ABN Amro: Dutch Central Bank To Impose Fine Over Bonuses?

Table of Contents

The DNB's Investigation into ABN Amro's Bonus Scheme

The DNB's investigation into ABN Amro's bonus scheme focuses on whether the bank's compensation structure aligns with responsible banking practices and complies with relevant Dutch banking regulations. This isn't an isolated incident; the DNB's financial supervision extends to all aspects of banking operations, with executive compensation being a key area of concern.

-

Regulatory Compliance: The investigation centers on whether ABN Amro's bonus scheme adequately mitigates the risk of excessive risk-taking. The DNB aims to ensure that bonuses don't incentivize short-term gains at the expense of long-term stability and responsible financial management. This is a crucial aspect of maintaining financial stability within the Netherlands.

-

Executive Compensation Scrutiny: The DNB is likely examining the criteria used to determine bonus payments, ensuring fairness and transparency. Questions might include whether the criteria adequately account for risk management and long-term performance, or if they disproportionately favor short-term profits. This falls under the broader scope of the DNB's oversight of executive compensation practices within the Dutch banking sector.

-

Financial Supervision and Prevention of Reckless Behavior: The investigation is part of a larger effort by the DNB to enhance financial stability and prevent reckless behavior within the Dutch banking sector. The DNB's actions reflect a growing global trend toward stricter regulation of financial institutions and a heightened focus on responsible corporate governance. The outcome will set a precedent for other banks operating within the Netherlands.

-

Investigation Timeline: The exact timeline of the investigation and the potential for further scrutiny remain unclear. However, the seriousness of the situation suggests that the DNB is thoroughly investigating ABN Amro's bonus practices and will take appropriate action based on its findings.

Potential Implications of a Fine for ABN Amro

The potential imposition of a fine by the DNB carries significant implications for ABN Amro and the broader Dutch financial landscape.

-

Financial Penalties and Profitability: A substantial financial penalty could significantly impact ABN Amro's financial performance and profitability, potentially leading to reduced shareholder returns. The size of the fine will directly influence the extent of this impact.

-

Reputational Damage and Investor Confidence: A fine would likely damage ABN Amro's reputation and erode investor confidence. This could lead to decreased market share and difficulties attracting and retaining top talent. Maintaining a strong reputation is vital for any financial institution.

-

Increased Regulatory Scrutiny and Stricter Enforcement: The case could trigger increased regulatory scrutiny of other Dutch banks, leading to stricter enforcement of bonus regulations across the board. Other institutions may face similar investigations and potential penalties.

-

Legal Challenges and Delays: ABN Amro might challenge the fine legally, potentially delaying the final outcome and prolonging the uncertainty surrounding the case. The legal process could add further complexity and costs.

ABN Amro's Response and Future Outlook

ABN Amro's official response to the DNB's investigation will be crucial in shaping the narrative and influencing the outcome. The bank's future actions will determine whether this serves as a learning experience or leads to more significant repercussions.

-

Corporate Response and Regulatory Reform: How ABN Amro responds will dictate public perception and influence future regulatory reforms. A proactive and transparent response could mitigate some of the negative consequences.

-

Adjusting Bonus Policies: The bank might need to revise its bonus policies to ensure greater alignment with regulatory requirements and promote responsible risk management. This could involve changes to the criteria for bonus payouts and a stronger emphasis on long-term performance.

-

Long-Term Impact on Risk Management: This investigation emphasizes the importance of robust risk management strategies for financial institutions. The potential fine underscores the need for thorough internal controls and risk assessments.

-

Influence on Executive Compensation Debate: This case will undoubtedly influence the broader debate surrounding executive compensation within the Dutch financial industry and potentially beyond. It will likely lead to a reassessment of bonus structures and compensation practices across many institutions.

Conclusion

The potential imposition of a fine on ABN Amro by the Dutch Central Bank underscores the ongoing challenge for financial institutions to navigate complex regulations concerning executive compensation. The outcome of the DNB investigation will have significant implications for ABN Amro's financial health, reputation, and potentially, the future of bonus structures within the Dutch banking sector. The focus on responsible banking practices and the consequences of non-compliance with bonus regulations are critical considerations for all financial institutions operating within the Netherlands.

Call to Action: Stay informed about the latest developments in this critical case by regularly checking our website for updates on the ABN Amro fine and the evolving landscape of Dutch banking regulations. Understanding the consequences of non-compliance with bonus regulations is crucial for all financial institutions.

Featured Posts

-

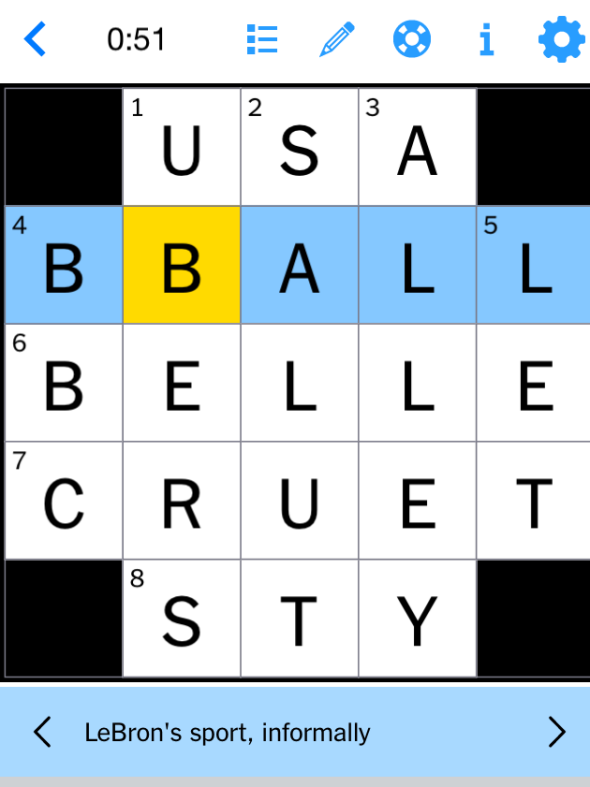

Nyt Mini Crossword Solutions April 26 2025

May 21, 2025

Nyt Mini Crossword Solutions April 26 2025

May 21, 2025 -

How Lack Of Funds Impacts Your Goals And What You Can Do

May 21, 2025

How Lack Of Funds Impacts Your Goals And What You Can Do

May 21, 2025 -

Amazon Workers Union Fight Quebec Tribunal Case Over Warehouse Shutdowns

May 21, 2025

Amazon Workers Union Fight Quebec Tribunal Case Over Warehouse Shutdowns

May 21, 2025 -

Ai Powered Blockchain Analysis Chainalysis And Alterya Combine Forces

May 21, 2025

Ai Powered Blockchain Analysis Chainalysis And Alterya Combine Forces

May 21, 2025 -

Gospodin Savrsen Vanja I Sime Nove Fotografije I Reakcije Obozavatelja

May 21, 2025

Gospodin Savrsen Vanja I Sime Nove Fotografije I Reakcije Obozavatelja

May 21, 2025

Latest Posts

-

Easy Nyt Mini Crossword Hints For April 26 2025

May 21, 2025

Easy Nyt Mini Crossword Hints For April 26 2025

May 21, 2025 -

Flavio Cobollis First Atp Title Bucharest Open Triumph

May 21, 2025

Flavio Cobollis First Atp Title Bucharest Open Triumph

May 21, 2025 -

Nyt Mini Crossword April 26 2025 Clue Assistance

May 21, 2025

Nyt Mini Crossword April 26 2025 Clue Assistance

May 21, 2025 -

Nyt Mini Crossword Puzzle Hints April 26 2025

May 21, 2025

Nyt Mini Crossword Puzzle Hints April 26 2025

May 21, 2025 -

Bucharest Tiriac Open Cobollis Maiden Atp Victory

May 21, 2025

Bucharest Tiriac Open Cobollis Maiden Atp Victory

May 21, 2025