Jim Cramer And CoreWeave (CRWV): Is It A Star Or A Falling Stock? An AI Infrastructure Perspective

Table of Contents

CoreWeave's Business Model and Competitive Advantages in the AI Infrastructure Market

CoreWeave's core business is providing cloud computing solutions specifically optimized for the intense computational demands of artificial intelligence workloads. Unlike general-purpose cloud providers, CoreWeave focuses on delivering superior infrastructure and tools tailored to AI development and deployment. This specialization gives them a significant competitive edge.

Key competitive advantages include:

- Superior GPU Infrastructure and Access to Cutting-Edge Hardware: CoreWeave boasts access to massive pools of high-end GPUs, the engines driving the most advanced AI models. This allows them to offer unparalleled processing power for AI training and inference. Their infrastructure supports GPU-accelerated computing at scale, a critical factor for many AI applications.

- Specialized Software and Tools Tailored to AI Development and Deployment: Beyond the hardware, CoreWeave offers specialized software and tools designed to streamline the AI development lifecycle. This includes optimized containerization, orchestration, and monitoring capabilities, simplifying the complexities of AI deployment for their clients.

- Strong Partnerships with Leading AI Companies and Researchers: CoreWeave has established strategic partnerships with key players in the AI industry, providing them with access to cutting-edge research and technology, further solidifying their position in the market. These collaborations fuel innovation and help ensure their services remain at the forefront of AI cloud computing.

The market for AI cloud computing services is experiencing explosive growth, driven by the increasing adoption of AI across various industries. CoreWeave is well-positioned to capture a significant share of this rapidly expanding market, leveraging its focus on high-performance computing and machine learning infrastructure.

Financial Performance and Growth Prospects of CRWV Stock

Analyzing CoreWeave's financial performance requires careful consideration of revenue growth, profit margins, and market capitalization. While specific numbers will fluctuate, a key metric to watch is their ability to maintain high revenue growth while balancing profitability. Comparisons to competitors in the AI cloud computing space are essential to gauge their relative performance and market positioning. Investors should also consider the potential for increased competition as more players enter the market.

Significant risks associated with investing in CRWV include:

- Intense Competition: The AI cloud computing market is attracting significant investment, leading to increased competition from established players and new entrants.

- Regulatory Changes: Government regulations concerning data privacy and AI ethics could impact CoreWeave's operations and profitability.

- Market Volatility: The technology sector is inherently volatile, and CRWV stock is likely to experience fluctuations based on broader market trends and investor sentiment. Careful assessment of stock valuation is crucial before investing.

Jim Cramer's Perspective (or Lack Thereof) on CRWV and Similar AI Stocks

While Jim Cramer's opinions carry weight for some investors, it's crucial to remember that his pronouncements are just one piece of the puzzle. His commentary on AI stocks, including (or excluding) CoreWeave, should not be the sole basis for investment decisions. Relying solely on celebrity financial advice can be risky. A comprehensive analysis considering various financial metrics, market trends, and competitor analysis offers a more informed perspective. Examining Cramer's past predictions on similar companies and comparing them to actual market performance highlights the limitations of relying on such opinions. Investors should treat any celebrity's views as just one factor among many.

The Broader AI Infrastructure Market and Future Trends

The AI infrastructure market is booming, propelled by several key drivers:

- Increasing Adoption of AI: Businesses across various sectors are increasingly adopting AI to improve efficiency, automate processes, and gain competitive advantages.

- Demand for More Powerful Computing Resources: Advanced AI models require massive computational power, driving demand for high-performance computing infrastructure.

- Technological Advancements: Continuous advancements in GPU technology and other hardware are fueling the growth of the AI infrastructure market.

Future trends to consider include:

- The Rise of Edge AI: Processing AI workloads closer to the data source (edge computing) will become increasingly important, offering advantages in latency and bandwidth.

- The Increasing Importance of Data Security: With the growing use of AI, data security and privacy concerns will become more critical, influencing investment in secure AI infrastructure.

These trends will significantly shape the future of AI infrastructure, and understanding their implications is crucial for assessing CoreWeave's long-term prospects. Data centers and cloud computing trends will continue to evolve, impacting the market.

Conclusion: Is CoreWeave (CRWV) a Star or a Falling Stock? A Final Verdict

Determining whether CoreWeave (CRWV) is a strong investment requires careful consideration of its competitive advantages in the rapidly expanding AI infrastructure market, its financial performance, and the broader market trends. While CoreWeave demonstrates significant potential with its specialized approach to AI cloud computing, investors must be aware of the inherent risks involved in investing in the volatile tech sector. The lack of significant commentary from Jim Cramer doesn't diminish the need for thorough due diligence. Weighing the potential rewards against the considerable risks is crucial.

Before making any investment decisions concerning CoreWeave (CRWV) or other AI infrastructure stocks, thorough research and a balanced perspective are paramount. Conduct further research and consider consulting with a financial advisor to make informed investment decisions regarding CoreWeave investment and the exciting landscape of AI infrastructure investing. A detailed CRWV stock analysis, including a review of financial statements and industry reports, is essential before committing capital.

Featured Posts

-

The Goldbergs Is The Show Still Relevant Today

May 22, 2025

The Goldbergs Is The Show Still Relevant Today

May 22, 2025 -

Wtt Star Contender Indias 19 Player Table Tennis Contingent In Chennai

May 22, 2025

Wtt Star Contender Indias 19 Player Table Tennis Contingent In Chennai

May 22, 2025 -

Phuong Tien Di Chuyen Giua Tp Hcm Va Ba Ria Vung Tau Huong Dan Chi Tiet

May 22, 2025

Phuong Tien Di Chuyen Giua Tp Hcm Va Ba Ria Vung Tau Huong Dan Chi Tiet

May 22, 2025 -

The Core Weave Crwv Investment Case A Look Through Jim Cramers Lens

May 22, 2025

The Core Weave Crwv Investment Case A Look Through Jim Cramers Lens

May 22, 2025 -

Understanding And Mitigating Susquehanna Valley Storm Damage

May 22, 2025

Understanding And Mitigating Susquehanna Valley Storm Damage

May 22, 2025

Latest Posts

-

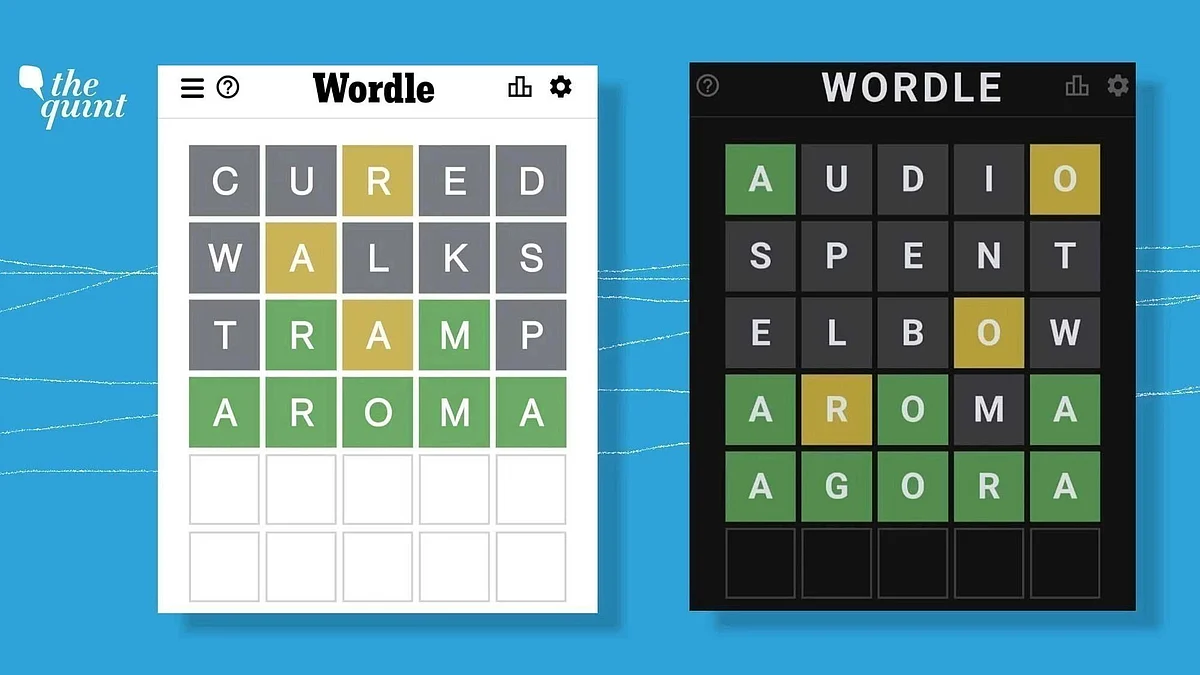

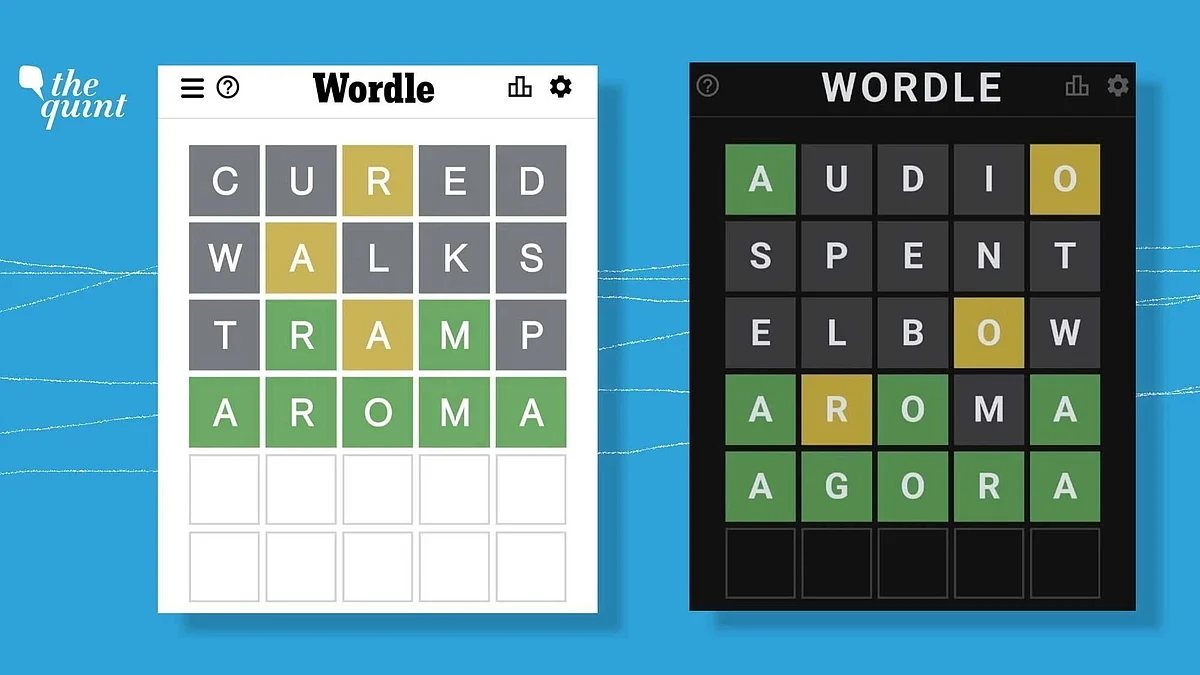

Wordle March 8th 1358 Clues And Solution

May 22, 2025

Wordle March 8th 1358 Clues And Solution

May 22, 2025 -

Wordle 1358 Hints And Answer For March 8th

May 22, 2025

Wordle 1358 Hints And Answer For March 8th

May 22, 2025 -

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025 -

Wordle Puzzle Solution Wordle 1366 March 16th Hints And Answer

May 22, 2025

Wordle Puzzle Solution Wordle 1366 March 16th Hints And Answer

May 22, 2025 -

Wordle Today 1 367 Hints Clues And Answer For Monday March 17th

May 22, 2025

Wordle Today 1 367 Hints Clues And Answer For Monday March 17th

May 22, 2025