Analysis Of CoreWeave Stock: Recent Developments

Table of Contents

CoreWeave's Financial Performance: A Deep Dive

Understanding CoreWeave's financial performance is crucial for any stock analysis. We will examine revenue growth, profitability, and its capital structure.

Revenue Growth and Projections

CoreWeave has demonstrated impressive revenue growth, fueled by the increasing demand for cloud computing services and strategic client acquisition. While precise figures may fluctuate, analysts project continued strong growth in the coming years.

- Year-over-year (YoY) growth: Examining YoY revenue growth provides a clear picture of CoreWeave's trajectory. Consistent high YoY growth indicates a healthy and expanding business.

- Factors influencing revenue: The burgeoning demand for high-performance computing (HPC) solutions and the increasing adoption of cloud-based AI applications are major drivers of CoreWeave's revenue growth. Successful client acquisition strategies further contribute to this positive trend.

- Financial reports: Closely monitoring CoreWeave's quarterly and annual financial reports provides crucial insights into its performance and future outlook. These reports should be analyzed to understand the company’s financial position.

Profitability and Margins

Analyzing CoreWeave's profitability is vital for assessing its long-term sustainability and investment potential. Key metrics include gross margins, operating margins, and net income.

- Gross margins: Examining gross margins reveals the efficiency of CoreWeave's operations and its ability to control costs.

- Operating expenses: Understanding operating expenses, such as research and development, sales and marketing, and general administration, is crucial for assessing profitability. Efficient management of these expenses can significantly impact profitability.

- Areas for improvement: Analyzing CoreWeave's financial statements can highlight areas where cost optimization strategies can be implemented to enhance profitability.

Debt and Equity

Understanding CoreWeave's capital structure – the balance between debt and equity financing – offers insights into its financial risk and growth potential.

- Debt levels: High debt levels can increase financial risk, especially during economic downturns. Analyzing CoreWeave's debt-to-equity ratio helps assess this risk.

- Equity financing: Recent funding rounds indicate investor confidence in CoreWeave's future. Analyzing the terms and conditions of these funding rounds provides further insights into its financial health and growth plans.

- Impact of debt: The company’s use of debt and its impact on its financial health and future growth should be carefully examined.

Market Position and Competitive Landscape

Analyzing CoreWeave's position within the competitive cloud computing infrastructure market is essential for assessing its growth potential and long-term prospects.

Market Share and Growth

CoreWeave operates in a rapidly expanding market. Understanding its market share and how it compares to competitors is crucial.

- Competitive analysis: Comparing CoreWeave's performance to its main competitors—like AWS, Google Cloud, and Microsoft Azure—helps gauge its market standing and potential for growth.

- Market trends: Staying abreast of trends in the cloud computing industry—such as increasing demand for specialized computing resources and the rise of AI—is vital for understanding the opportunities and challenges facing CoreWeave.

- Strengths and weaknesses: Identifying CoreWeave's strengths and weaknesses relative to its competitors helps determine its future prospects.

Competitive Advantages and Disadvantages

Identifying CoreWeave's competitive advantages and disadvantages is critical for a comprehensive CoreWeave stock analysis.

- Technology: CoreWeave's innovative technology, particularly in areas like GPU computing, provides a significant competitive advantage.

- Partnerships: Strategic partnerships enhance its reach and provide access to new markets and technologies.

- Scalability: The ability to scale its infrastructure to meet growing demand is a key competitive advantage.

- Customer base: A strong and diverse customer base signals resilience and future growth potential.

Recent Developments and News

Staying updated on recent developments is crucial for informed investing.

Key Partnerships and Collaborations

Strategic partnerships can significantly impact CoreWeave's growth trajectory.

- New markets: Partnerships can open up access to new markets and customer segments.

- Technology integrations: Collaborations can lead to enhanced technology and product offerings.

- Revenue streams: Partnerships can unlock new revenue streams and enhance profitability.

Technological Advancements and Innovations

Continuous innovation is crucial for staying competitive in the cloud computing sector.

- Product improvements: CoreWeave's ongoing investments in research and development lead to improved products and services.

- Competitive standing: Innovations can solidify its competitive position and attract new clients.

Regulatory Landscape and Potential Impacts

The regulatory environment influences the cloud computing industry.

- Compliance: Understanding and complying with data privacy regulations is paramount.

- Opportunities and risks: Changes in regulations can create new opportunities or pose significant challenges.

Future Outlook and Investment Implications

Predicting the future is inherently complex, but analyzing CoreWeave's potential and risks allows for a more informed investment decision.

Growth Potential and Risks

CoreWeave exhibits significant growth potential, but also faces several risks.

- Revenue growth: The potential for continued strong revenue growth hinges on maintaining its competitive edge and successfully navigating market trends.

- Market expansion: Expansion into new markets could fuel further growth but also carries inherent risks.

- Profitability improvements: Continuous improvement in efficiency and cost management is crucial for sustained profitability.

- Competition: Intense competition from established players and new entrants poses a significant risk.

- Economic downturn: Economic downturns can impact demand for cloud computing services.

- Technological disruption: Rapid technological advancements may render existing technology obsolete.

Valuation and Investment Recommendation

Based on the preceding analysis, an informed investment decision can be made. (Note: This section would include a specific valuation and recommendation—Buy, Hold, or Sell—based on detailed financial modeling and market analysis. This is omitted here due to the inherent limitations of providing financial advice.) The recommendation would be justified by the analysis of financial performance, market position, and the future outlook discussed above.

Investing in CoreWeave Stock: A Final Assessment

This CoreWeave stock analysis reveals a company with significant growth potential driven by strong revenue growth, an expanding market, and strategic partnerships. However, investors should carefully consider the competitive landscape, regulatory risks, and the potential impact of economic downturns. Our investment recommendation (which would be detailed in a full analysis) is based on a thorough assessment of these factors. Conduct thorough due diligence and consider your individual risk tolerance before making any investment decisions regarding CoreWeave stock investment. Further research into CoreWeave stock outlook and CoreWeave stock trading strategies may also be beneficial.

Featured Posts

-

Jim Cramer And Core Weave Crwv Is It A Star Or A Falling Stock An Ai Infrastructure Perspective

May 22, 2025

Jim Cramer And Core Weave Crwv Is It A Star Or A Falling Stock An Ai Infrastructure Perspective

May 22, 2025 -

Abn Group Victoria Awards Media Account To Half Dome

May 22, 2025

Abn Group Victoria Awards Media Account To Half Dome

May 22, 2025 -

Chi Vstupit Ukrayina Do Nato Otsinka Golovnikh Rizikiv

May 22, 2025

Chi Vstupit Ukrayina Do Nato Otsinka Golovnikh Rizikiv

May 22, 2025 -

Quiz Sur La Loire Atlantique Histoire Gastronomie Et Culture

May 22, 2025

Quiz Sur La Loire Atlantique Histoire Gastronomie Et Culture

May 22, 2025 -

Killing Of Ukrainian Ex Politician In Madrid Police Report

May 22, 2025

Killing Of Ukrainian Ex Politician In Madrid Police Report

May 22, 2025

Latest Posts

-

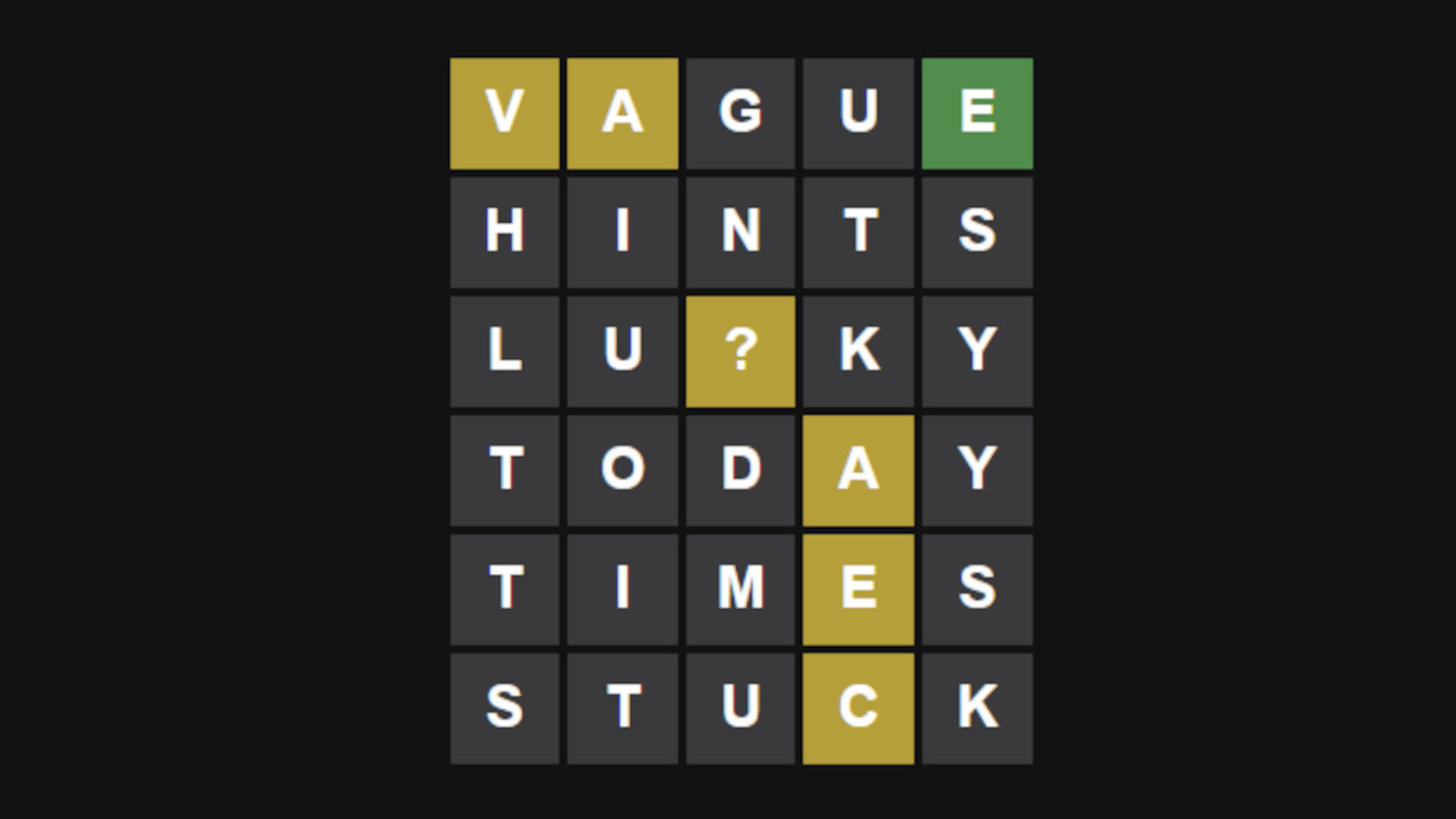

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025 -

Wordle Puzzle Solution Wordle 1366 March 16th Hints And Answer

May 22, 2025

Wordle Puzzle Solution Wordle 1366 March 16th Hints And Answer

May 22, 2025 -

Wordle Today 1 367 Hints Clues And Answer For Monday March 17th

May 22, 2025

Wordle Today 1 367 Hints Clues And Answer For Monday March 17th

May 22, 2025 -

Todays Wordle Answer March 16th Solving Wordle 1366

May 22, 2025

Todays Wordle Answer March 16th Solving Wordle 1366

May 22, 2025 -

Challenging Wordle Puzzle Nyt Answer For March 26

May 22, 2025

Challenging Wordle Puzzle Nyt Answer For March 26

May 22, 2025