Amundi DJIA UCITS ETF: A Guide To Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the underlying value of an ETF's holdings. It's a critical metric for evaluating an ETF's true worth, independent of short-term market price fluctuations. For ETFs like the Amundi DJIA UCITS ETF, which track an index like the Dow Jones Industrial Average, understanding the NAV is key to assessing its performance and making sound investment choices.

The NAV calculation for ETFs is relatively straightforward. It involves summing the market value of all the assets held within the ETF's portfolio (in this case, the stocks comprising the Dow Jones Industrial Average). From this total, any liabilities, such as expenses and fees, are deducted. This final figure is then divided by the total number of outstanding shares to arrive at the NAV per share. This calculation is performed daily, and the NAV is usually published at the close of market trading hours.

- NAV reflects the underlying asset value of the ETF. This means it shows the true value of the assets the ETF owns, regardless of what the market price might be at any given moment.

- It's calculated by summing the market value of all holdings and deducting liabilities. This ensures a precise representation of the ETF's net worth.

- NAV per share is obtained by dividing the total NAV by the number of outstanding shares. This provides a value per share that investors can easily compare to the market price.

- Understanding NAV helps gauge the ETF's true value independent of market price fluctuations. This is vital for long-term investors who are less concerned with short-term market volatility.

NAV and the Amundi DJIA UCITS ETF's Performance

The relationship between the Amundi DJIA UCITS ETF's share price and its NAV is generally close, but not always identical. The difference between the two is often referred to as the tracking error. Ideally, the ETF's price should closely track its NAV, reflecting the performance of the Dow Jones Industrial Average.

Investors can use the NAV to assess how well the Amundi DJIA UCITS ETF is performing against its benchmark, the Dow Jones Industrial Average. By comparing the NAV's growth to the index's performance, you can gauge the ETF's effectiveness in tracking its target. A significant divergence might indicate issues with the ETF's management or market conditions affecting the underlying assets.

Several factors can cause temporary discrepancies between the NAV and the market price of the Amundi DJIA UCITS ETF. These include:

-

Bid-ask spread: The difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept.

-

Trading volume: Lower trading volume can lead to wider price discrepancies.

-

Tracking error measures the difference between the ETF's return and its benchmark's return. A low tracking error is desirable, indicating the ETF is effectively mirroring its index.

-

Small discrepancies between NAV and market price are normal. These are often due to temporary market inefficiencies.

-

Significant deviations warrant further investigation. This could indicate underlying issues with the ETF's management or market conditions.

-

Regularly monitoring NAV helps investors evaluate their investment. This allows for timely adjustments to your investment strategy.

Where to Find the Amundi DJIA UCITS ETF NAV

Finding the daily NAV for the Amundi DJIA UCITS ETF is relatively easy. Several reliable sources provide this information:

- Amundi's Website: The official source for NAV data is typically the asset manager's website (Amundi). Look for their ETF listings and the specific details for the Amundi DJIA UCITS ETF.

- Major Financial News Websites: Many financial news and data providers (such as Bloomberg, Yahoo Finance, Google Finance) publish daily NAV information for various ETFs, including the Amundi DJIA UCITS ETF.

- Brokerage Accounts: If you hold the Amundi DJIA UCITS ETF through a brokerage account, the NAV will usually be displayed alongside the current market price.

Historical NAV data is also readily available through these sources. Most brokerage platforms and financial data providers offer tools to access this historical data, allowing investors to analyze long-term performance trends.

- Check the Amundi website for official NAV information. This ensures you're accessing the most accurate data.

- Major financial news websites often publish ETF NAV data. This provides convenient access to information.

- Your brokerage account will likely display the NAV. This is a convenient way to track your investment's performance.

Importance of NAV in Investment Strategy

Understanding the NAV of the Amundi DJIA UCITS ETF plays a vital role in formulating an effective investment strategy. It helps inform several key investment decisions:

-

Buy/Sell Signals: While not the sole determinant, comparing the NAV to the market price can provide insights into potential buying or selling opportunities. A significant discount of the market price to the NAV might indicate an attractive entry point, while a significant premium might suggest a potential sell signal.

-

Risk Assessment: NAV helps investors assess the underlying risk associated with the investment. By consistently monitoring the NAV and its relationship to the market price, investors can better gauge the volatility of their investment and adjust their risk tolerance accordingly.

-

Comparison with Similar ETFs: Comparing the NAV of the Amundi DJIA UCITS ETF to other ETFs tracking the same or similar indices allows investors to make informed comparisons and potentially identify better investment opportunities.

-

Long-Term Investment Planning: Consistent monitoring of the NAV contributes to sound long-term investment planning. By analyzing historical NAV data, investors can gain insights into the long-term performance of the ETF and adjust their investment strategy based on past trends.

-

NAV helps in evaluating potential investment opportunities. This allows investors to make informed decisions about allocating capital.

-

Comparing NAVs of similar ETFs facilitates better investment choices. This improves the efficiency of your investment strategy.

-

Consistent NAV monitoring contributes to informed portfolio management. This enables investors to effectively track their portfolio's performance and adjust their strategy as needed.

Conclusion

Understanding the Net Asset Value (NAV) is undeniably critical for any investor in the Amundi DJIA UCITS ETF. By regularly checking the NAV and understanding its relationship to the ETF's market price, investors can make more informed decisions, better manage their risk, and potentially optimize their portfolio returns. This guide has provided a clear explanation of NAV and how it applies to the Amundi DJIA UCITS ETF. Start monitoring the Amundi DJIA UCITS ETF's NAV today to enhance your investment strategy! Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Jymypaukku Muhii Tuukka Taponen F1 Autoon Jo Taenae Vuonna

May 24, 2025

Jymypaukku Muhii Tuukka Taponen F1 Autoon Jo Taenae Vuonna

May 24, 2025 -

Lewis Hamiltons Comments Criticized Ferraris Strong Response

May 24, 2025

Lewis Hamiltons Comments Criticized Ferraris Strong Response

May 24, 2025 -

Amsterdam Exchange Suffers 11 Drop Since Wednesday Three Days Of Losses

May 24, 2025

Amsterdam Exchange Suffers 11 Drop Since Wednesday Three Days Of Losses

May 24, 2025 -

Live Pedestrian Vs Vehicle Accident On Princess Road Ongoing Updates

May 24, 2025

Live Pedestrian Vs Vehicle Accident On Princess Road Ongoing Updates

May 24, 2025 -

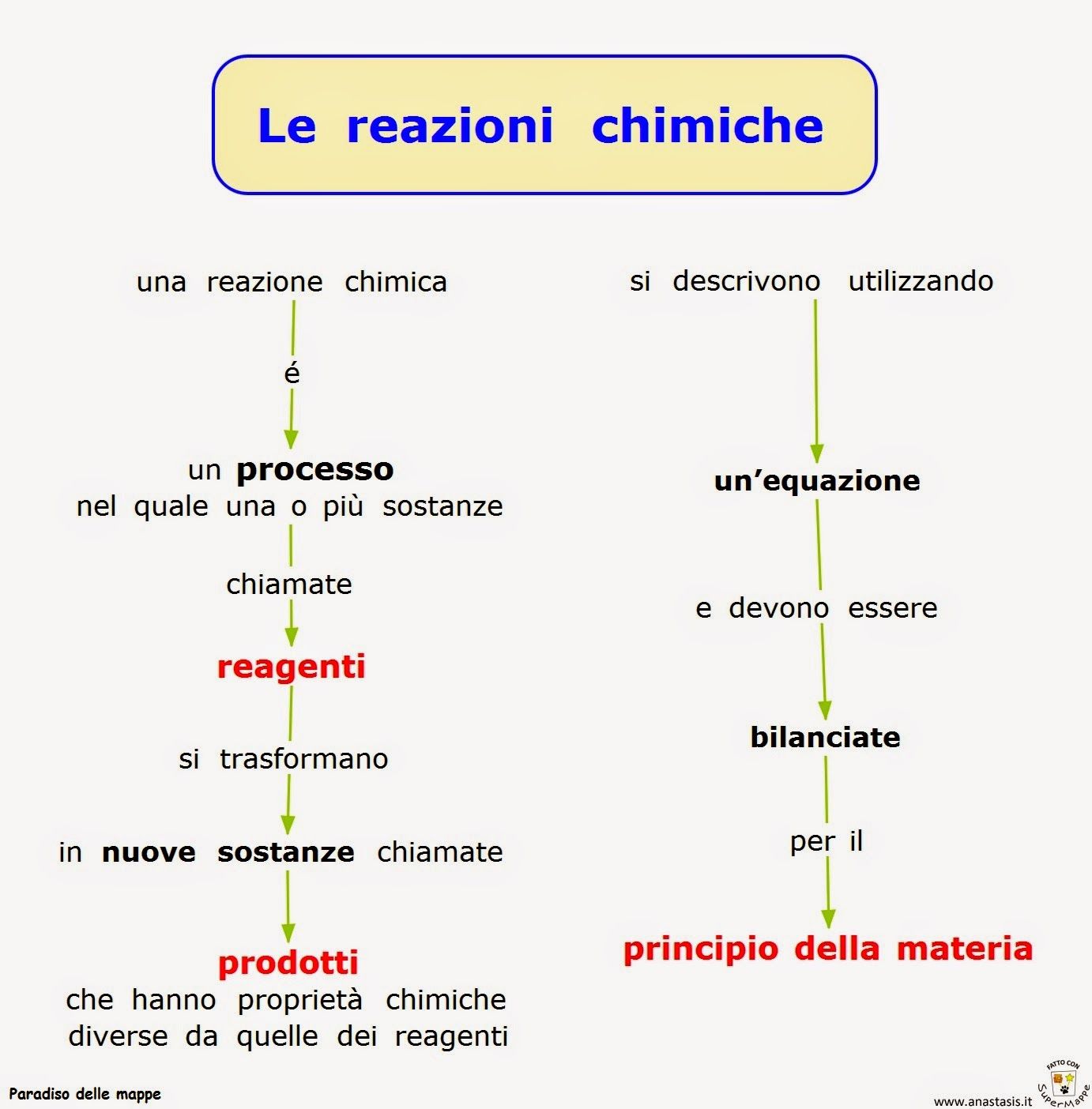

Le Sanzioni Ue Sui Dazi Conseguenze Per Le Borse E Le Aziende

May 24, 2025

Le Sanzioni Ue Sui Dazi Conseguenze Per Le Borse E Le Aziende

May 24, 2025

Latest Posts

-

Sharp Decline On Amsterdam Stock Exchange 11 Down In Three Days

May 24, 2025

Sharp Decline On Amsterdam Stock Exchange 11 Down In Three Days

May 24, 2025 -

Amsterdam Exchange Suffers 11 Drop Since Wednesday Three Days Of Losses

May 24, 2025

Amsterdam Exchange Suffers 11 Drop Since Wednesday Three Days Of Losses

May 24, 2025 -

Amsterdam Stock Exchange Plunges Third Consecutive Day Of Heavy Losses

May 24, 2025

Amsterdam Stock Exchange Plunges Third Consecutive Day Of Heavy Losses

May 24, 2025 -

Legal Battle Amsterdam Residents Sue City Council For Tik Tok Driven Overcrowding At Snack Bar

May 24, 2025

Legal Battle Amsterdam Residents Sue City Council For Tik Tok Driven Overcrowding At Snack Bar

May 24, 2025 -

Dazi E Mercati L Impatto Sulle Borse E Le Reazioni Della Ue

May 24, 2025

Dazi E Mercati L Impatto Sulle Borse E Le Reazioni Della Ue

May 24, 2025