Amsterdam Exchange Down 2% Following Latest Trump Tariff Announcement

Table of Contents

Immediate Market Reactions to the Tariff Announcement

The announcement triggered an immediate and sharp reaction within the Amsterdam Exchange. Various sectors felt the impact, with technology and financial stocks experiencing some of the most significant declines. The immediate impact was palpable:

-

Sharp decline in specific stocks: Shares of ASML Holding, a major player in the semiconductor industry, saw a noticeable drop, mirroring similar declines in other technology companies listed on the Amsterdam Exchange. Other prominent companies like Unilever and ING also experienced significant price reductions. Specific figures will need to be added here once they are available from reputable financial sources.

-

Increased trading volume: The increased trading volume reflected investor anxiety and a rush to react to the news. This surge in activity indicated a heightened level of uncertainty and a scramble to adjust portfolios based on the perceived risk. Data on increased trading volume from the Amsterdam Stock Exchange (Euronext Amsterdam) would strengthen this point.

-

Flight to safety: A noticeable flight to safety was observed, as investors sought refuge in more stable assets. This manifested in increased demand for government bonds and other safe-haven assets, a classic response to market uncertainty. This shift away from riskier investments further contributed to the decline in the Amsterdam Exchange.

Underlying Causes Beyond the Tariff Announcement

While the Trump tariff announcement served as the immediate catalyst, several underlying factors likely exacerbated the decline in the Amsterdam Exchange. These pre-existing conditions contributed to a market already sensitive to negative news.

-

Existing economic uncertainties in Europe: Sluggish economic growth in several European countries created a fragile environment vulnerable to external shocks like the tariff announcement. This pre-existing weakness amplified the impact of the news.

-

Geopolitical tensions impacting investor confidence: Ongoing geopolitical tensions, including the ongoing conflict in Ukraine, contribute to a climate of uncertainty, making investors more risk-averse. This uncertainty further dampened investor sentiment and exacerbated the market downturn.

-

Potential impact of Brexit lingering effects: The lingering effects of Brexit continue to impact investor confidence in the European market, creating an environment susceptible to further negative shocks. The uncertainty related to trade relations between the UK and the EU contributes to market volatility.

-

Internal factors within the Dutch economy: While the Dutch economy remains relatively strong, internal factors, such as potential regulatory changes or concerns about specific sectors, could have contributed to the negative sentiment. Analysis of domestic economic indicators would be necessary to fully assess this point.

Analysis of the Long-Term Implications for Investors

The 2% drop in the Amsterdam Exchange presents both risks and opportunities for investors. The long-term effects will depend on several factors, including the duration and extent of trade tensions and the response of governments and businesses.

-

Opportunities to buy low: The decline presents potential opportunities for long-term investors to acquire assets at reduced prices in affected sectors. This is particularly true for companies with strong fundamentals that have been unfairly impacted by the market downturn.

-

Risks associated with continued trade uncertainty: Continued trade uncertainty poses a significant risk, potentially leading to further market volatility and prolonged economic uncertainty. Investors should carefully assess their risk tolerance before making any investment decisions.

-

Recommendations for portfolio diversification: Diversification remains crucial to mitigate risks in a volatile market. Investors should consider diversifying their portfolios across different asset classes and geographies to reduce their overall exposure to risk.

-

Importance of long-term investment strategies: A long-term investment horizon is essential to weather market fluctuations. Focusing on the long-term prospects of companies and the overall health of the economy is critical for successful investing.

Potential Government Responses and Their Impact

The Dutch government may implement measures to mitigate the negative effects of the tariff announcement on the Amsterdam Exchange. Potential responses include:

-

Government stimulus packages or tax breaks: Stimulus packages targeted at affected sectors could help boost economic activity and investor confidence. Tax breaks for businesses could also encourage investment and job creation.

-

Negotiations with the US government to reduce trade barriers: Direct negotiations with the US government to resolve trade disputes could be crucial in alleviating concerns and stabilizing the market.

-

Support for affected businesses: Providing direct support to businesses affected by the tariffs, such as financial aid or assistance in accessing new markets, could help prevent widespread job losses and economic decline.

The effectiveness of these measures will significantly influence the future trajectory of the Amsterdam Exchange. A strong and swift response from the government could help to mitigate the long-term negative consequences.

Conclusion

The 2% drop in the Amsterdam Exchange following President Trump's latest tariff announcement underscores the fragility of global markets and the significant impact of trade policy. Several factors beyond the tariffs contributed to this decline, creating both risks and opportunities for investors. Understanding the complexities of the Amsterdam Exchange and global market fluctuations is crucial for navigating the complexities of investment in these volatile times.

Call to Action: Stay informed about developments in the Amsterdam Exchange and global trade to make informed investment decisions. Monitor the Amsterdam Exchange closely for further updates and consider consulting with a financial advisor to develop a suitable investment strategy for navigating these uncertain times.

Featured Posts

-

Evroviziya 2014 Kde E Sega Konchita Vurst

May 25, 2025

Evroviziya 2014 Kde E Sega Konchita Vurst

May 25, 2025 -

Major Gun Trafficking Bust In Massachusetts 18 Brazilian Nationals Face Charges

May 25, 2025

Major Gun Trafficking Bust In Massachusetts 18 Brazilian Nationals Face Charges

May 25, 2025 -

Actress Mia Farrow Sounds Alarm Is American Democracy On A 3 4 Month Timer

May 25, 2025

Actress Mia Farrow Sounds Alarm Is American Democracy On A 3 4 Month Timer

May 25, 2025 -

Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 25, 2025

Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 25, 2025 -

Trumps Tariff Decision 8 Jump In Euronext Amsterdam Stock Trading

May 25, 2025

Trumps Tariff Decision 8 Jump In Euronext Amsterdam Stock Trading

May 25, 2025

Latest Posts

-

The Rtx 5060 Launch What Gamers And Reviewers Should Learn

May 25, 2025

The Rtx 5060 Launch What Gamers And Reviewers Should Learn

May 25, 2025 -

Luxury And Politics A Look At Presidential Seals 100 000 Watches And High End Events

May 25, 2025

Luxury And Politics A Look At Presidential Seals 100 000 Watches And High End Events

May 25, 2025 -

Nvidias Rtx 5060 Debacle Exposes Issues In Gpu Reviews

May 25, 2025

Nvidias Rtx 5060 Debacle Exposes Issues In Gpu Reviews

May 25, 2025 -

Nvidia Rtx 5060 Review A Wake Up Call For Gamers

May 25, 2025

Nvidia Rtx 5060 Review A Wake Up Call For Gamers

May 25, 2025 -

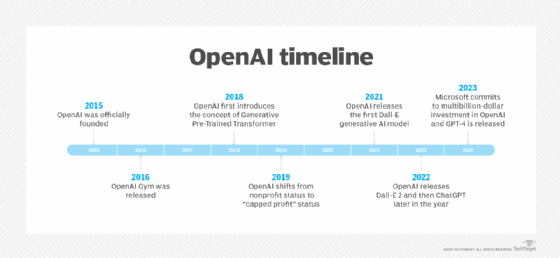

The Battle For Ai Supremacy Analyzing Googles I O And Open Ais Io Strategies

May 25, 2025

The Battle For Ai Supremacy Analyzing Googles I O And Open Ais Io Strategies

May 25, 2025