High Stock Market Valuations: A BofA Analyst's Rationale For Calm

Table of Contents

BofA's Justification for Current High Valuations

While many point to high price-to-earnings (P/E) ratios as a sign of an overvalued market, BofA's analysis suggests a more nuanced perspective. Their justification rests on several key pillars: strong corporate earnings, low interest rates, and the potential fueled by technological innovation.

Strong Corporate Earnings and Profitability

Robust corporate earnings and healthy profit margins are providing a significant underpinning for current market valuations, even with seemingly high P/E ratios. This strong performance isn't uniform across all sectors, but several key areas are demonstrating impressive growth.

- Examples of Strong Performers: The technology sector, particularly companies focused on cloud computing and artificial intelligence, have shown exceptional earnings growth. Similarly, certain consumer staples and healthcare companies have maintained impressive profitability despite economic headwinds. (Specific company examples could be added here, depending on the current market situation and the BofA analyst's specific recommendations - e.g., "Companies like Microsoft and Alphabet have demonstrated consistent earnings growth, supporting higher valuations.")

- Data Supporting Profitability Growth: Data from Q[Insert relevant Quarter] earnings reports indicates a [Insert Percentage]% increase in overall corporate profitability compared to the same period last year. This sustained earnings growth helps to justify, at least partially, the elevated P/E ratios. Further analysis focusing on specific industry sectors would provide a more granular picture.

Low Interest Rates and Abundant Liquidity

The impact of persistently low interest rates and abundant liquidity cannot be overstated. The Federal Reserve's monetary policy, along with similar actions from central banks globally, has resulted in cheap capital. This has several ramifications for stock valuations:

- Impact on Borrowing Costs: Low interest rates reduce borrowing costs for companies, allowing them to invest more aggressively in growth initiatives and potentially increase future earnings.

- Investor Sentiment: The availability of cheap capital encourages investment, pushing up demand for stocks and consequently their prices. This effect is amplified by the search for yield in a low-interest-rate environment. Many investors see equities as a better alternative to low-yielding bonds.

Technological Innovation and Growth Potential

Technological innovation is a crucial driver of future growth expectations, justifying higher valuations. Disruptive technologies are transforming industries at an unprecedented pace, creating new markets and opportunities for substantial long-term growth.

- Examples of Technological Advancements: Advancements in artificial intelligence, machine learning, and the Internet of Things are impacting various sectors, from healthcare and finance to manufacturing and transportation. These transformative changes are projected to fuel significant earnings growth in the coming years.

- Impact on Future Earnings: The potential for these technological advancements to boost future earnings is a key factor supporting higher market valuations. Investors are willing to pay a premium for companies positioned to benefit from this technological revolution.

Addressing Potential Risks and Counterarguments

While BofA's analysis provides a compelling counter-narrative, it's crucial to acknowledge the potential risks and counterarguments.

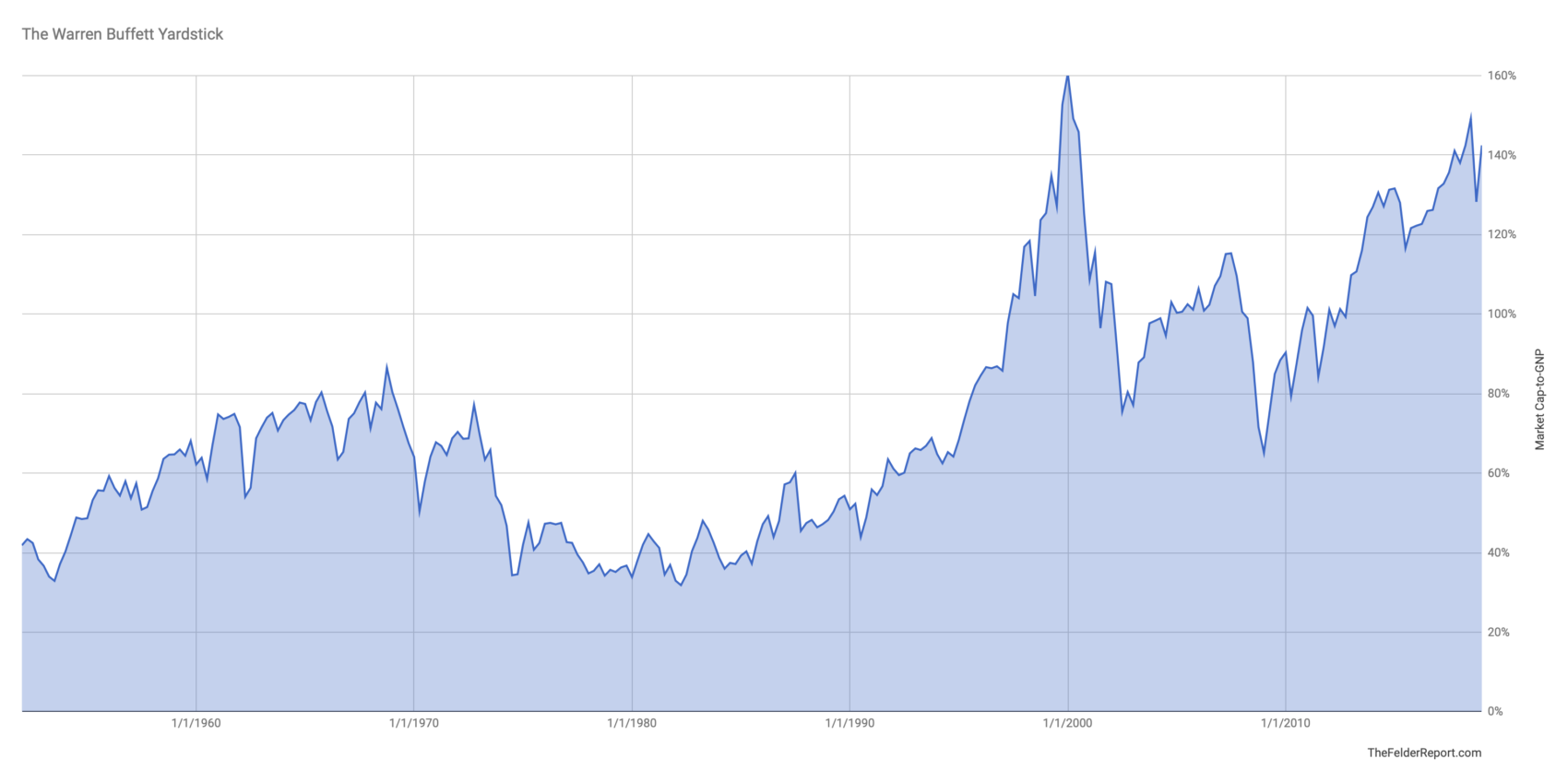

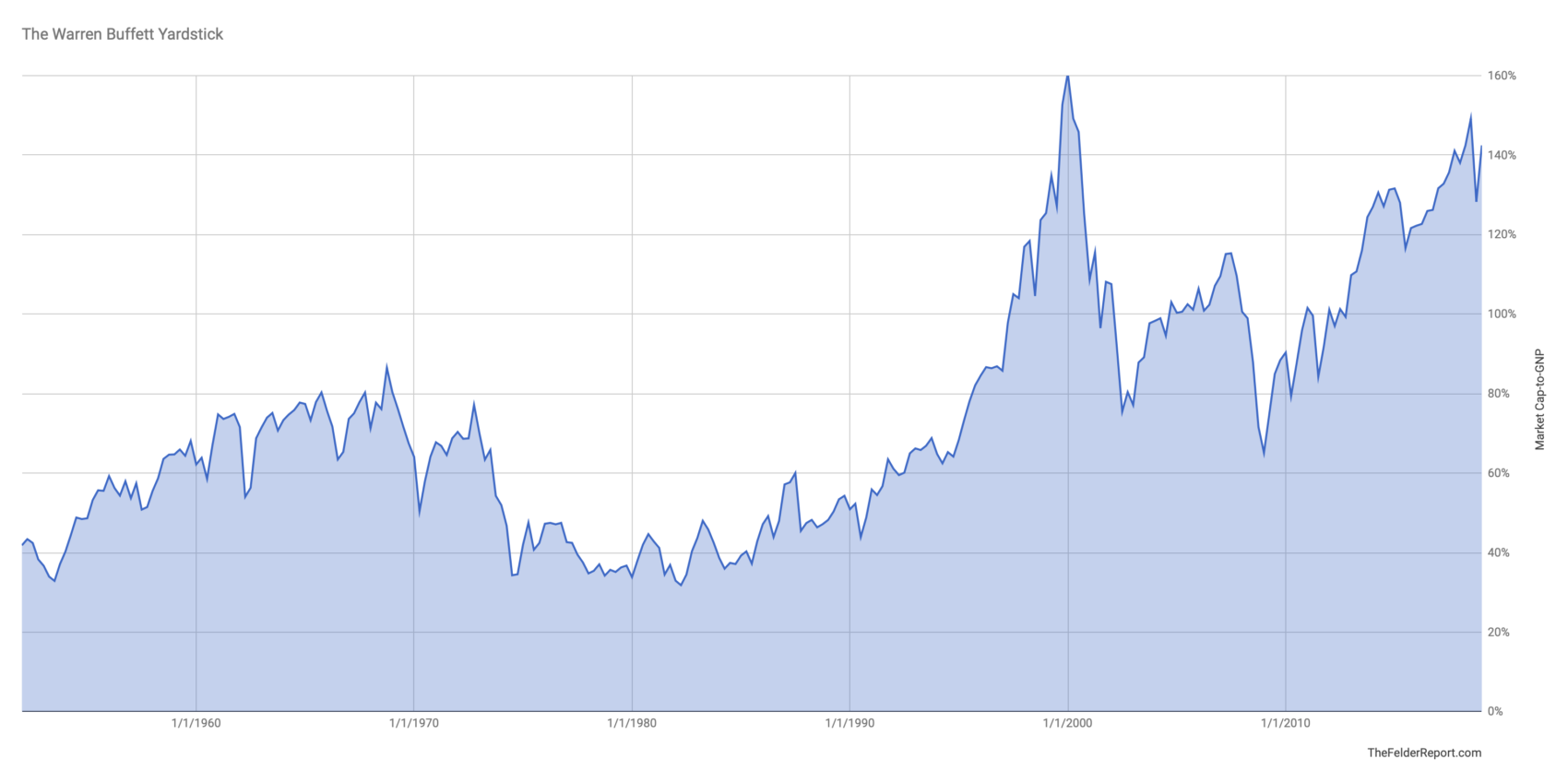

Valuation Metrics and Market Bubbles

Concerns about high valuation metrics and the potential for market bubbles are justified. Relying solely on P/E ratios can be misleading, particularly in periods of rapid growth and technological disruption.

- Alternative Valuation Metrics: Alternative valuation metrics such as the PEG ratio (Price/Earnings to Growth ratio) and Price-to-Sales ratio offer a more comprehensive picture. These ratios consider growth rates and sales figures, providing a more nuanced assessment of a company's value.

- Historical Examples of Market Bubbles: Examining historical examples of market bubbles, like the dot-com bubble of the late 1990s, highlights the dangers of excessive exuberance and the importance of diversification.

Geopolitical and Economic Uncertainty

Geopolitical risks, such as trade wars and political instability, coupled with economic uncertainty, can significantly impact stock market valuations.

- Potential Downside Risks: Factors like rising inflation, supply chain disruptions, and escalating geopolitical tensions pose potential downside risks to the current market. These risks need to be carefully considered in any stock market analysis.

- Impact of Macroeconomic Factors: Changes in macroeconomic factors, including interest rate hikes and shifts in consumer spending, can influence investor sentiment and lead to market corrections.

Navigating High Stock Market Valuations: A Calm Approach

BofA's analysis suggests that strong earnings, low interest rates, and technological innovation are currently supporting high stock market valuations. However, the potential risks associated with high valuation metrics and macroeconomic uncertainties must be acknowledged. High stock market valuations don't automatically signal an imminent crash; a balanced, long-term perspective is key. Investors should conduct thorough research, carefully consider their personal risk tolerance, and diversify their portfolios. Seeking professional financial advice is recommended before making any significant investment decisions related to high stock market valuations. For more in-depth information on stock market analysis and developing a robust investment strategy, visit [Insert Relevant Website Link Here].

Featured Posts

-

Jennifer Lawrence Antras Vaikas Naujausia Informacija Apie Aktores Seima

May 20, 2025

Jennifer Lawrence Antras Vaikas Naujausia Informacija Apie Aktores Seima

May 20, 2025 -

Understanding Your New Hmrc Tax Code Implications For Savings

May 20, 2025

Understanding Your New Hmrc Tax Code Implications For Savings

May 20, 2025 -

Philippines Should Withdraw Missile System Chinas Demand In South China Sea

May 20, 2025

Philippines Should Withdraw Missile System Chinas Demand In South China Sea

May 20, 2025 -

L Intelligence Artificielle Au Service De L Ecriture La Methode Agatha Christie

May 20, 2025

L Intelligence Artificielle Au Service De L Ecriture La Methode Agatha Christie

May 20, 2025 -

Reprise Du Bo Cafe A Biarritz De Nouveaux Gerants Experimentes

May 20, 2025

Reprise Du Bo Cafe A Biarritz De Nouveaux Gerants Experimentes

May 20, 2025

Latest Posts

-

Nyt Mini Crossword Hints For April 26 2025

May 20, 2025

Nyt Mini Crossword Hints For April 26 2025

May 20, 2025 -

Sabalenkas Top Ranking Confirmed Madrid Open Victory Over Mertens

May 20, 2025

Sabalenkas Top Ranking Confirmed Madrid Open Victory Over Mertens

May 20, 2025 -

Sabalenka Defeats Mertens Advances To Madrid Open Round Of 16

May 20, 2025

Sabalenka Defeats Mertens Advances To Madrid Open Round Of 16

May 20, 2025 -

Cobollis First Atp Title Bucharest Open Victory

May 20, 2025

Cobollis First Atp Title Bucharest Open Victory

May 20, 2025 -

Sabalenka Defeats Mertens In Madrid Open Top Ranked Showdown

May 20, 2025

Sabalenka Defeats Mertens In Madrid Open Top Ranked Showdown

May 20, 2025