Addressing China's Soybean Deficit: The Sinograin Auction

Table of Contents

Understanding China's Soybean Deficit

China's burgeoning soybean deficit stems from a significant gap between rapidly increasing demand and relatively stagnant domestic production.

Demand vs. Supply: A Widening Gap

The demand for soybeans in China is driven by several key factors:

- High demand for soybean meal for animal feed: China's massive livestock industry, fueled by a growing population and increasing meat consumption, requires enormous quantities of soybean meal for animal feed.

- Limited arable land suitable for soybean cultivation: China's arable land is constrained, and much of it is already dedicated to other crops. Expanding soybean cultivation faces significant limitations.

- Climate change impacting soybean yields: Erratic weather patterns and increasingly frequent extreme weather events negatively impact soybean yields across China.

- Growing demand for soybean oil: The demand for soybean oil for cooking and other industrial uses is also steadily rising.

This robust and growing demand far outstrips China's domestic production capacity. This imbalance leads to higher food prices, impacting both consumers and the profitability of businesses reliant on soybeans. The deficit underscores the critical importance of securing reliable and affordable soybean imports for China's food security.

The Sinograin Auction System

Sinograin, China's primary state-owned grain trader, plays a pivotal role in managing the country's soybean imports through a sophisticated auction system.

Mechanism and Process: Ensuring a Steady Supply

Sinograin's soybean auctions are a key mechanism for allocating imported soybeans to domestic processors and feed mills. The process typically involves:

- Frequent auctions: Auctions are held regularly to ensure a consistent supply of soybeans enters the market.

- Types of soybeans offered: Auctions include both domestically produced and imported soybeans, providing market participants with a diverse range of options.

- Target participants: Processors, feed mills, and other key players in the food and agricultural industries participate in these auctions.

- Transparency and pricing mechanisms: While the details of the auction mechanics are not always publicly available, the system aims to promote transparency and price discovery.

These auctions serve as a crucial mechanism for stabilizing soybean prices and ensuring that sufficient quantities reach the domestic market. The involvement of Sinograin, a state-owned enterprise, reflects the strategic importance of soybean supply for China's food security.

Effectiveness and Impact of Sinograin Auctions

The effectiveness of Sinograin auctions in mitigating China's soybean deficit is a subject of ongoing debate and analysis.

Price Stabilization: A Balancing Act

Analyzing the impact of Sinograin auctions on soybean prices reveals a mixed picture:

- Comparison of auction prices with global soybean prices: Auction prices often reflect, but don't always perfectly track, global soybean market prices. Factors like import tariffs and transportation costs influence the final price.

- Analysis of price volatility before and after the implementation of the auction system: The introduction of the auction system has arguably reduced extreme price swings compared to previous periods, but some volatility remains.

- Impact on the profitability of soybean processors and feed mills: The prices determined through these auctions directly influence the profitability of businesses across China's soybean processing and animal feed sectors.

While the Sinograin auctions have contributed to greater price stability, challenges remain in balancing the needs of domestic processors with the fluctuations of the international soybean market.

Future of Sinograin Auctions and China's Soybean Strategy

Looking ahead, the role of Sinograin auctions within China's broader agricultural policy will continue to evolve.

Policy Implications: A Long-Term Perspective

Future developments will likely be shaped by several interconnected factors:

- Government strategies to increase domestic soybean production: China is investing in research and development to improve soybean yields and expand domestic cultivation, aiming to reduce reliance on imports.

- Diversification of soybean import sources: Reducing dependence on a single supplier is a strategic priority for China, leading to increased efforts to diversify its import sources.

- The role of technology in improving soybean yields: Technological advancements, such as precision agriculture and improved seed varieties, hold significant potential to boost domestic soybean production.

- Potential impact of trade wars and geopolitical factors: International trade relations and geopolitical events can significantly impact China's ability to secure affordable soybean imports.

The future of Sinograin auctions is inextricably linked to the success of these broader policy initiatives. Their continued effectiveness will be crucial in addressing China's persistent soybean deficit and ensuring the country's long-term food security.

Conclusion: Navigating the Complexities of China's Soybean Market

China's soybean deficit presents a complex challenge requiring a multifaceted approach. Sinograin auctions serve as a vital tool in managing this deficit, contributing to price stability and ensuring a relatively consistent supply of soybeans to the domestic market. However, the effectiveness of these auctions is contingent upon the success of broader policy initiatives aimed at increasing domestic production, diversifying import sources, and adapting to the dynamic global soybean market. Understanding the dynamics of the Sinograin auction and its impact on China's soybean deficit is crucial for anyone involved in the global agricultural trade. Stay informed on future developments in the Chinese soybean market and the role of Sinograin auctions by following our updates on this important topic. Further research into China's soybean deficit and the Sinograin auction system is encouraged.

Featured Posts

-

Finding The Perfect Fit A Guide To The Nike Air Max 95 Og Big Bubble Hm 8755 001

May 29, 2025

Finding The Perfect Fit A Guide To The Nike Air Max 95 Og Big Bubble Hm 8755 001

May 29, 2025 -

I Nomiki Antiparathesi Tramp Me Ta Amerikanika Dikastiria

May 29, 2025

I Nomiki Antiparathesi Tramp Me Ta Amerikanika Dikastiria

May 29, 2025 -

Update Prakiraan Cuaca Besok 7 Mei 2024 Di Jawa Barat

May 29, 2025

Update Prakiraan Cuaca Besok 7 Mei 2024 Di Jawa Barat

May 29, 2025 -

Stock Journal Vater Machinerys New Holland Dealer Of The Year Win

May 29, 2025

Stock Journal Vater Machinerys New Holland Dealer Of The Year Win

May 29, 2025 -

Bryan Cranstons Net Worth In 2025 A Comprehensive Look At His Earnings

May 29, 2025

Bryan Cranstons Net Worth In 2025 A Comprehensive Look At His Earnings

May 29, 2025

Latest Posts

-

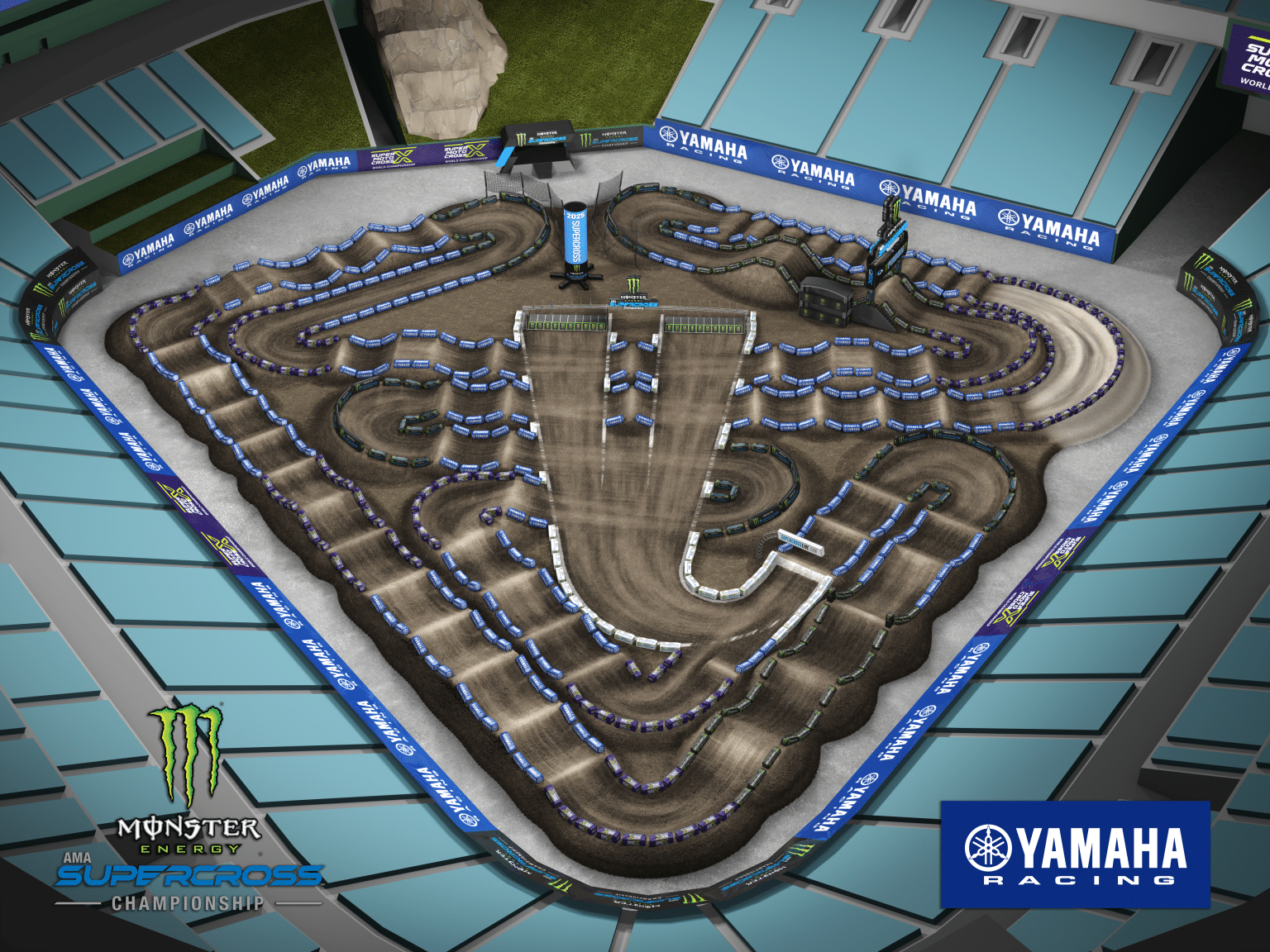

2025 Birmingham Supercross Updated Results For Round 10

May 31, 2025

2025 Birmingham Supercross Updated Results For Round 10

May 31, 2025 -

Rbc Earnings Miss Estimates Amidst Rising Loan Concerns

May 31, 2025

Rbc Earnings Miss Estimates Amidst Rising Loan Concerns

May 31, 2025 -

Posthaste Understanding The Implications Of The Recent Tariff Decision For Canada

May 31, 2025

Posthaste Understanding The Implications Of The Recent Tariff Decision For Canada

May 31, 2025 -

Birmingham Supercross Round 10 2025 Complete Results

May 31, 2025

Birmingham Supercross Round 10 2025 Complete Results

May 31, 2025 -

Provincial Regulations The Key To Accelerating Home Construction

May 31, 2025

Provincial Regulations The Key To Accelerating Home Construction

May 31, 2025