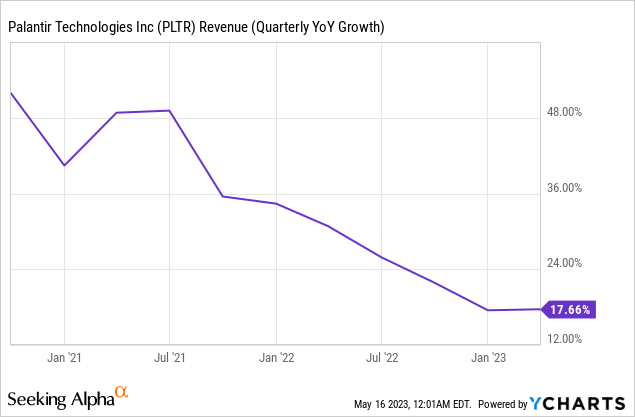

Revenue Growth: Palantir has shown significant revenue growth. Examining this trajectory and comparing it to projections is crucial in determining its long-term financial health and potential.

-

Profit Margins: While profitability remains a focus, analyzing current profit margins and projections is crucial to assess the company's efficiency and potential for future profitability.

-

Financial Health: Reviewing Palantir's debt levels and overall financial health paints a picture of its stability and long-term sustainability. High levels of debt can present significant risk.

-

Customer Acquisition and Retention: Analyzing customer acquisition and retention rates provides insight into Palantir's ability to attract and retain clients, a vital indicator of long-term success. High retention suggests a loyal customer base.

-

Key Performance Indicators (KPIs): Examining KPIs beyond revenue and profits—such as contract wins, platform usage, and customer satisfaction—provides a holistic view of Palantir's performance.

Evaluating Palantir's Long-Term Potential

Growth in the Government and Commercial Sectors

Palantir operates in two key markets: government and commercial. Both present significant growth opportunities.

-

Government Contracts: Palantir's government contracts are a significant source of revenue. Analyzing the potential for future contracts and the stability of this sector is essential.

-

Commercial Expansion: Palantir is actively expanding its commercial business. Identifying and analyzing its success in this area, exploring new applications, and evaluating potential partnerships will be key factors in determining Palantir's future success.

-

Technological Advantages: Assessing Palantir's technological advantages and its ability to innovate are crucial for evaluating its competitive position and long-term growth potential.

Assessing Palantir's Valuation

A crucial aspect of the Palantir investment decision is the valuation.

-

Peer Comparison: Comparing Palantir's valuation to similar companies in the data analytics sector helps determine whether the current price reflects its intrinsic value.

-

DCF Analysis: A discounted cash flow (DCF) analysis provides an estimate of Palantir's intrinsic value, a useful tool for assessing if the current price is undervalued or overvalued.

-

Valuation Metrics: Analyzing Palantir's price-to-earnings (P/E) ratio and other key valuation metrics, in light of the recent price drop, can help determine whether it's a buying opportunity.

Risk Assessment for Investing in Palantir Stock

Potential Downsides and Risks

Investing in Palantir stock carries inherent risks:

-

Stock Price Volatility: Palantir's stock price has historically been volatile. Investors must have a high risk tolerance.

-

Government Contract Dependence: The significant reliance on government contracts can make Palantir susceptible to changes in government policy or budget cuts.

-

Intense Competition: The competitive nature of the data analytics market presents a continuing risk.

-

Further Price Declines: The possibility of further price declines is a real consideration.

Mitigation Strategies for Investors

Investors can mitigate some risks by:

-

Portfolio Diversification: Diversifying investments across various asset classes can reduce overall portfolio risk.

-

Dollar-Cost Averaging: Investing smaller amounts over time reduces the impact of market volatility.

-

Long-Term Investment Horizon: A long-term perspective helps minimize the impact of short-term price fluctuations.

-

Thorough Due Diligence: Conducting comprehensive research and analysis before investing is crucial.

Conclusion

This article explored the recent 30% drop in Palantir stock, examining potential causes and analyzing the company's long-term prospects. While the substantial drop presents considerable risks, Palantir's potential for growth in both government and commercial sectors, coupled with its technological advantages, warrants careful consideration. Investors should conduct thorough due diligence, assessing their risk tolerance and long-term investment goals before making any decisions regarding Palantir stock. Weigh the potential upsides and downsides carefully and consult with a financial advisor if needed.

Call to Action: The 30% drop in Palantir stock presents a potentially significant opportunity, but it's crucial to conduct your own due diligence before deciding whether to invest in Palantir stock. Carefully consider your risk tolerance and long-term investment goals. Remember that past performance is not indicative of future results.

Featured Posts

-

Brekelmans Inzet Voor India Doelen En Uitdagingen

May 09, 2025

Brekelmans Inzet Voor India Doelen En Uitdagingen

May 09, 2025 -

Hoe Brekelmans India Zo Veel Mogelijk Aan Zijn Zijde Wil Houden

May 09, 2025

Hoe Brekelmans India Zo Veel Mogelijk Aan Zijn Zijde Wil Houden

May 09, 2025 -

Incendie A La Mediatheque Champollion De Dijon Premieres Informations

May 09, 2025

Incendie A La Mediatheque Champollion De Dijon Premieres Informations

May 09, 2025 -

Chinas Canola Supply Chain Adapting After Canada Relations Sour

May 09, 2025

Chinas Canola Supply Chain Adapting After Canada Relations Sour

May 09, 2025 -

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 09, 2025

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 09, 2025