Amundi DJIA UCITS ETF (Distributing): A Guide To Net Asset Value (NAV)

Table of Contents

Understanding Net Asset Value (NAV) in ETFs

Net Asset Value (NAV) represents the underlying value of an ETF's holdings. For the Amundi DJIA UCITS ETF (Distributing), the NAV calculation is directly tied to the value of its underlying assets – the 30 constituent stocks of the DJIA. The fund manager calculates the NAV by summing the current market value of each stock held, subtracting any liabilities, and dividing by the total number of outstanding ETF shares.

It's crucial to differentiate between NAV and the market price. While ideally they should be very close, the market price reflects the price at which the ETF is currently trading on the exchange. Several factors can cause slight discrepancies: supply and demand, trading volume, and market sentiment.

- NAV reflects the intrinsic value of the ETF's holdings. It's a snapshot of the net worth of the assets the ETF owns.

- Market price reflects the trading price of the ETF. It's the price buyers and sellers agree on at any given moment.

- Understanding the difference helps in making informed investment decisions. A significant deviation between NAV and market price might present arbitrage opportunities or signal underlying market pressures.

Factors Affecting the NAV of the Amundi DJIA UCITS ETF (Distributing)

Several factors directly impact the Amundi DJIA UCITS ETF (Distributing) NAV. The most significant is the performance of the Dow Jones Industrial Average itself. A rising DJIA generally leads to a higher NAV, while a falling DJIA results in a lower NAV. This correlation is almost direct, reflecting the ETF's objective of tracking the DJIA's index performance.

Currency fluctuations can also play a role, especially if the underlying DJIA companies have significant international operations or holdings. Changes in exchange rates can influence the value of assets held in different currencies, thereby affecting the overall NAV calculation.

Dividend distributions from the underlying DJIA companies are another key factor. When these dividends are paid out to the ETF, the NAV decreases as the total asset value within the fund is reduced. However, this decrease is offset by the dividend income received by ETF investors.

- DJIA increases generally lead to NAV increases. A positive correlation exists between the index's performance and the ETF's NAV.

- Currency fluctuations can positively or negatively affect NAV. Depending on the direction of currency movements, this effect can be substantial for internationally diversified holdings.

- Dividend payments lower the NAV but provide income to investors. This is a standard feature of distributing ETFs and should be considered when evaluating performance.

Accessing the NAV of the Amundi DJIA UCITS ETF (Distributing)

Finding the daily NAV for the Amundi DJIA UCITS ETF (Distributing) is straightforward. Reliable sources include the official Amundi website, reputable financial news websites (like Bloomberg or Yahoo Finance), and your brokerage platform. The NAV is typically updated daily, usually at the end of the trading day, reflecting the closing prices of the DJIA components. The data is usually presented as NAV per share, making it easy to calculate the total value of your investment.

- Regularly check the NAV for performance monitoring. Track your investment's progress over time.

- Compare the NAV to the market price for potential arbitrage opportunities. Though infrequent, significant discrepancies may present trading opportunities.

- Use reliable sources for accurate NAV data. Always verify information from multiple sources.

NAV and Investment Strategy for the Amundi DJIA UCITS ETF (Distributing)

While NAV is a crucial indicator, it shouldn't be the sole determinant of buy/sell decisions. Investors should consider other factors like market trends, economic indicators, and their overall risk tolerance. Long-term investors might pay less attention to daily NAV fluctuations, focusing instead on the overall long-term growth potential of the DJIA. Short-term investors, however, may be more sensitive to short-term NAV movements.

Monitoring NAV can be a valuable tool for risk management. Significant and sustained drops in NAV could signal potential problems and warrant a review of the investment strategy.

- NAV is one factor, but not the only factor, to consider when buying or selling. Use it in conjunction with other market analysis tools.

- Long-term investors may focus less on daily NAV fluctuations. Their investment horizon diminishes the significance of short-term variations.

- Monitor NAV to manage investment risk effectively. Use it as an early warning system for potential problems.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF (Distributing) is vital for informed investment decisions. By monitoring the NAV, understanding its influencing factors, and using this information alongside other market indicators, investors can develop sound investment strategies and effectively manage their risk. Learn more about the Amundi DJIA UCITS ETF (Distributing) NAV and other aspects of this investment opportunity by visiting [link to relevant resource]. Stay informed about your Amundi DJIA UCITS ETF (Distributing) NAV to maximize your investment potential.

Featured Posts

-

Record High For Dax Frankfurt Equities Opening Shows Strong Gains

May 25, 2025

Record High For Dax Frankfurt Equities Opening Shows Strong Gains

May 25, 2025 -

Aex Index Over 4 Decline Sends Market To 12 Month Low

May 25, 2025

Aex Index Over 4 Decline Sends Market To 12 Month Low

May 25, 2025 -

Finding Tranquility Your Escape To The Country Awaits

May 25, 2025

Finding Tranquility Your Escape To The Country Awaits

May 25, 2025 -

Statya Gryozy Lyubvi Ili Ilicha V Gazete Trud Retsenziya

May 25, 2025

Statya Gryozy Lyubvi Ili Ilicha V Gazete Trud Retsenziya

May 25, 2025 -

Is News Corps Current Valuation Justified Exploring Potential Undervaluation

May 25, 2025

Is News Corps Current Valuation Justified Exploring Potential Undervaluation

May 25, 2025

Latest Posts

-

1 500 Expected At Best Of Bangladesh Netherlands Event European Investors Attend

May 25, 2025

1 500 Expected At Best Of Bangladesh Netherlands Event European Investors Attend

May 25, 2025 -

Netherlands Hosts Major Bangladesh Business And Cultural Event

May 25, 2025

Netherlands Hosts Major Bangladesh Business And Cultural Event

May 25, 2025 -

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 25, 2025

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 25, 2025 -

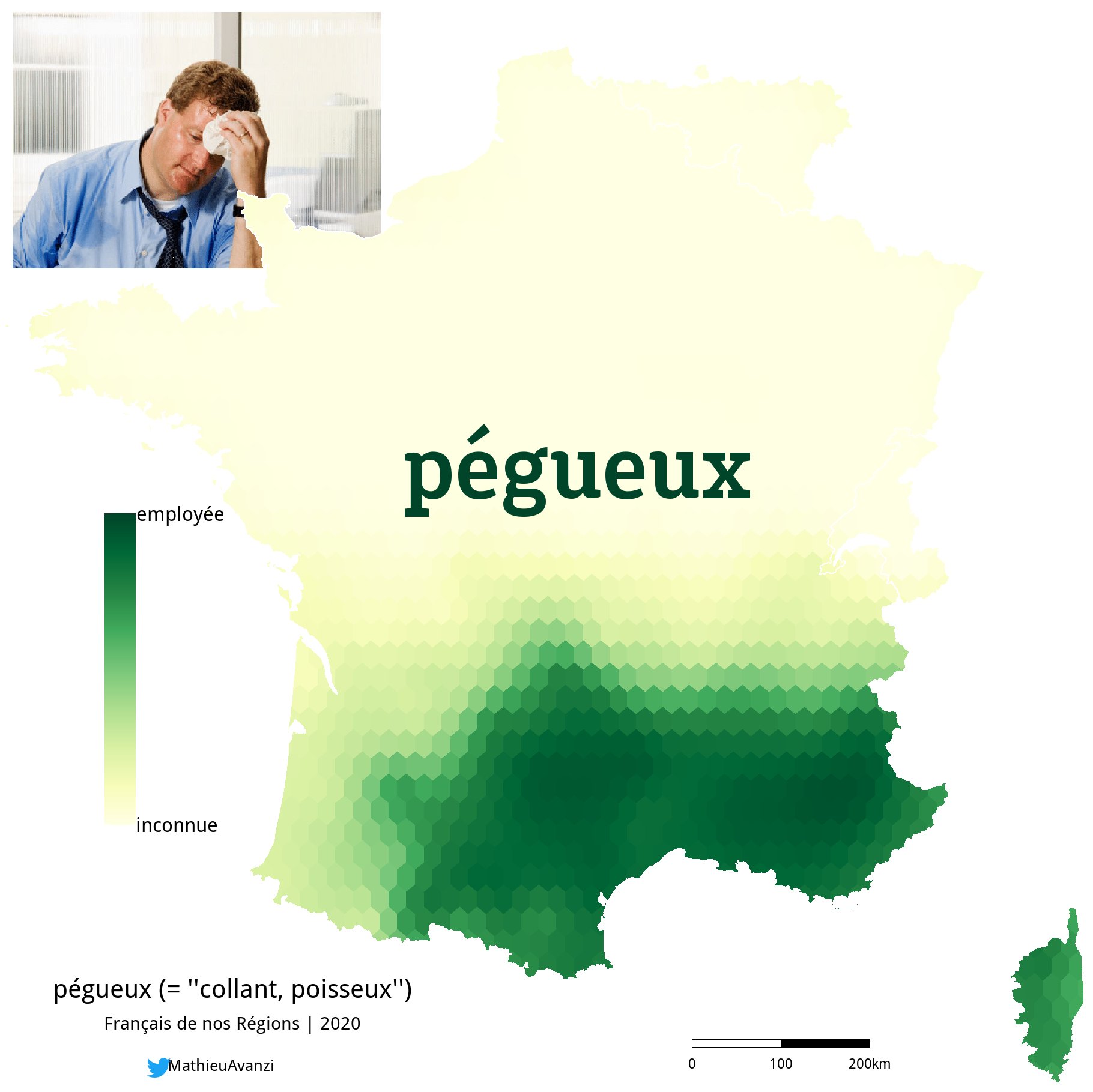

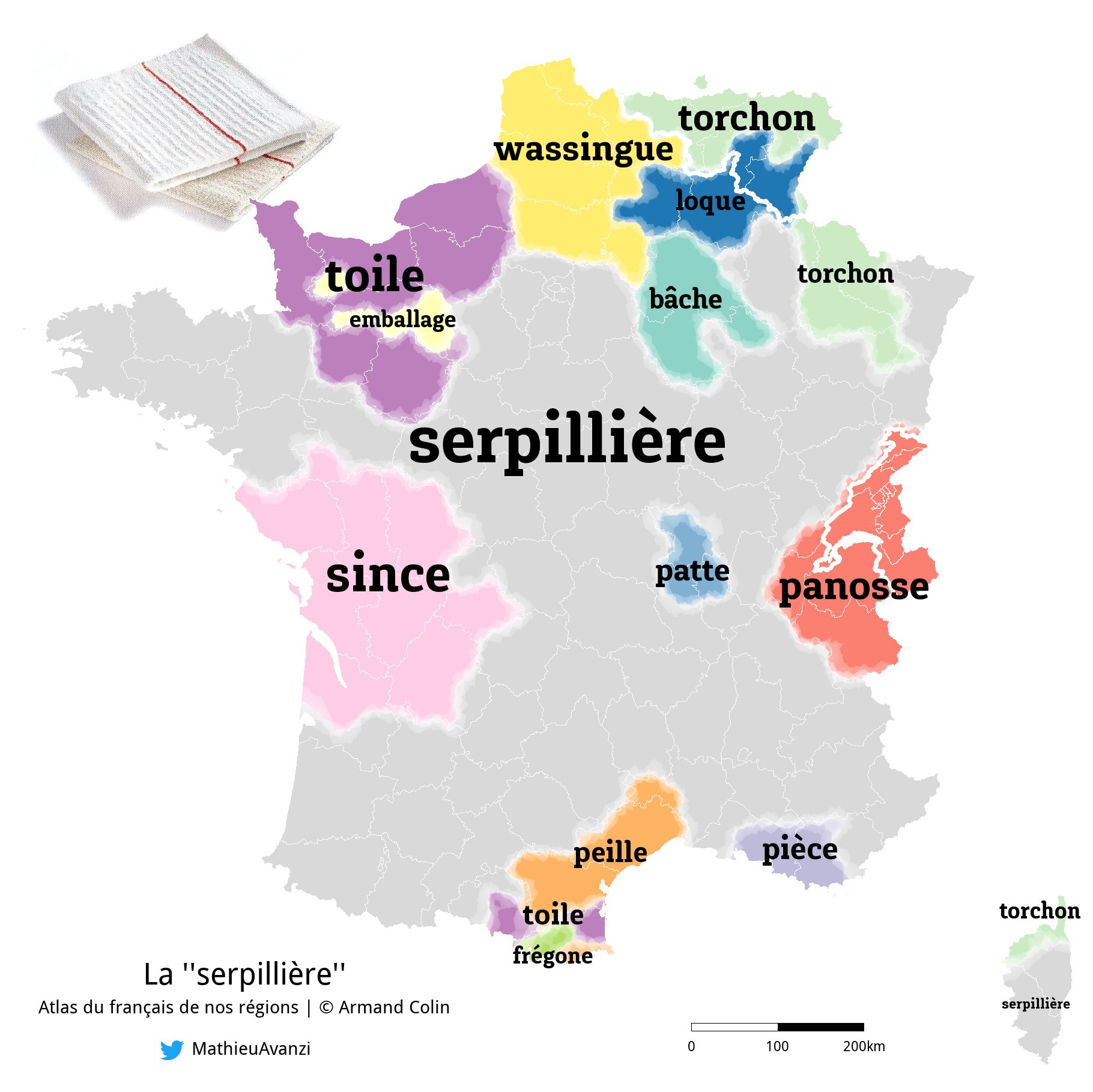

Le Francais Selon Mathieu Avanzi Bien Plus Qu Une Matiere Scolaire

May 25, 2025

Le Francais Selon Mathieu Avanzi Bien Plus Qu Une Matiere Scolaire

May 25, 2025 -

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 25, 2025

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 25, 2025