$584 Million: Dubai Holding Expands REIT Initial Public Offering

Table of Contents

The Expanded Offering: Details and Implications

The initial IPO size was significantly smaller, but the expansion to $584 million represents a substantial increase, reflecting a surge in investor interest and confidence in Dubai Holding's portfolio. This strategic move is driven by several factors:

- Increased Investor Demand: The initial offering was oversubscribed, indicating strong market appetite for Dubai real estate investments. The expansion allows Dubai Holding to capitalize on this high demand.

- Favorable Market Conditions: The current global economic climate, while presenting some challenges, has also created opportunities for investors seeking stable, high-growth markets like Dubai's.

- Strategic Growth Objectives: The expansion allows Dubai Holding to accelerate its growth plans within the REIT sector, further solidifying its position as a key player in the Dubai and global real estate market.

Key Figures:

- Initial IPO size: [Insert Initial IPO size here – find this information]

- Percentage increase: [Calculate the percentage increase from the initial to the expanded offering – find this information]

- New Assets Added: [List any newly added properties or assets included in the expanded offering – find this information]

- Projected ROI: [Insert projected ROI information if available – find this information]

Dubai Holding's Strategic Positioning in the REIT Market

Dubai Holding's expansion of its REIT IPO positions the company strategically within the dynamic Dubai and global REIT markets. The company enjoys several key competitive advantages:

- Prime Property Locations: Dubai Holding boasts a portfolio of high-quality properties in prime locations across Dubai, known for their strong rental yields and appreciation potential.

- Strong Management Team: A highly experienced and skilled management team provides expertise in property management, investment, and financial strategy.

- Diversified Portfolio: The REIT likely includes a mix of residential, commercial, and potentially hospitality assets, mitigating risk through diversification.

Competitive Landscape:

Several other REITs operate in Dubai, but Dubai Holding's expanded offering presents a compelling alternative due to its scale, strategic location, and the reputation of its parent company. A comparison with other REITs would highlight Dubai Holding's unique strengths.

Economic Impact: This significant investment will contribute positively to Dubai's overall economy, generating employment opportunities and boosting investor confidence in the emirate's long-term growth prospects.

Investor Interest and Market Response to the Expanded IPO

The market's response to the expanded IPO has been overwhelmingly positive. Preliminary indications suggest significant investor participation, driven by the attractive features of the offering.

Potential Risks and Rewards:

- Rewards: High potential returns on investment, diversification benefits, and exposure to a dynamic and growing real estate market.

- Risks: Market fluctuations, global economic uncertainties, and potential changes in government regulations. However, Dubai's robust regulatory environment and economic stability minimize these risks considerably.

Expert Opinions and Analysis:

[Insert relevant quotes from financial analysts or market experts regarding the IPO's success and outlook – find this information]

Future Growth:

The expanded REIT offers significant growth opportunities through future acquisitions and developments, further enhancing its value proposition for investors.

Analyzing the Appeal of Dubai Real Estate for Investors

Dubai's real estate market continues to attract significant international investment due to several compelling factors:

- Political Stability: Dubai offers a stable and secure investment environment, crucial for attracting long-term capital.

- Economic Growth: The emirate's diverse economy, driven by tourism, trade, and finance, creates a strong foundation for real estate appreciation.

- Tourism: Dubai's booming tourism sector fuels high demand for hospitality and residential properties.

Potential Risks and Mitigation Strategies:

- Market Fluctuations: While the market is strong, investors should be aware of the potential for short-term price fluctuations. Diversification within the REIT itself and a long-term investment horizon can mitigate this risk.

- Global Economic Conditions: Global economic downturns can impact real estate markets. Dubai's resilient economy and diversification offer a degree of insulation, but investors should consider this factor.

Market Trends and Future Projections:

[Include data on current market trends and future projections for Dubai real estate – find this information]

Conclusion: Dubai Holding's Expanded REIT IPO: A Promising Investment Opportunity

Dubai Holding's expansion of its REIT IPO to $584 million represents a significant development in the Dubai real estate market. The increased offering reflects strong investor confidence, favorable market conditions, and Dubai Holding's strategic vision for growth. This move strengthens Dubai's position as a leading investment destination and offers investors a compelling opportunity to participate in the continued growth of its real estate sector. Invest in Dubai's future; explore the Dubai Holding REIT IPO and learn more about this lucrative Dubai real estate investment opportunity. [Insert links to relevant resources here, if available.]

Featured Posts

-

Film Critics Weigh In An Assessment Of Jennifer Lawrences New Release

May 20, 2025

Film Critics Weigh In An Assessment Of Jennifer Lawrences New Release

May 20, 2025 -

Nyt Mini Crossword Answers Today March 20 2025 Hints And Clues

May 20, 2025

Nyt Mini Crossword Answers Today March 20 2025 Hints And Clues

May 20, 2025 -

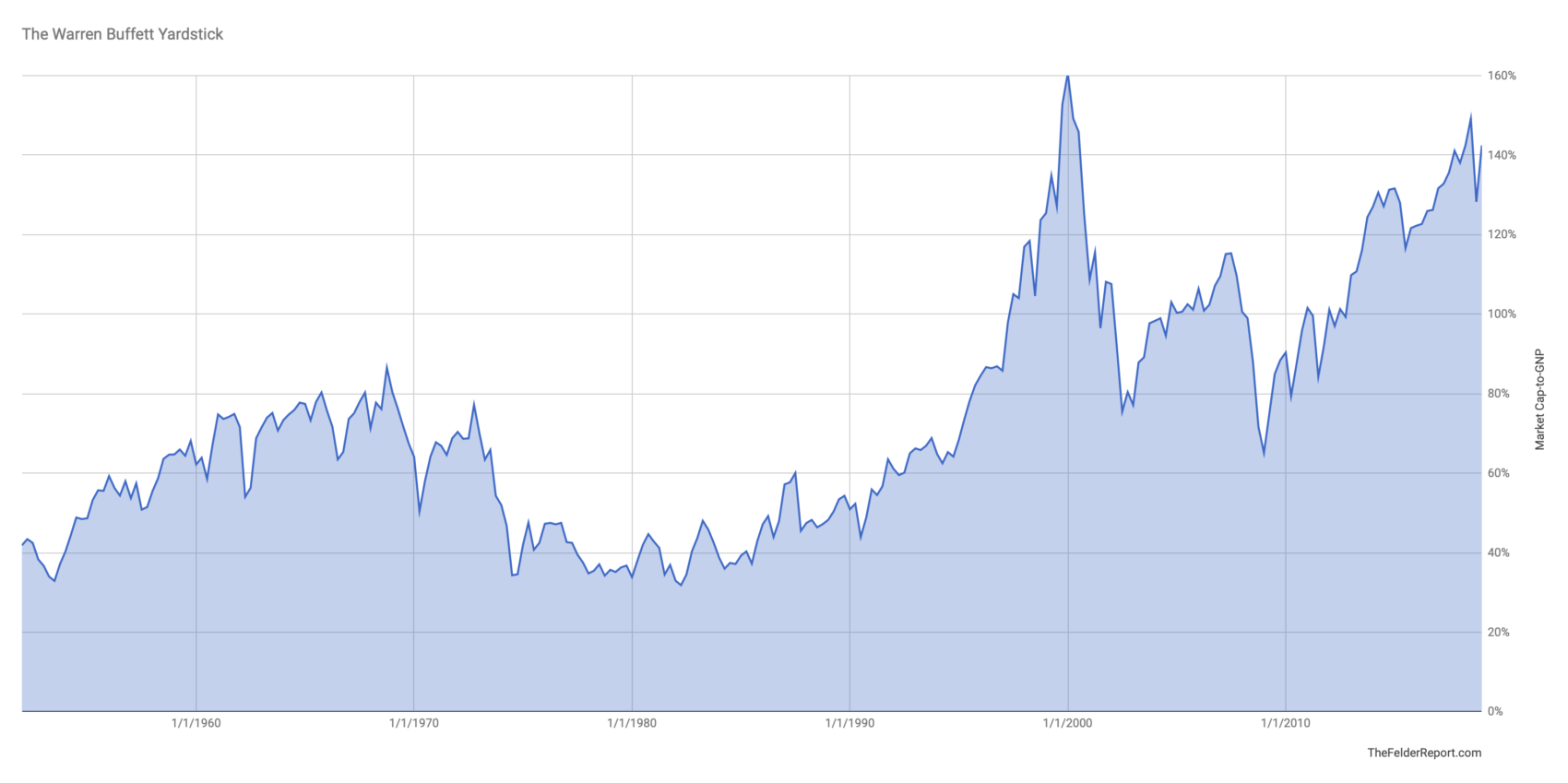

High Stock Market Valuations A Bof A Analysts Rationale For Calm

May 20, 2025

High Stock Market Valuations A Bof A Analysts Rationale For Calm

May 20, 2025 -

Hmrc Refunds Could Millions Be Entitled To A Payout

May 20, 2025

Hmrc Refunds Could Millions Be Entitled To A Payout

May 20, 2025 -

Agents Trip To Manchester World Class Striker Deal Imminent For Man Utd

May 20, 2025

Agents Trip To Manchester World Class Striker Deal Imminent For Man Utd

May 20, 2025

Latest Posts

-

The Paley Center Recognizes Gmas 50 Years Of Broadcasting

May 20, 2025

The Paley Center Recognizes Gmas 50 Years Of Broadcasting

May 20, 2025 -

Gmas 50th Anniversary A Celebration At The Paley Center

May 20, 2025

Gmas 50th Anniversary A Celebration At The Paley Center

May 20, 2025 -

Actor Ramon Rodriguez Will Trent Recounts Unexpected Scorpion Encounters

May 20, 2025

Actor Ramon Rodriguez Will Trent Recounts Unexpected Scorpion Encounters

May 20, 2025 -

Good Morning America Robin Roberts Announces Addition To Her Family

May 20, 2025

Good Morning America Robin Roberts Announces Addition To Her Family

May 20, 2025 -

Will Trents Ramon Rodriguez 3 Scorpion Stings During Sleep

May 20, 2025

Will Trents Ramon Rodriguez 3 Scorpion Stings During Sleep

May 20, 2025