400% Up: What's Next For XRP's Price?

Table of Contents

Ripple's Legal Victory and its Impact on XRP Price

The Ripple-SEC Lawsuit Resolution

The long-running legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) concluded with a partial victory for Ripple. The court ruled that XRP, when sold on exchanges, is not a security. This ruling dramatically impacted the XRP price, immediately boosting investor confidence and significantly reducing regulatory uncertainty surrounding XRP.

- Investor Confidence Rekindled: The court's decision largely removed the cloud of legal uncertainty that had hung over XRP for years. This restored investor confidence, leading to a significant influx of capital into the market.

- Regulatory Implications: While the ruling clarifies XRP's status in some jurisdictions, regulatory uncertainty remains in others. The impact of this decision on XRP's regulatory status in different countries and its overall global adoption will be crucial to monitor.

- Trading Volume and Market Capitalization Surge: Following the Ripple lawsuit outcome, XRP trading volume increased substantially, pushing its market capitalization higher. This reflected the increased demand and renewed interest in the asset.

Growing Adoption and Real-World Use Cases of XRP

XRP's Utility Beyond Speculation

XRP's value extends far beyond mere speculation. Its primary utility lies in facilitating fast, efficient, and cost-effective cross-border payments. This real-world utility is a key driver of its adoption and a critical factor in its price.

- Strategic Partnerships and Collaborations: Ripple has forged numerous partnerships with financial institutions globally, leveraging its XRP-powered On-Demand Liquidity (ODL) solution to streamline international payments. These partnerships demonstrate a tangible increase in XRP adoption.

- On-Demand Liquidity (ODL) Expansion: ODL utilizes XRP to facilitate near real-time cross-border transactions, reducing costs and processing times for financial institutions. The expansion of ODL networks is a strong indicator of growing XRP utility.

- New Integrations and Developments: The ongoing development of new applications and integrations using XRP further solidifies its position as a viable solution for financial transactions, enhancing its utility and potentially driving future price increases.

Market Sentiment and Technical Analysis of XRP

Predicting Future Price Movements

Analyzing current market sentiment and employing technical analysis tools are essential for gaining insight into potential future XRP price movements. While price prediction is inherently speculative, these methods provide valuable clues.

- Resistance and Support Levels: Technical analysis helps identify potential resistance and support levels for XRP's price, providing insights into potential price ceilings and floors. Breaking through significant resistance levels can signify further price appreciation.

- Broader Cryptocurrency Market Trends: The overall cryptocurrency market significantly impacts XRP's price. Positive market trends generally lift XRP, while bearish sentiment can put downward pressure on its price.

- Catalysts for Price Fluctuations: Announcements of new partnerships, regulatory developments, or significant technological advancements can act as catalysts, influencing both positive and negative price movements.

Risks and Challenges Facing XRP's Future

Potential Downsides and Uncertainties

Despite the positive momentum, several risks and challenges could hinder XRP's price growth. A realistic assessment of these factors is crucial for informed decision-making.

- Ongoing Regulatory Landscape: While the Ripple lawsuit outcome was positive, the regulatory landscape for cryptocurrencies remains dynamic and uncertain, and future legal challenges could still impact XRP's price.

- Competition from Other Cryptocurrencies: XRP faces competition from other cryptocurrencies offering similar functionalities. The competitive landscape will continue to evolve, potentially affecting XRP's market share and price.

- Macroeconomic Factors: Broader macroeconomic factors, such as inflation, economic recessions, or geopolitical instability, can negatively impact investor sentiment and XRP's price.

Conclusion: What's the Future of XRP Price?

The XRP price has experienced significant growth driven by Ripple's legal victory, increasing adoption through real-world use cases like ODL, and positive market sentiment. However, navigating the future requires awareness of potential risks, including ongoing regulatory challenges and competition. While predicting the exact XRP price is impossible, the factors discussed above paint a picture of a cryptocurrency with significant potential, but also considerable volatility. Stay informed about the latest news and analysis to make informed decisions regarding your XRP investments. Keep an eye on the evolving XRP price and its potential.

Featured Posts

-

222 Milione Euro Dhe Nje Cek Ne Arabisht Historia E Transferimit Te Neymar

May 08, 2025

222 Milione Euro Dhe Nje Cek Ne Arabisht Historia E Transferimit Te Neymar

May 08, 2025 -

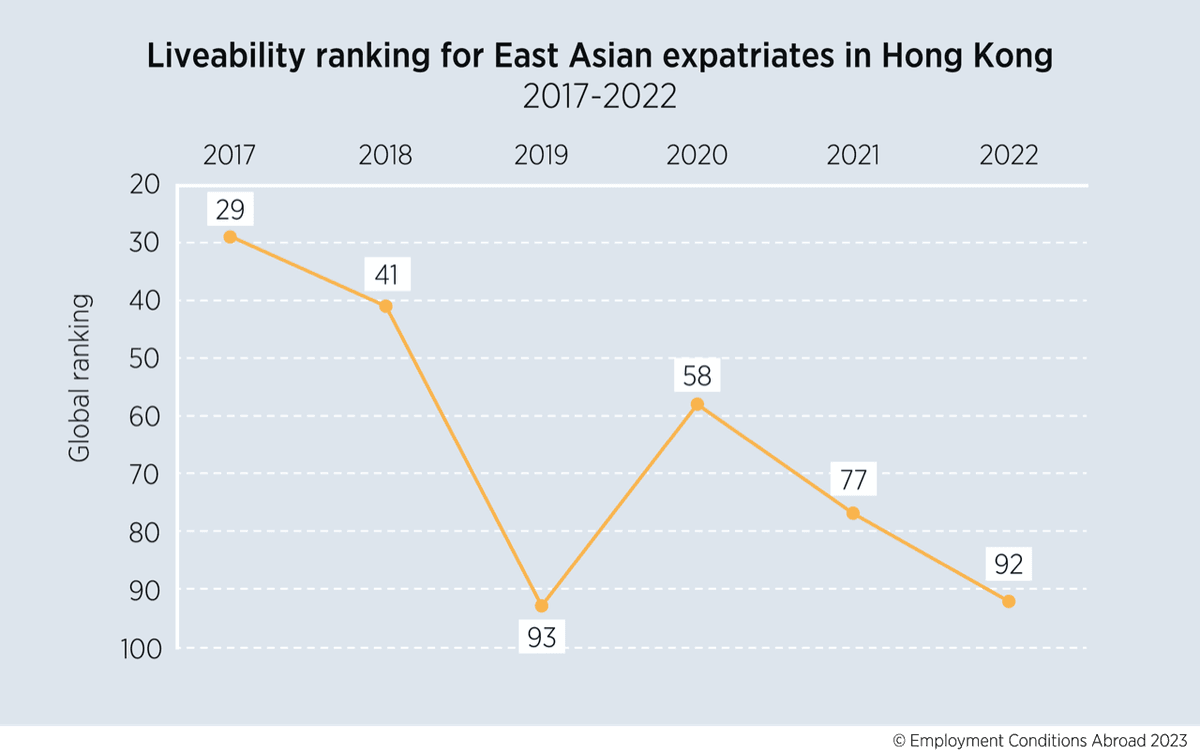

Hong Kong Dollar Plummets Interest Rates Biggest Drop Since 2008

May 08, 2025

Hong Kong Dollar Plummets Interest Rates Biggest Drop Since 2008

May 08, 2025 -

The Long Walk Movie Trailer Adaptation Of Stephen Kings Disturbing Novel

May 08, 2025

The Long Walk Movie Trailer Adaptation Of Stephen Kings Disturbing Novel

May 08, 2025 -

Who Is Penny Pritzker Examining The Billionaires Influence On Harvard

May 08, 2025

Who Is Penny Pritzker Examining The Billionaires Influence On Harvard

May 08, 2025 -

Xrp To 5 In 2025 A Comprehensive Price Prediction

May 08, 2025

Xrp To 5 In 2025 A Comprehensive Price Prediction

May 08, 2025