Addressing Investor Concerns About High Stock Market Valuations: BofA

Table of Contents

BofA's Perspective on Current Market Valuations

BofA's market outlook provides crucial insights into the current state of stock market valuations. Their analysts employ a multifaceted approach, considering various valuation metrics and market sentiment to paint a comprehensive picture.

-

BofA's Assessment: BofA's assessment of current stock market valuations often involves a nuanced perspective, acknowledging that some sectors might be overvalued while others appear reasonably priced. They rarely offer a simple "overvalued" or "undervalued" blanket statement. Instead, they emphasize the need for sector-specific analysis.

-

Key Valuation Metrics: BofA utilizes a range of metrics to assess valuations, including:

- Price-to-Earnings (P/E) ratios: Comparing a company's stock price to its earnings per share. High P/E ratios often indicate higher valuations.

- Shiller P/E (Cyclically Adjusted Price-to-Earnings ratio): This metric smooths out earnings fluctuations over time, providing a more stable valuation measure. A high Shiller P/E suggests potential overvaluation.

- Dividend Yields: The annual dividend payment relative to the stock price. Lower dividend yields often accompany higher valuations, reflecting investor expectations of future growth.

-

BofA's Market Outlook: BofA’s outlook, while subject to change, frequently highlights the importance of considering macroeconomic factors alongside valuation metrics. Their reports often caution against making overly simplistic conclusions based on valuation multiples alone. They stress the need for a holistic approach, factoring in future earnings growth potential and overall economic conditions.

-

Specific Examples: BofA's research often includes specific examples from their reports. For instance, they might highlight particular sectors showing signs of overvaluation based on their analysis of P/E ratios and industry growth prospects. Regularly reviewing BofA's published research provides real-time insights into their evolving assessment of market valuations.

Factors Contributing to High Stock Market Valuations

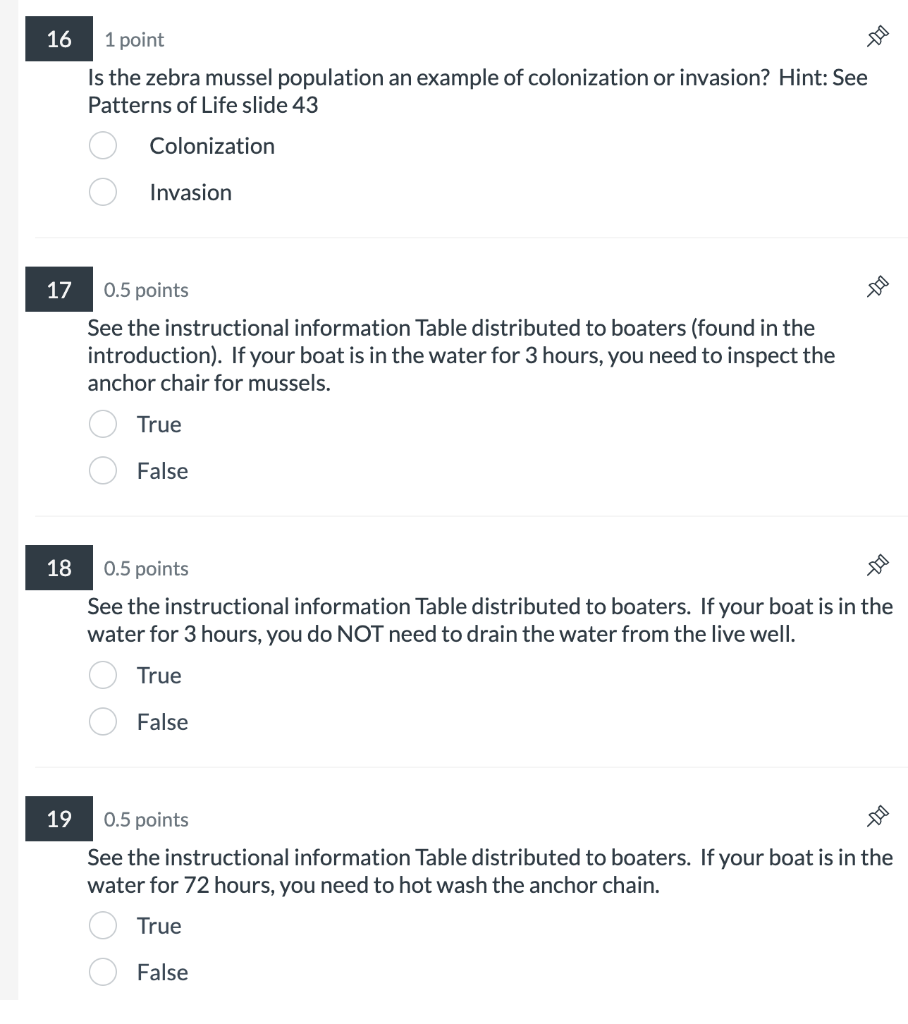

Several interconnected factors contribute to the current elevated stock market valuations. Understanding these factors is critical to developing a sound investment strategy.

-

Low Interest Rates: Historically low interest rates make bonds less attractive relative to stocks. This pushes investors towards equities, increasing demand and driving up prices.

-

Quantitative Easing (QE): Central bank policies like QE inject liquidity into the financial system, lowering borrowing costs and stimulating investment, potentially leading to inflated asset prices.

-

Economic Growth Projections: Positive economic growth forecasts and expectations of strong corporate earnings contribute to higher valuations, as investors anticipate future returns.

-

Inflation: While inflation can negatively impact some sectors, moderate inflation can often be viewed positively, especially when accompanied by wage growth. This can boost consumer spending and corporate profits, further supporting stock prices. However, high and uncontrolled inflation presents a significant risk.

-

Investor Sentiment and Speculation: Market psychology plays a crucial role. High investor confidence and speculative trading can further inflate valuations, sometimes beyond what fundamental analysis would suggest.

Assessing the Risks Associated with High Valuations

High stock market valuations inherently carry increased risk. While the market can continue to rise, understanding the potential downsides is crucial for prudent investment.

-

Market Correction/Crash: Overvalued markets are susceptible to sharp corrections or even crashes. A sudden shift in investor sentiment or an unexpected economic event could trigger a significant downturn.

-

Sector-Specific Risks: Not all sectors are equally overvalued. Investing in highly valued sectors increases the risk of disproportionate losses during a market correction.

-

Amplified Losses: High valuations can amplify losses during market downturns. The higher the initial price, the greater the potential percentage decline.

Strategies for Managing Investor Concerns

Managing investor concerns regarding high stock market valuations requires a proactive and diversified approach.

-

Portfolio Diversification: Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors reduces your overall risk exposure. Don't put all your eggs in one basket.

-

Defensive Investing: During periods of high valuations, a more defensive approach may be warranted. This could involve:

- Value Investing: Focusing on undervalued companies with strong fundamentals.

- Dividend-Paying Stocks: Prioritizing companies with a history of paying consistent dividends, providing a steady income stream.

-

Long-Term Investment Strategy: A long-term investment horizon helps to weather short-term market fluctuations. Avoid impulsive decisions based on short-term market movements.

-

Regular Portfolio Rebalancing: Periodically rebalancing your portfolio ensures your asset allocation aligns with your risk tolerance and long-term goals.

-

Professional Financial Advice: Seeking advice from a qualified financial advisor can provide personalized guidance based on your individual circumstances and risk profile.

Conclusion

BofA's analysis of high stock market valuations offers valuable insights for investors. While the current market presents opportunities, it’s crucial to acknowledge the associated risks and implement effective risk management strategies. Understanding the factors contributing to high valuations and diversifying your portfolio are key to navigating this environment.

Call to Action: Stay informed about BofA's ongoing analysis of high stock market valuations and adapt your investment strategy accordingly. By proactively addressing your concerns and making informed decisions, you can build a resilient investment portfolio that can withstand market volatility. Don't hesitate to seek professional advice to better understand how to manage your investments in light of these high stock market valuations.

Featured Posts

-

Funbox Mesa Arizonas First Permanent Indoor Bounce Park

May 22, 2025

Funbox Mesa Arizonas First Permanent Indoor Bounce Park

May 22, 2025 -

Defiez Vos Amis Quiz Sur La Loire Atlantique

May 22, 2025

Defiez Vos Amis Quiz Sur La Loire Atlantique

May 22, 2025 -

The Thames Water Bonus Controversy Examining Executive Compensation

May 22, 2025

The Thames Water Bonus Controversy Examining Executive Compensation

May 22, 2025 -

Large Zebra Mussel Population Found On Casper Boat Lift

May 22, 2025

Large Zebra Mussel Population Found On Casper Boat Lift

May 22, 2025 -

Second Gray Wolf From Colorado Dies After Relocation To Wyoming

May 22, 2025

Second Gray Wolf From Colorado Dies After Relocation To Wyoming

May 22, 2025

Latest Posts

-

Why Did Core Weave Inc Crwv Stock Price Soar On Thursday

May 22, 2025

Why Did Core Weave Inc Crwv Stock Price Soar On Thursday

May 22, 2025 -

The Status Of Blake Lively And Taylor Swifts Friendship Post Lawsuit

May 22, 2025

The Status Of Blake Lively And Taylor Swifts Friendship Post Lawsuit

May 22, 2025 -

Core Weave Crwv Stock Surge Understanding Thursdays Jump

May 22, 2025

Core Weave Crwv Stock Surge Understanding Thursdays Jump

May 22, 2025 -

Blake Lively And Taylor Swift Reconciliation Rumors Amidst Recent Legal Troubles

May 22, 2025

Blake Lively And Taylor Swift Reconciliation Rumors Amidst Recent Legal Troubles

May 22, 2025 -

The Blake Lively Taylor Swift Dispute A Look At The Leaked Texts And Blackmail Claims

May 22, 2025

The Blake Lively Taylor Swift Dispute A Look At The Leaked Texts And Blackmail Claims

May 22, 2025