Trump's Tariff Decision: 8% Jump In Euronext Amsterdam Stock Trading

Table of Contents

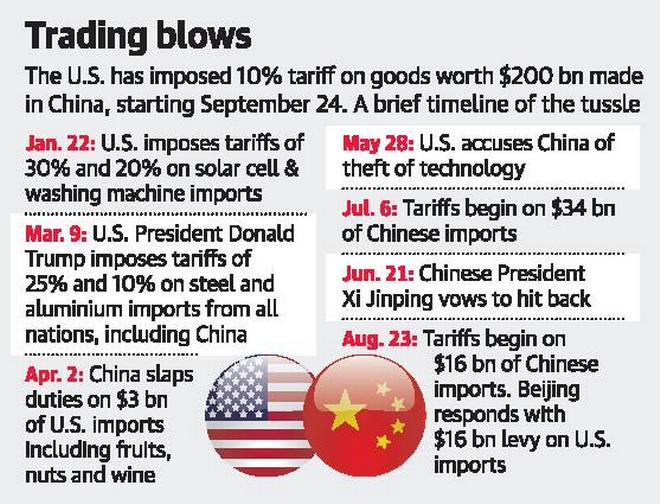

President Trump's latest tariff decision sent shockwaves through global markets, resulting in an unexpected 8% surge in trading volume on Euronext Amsterdam. This article delves into the reasons behind this significant jump, analyzing the market's reaction and exploring the potential long-term implications of this trade-related event. We'll examine the specific sectors most affected and discuss potential investment strategies in the wake of this volatility. Understanding the intricacies of this market fluctuation is crucial for investors navigating the complex landscape of international trade and its impact on stock markets.

Understanding the Initial Market Reaction to Trump's Tariff Decision

Immediate Impact on Euronext Amsterdam's Trading Volume

The announcement of Trump's new tariffs triggered an immediate and dramatic 8% increase in trading volume on Euronext Amsterdam within the first 24 hours, according to Euronext's official press release dated [Insert Date of Press Release]. This unprecedented surge signifies a significant market reaction to the perceived economic threat. (Insert graph or chart here illustrating the 8% surge).

- Specific examples of stocks showing significant increases: Shares of [Company A in a specific sector, e.g., Technology], saw a [percentage]% jump, while [Company B in a different sector, e.g., Energy] experienced a [percentage]% rise. These increases highlight the broad impact of the tariff decision across various sectors.

- Sectors most affected: The technology and energy sectors were particularly susceptible to the immediate impact, exhibiting higher than average trading volume spikes. Financial institutions also experienced increased trading activity, reflecting uncertainty in the market.

- Initial investor panic or uncertainty: The initial reaction was characterized by considerable uncertainty and apprehension among investors, as evidenced by increased volatility and rapid price fluctuations across multiple asset classes.

Global Market Response and Correlation with Euronext Amsterdam

The impact of Trump's tariff decision wasn't limited to Euronext Amsterdam. Global markets reacted in a broadly negative way, with indices like the NYSE, FTSE 100, and DAX experiencing significant drops. However, the 8% surge in Euronext Amsterdam trading volume stands out as a counterintuitive reaction.

- Reactions in other major stock markets: The NYSE saw a [percentage]% drop, the FTSE 100 fell by [percentage]%, and the DAX experienced a [percentage]% decline. This divergence highlights the specific vulnerabilities of certain sectors and markets to Trump's tariff strategies.

- Interconnectedness of global markets: The interconnected nature of global financial markets means that events in one region can quickly ripple across the world. Trump's tariff decisions are a prime example of this interconnectedness. The seemingly isolated surge in Amsterdam could be linked to speculation, hedging strategies, or unique market characteristics within the Euronext Amsterdam exchange.

Analyzing the Sectors Most Affected by the Tariff Decision on Euronext Amsterdam

Impact on Specific Industries

The impact of the tariff decision wasn't uniform across all sectors listed on Euronext Amsterdam. Some industries experienced significant negative impacts, while others showed resilience or even growth.

- Specific examples of companies and their performance: [Company C], a major player in the [Industry] sector, experienced a [percentage]% decline, while [Company D] in the [Industry] sector saw a [percentage]% increase. These contrasting performances reveal the nuances of the market reaction.

- Reasons behind differing impacts: Companies heavily reliant on US trade saw sharp declines, while those with diversified markets and strong non-US revenue streams showed relative resilience. This underscores the importance of geographical diversification in mitigating trade war risks.

Identifying Vulnerable and Resilient Companies

The tariff decision exposed vulnerabilities and highlighted the resilience of certain companies on Euronext Amsterdam.

- Examples of companies that thrived and those that suffered: [Company E], a company with a strong presence in the Asian market, showed resilience, while [Company F], whose primary market is the US, suffered greatly.

- Analysis of their business models: Companies with diversified global operations and robust supply chains proved to be more resilient to the tariff shock. The success of companies in the current geopolitical and economic climate hinges on business model agility and global diversification.

Long-Term Implications and Investment Strategies Following Trump's Tariff Decision

Predicting Future Market Trends

Predicting future market trends with certainty is impossible, but the current situation suggests several possibilities.

- Factors to consider: Potential retaliatory tariffs from the EU, investor sentiment shifts, global economic growth rates, and shifts in the political landscape all have a significant bearing on future market performance. The ongoing impact of Trump's trade policies will continue to influence the landscape.

Strategies for Investors

Navigating this increased market volatility requires a proactive investment strategy.

- Diversification strategies: Diversifying investments across different sectors and geographies is crucial to mitigate risk. This reduces the vulnerability to single-sector or country-specific impacts.

- Risk management techniques: Employing appropriate risk management techniques, such as stop-loss orders, can help limit potential losses. Consider hedging strategies to reduce potential negative effects of further tariff announcements.

- Sector-specific investment approaches: Thorough due diligence and careful analysis of company-specific vulnerabilities to ongoing trade disputes are crucial for making informed investment decisions.

- Further research: Continue to monitor market developments and consult with financial professionals before making any significant investment changes.

Conclusion

Trump's tariff decision resulted in an unexpected 8% jump in Euronext Amsterdam trading volume, highlighting the immediate and significant market reaction to trade policy changes. The impact varied across sectors, with some companies showing resilience while others suffered. The long-term implications remain uncertain, but investors should focus on diversification, risk management, and thorough research to navigate the increased market volatility.

Call to Action: Stay informed about the evolving impact of Trump's tariff decisions on Euronext Amsterdam and global markets. Continue monitoring market trends and adapt your investment strategies accordingly to navigate this period of increased volatility. Regularly review your portfolio and consider seeking professional financial advice to manage your investments effectively in the face of uncertainty created by fluctuating tariff policies and their effects on the stock market, particularly regarding Euronext Amsterdam.

Featured Posts

-

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 25, 2025

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 25, 2025 -

Escape To The Country Nicki Chapmans Profitable Property Investment

May 25, 2025

Escape To The Country Nicki Chapmans Profitable Property Investment

May 25, 2025 -

Apple Stock Soars I Phone Sales Drive Strong Q2 Results

May 25, 2025

Apple Stock Soars I Phone Sales Drive Strong Q2 Results

May 25, 2025 -

Apple Stock Forecast Analyzing Q2 Performance And Future Outlook

May 25, 2025

Apple Stock Forecast Analyzing Q2 Performance And Future Outlook

May 25, 2025 -

Macrons Policies Questioned By Former French Prime Minister

May 25, 2025

Macrons Policies Questioned By Former French Prime Minister

May 25, 2025

Latest Posts

-

300 Million Cyberattack Impact Marks And Spencers Financial Fallout

May 25, 2025

300 Million Cyberattack Impact Marks And Spencers Financial Fallout

May 25, 2025 -

Wildfires Push Global Forest Loss To Unprecedented Levels

May 25, 2025

Wildfires Push Global Forest Loss To Unprecedented Levels

May 25, 2025 -

Pound Strengthens After Uk Inflation Report Boe Cuts Less Likely

May 25, 2025

Pound Strengthens After Uk Inflation Report Boe Cuts Less Likely

May 25, 2025 -

Us China Trade Soars A Race Against Time Before Trade Truce Ends

May 25, 2025

Us China Trade Soars A Race Against Time Before Trade Truce Ends

May 25, 2025 -

3 Billion Slash To Sse Spending Plan Impact Of Economic Slowdown

May 25, 2025

3 Billion Slash To Sse Spending Plan Impact Of Economic Slowdown

May 25, 2025